TIDMAIQ

RNS Number : 1670U

AIQ Limited

29 July 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014, WHICH IS PART OF UK LAW BY

VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018.

29 July 2022

For Immediate Release

AIQ Limited

("AIQ" or the "Company" or, together with Alchemist Codes and

Alcodes International, the "Group")

Interim Results

The Board of AIQ (LSE: AIQ) announces the Company's unaudited

consolidated interim results for the six months ended 30 April

2022.

Summary

-- Progressed delivery of a contract to supply a decentralised

finance ("DeFi") exchange ("DEX") to a customer based in Australia,

which was completed post period

-- Awarded a contract to supply a non-fungible token ("NFT")

marketplace for education applications in Hong Kong

-- Revenue for the six months ended 30 April 2022 increased to GBP361k (H1 2021: GBP12k)

-- Net loss for the period was reduced to GBP202k (H1 2021: GBP915k loss)

-- Cash and cash equivalents of GBP852k at 30 April 2022 (31

October 2021: GBP581k), having r aised GBP500k through the issue of

unsecured convertible loan notes

Graham Duncan, Chairman of AIQ, said: " We delivered a strong

increase in revenue for the first half of our 2022 financial year,

albeit from a very low base and still a relatively small amount,

and, thanks to the action we took last year to substantially cut

costs, we reduced our losses significantly. During the period, we

focused on delivering the DeFi DEX project and seeking to win new

business, which resulted in us securing a contract to supply an NFT

platform for educational applications. However, it is still early

days for the new strategy. The Board continues to closely monitor

the progress of the Group and evaluate opportunities for generating

value for shareholders."

Enquiries

AIQ Limited c/o +44 (0)20 7618 9100

Graham Duncan, Chairman

Luther Pendragon (Media Relations)

Claire Norbury +44 (0)20 7618 9100

Operational Review

During the first half of the 2022 financial year, the Group

focused on the delivery of a contract, secured at the end of the

previous year, to supply a DeFi DEX to a customer based in

Australia. For the project, the Group performs the role of project

manager and subcontracts the technical delivery (such that the net

benefit to the Group is the margin earned on the contract). The

majority of the project was delivered during the first half, with

completion occurring since period end.

Also during the period the Group was awarded a contract to

supply an NFT platform designed to enable art schools and education

centres in Hong Kong to assist their students in publishing NFTs

and developing their creative talent under Web3 technology. The

Group will oversee and manage the project, with the development of

the marketplace being provided by Accubits Technologies Inc., a

full-service software provider, and digiXnode Technology Ltd.,

which specialises in blockchain development. Work on the platform

is underway and the beta version is expected to be ready for

testing in the coming months.

Financial Review

Revenue for the six months to 30 April 2022 was GBP361k compared

with GBP12k for the first half of the previous year. The revenue

was predominantly based on the delivery of the DeFi DEX contract

(GBP331k), with GBP10k from the NFT contract and a GBP19k

contribution from IT projects in Hong Kong.

The Group recognised a gross profit of GBP115k compared with a

gross loss of GBP197k for the first six months of the previous

year. This was as a result of the higher revenue.

Administrative expenses were reduced to GBP392k (H1 2021:

GBP573k) reflecting a reduction in personnel costs of GBP43k,

Directors' fees of GBP28k, and consultancy and other overhead

savings of GBP110k.

In Malaysia, the Group was able to sublet around half of its

office space during the period, which has been substantially

increased post period, thereby serving to further reduce the

Group's outgoings.

The Group recognised a net gain on foreign exchange of GBP70k

compared with a net loss of GBP138k for the same period of the

prior year.

The lower expenses combined with the higher revenue enabled a

significant reduction in operating loss for the period to GBP207k

(H1 2021: GBP908k loss).

Net finance costs were GBP5k compared with GBP7k for the first

half of the previous year.

As a result, loss before tax for the period was reduced to

GBP202k (H1 2021: GBP915k loss) and the loss per share to 0.3 pence

(H1 2021: 1.4 pence loss per share).

During the period, as announced on 25 January 2022, the Group

raised GBP500k from the issue of convertible loan notes.

At 30 April 2022, the Group had cash and cash equivalents of

GBP852k (31 October 2021: GBP582k).

Outlook

In the second half of the year, the Group has continued to

deliver its IT consultancy projects and maintain tight control over

costs. The Group expects revenue for the full year to be

significantly higher than for the year to 31 October 2021 and

anticipates a substantial reduction in net loss. However, the Group

expects revenue for the second half of the year to be lower than

that generated in the first half as the majority of the DeFi DEX

contract was delivered during the first six-month period. The Board

continues to closely monitor the progress of the Group and evaluate

opportunities for generating value for shareholders.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 April 2022

Six months Six months

Note ended ended Year ended

30 Apr 2022 30 Apr 2021 31 Oct 2021

Unaudited Unaudited Audited

GBP GBP GBP

Revenue 7 361,061 12,079 61,863

Cost of sales (246,097) (208,880) (250,670)

-------------- -------------- --------------

Gross profit/(loss) 114,964 (196,801) (188,807)

Administrative expenses (391,791) (573,030) (864,601)

Gain/(loss) on foreign

exchange 69,985 (138,498) (126,708)

Operating loss (206,842) (908,329) (1,180,116)

Finance income 9,184 263 447

Finance costs (4,563) (7,359) (13,151)

Loss before taxation (202,221) (915,425) (1,192,820)

Taxation - - (2,109)

-------------- -------------- --------------

Loss attributable

to equity holders

of the Company for

the period (202,221) (915,425) (1,194,929)

============== ============== ==============

Other comprehensive

income ( as may

be reclassified

to profit

and loss in subsequent

periods, net of

taxes):

Exchange difference

on translating foreign

operations (21,110) 30,223 (16,949)

-------------- -------------- --------------

Comprehensive income

attributable to

equity holders of

the Company for

the period (223,331) (885,202) (1,177,980)

============== ============== ==============

Loss per share -

basic (GBP per share) 8 (0.003) (0.014) (0.018)

Loss per share -

fully diluted (GBP

per share) 8 (0.003) (0.014) (0.018)

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 April 2022

Note 30 Apr 31 Oct

2022 2021

Unaudited Audited

GBP GBP

Assets

Non-current assets

Property, plant and equipment 111,272 175,207

Right-of-use assets 60,417 163,410

Intangible assets 6 - -

Rental deposits 30,886 29,834

------------ ------------

Total non-current assets 202,575 368,451

------------ ------------

Current assets

Investment in leases 60,417 -

Trade and other receivables 162,300 127,414

Tax receivable 24,317 23,489

Cash and cash equivalents 851,639 581,618

------------ ------------

Total current assets 1,098,673 732,521

------------ ------------

Total assets 1,301,248 1,100,972

------------ ------------

Equity and liabilities

Capital and reserves

Ordinary shares 9 647,607 647,607

Share premium 6,019,207 6,019,207

Foreign currency translation

reserve (11,780) 9,330

Accumulated losses (6,192,621) (5,990,400)

------------ ------------

Total equity 462,413 685,744

------------ ------------

Liabilities

Current liabilities

Trade payables 8,210 1,075

Accruals and other payables 203,436 244,664

Lease liabilities 100,985 94,672

Total current liabilities 312,631 340,411

------------ ------------

Non-current liabilities

Lease liabilities 26,204 74,817

Convertible loan notes 10 500,000 -

Total non-current liabilities 526,204 74,817

------------ ------------

Total equity and liabilities 1,301,248 1,100,972

------------ ------------

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 April 2022

Foreign

currency

Share Share translation Accumulated Total

capital premium reserve losses equity

GBP GBP GBP GBP GBP

Balance as at 31

October 2020 (Audited) 647,607 6,019,207 (7,619) (4,795,471) 1,863,724

Total comprehensive

loss for the

period - - 30,223 (915,425) (885,202)

Balance at 30 April

2021 (Unaudited ) 647,607 6,019,207 (6,682) (1,770,877) 4,889,255

---------- ---------- ------------- -------------- --------------

Total comprehensive

loss for the

period - - (937) (3,024,594) (3,025,531)

Balance at 31 October

2021 (Audited ) 647,607 6,019,207 9,330 (5,990,400) 685,744

---------- ---------- ------------- -------------- --------------

Total comprehensive

(loss) for the

financial period (21,110) (202,221) (223,331)

Balance at 30 April

2022 (Unaudited ) 647,607 6,019,207 (11,780) (6,192,621) 462,413

---------- ---------- ------------- -------------- --------------

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 April 2022

Six months Six months

ended ended Year ended

30 Apr 30 Apr 31 Oct

2022 2021 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Loss before taxation (202,221) (915,425) (1,192,820)

Adjustment for:-

Depreciation charges 117,383 60,137 119,328

Interest income (9,184) (263) (447)

Loss/(gain) on foreign exchange (57,595) (61,843) 116,106

------------ ------------ -------------

Operating loss before working

capital changes (151,617) (709,451) (957,833)

(Increase)/ decrease in receivables (34,886) 13,916 (56,318)

(Decrease)/ increase in payables (15,840) 47,602 (48,854)

(Decrease)/ increase in amount

owing to directors (9,116) - 2,533

Tax paid - - (2,109)

------------ ------------ -------------

Cash used in operations (211,459) (647,933) (1,062,581)

Interest received 9,184 263 447

------------ ------------ -------------

Net cash used in operating activities (202,275) (646,670) (1,062,134)

------------ ------------ -------------

Cash flows from investing activities

Acquisition of plant and equipment - (4,975) (6,540)

Net cash used in investing activities - (4,975) (6,540)

------------ ------------ -------------

Cash flows from financing activities

Repayment of lease liabilities (55,862) (44,803) (82,512)

Issue of convertible loan notes 500,000 - -

Net cash from / (used in) financing

activities 444,138 (44,803) (82,512)

------------ ------------ -------------

Net increase / (decrease) in

cash and cash equivalents 241,863 (697,448) (1,151,186)

Cash and cash equivalents at

beginning of the period 581,618 1,827,379 1,827,379

Effect of exchange rates on cash

and cash equivalents 28,158 (107,346) (94,575)

Cash and cash equivalents at

end of the period 851,639 1,022,585 581,618

------------ ------------ -------------

The accompanying notes form an integral part of these

consolidated financial statements.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

AIQ Limited ("the Company") was incorporated and registered in

The Cayman Islands as a private company limited by shares on 11

October 2017 under the Companies Law (as revised) of The Cayman

Islands, with the name AIQ Limited, and registered number

327983.

The Company's registered office is located at 5th Floor Genesis

Building, Genesis Close, PO Box 446, Cayman Islands, KY1-1106.

The Company has a standard listing on the London Stock

Exchange.

The consolidated financial statements include the financial

statements of the Company and its controlled subsidiaries (the

"Group").

2. PRINCIPAL ACTIVITIES

The principal activity of the Company is to seek acquisition

opportunities and to act as a holding company for a group of

subsidiaries that are involved in the technology sector.

The Group is an information technology (IT) solutions provider,

currently focused on the delivery of blockchain platforms in Asia

through the provision of IT consultancy.

3. ACCOUNTING POLICIES

a) Basis of preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Conduct Authority and International

Accounting Standard 34 "Interim Financial Reporting" (IAS 34).

Other than as noted below, the accounting policies applied by the

Group in these condensed interim financial statements are the same

as those set out in the Group's audited financial statements for

the year ended 31 October 2021. These financial statements have

been prepared under the historical cost convention and cover the

six-month period to 30 April 2022.

These condensed financial statements do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the audited financial statements for the year

ended 31 October 2021.

The condensed interim financial statements are unaudited and

have not been reviewed by the auditors and were approved by the

Board of Directors on 28 July 2022.

The financial information is presented in Pounds Sterling (GBP),

which is the presentational currency of the Company.

A summary of the principal accounting policies of the Group are

set out below.

b) Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries made up to the end

of the reporting period. Subsidiaries are entities over which the

Group has control. The Group controls an investee if the Group has

power over the investee, exposure to variable returns from the

investee, and the ability to use its power to affect those variable

returns.

The consolidated financial statements present the results of the

Company and its subsidiaries as if they formed a single entity.

Inter-company balances and transactions between Group companies are

therefore eliminated in full. The financial information of

subsidiaries is included in the Group's financial statements from

the date that control commences until the date that control

ceases.

c) Going concern

The financial statements are required to be prepared on the

going concern basis unless it is inappropriate to do so.

The Group incurred losses of GBP0.2 million during the period

and cash outflows from operating activities of GBP0.2 million. As

at 30 April 2022, the Group had net current liabilities of GBP0.1

million and cash of GBP0.9 million. The Group's cash position was

approximately GBP800,000 at the date of this report.

The Group meets its day-to-day working capital requirements

through cash generated from the capital it raised on admission to

the London Stock Exchange, the issue of the convertible loan notes

in the period (see note 10) and from the operations of its

subsidiaries.

Notwithstanding these actions, a material uncertainty exists

that may cast significant doubt on the Group's ability to continue

as a going concern with the uncertainty of future trading

performance giving rise to a material uncertainty over the going

concern status of the Group. The Directors consider the Group to be

a going concern but have identified a material uncertainty in this

regard.

4. SUBSIDIARIES

Name Place Registered Principal Effective interest

of incorporation address activity

30.04.2022 31.10.2021

------------------- ------------------ ---------------------- ----------- -----------

2-9, Jalan

Puteri 4/8,

Bandar Puteri,

47100 Puchong,

Alchemist Selangor Darul Design and

Codes Sdn Ehsan development

Bhd Malaysia Malaysia of software 100% 100%

------------------- ------------------ ---------------------- ----------- -----------

Cyberport 3,

3 Cyberport

Alcodes International Road, Telegraph Software

Limited* Hong Kong Bay, Hong Kong and app development 100% 100%

------------------- ------------------ ---------------------- ----------- -----------

* Held by Alchemist Codes Sdn Bhd

5. INTANGIBLE ASSETS

Goodwill and acquisition related intangible assets arising from

the acquisition of Alchemist Codes were fully impaired in the year

ended 31 October 2020. The OctaPLUS Platform and Messenger App were

also fully impaired in the year ended 31 October 2021.

No research and development costs were capitalised in the period

ended 30 April 2022.

6. REVENUE

Six months Six months

ended ended Year ended

30 Apr 2022 30 Apr 2021 31 Oct 2021

Unaudited Unaudited Audited

GBP GBP GBP

Sale of software products 19,052 10,635 37,639

Project management and coordination

income 341,263 - 19,415

Cashback income 746 1,332 4,628

Other - 112 181

Total 361,061 12,079 61,863

-------------- -------------- --------------

All revenues were generated in Asia.

During the period ended 30 April 2022, one customer accounted

for GBP331,619 (92%) of revenues. No other customers accounted for

more than 10%.

An analysis of revenue by the timing of the delivery of goods

and services to customers for the period ended 30 April 2022 and

the year ended 31 October 2021 is as follows:

Services

Goods transferred at a point transferred

in time over time

Six months Six months

ended ended

30 Apr 2022 30 Apr 2022

Unaudited Unaudited

GBP GBP

Sale of software products - -

Project management - 360,315

Cashback income 746 -

Other - -

Total 746 360,315

-------------- --------------------

Services

Goods transferred at a point transferred

in time over time

Six months Six months

ended ended

30 Apr 2021 30 Apr 2021

Unaudited Unaudited

GBP GBP

Sale of software products - 10,635

Project management - -

Cashback income 1,332 -

Other 112 -

Total 1,444 10,635

-------------- --------------------

Services

Goods transferred at a point transferred

in time over time

Year ended Year ended

31 Oct 2021 31 Oct 2021

Audited Audited

GBP GBP

Sale of software products 35,424 2,215

Project management 12,822 6,593

Cashback income - 4,628

Other - 181

Total 48,246 13,617

---------------- -------------

7. SEGMENT REPORTING

IFRS 8 defines operating segments as those activities of an

entity about which separate financial information is available and

which are evaluated by the Board of Directors to assess performance

and determine the allocation of resources. The Board of Directors

is of the opinion that under IFRS 8 the Group has only one

operating segment, the sale of software and ancillary services. The

Board of Directors assesses the performance of the operating

segment using financial information that is measured and presented

in a manner consistent with that in the Financial Statements.

All revenues were derived from Asia.

8. LOSS PER SHARE

The Company presents basic and diluted earnings per share

information for its ordinary shares. Basic loss per share is

calculated by dividing the loss attributable to ordinary

shareholders of the Company by the weighted average number of

ordinary shares in issue during the reporting period. Diluted

earnings per share are determined by adjusting the loss

attributable to ordinary shareholders and the weighted average

number of ordinary shares outstanding for the effects of all

dilutive potential ordinary shares.

Six months Six months

ended 30 ended 30 Year ended

Apr 2022 Apr 2021 31 Oct 2021

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax attributable to

owners of the Company (202,221) (885,202) (1,177,980)

Weighted average number of shares:

* Basic 64,760,721 64,760,721 64,760,721

Conversion of loan note at period

end share price 5,555,556 - -

Fully diluted 70,316,277 64,760,721 64,760,721

Loss per share (expressed as GBP

per share)

* Basic (0.003) (0.014) (0.018)

* Fully diluted (0.003) (0.014) (0.018)

9. SHARE CAPITAL

Six months Six months Year

ended ended ended

30 Apr 2022 30 Apr 2021 31 Oct

2021

Unaudited Unaudited Audited

GBP GBP GBP

As at beginning of period 647,607 647,607 647,607

As at end of period 647,607 647,607 647,607

--------- ------------ ------------------

Nominal

value

Number GBP

Authorised

Ordinary shares of GBP0.01 each 800,000,000 8,000,000

Issued and fully paid:

As at 1 November 2021 64,760,721 647,607

Issue of shares in the period - -

At 30 April 2022 64,760,721 647,607

------------- ----------

10. CONVERTIBLE LOAN NOTES

On 24 January 2022, the Company entered into an unsecured

convertible loan note agreement for a total subscription of

GBP500,000 (the "Loan Notes").

The Loan Notes have an expiration date of 24 January 2024

("Expiration Date") and can be repaid, in part or in full, by the

Company on 31 December in any year prior to the Expiration Date by

giving not less than 14 days' written notice to the noteholders.

All outstanding Loan Notes attract interest at a rate of 5% per

annum from the date of issue (24 January 2022) to the date of

repayment or conversion.

The Loan Notes shall be convertible into new Ordinary Shares of

the Company at the lesser of 11 pence per Ordinary Share or the

Volume Weighted Average Price of the Company's Ordinary Shares on

the London Stock Exchange in the seven-day period prior to the date

on which the Loan Note is converted into Ordinary Shares. The Loan

Notes shall be convertible, in part or in full, at any time from

the date of issue until the Expiration Date by the noteholder

giving to the Company at least one week's written notice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDRRUDDGDI

(END) Dow Jones Newswires

July 29, 2022 02:00 ET (06:00 GMT)

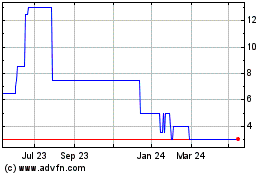

Aiq (LSE:AIQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aiq (LSE:AIQ)

Historical Stock Chart

From Feb 2024 to Feb 2025