By Juliet Chung and Margot Patrick

Investor Bill Hwang set off a storm in the stock market in March

when his firm, Archegos Capital Management, and its banks, began

liquidating huge positions in blue-chip companies, according to

people familiar with the transactions. The sales sent individual

stocks swooning and have left at least three banks with major

damage. Credit Suisse said on April 6 that it would take a $4.7

billion hit because of the meltdown.

What is Archegos Capital?

Archegos is the family investment vehicle owned by Mr. Hwang, a

former protégé of hedge-fund titan Julian Robertson. Mr. Hwang was

a so-called Tiger cub, an offshoot of Mr. Robertson's Tiger

Management. Mr. Hwang founded Tiger Asia in 2001. Based in New

York, it went on to become one of the biggest Asia-focused hedge

funds, running more than $5 billion at its peak. In 2008, it was

one of a swath of funds that suffered losses related to the soaring

share price of Volkswagen AG of Germany

In 2012, Tiger Asia said it planned to hand money back to

investors. Later that year, the firm pleaded guilty to a criminal

fraud charge for using inside information from investment banks to

profit on securities trades. Mr. Hwang and Tiger Asia paid $44

million to settle a related civil lawsuit, The Wall Street Journal

reported at the time.

Mr. Hwang turned Tiger Asia into his family office and renamed

it Archegos, according to its website.

"This is a challenging time for the family office of Archegos

Capital Management, our partners and employees. All plans are being

discussed as Mr. Hwang and the team determine the best path

forward," a company spokeswoman said in a written statement on

March 29.

What did Archegos invest in?

Archegos describes itself as focused on public stocks in the

U.S., China, Japan, South Korea and Europe. In recent months,

traders say, it played a part in the strong rally -- and subsequent

fall -- in shares of ViacomCBS Inc., Discovery Inc. Farfetch Ltd.

and New York-listed Chinese tutoring company GSX Techedu Inc.,

Tencent Music Entertainment Group, Baidu Inc. and IQIYI Inc.

How big was Archegos?

Archegos is estimated to have managed about $10 billion of its

own money, according to people familiar with the fund. But its

total positions that were unwound Thursday and Friday approached

$30 billion thanks to leverage Archegos obtained from banks. The

firm isn't known to have managed outside capital.

What are swaps and why did Archegos use them?

Archegos took big, concentrated positions in companies and held

some positions via something called "total return swaps." Those are

contracts brokered by Wall Street banks that allow a user to take

on the profits and losses of a portfolio of stocks or other assets

in exchange for a fee.

Swaps allow investors to take huge positions while posting

limited funds up front, in essence borrowing from the bank. The use

of swaps allowed Mr. Hwang to maintain his anonymity, even as

Archegos was estimated to have had exposure to the economics of

more than 10% of multiple companies' shares. Investors holding more

than 10% of a company's securities are deemed to be company

insiders and are subject to additional regulations around

disclosures and profits.

Swaps are common and have been around for a long time. They are

also controversial. Long Term Capital Management, a hedge fund

advised by two Nobel laureates that nearly brought down Wall Street

in the late 1990s, used swaps. Warren Buffett wrote about the risks

of swaps in his 2003 letter to investors.

How did leverage play a role?

Swaps can amplify the size of an investment in a stock by

allowing the investor to put up only limited funds up front. When

the underlying investments went the wrong way, the banks sold the

shares they held on behalf of the investor. This selling reinforces

the drop in the shares, which helps explain why the stocks that

Archegos had invested in fell so sharply.

What prompted the selloff?

Mr. Hwang's strategy began backfiring in recent weeks, as the

stock price of companies in which Archegos had significant

exposure, including China internet-search giant Baidu and Farfetch,

began to sell off. Baidu's stock price rose sharply in February,

but by mid-March its shares had dropped more than 20% from its

highs.

ViacomCBS on March 22 announced a sale of common stock, which

put further stress on Archegos, said people familiar with the

matter, with news of the deal sparking a slide in the shares and

adding to Archegos's mounting losses. The fund by that time had

started selling some of its position in ViacomCBS to try to offset

losses, adding to pressure on the stock.

But once the stock prices started to fall, Archegos's banks

started selling huge chunks of shares in the market in what are

known as block trades.

What is a block trade?

A block trade is the sale of a huge chunk of a company's shares.

These trades are often done at a discount to the current share

price because it is harder to find a buyer for a large quantity of

something than for a tiny piece.

What is a prime broker?

A prime broker is the part of a Wall Street bank that services

hedge funds. Prime brokers help hedge funds make trades and lend

them capital in the form of margin lending. Archegos used at least

half a dozen prime brokers, including Credit Suisse Group AG, UBS

Group AG, Goldman Sachs Group Inc., Morgan Stanley, Deutsche Bank

AG and Nomura Holdings Inc.

Who got hurt from Archegos?

Credit Suisse said it will take a $4.7 billion hit and two top

executives will leave their roles. Nomura warned investors of a $2

billion loss. Mitsubishi UFJ Financial Group Inc. of Japan said it

could lose $300 million from its exposure to a U.S. client, which a

person familiar with the matter said was Archegos.

Deutsche Bank said it has sold off its exposure and will emerge

unscathed.

Goldman Sachs and Morgan Stanley were quick to move large blocks

of assets before other large banks that traded with Archegos

Capital Management, as the scale of the hedge fund's losses became

apparent, according to people with knowledge of the transactions.

The strategy helped limit the U.S. firms' losses in March's epic

stock liquidation, they said.

How do you pronounce 'Archegos'?

The name comes from the ancient Greek word for leader. In Greek,

the word is pronounced "Ar-Khee-Gos" or "Ar-Khay-Gos." It was used

in the New Testament in reference to Jesus. Mr. Hwang is a devout

Christian.

Write to Juliet Chung at juliet.chung@wsj.com and Margot Patrick

at margot.patrick@wsj.com

(END) Dow Jones Newswires

April 06, 2021 04:40 ET (08:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

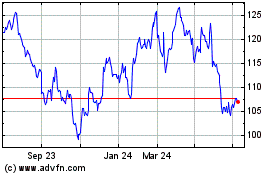

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

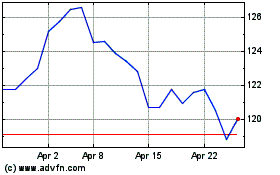

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024