Battery Maker QuantumScape Going Public Through SPAC Kensington Capital

September 03 2020 - 10:34AM

Dow Jones News

By Colin Kellaher

QuantumScape Corp., an electric-vehicle battery startup backed

by Germany's Volkswagen AG, on Thursday unveiled plans to go public

by combining with blank-check company Kensington Capital

Acquisition Corp.

The deal, which gives the combined company an implied enterprise

value of $3.3 billion, sent shares of special-purpose acquisition

company Kensington soaring.

Kensington, which in June raised $200 million in an upsized

initial public offering, said the transaction raises more than $700

million for QuantumScape, including $500 million from a from a

fully committed private placement led by institutional investors

including Fidelity Management & Research Co. and Janus

Henderson Investors.

Volkswagen, which has worked with QuantumScape since 2012, in

June said it would invest an additional $200 million in the

startup, bringing its total investment to more than $300 million.

QuantumScape and VW in 2018 formed a joint venture aimed at

industrial-level production of solid-state batteries for use in

VW's vehicles.

On completion of the transaction, expected by the end of the

year, the combined company will be named QuantumScape and will

remain listed on the New York Stock Exchange under the symbol QS,

the companies said.

Shares of Kensington surged 57% to $15.70 in early trading

Thursday.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 03, 2020 10:19 ET (14:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

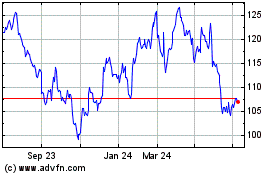

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

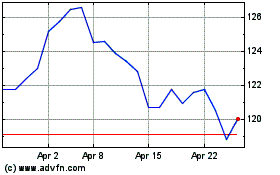

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024