Why Car Makers Are Taking On the EV Supply Chain -- Heard on the Street

May 19 2021 - 8:52AM

Dow Jones News

By Stephen Wilmot

Henry Ford invested in steel production and Brazilian rubber.

Today's car makers are getting into batteries and software.

On Tuesday, Chrysler owner Stellantis and iPhone-assembler

Foxconn, also known as Hon Hai Precision Industry, announced a

joint venture to develop in-vehicle software and services. This is

the latest in a long series of moves by auto makers to improve

their supply chains for fully electric, digital vehicles.

Car makers want more control over components central to the

performance and experience of EVs. But they don't have a lot of

experience with those parts, and face many competing claims for

investment. JVs with specialist suppliers offer a solution.

Batteries, the single most expensive EV component, have been the

chief focus so far. General Motors has a JV with South Korean

battery giant LG Chem to make cells; Stellantis and Volkswagen have

deals with European battery companies; Toyota has one with

Panasonic. Ford said last month that it too wanted to get into cell

production, though it hasn't yet detailed how.

The Stellantis-Foxconn JV, called Mobile Drive, applies this

approach to software. It is a logical step, but still an unusual

one. Toyota and Volkswagen, the two largest car makers by sales,

are building up their own software companies. Smaller players such

as Volvo and Renault are leaning heavily on Google owner Alphabet,

which has a version of its Android smartphone operating system for

vehicles.

So-called vertical integration with the supply chain has a long

history in the automotive industry. In the 1920s, Henry Ford built

his own steel mill and even established an ill-fated rubber

plantation in Brazil, encouraged by concerns in Washington about a

British stranglehold on East Asian rubber as the car industry

boomed. With EVs taking off, the U.S. government worries about

Chinese control of the battery supply chain. Tesla has talked about

mining and refining lithium, a key battery component.

There is thus a political side to battery investments in the

U.S. and Europe, where the industry is a pillar of a new industrial

strategy. Amid much anxiety about semiconductor shortages, though,

they are also competitive moves by car makers to secure supplies of

what might become another scarce component. Battery quality is a

third consideration, both in terms of cost and performance. Car

makers are still working out what will differentiate their brands

in a world of EVs, but battery technology -- the equivalent of

their traditional engine know-how -- is a plausible part of the

mix.

Even more important in the competition for EV buyers might be

the so-called user experience, defined increasingly by the touch

screens that are now essential components of car design. This will

be the focus of Mobile Drive. The JV's main benefit for Stellantis

may be access to Foxconn's electronics and software expertise for

brands such as Jeep and RAM.

Stellantis and Foxconn want to sell Mobile Drive to other car

makers, just as GM and LG Chem have pitched their cells to third

parties under the "Ultium" brand. Such ambitions are perhaps best

interpreted as a recognition that investments in the supply chain

can be justified more easily with a scale that few single car

makers offer.

These are riskier bets than traditional car makers are used to.

Software and batteries are both changing fast, and Silicon Valley

is much more experienced than Detroit in building slick digital

interfaces. Missteps are inevitable, but there is some comfort for

investors in the fact that companies are sharing the risks.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

May 19, 2021 08:37 ET (12:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

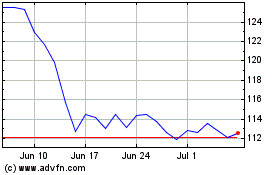

Volkswagen (TG:VOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

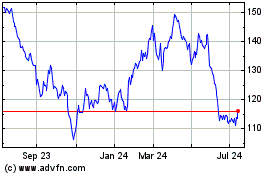

Volkswagen (TG:VOW)

Historical Stock Chart

From Apr 2023 to Apr 2024