SAP's Qualtrics Looks to Raise More Than $1 Billion in IPO

January 19 2021 - 8:31AM

Dow Jones News

By Colin Kellaher

Qualtrics International Inc., the

customer-relationship-management software vendor owned by Germany's

SAP SE, on Tuesday said it plans to sell about 49.2 million shares

at between $22 and $26 apiece in its initial public offering.

At the $24 midpoint of that range, the Provo, Utah, company said

it expects net proceeds of about $1.12 billion, or roughly $1.285

billion if the underwriters exercise an option to buy an additional

7.38 million shares.

Qualtrics said funds affiliated with Silver Lake Technology

Management LLC have agreed to buy $550 million of stock in a

concurrent private placement.

SAP, which in late 2018 agreed to buy Qualtrics for about $8

billion as the startup was on the cusp of going public, would still

hold 98% voting power after the IPO.

In a filing with the U.S. Securities and Exchange Commission,

Qualtrics said it would have roughly 510.2 million shares

outstanding after the IPO, assuming exercise of the overallotment

option, for a market capitalization of about $12.24 billion at the

$24-a-share midpoint.

Qualtrics said it has applied to list its shares on the Nasdaq

Global Select Market under the symbol XM.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

January 19, 2021 08:16 ET (13:16 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

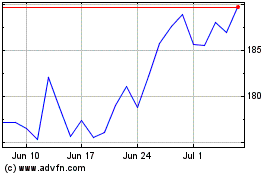

Sap (TG:SAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sap (TG:SAP)

Historical Stock Chart

From Apr 2023 to Apr 2024