Germany, Lufthansa Agree on $9.8 Billion Bailout -- Update

May 25 2020 - 4:38PM

Dow Jones News

By Ruth Bender

BERLIN -- The German government and Deutsche Lufthansa AG said

Monday they have agreed on a EUR9 billion euro ($9.81 billion)

bailout deal -- one of the biggest aid packages by a single country

hatched so far in the pandemic-hit air travel sector.

The deal, widely expected and weeks in the making, comes after

the world's largest airlines have grounded a majority of their

flights as most borders remain closed to contain the novel

coronavirus. Airlines are furloughing or laying off tens of

thousands of staff and negotiating bailouts with their

governments.

"This is an important step as it's about more than 100,000 jobs,

about preserving Germany's leading position in global civil

aviation and about making sure that a healthy and tradition-rich

company that got into trouble because of the coronavirus pandemic

can exist also in the future, " Economy Minister Peter Altmaier

said Monday.

Under the deal -- which still needs approval from Lufthansa's

boards, shareholders and the European Commission -- the German

government will take a 20% stake in the company and appoint two

supervisory board seats.

The agreement caps a weekslong tug of war between Lufthansa's

management and the government over how much control the latter

should be given in return for financial support.

Lufthansa Chief Executive Carsten Spohr had warned against too

much state influence on business decisions. Germany's

economic-stabilization fund, or WSF, agreed not to exercise its

voting rights except in the event of a takeover, which would allow

it to raise its stake to a blocking 25% plus one share. Mr.

Altmaier said the deal would prevent foreign investors from taking

advantage of the crisis.

WSF will build its 20% stake through a capital increase,

acquiring new shares for a total of about EUR300 million in cash,

Lufthansa said.

The EUR9 billion also includes an equity injection by the

government of up to EUR5.7 billion in the form of a silent

participation that is unlimited in time and can be repaid by

Lufthansa on a quarterly basis in whole or in part, as well as a

EUR3 billion loan from state-backed bank KfW, of which EUR600

million will come from private banks.

Mr. Altmaier said the government was still in talks with the

European Commission, the European Union's competition watchdog,

which could impose conditions on the deal. He declined to comment

on details of the talks.

In the U.S., the $2.2 trillion federal stimulus bill known as

the Cares Act included $25 billion in grants for passenger airlines

to keep paying workers' salaries and benefits through September.

The 12 larger passenger carriers are required to repay 30% of the

grant money, and provide warrants that could be converted to stock

later. In addition, airlines can seek another $25 billion in

government loans.

American Airlines Group Inc. is receiving $5.8 billion in grants

and loans from the federal government to cover payroll. It has

applied for another loan of $4.75 billion and has said it is still

negotiating with the Treasury over collateral and terms. United

Airlines Holdings Inc. is receiving $5 billion in grants and loans

to cover payroll, and has applied for another loan of as much as

$4.5 billion.

Delta Air Lines Inc. is set to receive $5.4 billion in payroll

support and is eligible for another $4.6 billion in loans.

Southwest Airlines Co. is receiving $3.3 billion in funding to

cover payroll and has said it would apply for a $2.8 billion

loan.

German daily Handelsblatt reported earlier that Germany was

resisting a push by the commission to have Lufthansa give up

important landing slots at its Frankfurt and Munich hubs. A

spokeswoman for the commission declined to comment.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

May 25, 2020 16:23 ET (20:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

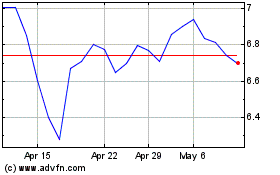

Deutsche Lufthansa (TG:LHA)

Historical Stock Chart

From Mar 2024 to Apr 2024

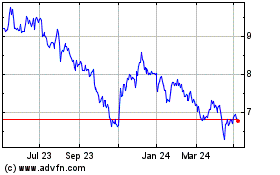

Deutsche Lufthansa (TG:LHA)

Historical Stock Chart

From Apr 2023 to Apr 2024