Shares in Germany's Deutsche Wohnen Jump on Vonovia's $23 Billion Takeover Bid

May 25 2021 - 5:05AM

Dow Jones News

By Mauro Orru

Shares in German residential-property company Deutsche Wohnen SE

soared Tuesday after peer Vonovia SE put forward a takeover bid

valuing the company at about 19.08 billion euros ($23.31

billion).

At 0830 GMT, Deutsche Wohnen shares traded 15% higher at

EUR51.92, while Vonovia's shares traded 4.1% lower at EUR49.97.

Vonovia said late Monday that it would pay a total consideration

of EUR53.03 per Deutsche Wohnen share, with an offer price of EUR52

in cash plus Deutsche Wohnen's proposed dividend of EUR1.03 per

share.

The offer, which represents a 17.9% premium to Deutsche Wohnen's

Friday closing price, could create Europe's largest residential

real-estate group with a real estate value of about EUR90 billion

and a market capitalization of around EUR45 billion.

Deutsche Wohnen backs the deal aimed at establishing a

"tenant-oriented and socially responsible housing company" that

will work in close liaison with policy makers. Deutsche Wohnen's

Chief Executive Officer Michael Zahn said at a press conference

that the offer was fair.

"The housing market is facing major challenges, especially in

the German capital: affordable and senior-friendly apartments are

in short supply, many buildings need to be refurbished to improve

energy efficiency, and clearly there is a need to build more

affordable new housing. The combination with Deutsche Wohnen now

gives us the opportunity to effectively tackle these challenges,"

Vonovia Chief Executive Rolf Buch said.

Vonovia estimates the deal will bring cost savings of EUR105

million per year, mostly from the joint management of the portfolio

of more than 500,000 apartments as well as falling costs.

Berenberg analysts said the estimated synergies should be

achievable, with Vonovia's development pipeline receiving a boost

from the merger.

"As residential real estate offers substantial operational

synergies, we regard the envisaged cost advantages as achievable

and think that Vonovia's development pipeline will be strengthened

by Deutsche Wohnen's development activities," Berenberg analysts

said.

Vonovia expects to complete the takeover by the end of

August.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

May 25, 2021 04:52 ET (08:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

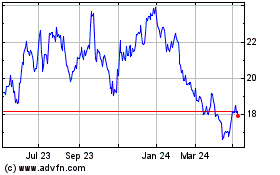

Deutsche Wohnen (TG:DWNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

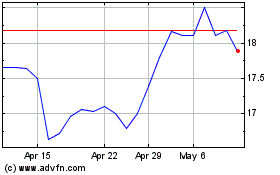

Deutsche Wohnen (TG:DWNI)

Historical Stock Chart

From Apr 2023 to Apr 2024