By Julia-Ambra Verlaine and Ben Eisen

Deutsche Bank traders in Brooklyn sit side by side while

managers work in glass-enclosed offices. At a Royal Bank of Canada

trading floor in Queens, employees crowd the shared lunch buffet.

JPMorgan Chase & Co. has assigned staffers to hold doors and

press elevator buttons.

Wall Street traders are navigating the wildest market conditions

since the financial crisis. They are doing it on trading floors and

at backup sites dotted throughout the New York City metro area --

the latest coronavirus disaster zone -- worried that they will

catch the virus in crowded offices or while commuting to them.

But as the number of confirmed novel coronavirus cases in New

York skyrockets, a rift is growing between the rank and file and

senior managers, who are trying to preserve liquidity in a fragile

market. A UBS Group AG trader said his wife refused to let him

return to the office. A Goldman Sachs Group Inc. salesperson walked

out of the office in the middle of the day and didn't return.

Markets have melted down at the fastest pace on record, creating

an all-hands-on-deck moment unseen since the financial crisis.

Banks -- like other big employers in the city -- have sent many of

their employees to work from home and closed thousands of retail

branches. But the pandemic poses a logistical challenge on trading

floors designed to facilitate the kind of face-to-face

communication that allows deals to close in seconds.

JPMorgan executives told sales and trading employees they can't

close up shop because the bank makes up at least 20% of the market

in some sectors, according to people familiar with the matter.

Market conditions, they said, would decline markedly were the bank

to shut down its trading floor.

Regulators have eased some of the strict requirements that make

it difficult for traders to work remotely. Still, traders need

multiple computer monitors, recorded phone lines and Bloomberg

terminals -- an environment that is tough to replicate in a home

office.

Typical bank policy has been to split up groups of traders and

send them to multiple locations. The idea is that if the virus

infects staffers at one location, those working at other sites will

be able to keep trading.

Wall Street firms are fielding a flurry of requests to work from

home now that colleagues are testing positive for the virus in

larger numbers.

A Goldman spokesman said the bank encourages employees to work

from home as they see fit. "What matters most is that each of you

do what feels right for you and your family," Chief Executive David

Solomon wrote in a firmwide memo on March 8.

Several employees at JPMorgan's Manhattan headquarters were

diagnosed with the virus last week, according to people familiar

with the matter, including some on the floor where the bank's

equity traders sit. While the bank sent home employees in the same

row as the confirmed cases, staffers across the aisle were told to

stay in the office, the people said.

A JPMorgan spokesman said the bank's protocol goes beyond the

guidance from the Centers for Disease Control and Prevention to

maintain at least 6 feet between employees to reduce the chances of

transmission. "We have spread traders out within floors and across

buildings," the spokesman said.

Deutsche Bank moved traders at its Brooklyn backup site further

apart Monday, according to a person familiar with the matter.

On Bank of America Corp.'s trading floor, word that a colleague

had tested positive for the virus angered employees who wondered

why the lender hadn't told them of the diagnosis or why they

weren't sent home, according to people familiar with the

matter.

The bank's policy when a staffer tests positive is not to spread

the word widely. It informs managers and their employees in the

colleague's immediate area and asks them to quarantine, and deep

cleans the area, a spokeswoman said. She declined to comment on

whether anyone who works on the trading floor has tested positive

for the coronavirus.

For large banks, sending traders home to do their jobs is much

harder than for employees in other parts of the lender. One of the

biggest problems is the phone lines. Sales teams rely on turrets,

two-foot-long switchboards that can field hundreds of client calls,

and they communicate directly with traders around the world over

internal intercoms known as squawk boxes.

While modern turrets are available with remote login capacity,

some banks haven't upgraded them in years.

RBC is working to equip trading staff to work from home, but the

effort is slow going. Meanwhile, traders have been showing up to

work at the bank's Long Island City backup site, where space is

tight for the rank and file, according to a person familiar with

the matter. While the bank allows traders to work from home, some

feel pressured by their managers to stick it out in the office, the

person said.

An RBC spokeswoman said the bank is continually making

adjustments to prioritize health and safety while supporting

clients. "The vast majority of our employees are now working from

home, and we expect that number to increase," she said.

The pandemic also is highlighting a generational divide. For

many veteran traders, making markets when times are tough is just

part of the job. Traders who haven't been through a crisis said

they are routinely reminded of this by their more experienced

colleagues and managers.

Banks have had to scramble in the face of rapidly evolving

situations. Most disaster-recovery plans at banks were designed to

respond to acts of terrorism or natural disasters. After the Sept.

11 terrorist attacks and superstorm Sandy, Wall Street firms leaned

on employees in London and Singapore to pick up the slack. The

coronavirus pandemic marks perhaps the first time nearly every

financial center across the world is simultaneously disrupted.

For smaller shops, it is easier to move operations. Mike

Kerensky, a futures trader at R.J. O'Brien & Associates LLC,

said employees of its New York office have been working from home

since March 16. He and three colleagues set up shop at the

dining-room table in his Long Island home. One of them is staying

over at his house and two others drive out each morning.

"Not 100%," Mr. Kerensky said. "But our clients are very happy

because we are up and running."

At WallachBeth Capital, a trading firm with about 50 employees,

traders now have at-home setups installed. Michael Beth, the head

equities trader, said he prefers to come into the office to handle

the onslaught.

On Friday morning, four people were on their trading floor, well

within the government guidance that no more than 10 people should

congregate at once. Those at the office in Jersey City, N.J., were

in a running video chat with their housebound co-workers.

"You don't even want to get up and use the restroom during the

day," Mr. Beth said. "I'd rather be sitting at the desk and be

watching for any new orders coming in."

--Dana Mattioli contributed to this article.

(END) Dow Jones Newswires

March 24, 2020 11:40 ET (15:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

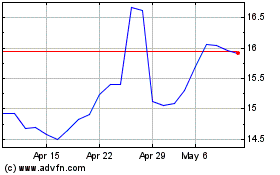

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Apr 2023 to Apr 2024