ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of Plan and the securities

offered under the Plan. The second part is the accompanying prospectus, which gives more general information, some of which may not apply

to this offering under the Plan. To the extent there is a conflict between the information contained in this prospectus supplement and

the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus,

and any free writing prospectus that we authorize to be distributed to you. We have not authorized anyone to provide you with different

or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information

appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus supplement

and the accompanying prospectus, and any free writing prospectus is accurate only as of the date of those respective documents. Our business,

financial condition, results of operations, and prospects may have changed since such dates.

Unless

otherwise indicated, all references to “Zion Oil & Gas”, “Company”, “our”, “we”,

“us”, and similar terms refer to Zion Oil & Gas, Inc., a Delaware corporation.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and

the accompanying prospectus. This summary does not contain all the information that you should consider before investing in our securities.

You should carefully read this entire prospectus supplement, the accompanying prospectus and any free writing prospectus that we authorize

to be distributed to you, including the “Risk Factors” section beginning on page S-27 of this prospectus supplement and,

the financial statements and related notes and other information included or incorporated by reference in this prospectus supplement

and the accompanying prospectus, before making an investment decision.

Zion

Oil & Gas, Inc.

Zion

Oil and Gas, Inc., a Delaware corporation, is an oil and gas exploration company with a history of 19 years of oil and gas exploration

in Israel. We were incorporated in Florida on April 6, 2000 and reincorporated in Delaware on July 9, 2003. We completed our initial

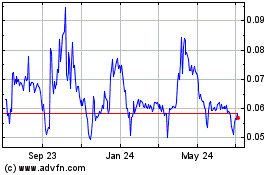

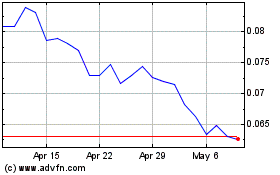

public offering in January 2007. Our common stock, par value $0.01 per share (the “Common Stock”) currently trades on the

OTCQX under the symbol “ZNOG” and our Common Stock warrant under the symbol “ZNOGW.”

The

Company currently holds one active petroleum exploration license onshore Israel, the New Megiddo License 428 (“NML 428”),

comprising approximately 99,000 acres. The NML 428 was awarded on December 3, 2020 for a six-month term with the possibility of

an additional six-month extension. On April 29, 2021, Zion submitted a request to the Ministry of Energy for a six-month extension to

December 2, 2021. On May 30, 2021, the Ministry of Energy approved our request for extension to December 2, 2021. On November 29, 2021,

the Ministry of Energy in Israel granted Zion Oil & Gas an extension of the “New Megiddo”/428 License until August 1,

2022 for the purpose of completing the activities regarding its MJ-02 drilling and testing. The ML 428 lies onshore, south and west of

the Sea of Galilee and we continue our exploration focus here, as it appears to possess the key geologic ingredients of an active petroleum

system with significant exploration potential.

The

Megiddo Jezreel #1 (“MJ #1”) exploratory well was spud on June 5, 2017 and drilled to a total depth (“TD”) of

5,060 meters (approximately 16,600 feet). Thereafter, the Company successfully cased and cemented the well while awaiting the approval

of the testing protocol. The Ministry of Energy approved the well testing protocol on April 29, 2018.

During

the fourth quarter of 2018, the Company testing protocol was concluded at the MJ #1 well. The test results confirmed that the MJ #1 well

did not contain hydrocarbons in commercial quantities in the zones tested. As a result, in the year ended December 31, 2018, the Company

recorded a non-cash impairment charge to its unproved oil and gas properties of $30,906,000. During the six months ended June 30, 2021,

and 2020, respectively, the Company did not record any post-impairment charges.

While

the well was not commercially viable, Zion learned a great deal from the drilling and testing of this well. We believe that the drilling

and testing of this well carried out the testing objectives, which would support further evaluation and potential further exploration

efforts within our License area. Zion believed it was prudent and consistent with good industry practice to try to answer some of these

questions with a focused 3-D seismic imaging shoot of approximately 72 square kilometers surrounding the MJ#1 well. Zion completed all

of the acquisition, processing and interpretation of the 3-D data and incorporated its expanded knowledge base into the drilling of our

current MJ-02 exploratory well.

At

present, we have no revenues or operating income. Our ability to generate future revenues and operating cash flow will depend on the

successful exploration and exploitation of our current and any future petroleum rights or the acquisition of oil and/or gas producing

properties, and the volume and timing of such production. In addition, even if we are successful in producing oil and gas in commercial

quantities, our results will depend upon commodity prices for oil and gas, as well as operating expenses including taxes and royalties.

Our

executive offices are located at 12655 North Central Expressway, Suite 1000, Dallas, Texas 75243, and our telephone number is (214) 221-4610.

Our branch office’s address in Israel is 9 Halamish Street, North Industrial Park, Caesarea 3088900, and the telephone number is

+972-4-623-8500. Our website address is: www.zionoil.com.

Exploration

and Operation Efforts

Megiddo-Jezreel

Petroleum License

The

Company held an active petroleum exploration license onshore Israel, the Megiddo-Jezreel License, comprising approximately 99,000 acres.

The Megiddo Jezreel #1 (“MJ #1”) exploratory well was spud on June 5, 2017 and drilled to a total depth (“TD”)

of 5,060 meters (approximately 16,600 feet). Thereafter, the Company successfully cased and cemented the well while awaiting the approval

of the testing protocol. The Ministry of Energy approved the well testing protocol on April 29, 2018.

During

the fourth quarter of 2018, the Company’s testing protocol was concluded at the MJ #1 well. The test results confirmed that the

MJ #1 well did not contain hydrocarbons in commercial quantities in the zones tested. The MJ#1 well provided Zion with information

Zion believes is important for potential future exploration efforts within its license area. As with many frontier wildcat wells, the

MJ#1 also left several questions unanswered.

While

not meant to be an exhaustive list, a summary of what Zion believes to be key information learned in the MJ#1 well is as follows:

|

|

1.

|

The MJ#1 encountered much

higher subsurface temperatures at a depth shallower than expected before drilling the well. In our opinion, this is significant because

reaching a minimum temperature threshold is necessary for the generation of hydrocarbons from an organic-rich source rock.

|

|

|

|

|

|

|

2.

|

The known organic rich

(potentially hydrocarbon bearing) Senonian age source rocks that are typically present in this part of Israel were not encountered

as expected. Zion expected these source rocks to be encountered at approximately 1,000 meters in the MJ#1 well.

|

|

|

3.

|

MJ#1 had natural fractures,

permeability (the ability of fluid to move through the rock) and porosity (pore space in rock) that allowed the sustained flow of

formation fluid in the shallower Jurassic and lower Cretaceous age formations between approximately 1,200 and 1,800 meters. While

no hydrocarbons were encountered, Zion believes this fact is nonetheless significant because it provides important information about

possible reservoir pressures and the ability of fluids to move within the formation and to the surface.

|

|

|

|

|

|

|

4.

|

MJ#1 encountered oil in

the Triassic Mohilla formation, which Zion believes suggests an active deep petroleum system is in Zion’s license area. There

was no natural permeability or porosity in the Triassic Mohilla formation to allow formation fluid to reach the surface naturally

during testing, and thus the MJ#1 was not producible or commercial.

|

|

|

|

|

|

|

5.

|

The depths and thickness

of the formations we encountered varied greatly from pre-drill estimates. This required the MJ#1 to be drilled to a much greater

depth than previously expected. Zion has tied these revised formation depths to seismic data which will allow for more accurate interpretation

and mapping in the future.

|

A

summary of what Zion believes to be some key questions left to be answered are:

|

|

1.

|

Is the missing

shallow Senonian age source rock a result of regional erosion, or is it missing because of a fault that cut the well-bore and could

be reasonably expected to be encountered in the vicinity of the MJ#1 drill site? Zion believes this is an important question to answer

because if the Senonian source rocks do exist in this area, the high temperatures encountered are sufficient to mature these source

rocks and generate oil.

|

|

|

|

|

|

|

2.

|

Do the unusually high shallow

subsurface temperatures extend regionally beyond the MJ#1 well, which could allow for the generation of hydrocarbons in the Senonian

age source rock within our license area?

|

|

|

|

|

|

|

3.

|

As

a consequence of seismic remapping, where does the MJ#1 well lie relative to the potential traps at the Jurassic and Triassic

levels, and was the well location too low on the structures and deeper than the potential hydrocarbons within those traps?

As

a result of these unanswered questions and with the information gained drilling the MJ#1 well, Zion believed it was prudent and consistent

with good industry practice to try and answer some of these questions with a focused 3-D seismic imaging shoot of approximately 72

square kilometers surrounding the MJ#1 well. Zion has completed all of the acquisition, processing and interpretation of the 3-D

data and incorporated its expanded knowledge base into the drilling of our current MJ-02 exploratory well (see further details below).

The Geology team is continuing to work on a larger interpretation of 3D areas, along with potential exploration locations located

in the western portion of the NML 428 license area.

|

Map

1. Zion’s Megiddo-Jezreel Petroleum Exploration License.

As

a result of these unanswered questions and with the information gained drilling the MJ#1 well, Zion believed it was prudent and consistent

with good industry practice to try and answer some of these questions with a focused 3-D seismic imaging shoot of approximately 72 square

kilometers surrounding the MJ#1 well. Zion has completed all of the acquisition, processing and interpretation of the 3-D data and has

incorporated its expanded knowledge base into the drilling of our current MJ-02 exploratory well (see further details below). The Megiddo-Jezreel

License 401 was awarded on December 3, 2013 for a three-year primary term through December 2, 2016 with the possibility of additional

one-year extensions up to a maximum of seven years. The Megiddo-Jezreel License 401 lies onshore, south and west of the Sea of Galilee,

and we continue our exploration focus here as it appears to possess the key geologic ingredients of an active petroleum system with significant

exploration potential.

Current

Exploration and Operation Efforts

On

March 12, 2020, Zion entered into a Purchase and Sale Agreement with Central European Drilling kft, a Hungarian corporation, to purchase

an onshore oil and gas drill rig, drilling pipe, related equipment and spare parts for a purchase price of $5.6 million in cash, subject

to acceptance testing and potential downward adjustment. We remitted to the Seller $250,000 on February 6, 2020 as earnest money towards

the Purchase Price. The Closing anticipated by the Agreement took place on March 12, 2020 by the Seller’s execution and delivery

of a Bill of Sale to us. On March 13, 2020, the Seller retained the earnest money deposit, and the Company remitted $4,350,000 to the

seller towards the purchase price, and $1,000,000 (the “Holdback Amount”) was deposited in escrow with American Stock Transfer

and Trust Company LLC. On January 6, 2021, Zion completed its acceptance testing of the I-35 drilling rig and the Holdback Amount was

remitted to Central European Drilling.

The

Company currently holds one active petroleum exploration license onshore Israel, the New Megiddo License 428 (“NML 428”),

comprising approximately 99,000 acres. This license effectively replaced the Megiddo-Jezreel License 401 as it has the same area

and coordinates. The NML 428 was awarded on December 3, 2020 for a six-month term with the possibility of an additional six-month extension.

On April 29, 2021, Zion submitted a request to the Ministry of Energy for a six-month extension to December 2, 2021. On May 30, 2021,

the Ministry of Energy approved our request for extension to December 2, 2021. On November 29, 2021, the Ministry of Energy in Israel

granted Zion Oil & Gas an extension of the “New Megiddo”/428 License until August 1, 2022 for the purpose of completing

the activities regarding its MJ-02 drilling and testing. The ML 428 lies onshore, south and west of the Sea of Galilee, and we continue

our exploration focus here as it appears to possess the key geologic ingredients of an active petroleum system with significant exploration

potential.

The

MJ-02 drilling plan was approved by the Ministry of Energy on July 29, 2020. On January 6, 2021, Zion officially spudded its MJ-02 exploratory

well. On November 23, 2021 Zion announced that it completed the drilling of the MJ-02 well to a total depth of 5,531 meters (~18,141

feet). A full set of detailed and comprehensive tests including neutron-density, sonic, gamma, and resistivity logs, paired with well

testing, have commenced. Based on these logs and analysis, additional zones of interest may be identified and tested.

Plan

Summary

We

are offering new investors and existing stockholders a convenient method to purchase shares of Common Stock directly from Zion and to

reinvest cash dividends paid on Zion’s Common Stock in the purchase of additional shares of Common Stock. In addition, the Plan

includes a feature whereby new investors and existing stockholders can also purchase, directly from Zion, units (each a “Unit”

and collectively the “Units”) of Zion securities, with each Unit consisting of (i) one or more shares of our Common Stock

and (ii) one or more warrants to purchase one or more additional shares of our Common Stock at a fixed exercise price (each a “Warrant”

and collectively the “Warrants”), all as described below.

The

Plan is administered by the American Stock Transfer & Trust Company, LLC, a New York limited liability trust company (“AST”),

located at 6201 15th Avenue, Brooklyn, NY 11219 (the “Plan Agent”). As Plan Agent, AST keeps records,

sends statements of account to Plan participants and performs other duties relating to the Plan.

Under

the Plan, you can make an initial investment in Zion’s Common Stock or Units, or a combination of both, with an initial payment

of $250 or more. Once you are a registered shareholder, you can increase your holdings of our Common Stock or Units (while the Units

continue to be offered) through optional monthly cash payments of $50 or more.

Investments

in excess of $10,000 in any month or an initial investment in excess of $10,000 can only be made with our approval and if necessary by

a written “Request for Waiver.” See Question 13. The dollar limitation of $10,000 and the approval of the “Request

for Waiver” for amounts in excess of $10,000 do not apply to Unit purchases.

Shares

Generally Recorded Daily

Checks,

bank wire payments, or electronic bank payments for purchases received by the Plan Agent, or at the offices of the Company, before 12

noon (EST) on a business day generally will be recorded as purchased on the same business day (the “Purchase Date”). The

Plan Agent has online interactive purchase facilities (www.amstock.com) to handle electronic enrollment and electronic check processing.

In addition, the same electronic services are offered through the Company’s website (www.zionoil.com). Checks, bank wire payments,

or electronic bank payments for purchases received by the Plan Agent, or at the offices of Company, after 12 noon (EST) on a business

day generally will be recorded as purchased on the next business day for the Purchase Date. Electronic bank payments are treated as received

and recorded on the date of receipt of the funds into the Plan Agent’s or the Company’s bank account.

Since

only shares are purchased directly from the Company, the investor’s Plan account will be credited with the number of shares (including

fractional shares, computed to three decimals) of the Company’s Common Stock that was purchased. The price at which shares will

be deemed purchased and credited to the investor’s account will be at the average of the high and low sale prices of the Company’s

publicly traded Common Stock as reported on the OTCQX or any other exchange or securities market on the Purchase Date. Transaction confirmations

are communicated daily by the Plan Agent and also quarterly and year-end statements are mailed by the Plan Agent.

Electronic

Enrollment and Payment Procedures

For

Automated Clearing House debits (ACH) withdrawals that have been set up by the Plan Agent, the Plan Agent would debit a bank account.

We have successfully implemented an electronic enrollment procedure with the Telecheck Internet Check Acceptance service as a payment

method. In addition to the enrollment procedures otherwise specified with the mailing to the Plan Agent of the signed Plan Enrollment

Form and check payment, current stockholders and prospective investors may enroll in the Plan by the procedures that allow for an acceptance

of an electronic signature and date to the Plan Enrollment Form and a secure internet check acceptance by First Data/Citibank Merchant

Services as coordinated with the Plan Agent.

Electronic

enrollment and payment procedures have expanded, in which AST can accept electronic enrollment and electronic bank payments in U.S. Dollars

and international shareholders and investors can make payments in British Pounds, Euros, Swiss Francs, or Canadian Dollars for DSPP purchases

through the Company as coordinated with AST. Funds received in foreign currency will be recorded by AST in US Dollars based upon the

New York Closing Foreign Exchange Rate (5:00 p.m. EST) on the Purchase Date as published online in the Wall Street Journal, Market Data

Center under Currencies (www.wsj.com/mdc).

Automatic

Monthly Investments

If

you elect this option, your funds will be debited from your bank account on the 25th day of each month (the “Purchase

Date”). If the 25th day of the month is a weekend or holiday, the debit date will be the next succeeding business day.

The price at which shares will be deemed purchased and credited to the investor’s Plan account will be at the average of the daily

averages of the high and low sale prices of the Company’s publicly traded Common Stock as reported on the OTCQX or any other exchange

or securities market for the five trading day period ending on the Purchase Date (hereinafter the “Market Price of the Publicly

Traded Stock”). You may change the amount of funds to be deducted or terminate an automatic monthly investment of funds by either

accessing your account online (www.amstock.com) or by completing and submitting to AST a new automatic investment form.

Obtaining

Certificates and Transferring or Selling Shares

Initially,

all shares that are purchased will be held by the Plan Agent and reflected in book-entry form in the shareholder’s account on the

records of the Plan Agent. A shareholder may request a certificate (at no cost) for some of or all whole shares (or issuable warrants)

at any time by a request to the Plan Agent by internet (www.amstock.com), calling 1-844-699-6645 (International 1-718-921-8205), or sending

in the form attached to the DSPP account statement. Certificates are normally issued within three business days after receipt of the

request and mailed no later than the day after the issuance. No certificates will be issued for fractional shares; instead, the market

value of any fractional share will be paid in cash.

You

may transfer (at no cost) ownership (or make gifts) of some or all shares (or issuable warrants) held through the Plan Agent by calling

the Plan Agent at 1-844-699-6645 (International 1-718-921-8205) for complete transfer instructions, or online at (www.amstock.com/shareholder/

sh_transfinst.asp). The transfer form must be completed, signed and returned to American Stock Transfer & Trust Company, LLC, 6201

15th Avenue, Brooklyn, NY 11219. The Medallion Guarantee form may be downloaded from www.amstock.com/shareholder/sh_downloads.asp.

You

may sell shares through the Plan Agent by accessing www.amstock.com on the internet, by calling the Plan Agent at 1-844-699-6645 (International

1-718-921-8205), or by mailing the form attached to the DSPP account statement to the Plan Agent. On receipt of a request to sell some

of or all the Plan shares, the Plan Agent will sell the shares on the open market no later than three business days after receipt of

the request and will send the proceeds less a service charge of $5 and applicable brokerage commissions of only $0.03 per share sold

(e.g., if 100 shares sold, commission is $3). All sell orders received by the Plan Agent by noon Eastern Time will result in shares being

sold the next business day. Sell orders received after noon Eastern Time will result in shares being sold the second business day after

receipt. The market value of any fractional share will be paid in cash. Proceeds are normally paid by check, which is distributed within

five business days after the sale. Tradable warrants will be treated the same above as shares with respect to obtaining certificates

and transferring or selling warrants.

|

DSPP Transaction Processing:

|

General Mailing Inquires:

|

|

|

|

|

Zion Oil & Gas, Inc.

|

Zion Oil & Gas, Inc.

|

|

c/o American Stock Transfer & Trust Co., LLC

|

c/o American Stock Transfer & Trust Co., LLC

|

|

Plan Administration Department

|

6201 15th Avenue

|

|

Post Office Box 922

|

Brooklyn, NY 11219

|

|

Wall Street Station

|

Domestic (844) 699-6645

|

|

New York, NY 10269-0560

|

International (718) 921-8205

|

|

|

www.amstock.com

|

Domestic

and Foreign Multi-Lingual Call Center

If

you have any questions about the DSPP, resident shareholders and investors of the United States and Canada can call the Plan Agent toll

free at 1-844-699-6645 (844-MYZNOIL) and other foreign resident shareholders and investors can call the Plan Agent at 1-718-921-8205.

Customer service representatives with multi-lingual capability for both domestic and foreign callers are available between the hours

of 8:00 a.m. and 8:00 p.m. EST, Monday through Friday. After hours, all calls will be forwarded to the AST automated line 24 hours a

day, seven days a week.

Purchasing

Shares under the Plan

Your

Plan account will be credited with the number of shares (including fractional shares, computed to four decimals) of our Common Stock

that you purchased. Management may, in its sole discretion, determine to provide a discount off the Market Price of the Publicly Traded

Stock, which will in no event exceed 10% off Market Price of the Publicly Traded Stock. Zion shall have the sole discretion to determine,

if there is to be a discount, the amount of such discount, if any (the “Discount Amount”), and the period in which such discount

is to remain in effect (the “Discount Period”). The Discount Period and the Discount amount will be posted on the Zion website

and the Plan Agent’s website at least two business days prior to the next succeeding Purchase Date. Modifications of the Discount

Amount and the Discount Period will become effective on such succeeding Purchase Date following the announcement of such change.

As

a participant, you are required to have your Common Stock held in book entry in the Plan with the Plan Agent during the initial six (6)

months after the date of your purchase of any discounted shares. Any shares withdrawn from the Plan Account within six (6) months

after the date of purchase will be subject to a withdrawal fee equal to the discount to the Market Price of the Publicly Traded Stock

that you received, if any, when purchasing the shares being withdrawn, if any discount.

Subject

to compliance with all applicable laws, you may transfer ownership of some or all of your Plan shares by sending the Plan Agent written,

signed transfer instructions and acceptable to the Plan Agent and endorsed by the Participant with a medallion guarantee applied to the

endorsement. You will be responsible for any applicable taxes in connection with the transfer.

You

will also be credited with dividends on fractions of shares you hold in the Plan. You can elect to reinvest all or a portion of your

dividends. To date, Zion has not paid dividends on its common stock and no assurance can be given as to when, if ever, Zion will be

able to pay dividends on its common stock.

Purchasing

Units under the Plan

The

Plan provides a feature whereby new investors and existing stockholders may also purchase, directly from Zion, Units of Zion securities,

with each Unit consisting of (i) one or more shares of our Common Stock and (ii) one or more warrants to purchase additional shares of

our Common Stock.

The

Unit will be offered directly to Plan participants at a price per Unit to be fixed periodically by Zion. Changes to the per Unit purchase

price will be posted on the Zion website and the Plan Agent’s at least two business days prior to next succeeding Purchase Date.

No changes will be made to the Warrant exercise price, which will be fixed at a price per share at the time of the Unit offering.

The

Warrants to be issued as part of Units purchased under the Plan may be separately transferable following their issuance and through their

expiration date. The Warrants will remain a book-keeping entry by the Plan Agent until the Participant requests delivery of the certificate

representing the Warrant. The Warrants will become first exercisable on the 31st day following the Unit Option Termination

Date and continue to be exercisable through the expiration date. The Warrants are not exercisable prior to such date. We may file an

application with OTCQX or any other exchange or securities market to list the Warrants; however, no assurance can be provided that any

warrants will be approved for listing on any exchange or securities market.

Unlike

shares purchased under the Plan, share of Common Stock and the Warrants purchased as part of the Units are not subject to the mandatory

deposit requirement, nor to the Withdrawal fee.

Federal

Income Tax Considerations

Since

you may be purchasing shares at a discount to fair market value, you may be treated as having received an additional dividend distribution

equal to the excess, if any, of the fair market value of the shares acquired on the Purchase Date over the amount of your investment.

Generally, participants in the Plan should not recognize income or loss for United States federal income tax purposes in connection with

the purchase of Units under the Plan. You should consult your tax advisor as to the particular consequences to you of the Plan and any

future dividend reinvestment. For a detailed discussion, see “Certain U.S. Federal Income Tax Consequences” on Page S-31.

DESCRIPTION

OF THE PLAN

The

following is a detailed description of the Plan in question-and-answer format.

PLAN

OVERVIEW

|

1.

|

What

is the purpose of the Plan?

|

The

Plan provides Zion with an economical and flexible mechanism to raise equity capital through sales of our Common Stock and Units.

We will be using these proceeds to further our operations, including our exploration for oil and gas in onshore Israel.

The

Plan is also intended to promote long-term stock ownership among existing and new investors in Zion by providing a convenient and economical

method to purchase shares of our Common Stock and reinvest cash dividends in shares of common stock (when we pay dividends in the future,

if ever) without payment of a brokerage commission.

The

Plan is designed for long-term investors who wish to invest and build their share ownership over time. The Plan is not intended to provide

holders of shares of Common Stock with a mechanism for generating assured short-term profits through rapid turnover of shares acquired

at a discount. The Plan’s intended purpose precludes any person, organization or other entity from establishing a series of related

accounts for the purpose of conducting arbitrage operations and/or exceeding the optional monthly cash investment limit. We reserve the

right to modify, suspend or terminate participation in this Plan by otherwise eligible holders of our Common Stock or new investors in

order to eliminate practices that we determine, in our sole discretion, to be inconsistent with the purposes of the Plan or that could

reasonably be used to circumvent the rules of the Plan.

|

2.

|

What

features does the Plan offer?

|

Initial

investment. If you are not an existing shareholder with a Plan Account through the Plan Agent, you can make an initial investment

in Zion’s Common Stock, starting with as little as $250. If you wish to make initial cash investments in excess of $10,000 for

the purchase of stock, you will need to obtain our approval and if necessary a written “Request for Waiver.” See Question

13.

If

you wish, you can also apply this amount to the purchase of Units, so long as the Units are available for purchase. Please note that

the dollar limitation of $10,000 and the approval and the “Request for Waiver” for amounts in excess of $10,000 do not apply

to Unit purchases.

Optional

monthly cash investments. Once you are a registered shareholder with a Plan Account through the Plan Agent, you can increase your

holdings of our Common Stock through optional monthly cash investments of $50 or more. Participants are not required to make additional

investments. You can make optional monthly cash investments by check, or electronically with deductions from your personal bank account.

If you wish to make monthly cash investments in excess of $10,000 for the purchase of stock, you will need to obtain our prior approval.

See Question 13.

For

monthly automatic cash purchases, participants must complete the Enrollment Form, checking the box for Automatic Monthly Investments,

indicate the amount of the monthly debit (minimum $50, maximum $10,000 (unless you obtain our prior approval)) and include a voided check

for the account to be debited. Only accounts at U.S. banks can participate in this program.

Checks

drawn on U.S. banks must be received at least three business days before the Purchase Dates. Purchases of shares and/or Units are recorded

daily (the “Purchase Date”). For ACH withdrawals that have been set up by the Plan Agent, the Plan Agent would debit the

bank account only on the 25th of the month.

You

can also apply these amounts to the purchase of Units, as long as the Units are available for purchase under the Plan. Please note that

the dollar limitation of $10,000 and the approval and the “Request for Waiver” for amounts in excess of $10,000 do not apply

to Unit purchases.

Automatic

dividend reinvestment. You can also increase your holdings of our Common Stock through automatic reinvestment of your cash dividends

(when and if dividends are paid in the future). You will also be credited with dividends on fractions of shares you hold in the Plan.

You can elect to reinvest all or a portion of your dividends. However, Participants electing to reinvest dividends are required to reinvest

at least 10% of the dividend to qualify as a dividend reinvestment program under I.R.S. Regulations. To date, Zion has not paid dividends

on its common stock and no assurance can be given as to when, if ever, Zion will be able to pay dividends on its common stock.

Mandatory

Share Deposit for Discounted Shares. As a participant, you are required to have your Common Stock held in book entry form in the

Plan with the Plan Agent for at least six (6) months after the date of purchase of your shares for any discounted shares. Any

discounted shares withdrawn from the Plan Account within six (6) months after the date of purchase will be subject to a withdrawal penalty.

See Question 18.

You

are not required to deposit shares of Common Stock and Warrants that are purchased as part of a Unit and also you are not subject to

any withdrawal fee for such securities.

Automated

transactions. The Plan Agent does have online interactive purchase facilities. The Plan Agent does provide the Plan Prospectus and

enrollment forms online. Participants will be able to view their accounts and statements online.

|

3.

|

How

does the purchase of Units work?

|

We

offer for limited time periods, the opportunity to purchase Units of our securities where each Unit is comprised of one or more shares

of Common Stock and one or more Common Stock purchase warrants. The Warrant affords you the opportunity to purchase additional shares

of our Common Stock at a fixed warrant exercise price. The Warrants would become first exercisable on the 31st day following

the Unit Option Termination Date and continue to be exercisable through the expiration date at a per share fixed exercise price. The

Warrants would not be exercisable prior to such date. We may file an application with OTCQX or any other exchange or securities market

to list the Warrants: however, no assurance can be provided that any warrants would be approved for listing on any exchange or securities

market.

|

4.

|

What

is the price that I will pay for shares of Common Stock under the Plan?

|

Checks,

bank wire payments, or electronic bank payments for purchases received by the Plan Agent, or at the offices of the Company, before 12

noon (EST) on a business day generally will be recorded as purchased on the same business day (the “Purchase Date”). The

Plan Agent has online interactive purchase facilities (www.amstock.com) to handle electronic enrollment and electronic check processing.

In addition, the same electronic services are offered through the Company’s website (www.zionoil.com). Checks, bank wire payments,

or electronic bank payments for purchases received by the Plan Agent, or at the offices of Company, after 12 noon (EST) on a business

day generally will be recorded as purchased on the next business day for the Purchase Date. Electronic bank payments are treated as received

and recorded on the date of receipt of the funds into the Plan Agent’s or the Company’s bank account.

The

price at which shares will be deemed purchased and credited to the investor’s account will be at the average of the high and low

sale prices of the Company’s publicly traded Common Stock as reported on the OTCQX or any other exchange or securities market on

the Purchase Date.

Any

discount is subject to periodic change by Zion. Zion reserves the sole discretion to determine any current or future discount off the

Market Price of the Publicly Traded Stock for continuing investments in shares of our Common Stock. Zion shall have the sole discretion

to determine, if there is to be a Discount Amount, if any, and the duration of the Discount Period. The Discount Period and the Discount

amount, if any, shall be posted on the Zion website and the Plan Agent’s website at least two business days prior to the next succeeding

Purchase Date.

Your

Plan account will be credited with the number of shares (including fractional shares, computed to four decimals) equal to the amount

invested for your Plan account divided by the applicable price per share.

|

5.

|

What

is the price that I will pay for Units under the Plan?

|

The

Unit will be offered directly to Plan participants at a price per Unit to be fixed periodically by Zion. Changes to the per Unit purchase

price will be posted on the Zion website and the Plan Agent’s website at least two business days prior to the next succeeding Purchase

Date.

|

6.

|

When

will purchases of shares or Units be actually made?

|

Since

only shares are purchased directly from the Company, the investor’s Plan account will be credited with the number of shares (including

fractional shares, computed to three decimals) of the Company’s Common Stock that was purchased. The price at which shares will

be deemed purchased and credited to the investor’s account will be at the average of the high and low sale prices of the Company’s

publicly traded Common Stock as reported on the OTCQX or any other exchange or securities market on the Purchase Date. Transaction confirmations

are communicated daily by the Plan Agent and also quarterly and year-end statements are mailed by the Plan Agent.

Under

dividend reinvestments, the Plan Agent will combine the dividend funds of all Plan participants whose dividends are automatically reinvested

and will generally invest such dividend funds on the dividend payment date (and any succeeding trading days necessary to complete the

order). If the dividend payment date falls on a day that is not a trading day, then the investment will occur on the next OTCQX or any

other exchange or securities market trading day. In addition, if the dividend is payable on a day when optional cash payments are to

be invested, dividend funds may be commingled with any such pending cash investments and a combined order may be executed. The record

date associated with a particular dividend is referred to as the “dividend record date”.

Zion

shall have the sole discretion to determine, if there is to be a discount to the Market Price of the Publicly Traded Stock. The Discount

Amount, if any, and the duration of the Discount Period shall be posted on the Zion website and the Plan Agent’s website at least

two business days prior the next succeeding Purchase Date. Modifications of the Discount Amount and the Discount Period will become effective

on the succeeding Purchase Date following the announcement of such change.

No

interest will be paid on cash held pending purchase.

|

7.

|

Where

will the shares under the Plan come from?

|

Shares

under the Plan, whether sold directly, or as part of a Unit or issued upon the exercise of a Warrant, will be purchased directly from

Zion from our pool of authorized and unissued Common Stock.

Currently,

Zion has reserved approximately 100,000,000 shares of its authorized and unissued shares of Common Stock to purchases under the Plan.

ADMINISTRATION

OF THE PLAN

|

8.

|

Who

administers the Plan?

|

The

Plan is administered by American Stock Transfer & Trust Company, LLC (the “Plan Agent”). The Plan Agent keeps

records, sends statements of account to Plan participants and performs other duties relating to the Plan. The Common Stock

purchased in your Plan account will be registered in the name of the Plan Agent. You may, at any time, withdraw all or any

part of the shares held in your Plan account; subject to applicable withdrawal fees (see Question 18). Special arrangements may

be made with the Plan Agent if you are an institution that is required by law to maintain physical possession of share certificates.

Also,

the Plan Agent acts as the warrant agent, receiving Unit purchases, accepting exercises, issuing common stock and warrants and forwarding

funds when requested.

|

|

9.

|

How

do I contact the Plan Agent or the Company?

|

|

|

Plan Agent

|

Company

|

|

Written Inquiries:

|

Zion Oil & Gas, Inc.

|

Zion Oil & Gas, Inc.

|

|

|

c/o

American Stock Transfer

&

Trust Co., LLC

|

12655

North Central Expressway

Suite

1000

|

|

|

6201 15th Avenue

|

Dallas, Texas 75243

|

|

|

Brooklyn, NY 11219

|

Attn: Investor Relations

|

|

|

|

invest@zionoil.com

|

|

|

www.amstock.com

|

www.zionoil.com

|

|

|

|

|

|

Phone Inquiries:

|

(844) 699-6645 (Domestic)

|

(214) 221-4610

|

|

|

|

(718)

921-8205 (International)

|

|

|

|

10.

|

What

kind of reports will be sent to participants in the Plan?

|

As

a Plan participant, you will receive a statement of your account as soon as practicable after each transaction (i.e., dividend reinvestment,

optional cash payments, share withdrawals, transfers, Unit purchases, warrant transactions, etc.) is posted to your Plan account. You

should retain these statements in order to establish the cost basis of shares and Warrants purchased under the Plan for income tax and

other purposes. In addition, you will receive copies of all communications sent to all other shareholders, such as annual

and quarterly reports, proxy statements and income tax information for reporting dividends paid. Under certain circumstances,

in lieu of copies, you may receive a Notice of Internet Availability of Proxy Materials providing access to the Company’s proxy

statement and annual report online. The Plan Agent will provide account and statement information online to investors.

PLAN

ELIGIBILITY AND ENROLLMENT

|

11.

|

Who

is eligible to participate in the Plan?

|

Any

person or legal entity is eligible to participate in the Plan. You do not have to be a current shareholder, nor do you have to reside

or be located in the U.S. or be a U.S. citizen. Purchases of shares of Common Stock or Units through the Plan are usually made in U.S.

currency, drawn on a U.S. bank account or by a wire in U.S. currency from a foreign bank account; except, we can handle certain foreign

currency transactions as outlined below.

We

have successfully implemented an electronic enrollment procedure with the Telecheck Internet Check Acceptance service as a payment method.

In addition to the enrollment procedures otherwise specified with the mailing to the Plan Agent of the signed Plan Enrollment Form and

check payment, current stockholders and prospective investors may enroll in the Plan by the procedures that allow for an acceptance of

an electronic signature and date to the Plan Enrollment Form and a secure internet check acceptance by First Data/Citibank Merchant Services

as coordinated with the Plan Agent.

Electronic

enrollment and payment procedures have been implemented, in which AST can accept electronic enrollment and electronic bank payments in

U.S. Dollars and international shareholders and investors can make payments in British Pounds, Euros, Swiss Francs, Israeli Shekels,

or Canadian Dollars for DSPP purchases through the Company as coordinated with AST. Funds received in foreign currency will be recorded

by AST in US Dollars based upon the New York Closing Foreign Exchange Rate (5:00 p.m. EST) on the Purchase Date as published online in

the Wall Street Journal, Market Data Center under Currencies (www.wsj.com/mdc).

In

addition, before investing in our Common Stock and/or Units, each participant who resides or is located outside the U.S. is responsible

for reviewing the laws of his or her country of residence or other applicable laws to determine if there are any restrictions on his

or her ability to invest through the Plan.

Investors

who are not U.S. persons should keep the following in mind: (1) they may face tax obligations in their own country on dividends and company-paid

fees; and (2) the enrollment procedure is the same as for U.S. taxpayers, except that a W-8 tax form must be filed so that withholding

on dividends will be reduced to the Tax Treaty amount for the resident country of the investor, if there is an income tax treaty between

the United States and the resident country of the investor .

The

Plan Agent or Zion may refuse to offer the Plan to residents of any state that may require registration, qualification or exemption of

the securities to be issued under the Plan, or require registration or qualification of the Plan Agent or any of its officers or employees

as a broker-dealer, a salesperson or an agent, where we determine, in our sole discretion, that the number of shareholders or the number

of shares held does not justify the expense that we may incur with respect to effecting sales of our common stock under the Plan in the

state.

|

|

12.

|

How can I participate in the Plan?

|

Current

Shareholders of Record

If

you already hold shares of our common stock registered in your name, you may join the Plan by returning a completed enrollment form to

the Plan Agent. Your participation will begin promptly after your signed Enrollment Form is received by the Plan Agent. Once you have

enrolled, your participation will continue automatically until either you elect to withdraw from the Plan or we terminate the Plan or

your participation in the Plan. However, any Plan discounts apply only to new purchases under the Plan of Common Stock and/or Unit

purchases and not to existing shareholders depositing current Common Stock with the Plan Agent.

New

Investors

If

you are not a current shareholder, you may join the Plan by returning to the Plan Agent a completed enrollment form along with an initial

investment of at least $250, but not more than $10,000 (subject to our right to waive this maximum, see Question 13) for direct Common

Stock purchases.

Along

with the Enrollment Form, the new investor must send a voided check to have electronic debits processed from your bank account for your

initial investment or send your initial investment by check payable to the “American Stock Transfer & Trust Company, LLC.”

You are being required to send a voided check to prevent any mistakes that can be made in submitting the correct account. Electronic

enrollment and payment procedures are in place as another option for new investors as outlined above.

Beneficial

Owners and Shares Held in “Street Name”

If

you are a beneficial owner of Zion’s Common Stock and your shares are registered in the name of a bank, broker, trustee or other

agent, you may transfer your shares to a Plan account to enroll in the dividend reinvestment program by instructing your bank, broker,

trustee or agent to transfer shares into your name and following the above instructions for Current Shareholders or by following the

above instructions for New Investors.

|

|

13.

|

How

may I invest in excess of $10,000 under the Plan?

|

If

you want to make optional monthly cash investments in excess of $10,000 in any month or an initial investment in excess of $10,000 for

direct Common Stock purchases, you must receive our approval. To obtain our approval, you must contact us directly and you may be required

to submit a “Request for Waiver” form. You can obtain a Request for Waiver form on our website or the website of the Plan

Agent at www.amstock.com or by contacting Zion Oil & Gas, Inc., Investor Relations, 12655 North Central Expressway, Suite 1000, Dallas,

Texas 75243 Upon completion, please send it directly to Zion Oil & Gas, Inc. for review and approval. Zion shall notify the investor

of approval of the investment and the Plan Agent of approval and approval of any Waiver as well as the form of the payment (wire or check).

We have the sole discretion to approve or refuse any request to make an optional monthly cash investment or initial investment in excess

of the maximum amount and to set the terms of any such optional monthly cash investment or initial investment. We have the sole discretion

to structure the “Request for Waiver” program in any way with respect to any requirements, features, terms, or conditions

with respect to any investor.

We

will decide whether to approve a submitted Request for Waiver within three (3) business days of the receipt of the request. If you do

not receive a response from us in connection with your request, you should assume that we have denied your request. If a request is approved,

funds must be received no later than 3:00 p.m. Eastern time, one business day prior to the first day of the applicable “Pricing

Period” (as defined below). We may alter, amend, supplement or waive, in our sole discretion, the time periods and/or other parameters

relating to optional cash purchases in excess of $10,000 made by one or more participants in the Plan or new investors, at any time and

from time to time, prior to the granting of any Request for Waiver.

If

we approve your Request for Waiver, we will notify you promptly. In deciding whether to approve a Request for Waiver, we will consider

relevant factors, including, but not limited to, the following:

|

|

●

|

our

need for additional funds;

|

|

|

●

|

the

attractiveness of obtaining additional funds through the sale of common stock as compared to other sources of funds;

|

|

|

●

|

the

purchase price likely to apply to any sale of common stock;

|

|

|

●

|

the

shareholder submitting the request;

|

|

|

●

|

the

extent and nature of the shareholder’s prior participation in the Plan;

|

|

|

●

|

the

number of shares of common stock held of record by the shareholder;

|

|

|

●

|

the

aggregate number of cash investments and initial investments in excess of $10,000 for which requests for waiver have been submitted by

all existing shareholders and new investors; and

|

|

|

●

|

our

current and projected capital needs.

|

If

requests for waiver are submitted for an aggregate amount in excess of the amount, we are then willing to accept, we may honor such requests

in order of receipt, pro rata or by any other method that we determine to be appropriate. We may determine, in our discretion, the maximum

amount that an existing shareholder or new investor may invest pursuant to the Plan or the maximum number of shares of Common Stock that

may be purchased pursuant to a request for waiver. In addition, we may place reasonable conditions regarding the form and timing of payment

on the granting of any waiver.

Purchase

Price of Shares for Optional Cash Investments in Excess of $10,000. Shares purchased pursuant to an approved Request for Waiver will

be purchased directly from us as described herein, including the establishment of a “Threshold Price” and a “Waiver

Discount,” as more fully described below. If we grant your request to purchase shares pursuant to a Request for Waiver, there will

be a “Pricing Period,” which will generally consist of one to 15 consecutive separate trading days on the OTCQX or any other

exchange or securities market, to be determined at our discretion. Each of these separate trading days will be a “Purchase Date,”

and an equal proportion of your optional cash investment will be invested on each trading day during such Pricing Period, subject to

the qualifications listed below. The “Purchase Price” for shares acquired on a particular Purchase Date will be equal to

100% (subject to change as provided below) of the volume weighted average price, rounded to four decimal places, of our common shares

as reported by OTCQX or any other exchange or securities market for the trading hours from 9:30 a.m. to 4:00 p.m., Eastern time (through

and including the OTCQX or any other exchange or securities market closing print), for that Purchase Date. For example, if a cash investment

of $1,000,000 is made pursuant to an approved Request for Waiver, and the Pricing Period consists of ten trading days, there would be

ten separate investments, each for $100,000, beginning on the Pricing Period commencement date and continuing for ten trading days. The

number of shares purchased for each Purchase Date would be calculated by dividing the proportionate amount of the approved waiver request

amount, in this example $100,000, by the volume weighted average price as reported by OTCQX or any other exchange or securities market,

rounded to four decimal places, for the trading hours from 9:30 a.m. to 4:00 p.m., Eastern time (through and including the OTCQX or any

other exchange or securities market closing print), for that Purchase Date, less any Waiver Discount. Plan shares will not be available

to Plan participants until the conclusion of each Pricing Period or investment, unless we activate the Continuous Settlement Feature

(see below).

The

Plan Agent will apply all optional cash purchases made pursuant to a Request for Waiver for which good funds are received on or before

the first business day before the Pricing Period to the purchase of shares of Common Stock on each Purchase Date of the applicable Pricing

Period.

Threshold

Price. For any given Pricing Period, we may establish a minimum price, or “Threshold Price,” applicable to optional cash

purchases made pursuant to a Request for Waiver. This determination will be made by us in our discretion after a review of current market

conditions, the level of participation in the Plan, and current and projected capital needs.

If

established for any Pricing Period, the Threshold Price will be stated as a dollar amount that the volume weighted average price, rounded

to four decimal places, of our common shares as reported on the OTCQX or any other exchange or securities market for the trading hours

from 9:30 a.m. to 4:00 p.m., Eastern time (through and including the OTCQX or any other exchange or securities market closing print),

for each trading day of such Pricing Period (not adjusted for discounts, if any) must equal or exceed. Except as provided below, we will

exclude from the Pricing Period any trading day that the volume weighted average price is less than the Threshold Price. We also will

exclude from the Pricing Period and from the determination of the purchase price any day in which no trades of our common shares are

made on the OTCQX or any other exchange or securities market. For example, if the Threshold Price is not met for two of the trading days

in a 10 day Pricing Period, then we will return 20% of the funds you submitted in connection with your Request for Waiver unless we have

activated the Pricing Period Extension Feature for the Pricing Period (described below).

Pricing

Period Extension Feature. We may elect to activate for any particular Pricing Period the “Pricing Period Extension Feature,”

which will provide that the initial Pricing Period will be extended by the number of days that the Threshold Price is not satisfied,

or on which there are no trades of our common shares reported by OTCQX or any other exchange or securities market, subject to a maximum

of five trading days. If we elect to activate the Pricing Period Extension Feature and the Threshold Price is satisfied for any additional

day that has been added to the initial Pricing Period, that day will be included as one of the trading days for the Pricing Period in

lieu of the day on which the Threshold Price was not met or trades of our common shares were not reported. For example, if the determined

Pricing Period is 10 days, and the Threshold Price is not satisfied for three out of those 10 days in the initial Pricing Period, and

we had previously announced at the time of the Request for Waiver acceptance that the Pricing Period Extension Feature was activated,

then the Pricing Period will automatically be extended, and if the Threshold Price is satisfied on the next three trading days (or a

subset thereof), then those three days (or a subset thereof) will become Purchase Dates in lieu of the three days on which the Threshold

Price was not met. As a result, because there were 10 trading days during the initial and extended Pricing Period on which the Threshold

Price was satisfied, all of the optional cash purchase will be invested.

Continuous

Settlement Feature. If we elect to activate the Continuous Settlement Feature, shares of Common Stock will be available to Plan Participants

within three business days of each Purchase Date beginning on the first trading day in the applicable Pricing Period and ending on the

final trading day in the applicable Pricing Period, with an equal amount being invested on each such day, subject to the qualifications

set forth above. We may elect to activate the Continuous Settlement Feature at the time of the Request for Waiver form acceptance.

Return

of Unsubscribed Funds. We will return a portion of each optional cash investment, provided the total optional cash investment is

in excess of $10,000, for each trading day of a Pricing Period or extended Pricing Period, if applicable, for which the Threshold Price

is not met or for each day in which no trades of our common shares are reported on the OTCQX or any other exchange or securities market,

which we refer to as unsubscribed funds. Any unsubscribed funds will be returned within three business days after the last day of the

Pricing Period, or if applicable, the extended Pricing Period, without interest. The amount returned will be based on the number of days

on which the Threshold Price was not met compared to the number of days in the Pricing Period or extended Pricing Period. For example,

the return amount in a 10 day Pricing Period will equal one-tenth (1/10) of the total amount of such optional cash investment (not just

the amount exceeding $10,000) for each trading day that the Threshold Price is not met or for each trading day in which sales are not

reported.

The

establishment of the Threshold Price and the possible return of a portion of the investment apply only to optional cash investments in

excess of $10,000. Setting a Threshold Price for a Pricing Period will not affect the setting of a Threshold Price for any other Pricing

Period. We may waive our right to set a Threshold Price for any particular Pricing Period.

In

any event, no interest will be paid on returned funds.

Waiver

Discount. We may establish a discount from the market price applicable to optional cash investments in excess of $10,000 made pursuant

to a Request for Waiver. This discount, which we also refer at as the “Waiver Discount,” may be between 0% and 10% of the

purchase price and may vary for each Pricing Period and for each optional cash investment.

The

Waiver Discount will be established at our sole discretion after a review of current market conditions, the level of participation in

the Plan, the attractiveness of obtaining such additional funds through the sale of common shares as compared to other sources of funds,

current and projected capital needs and other factors that we determine in our sole discretion. Setting a Waiver Discount for a particular

Pricing Period shall not affect the setting of a Waiver Discount for any other Pricing Period. The Waiver Discount will apply only to

optional cash investments of more than $10,000 (or other applicable maximum monthly amount). The Waiver Discount will apply to the entire

optional cash investment and not just the portion of the optional cash investment that exceeds $10,000. A Pricing Period is the time

period, in which we establish certain Waiver Discounts to be in effect with a specified discount amount.

The

above restriction and Waiver Discount apply only to direct stock purchases. The dollar limitation of $10,000, the Waiver Discount and

the approval of the “Request for Waiver” for amounts in excess of $10,000 do not apply to Unit purchases.

|

14.

|

Are

there fees associated with enrollment?

|

No. The

Company pays all fees, administrative and other expenses related to your Plan enrollment. However, you may incur certain charges for

certain other transactions, requests or withdrawals under the Plan. However, Participants can be subject to an early withdrawal fee on

direct stock purchases at a discounted price and would be responsible for any brokerage commissions attributable to any open market sale.

|

15.

|

Are

there special eligibility or enrollment rules applicable to Company employees?

|

Yes,

if you are a Company employee, you have the additional option of purchasing shares through automatic payroll deductions. Employees

who participate through the automatic payroll deduction option may open a Plan account simply by completing an Enrollment Form and returning

it to Zion. Otherwise, the stock purchase plans are available on equal terms to all shareholders, new investors and Company employees.

MANDATORY

BOOK-ENTRY SERVICES

|

16.

|

What

is meant by book-entry shares?

|

All

shares of Zion Oil’s Common Stock that are purchased through the Direct Stock Plan will be held by the Plan Agent and reflected

in book-entry form in your account on the records of the Plan Agent. If you hold other Zion Common Stock certificates, you

may also, at any time, deposit those certificates with the Plan Agent, but the shares represented by the deposited certificates will

not be included in the book-entry form in your Plan account. Note: The certificates should not be endorsed and the assignment section

should not be completed.

The

Common Stock and Warrants purchased as part of a Unit will also be held in book-entry form with the Plan Agent, unless a Participant

requests delivery of the certificates representing the Common Stock and/or Warrants in whole shares with a check representing fractional

shares and/or warrants.

|

17.

|

Are

there any charges associated with this book entry service?

|

No. There

is no cost to you either for having the Plan Agent hold the shares purchased for you through the Plan or for depositing with the Plan

Agent the stock certificates you hold for the purpose of adding the shares to your book-entry share position. However, you

may incur certain charges for certain other transactions, requests or withdrawals under the Plan.

|

|

18.

|

Are

there fees associated with withdrawing share certificates within the six month period following purchase of discounted shares?

|

Yes.

Any shares withdrawn from the Plan Account within six (6) months after the date of purchase will be charged a withdrawal fee equal to

the discount to the Market Price of the Publicly Traded Stock that you received when purchasing the shares being withdrawn, up to a maximum

of the number of shares purchased at the discounted price. Shares cannot be transferred within the Plan or gifted without incurring

the same withdrawal fee, whether by act of law or by voluntary transfer. The Participant is subject to the withdrawal fee at the time

of withdrawal. The withdrawal fee will also apply to any purchases of shares made at the discounted price through automatic dividend

reinvestment and employee payroll deductions (if applicable) during the six (6) month period before the date of withdrawal. The Participant

must send in a check for the amount of the withdrawal fee for the applicable shares being withdrawn from the Plan, or, alternatively,

the Plan Agent is authorized to sell sufficient whole shares equal to the withdrawal fee and remit the residual whole shares and cash

in lieu of fractional shares to the requesting Participant.

The

above provisions do not apply to shares of Common Stock and Warrants purchased as part of a Unit, along with any shares issuable upon

exercise of a Warrant. Also, the above provision does not apply to any shares purchased without any discount to the Market Price of the

Publicly Traded Stock, or purchased under a “Request for Waiver” program.

PURCHASE

OF UNITS

|

|

19.

|

Will

the Unit that I purchase under the Plan be tradable?

|

No.

The Units are not tradable. The shares of Common Stock and Warrants are being sold as part of a Unit solely for convenience sake and

immediately upon purchase the shares of Common Stock and Warrants are separable and may be traded separately.

|

|

20.

|

Will

the shares of Common Stock and Warrants that I receive from the Units be tradable on the OTCQX or any other exchange or securities market?

|

Our

common stock is currently traded on the OTCQX under the symbol “ZNOG”. The Units are non-transferable and will

not be traded. The Common Stock included in the Units will be listed for quotation on the OTCQX or any other exchange or securities market

under the symbol “ZNOG”.

The

Warrants included in the Units may be separately transferable following their issuance. The Warrants will become first exercisable on

the 31st day following any Unit Option Termination Date and continue to be exercisable through the expiration date at a fixed

per share exercise price. The Warrants would not be exercisable prior to such date. We may file an application with OTCQX or any other

exchange or securities market to list the Warrants on the OTCQX or any other exchange or securities market; however, no assurance can

be provided that the warrants would be approved for listing on the OTCQX or any other exchange or securities market.

The

shares of Common Stock issuable upon exercise of the Warrants would be immediately tradable upon issuance and would be listed for quotation

on the OTCQX or any other exchange or securities market under the symbol “ZNOG”, assuming that the registration statement,

as amended, of which this Prospectus Supplement forms a part remains effective, and that our Common Stock is still listed on the OTCQX

or any other exchange or securities market, at that time. Such registration statement, as amended, was declared effective by the SEC

on December 15, 2021 and, therefore, expires on the third anniversary thereof, subsequent to a 180-day grace period. Such registration

statement, as amended, is sometimes referred to herein as the “registration statement” or the “shelf registration statement.”

The

Common Stock and Warrants purchased, as part of a Unit will be held in book-entry form with the Plan Agent, unless a Participant requests

delivery of the certificates representing the Common Stock in whole shares with a check representing fractional shares and/or Warrants.

OPTIONAL

CASH PAYMENTS

|

|

21.

|

How

does the cash payment option work? What are the minimum and maximum amounts for optional cash payments?

|

As

a Plan participant, you may (but are not required to) make optional cash payments at any time in our Common Stock in amounts of at least

$50, subject to a limitation of $10,000, per month, subject to approval and if necessary a “Request for Waiver” approval

for amounts greater than $10,000 per month.

All

optional cash payments will be invested in our Common Stock on the 25th day of each calendar month and if such day falls on

a holiday or a weekend, then on the next trading day. See Question 6. Interest will not be paid on funds held pending investment.

|

|

22.

|

How

do I make an optional cash payment?

|

Optional

cash payments may be made by sending a personal check, drawn from a U.S. Bank in US Dollars, or by sending a bank wire in U.S. dollars,

payable to “American Stock Transfer & Trust Co., LLC,” (“AST”) along with the Enrollment Form. AST can accept

electronic enrollment and electronic bank payments in U.S. Dollars and international shareholders and investors can make payments in

British Pounds, Euros, Swiss Francs, Israeli Shekels, or Canadian Dollars for DSPP purchases through the Company as coordinated with

AST. Funds received in foreign currency will be recorded by AST in US Dollars based upon the New York Closing Foreign Exchange Rate (5:00

p.m. EST) on the Purchase Date as published online in the Wall Street Journal, Market Data Center under Currencies (www.wsj.com/mdc).

If

you elect this option, your funds will be debited from your bank account on the 25th day of each month (the “Purchase

Date”). If the 25th day of the month is a weekend or holiday, the debit date will be the next succeeding business day.

The price at which shares will be deemed purchased and credited to the investor’s Plan account will be at the average of the daily

averages of the high and low sale prices of the Company’s publicly traded Common Stock as reported on the OTCQX or any other exchange

or securities market for the five trading day period ending on the Purchase Date (hereinafter the “Market Price of the Publicly

Traded Stock”). You may change the amount of funds to be deducted or terminate an automatic monthly investment of funds by either

accessing your account online (www.amstock.com) or by completing and submitting to AST a new automatic investment form.

|

|

23.

|

Will

I be charged fees for optional cash payments?

|

No. You

will not be charged any fees in connection with your optional cash payments. However, you may incur certain charges for certain

other transactions, requests or withdrawals under the Plan.

|

|

24.

|

How

are payments with “insufficient funds” handled?

|

If

an optional cash payment is made by a check drawn on insufficient funds or incorrect draft information, or the Plan Agent otherwise does

not receive the money, the requested purchase will be deemed void, and the Plan Agent will immediately remove from your account any shares

already purchased upon the prior credit of such funds.

ISSUANCE

OF STOCK CERTIFICATES

|

|

25.

|

Will

stock certificates be issued for shares acquired through the Plan?

|

No. Stock

certificates will not be issued for direct purchases of shares of Common Stock in a Plan account unless a specific request is made to

the Plan Agent.

|

26.

|

How

do I request a stock certificate?

|

Certificates

for full shares held in the Plan may be obtained, without charge, by writing to the Plan Agent and requesting the issuance of shares

in certificate form with the exception of the Withdrawal Fee in Question 18, if the Fee applies.

Certificates

for fractional shares will not be issued under any circumstances.

|

|

27.

|

Can

I pledge or assign the shares held in my Plan account?

|

No. Shares

held in your Plan account may not be pledged or assigned. If you wish to pledge or assign your shares, you first must write

to the Plan Agent and request the issuance of shares in certificate form, and pay any applicable withdrawal fees.

GIFTS

AND TRANSFERS OF SHARES

|

|

28.

|

Can

I transfer shares that I hold in the Plan to someone else?

|

Yes. Subject

to compliance with all applicable laws, you may transfer ownership of some or all of your Plan shares by sending the Plan Agent written,

signed transfer instructions. You will be responsible for any applicable taxes in connection with the transfer. However,

a new or existing shareholder must sign an Enrollment Form in order to become a Plan Participant.

You

may transfer shares to new or existing shareholders. The Participant will be responsible for any brokerage commissions, if

there are any with any sales. If you are opening a new Plan account for the transferee, you must include a completed Enrollment Form

with the gift/transfer instructions; however, a new Plan account will not be opened as a result of a transfer of fewer than ten (10)

shares, unless you (i) authorize the reinvestment of dividends on the shares to be transferred and (ii) include an optional cash payment

with your transfer instructions sufficient to purchase the remainder of the ten (10) shares required to enroll. The Plan Agent may charge

the Participant a $15 fee for this transfer service, subject to any applicable Withdrawal Fee in Question 18.

CHANGING

METHOD OF PARTICIPATION AND WITHDRAWAL

|

|

29.

|

How

do I change my method of participation in the Plan?

|

You

may change your method of participation at any time by completing a new Enrollment Form and returning it to the Plan Agent.

|

|

30.

|

How

do I close my Plan account?

|

You

may terminate your participation in the Plan by giving written notice to the Plan Agent. Upon termination, you must elect

either (a) to receive a certificate for the number of whole shares held in your Plan account and a check for the value of any fractional

share (which value will be based on the closing market price on OTCQX or any other exchange or securities market of the Common Stock

on the first day that shares of Common Stock are traded after the withdrawal request is received); or (b) to have all of the shares in

your Plan account sold for you. If you request that your shares be sold, the Plan Agent will make the sale in the market,

if practicable, within ten (10) trading days after receipt of the request. You will receive the proceeds of sale, less any

brokerage commission and transfer tax. Receipt by the Plan Agent of due notice of a participant’s death or incompetence shall be

deemed a notice of withdrawal. Medallion Signature Guarantee is required for sale requests of $10,000 or higher. Because