Current Report Filing (8-k)

March 24 2020 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 18, 2020

XSUNX, INC.

(Exact name of registrant as specified in its charter)

|

Colorado

|

000-29621

|

84-1384159

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

65 Enterprise, Aliso Viejo, CA 92656

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (949) 330-8060

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock

|

XSNX

|

OTC Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

On March 18, 2020, XsunX, Inc. (the “Company”), Tom Djokovich, the President and Chief Executive Officer of the Company, and TN3, LLC, a Wyoming limited liability company (“TN3”) entered into a Stock Purchase Agreement (the “Agreement”). Pursuant to the Agreement, Mr. Djokovich agreed to sell his 5,000 shares of Series A Preferred Stock of the Company to TN3. The holder of the Series A Preferred Stock may cast votes equal to not less than 60% of the total outstanding voting power of the Company on all matters voted on by the shareholders of the Company. Completion of the sale of the Series A Preferred Stock is conditioned upon a number of events, including the filing by the Company of a Schedule 14F to disclose changes in the management of the Company that will occur in connection with the sale. Upon the completion of the sale of the Series A Preferred Stock, the Company will issue each of the current resigning directors of the Company 500,000,000 common stock purchase warrants to purchase up to 500,000,000 shares of the Company common stock on a pre-Stock Split (as that term is below defined) basis. These warrants will be exercisable on a cashless basis for a period of ten years from the effective date of the Stock Split at an exercise price of $0.00001 per share on a pre-Stock Split basis.

Daniel G. Martin is the sole owner and president of TN3 and the chairman of the board and chief executive officer of Innovest Global, Inc., a diversified industrial company. Upon completion of the sale, the current board and officers will resign and be replaced by a new board and officers to be identified by Mr. Martin. After the completion of the sale of the Series A Preferred Stock, the parties intend for the Company to continue to market its current solar services while preparing to acquire biotechnology assets from Innovest Global, Inc. and transition into a new business plan focused in the biotechnology, medical and health & wellness markets, commercializing developmental healthcare solutions. Initially, the Company will focus on biotechnology developing a third-generation brain cancer vaccine the technology for which has been patent approved and is known as StemVax Glioblast (SVX-GB). In preparation for the issuance of additional shares for the acquisition of biotechnology assets, the Company plans to effectuate a 1-for-1,000 reverse stock split of issued and outstanding common stock (the “Stock Split”). The Company will file a Schedule 14F describing these matters in additional detail in the near future.

There can be no guarantees that the sale will close as expected, that a new management team will be appointed, or that the Company will successfully refocus its business on biotechnology. A copy of the Agreement will be filed with the Company’s Report on Form 10Q for the quarter ending March 31, 2020.

SECTION 9 – FINANCIAL STATEMENTS, PRO FORMA FINANCIALS & EXHIBITS

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

10.1 Stock Purchase Agreement, dated March 18, 2020.*

*To be filed with the Company’s Report on Form 10Q for the quarter ending March 31, 2020.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

XSUNX, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: March 24, 2020

|

By:

|

/s/ Tom M. Djokovich

|

|

|

|

|

Name: Tom M. Djokovich

Title: CEO/Secretary

|

|

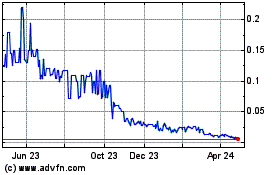

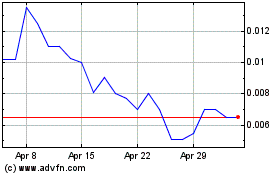

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Apr 2023 to Apr 2024