Notes

to Financial Statements

March

31, 2019

Note 1 – Nature of Business and Significant Accounting

Policies

Nature of Business

WEED,

Inc. (the “Company”), (formerly United Mines, Inc.) was

incorporated under the laws of the State of Arizona on August 20,

1999 (“Inception Date”) as Plae, Inc. to engage in the

exploration of gold and silver mining properties. On November 26,

2014, the Company was renamed from United Mines, Inc. to WEED, Inc.

and was repurposed to pursue a business involving the purchase of

land, and building Commercial Grade “Cultivation

Centers” to consult, assist, manage & lease to Licensed

Dispensary owners and organic grow operators on a contract basis,

with a concentration on the legal and medical marijuana sector. The

Company’s plan is to become a True “Seed-to-Sale”

company providing infrastructure, financial solutions and real

estate options in this new emerging market. The Company, under

United Mines, was formerly in the process of acquiring mineral

properties or claims located in the State of Arizona, USA. The name

was previously changed on February 18, 2005 to King Mines, Inc. and

then subsequently changed to United Mines, Inc. on March 30, 2005.

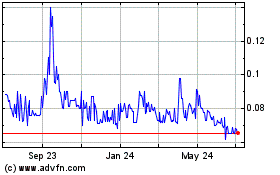

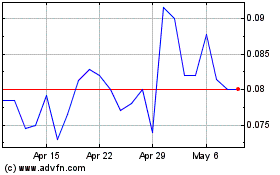

The Company trades on the OTC Pink Sheets under the stock symbol:

BUDZ.

On

April 20, 2017, the Company acquired Sangre AT, LLC, a Wyoming

company doing business as Sangre AgroTech. (“Sangre”).

Sangre is a plant genomic research and breeding company comprised

of top-echelon scientists with extensive expertise in genomic

sequencing, genetics-based breeding, plant tissue culture, and

plant biochemistry, utilizing the most advanced sequencing and

analytical technologies and proprietary bioinformatics data systems

available. Sangre is working on a cannabis genomic study to

complete a global genomic classification of the cannabis plant

genus.

The

accompanying financial statements have been prepared in conformity

with accounting principles generally accepted in the United States

of America. These statements reflect all adjustments, consisting of

normal recurring adjustments, which in the opinion of management

are necessary for fair presentation of the information contained

therein.

The

Company has a calendar year end for reporting

purposes.

Basis of Presentation:

The

accompanying condensed consolidated balance sheet at December 31,

2018, has been derived from audited consolidated financial

statements and the unaudited condensed consolidated financial

statements as of March 31, 2019 and 2018 ( the “financial

statements”), have been prepared in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”) for interim financial information and

with the instructions to Form 10-Q and Article 8 of Regulation S-X.

Accordingly, they do not include all of the information and

footnotes required by GAAP for complete financial statements and

should be read in conjunction with the audited consolidated

financial statements and related footnotes included in our

Registration Statement on Form S-1 for the year ended December 31,

2018 (the “2018 Annual Report”), filed with the

Securities and Exchange Commission (the “SEC”). It is

management’s opinion, however, that all material adjustments

(consisting of normal recurring adjustments), have been made which

are necessary for a fair financial statements presentation. The

condensed consolidated financial statements include all material

adjustments (consisting of normal recurring accruals) necessary to

make the condensed consolidated financial statements not misleading

as required by Regulation S-X, Rule 10-01. Operating results for

the three ended March 31, 2019, are not necessarily indicative of

the results of operations expected for the year ending December 31,

2019.

Principles of Consolidation

The

accompanying consolidated financial statements include the accounts

of the following entities, all of which are under common control

and ownership:

|

|

|

State

of

|

|

|

|

Abbreviated

|

|

Name of

Entity

|

|

Incorporation

|

|

Relationship

(1)

|

|

Reference

|

|

WEED,

Inc.

|

|

Nevada

|

|

Parent

|

|

WEED

|

|

Sangre

AT, LLC (2)

|

|

Wyoming

|

|

Subsidiary

|

|

Sangre

|

(1)

Sangre is a wholly-owned subsidiary of WEED, Inc.

(2)

Sangre AT, LLC is doing business as Sangre AgroTech.

The

consolidated financial statements herein contain the operations of

the wholly-owned subsidiary listed above. All significant

inter-company transactions have been eliminated in the preparation

of these financial statements. The parent company, WEED and

subsidiary, Sangre will be collectively referred to herein as the

“Company”, or “WEED”. The Company's

headquarters are located in Tucson, Arizona and its operations are

primarily within the United States, with minimal operations in

Australia.

These

statements reflect all adjustments, consisting of normal recurring

adjustments, which in the opinion of management are necessary for

fair presentation of the information contained

therein.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 1 – Nature of Business and Significant Accounting

Policies (continued)

Use of Estimates

The

preparation of financial statements in conformity with accounting

principles generally accepted in the United States requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, and the disclosure of

contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those

estimates.

Fair Value of Financial Instruments

Under

FASB ASC 820-10-05, the Financial Accounting Standards Board

establishes a framework for measuring fair value in generally

accepted accounting principles and expands disclosures about fair

value measurements. This Statement reaffirms that fair value is the

relevant measurement attribute. The adoption of this standard did

not have a material effect on the Company’s financial

statements as reflected herein. The carrying amounts of cash,

prepaid expenses and accrued expenses reported on the balance sheet

are estimated by management to approximate fair value primarily due

to the short term nature of the instruments.

Impairment of Long-Lived Assets

Long-lived

assets held and used by the Company are reviewed for possible

impairment whenever events or circumstances indicate the carrying

amount of an asset may not be recoverable or is impaired.

Recoverability is assessed using undiscounted cash flows based upon

historical results and current projections of earnings before

interest and taxes. Impairment is measured using discounted cash

flows of future operating results based upon a rate that

corresponds to the cost of capital. Impairments are recognized in

operating results to the extent that carrying value exceeds

discounted cash flows of future operations.

Basic and Diluted Loss Per Share

The

basic net loss per common share is computed by dividing the net

loss by the weighted average number of common shares outstanding.

Diluted net loss per common share is computed by dividing the net

loss adjusted on an “as if converted” basis, by the

weighted average number of common shares outstanding plus potential

dilutive securities. For the periods presented, potential dilutive

securities had an anti-dilutive effect and were not included in the

calculation of diluted net loss per common share.

Stock-Based Compensation

Under

FASB ASC 718-10-30-2, all share-based payments to employees,

including grants of employee stock options, to be recognized in the

income statement based on their fair values. Pro forma disclosure

is no longer an alternative.

Revenue Recognition

On

January 1, 2018, the Company adopted the new revenue recognition

standard ASU 2014-09, “Revenue from Contracts with Customers

(Topic 606)”, using the cumulative effect (modified

retrospective) approach. Modified retrospective adoption requires

entities to apply the standard retrospectively to the most current

period presented in the financial statements, requiring the

cumulative effect of the retrospective application as an adjustment

to the opening balance of retained earnings at the date of initial

application. No cumulative-effect adjustment in retained earnings

was recorded as the Company’s has no historical revenue. The

impact of the adoption of the new standard was not material to the

Company’s condensed consolidated financial statements for the

three ended March 31, 2019. The Company expects the impact to be

immaterial on an ongoing basis.

The

primary change under the new guidance is the requirement to report

the allowance for uncollectible accounts as a reduction in net

revenue as opposed to bad debt expense, a component of operating

expenses. The adoption of this guidance did not have an impact on

our condensed consolidated financial statements, other than

additional financial statement disclosures. The guidance requires

increased disclosures, including qualitative and quantitative

disclosures about the nature, amount, timing and uncertainty of

revenue and cash flows arising from contracts with

customers.

The

Company operates as one reportable segment.

Sales

on fixed price contracts are recorded when services are earned, the

earnings process is complete or substantially complete, and the

revenue is measurable and collectability is reasonably assured.

Provisions for discounts and rebates to customers, estimated

returns and allowances, and other adjustments are provided for in

the same period the related sales are recorded. The Company will

defer any revenue from sales in which payment has been received,

but the earnings process has not occurred. Sales have not yet

commenced.

Advertising and Promotion

All

costs associated with advertising and promoting products are

expensed as incurred. These expenses were $1,247 and $602 for the

three months ended March 31, 2019 and 2018,

respectively.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 1 – Nature of Business and Significant Accounting

Policies (continued)

Recently Issued Accounting Pronouncements

In May

2014, the FASB issued Accounting Standards Update ASU 2014-09,

“Revenue from Contracts with Customers (Topic 606),”

which supersedes nearly all existing revenue recognition guidance,

including industry-specific guidance. Subsequent to the issuance of

ASU No. 2014-09, the FASB clarified the guidance through several

Accounting Standards Updates; hereinafter the collection of revenue

guidance is referred to as “Topic 606.” Topic 606 is

based on the principle that an entity should recognize revenue to

depict the transfer of goods or services to customers in an amount

that reflects the consideration to which the entity expects to be

entitled in exchange for those goods or services. Topic 606 also

requires additional disclosures about the nature, amount, timing

and uncertainty of revenue and cash flows arising from customer

contracts, including significant judgments and changes in judgments

and assets recognized from costs incurred to fulfill a contract.

The Company adopted Topic 606 on January 1, 2018 using the modified

retrospective transition method; accordingly, Topic 606 has been

applied to the fiscal 2018 financial statements and disclosures

going forward, but the comparative information has not been

restated and continues to be reported under the accounting

standards in effect for those periods. We expect the impact of the

adoption of Topic 606 to be immaterial to our operating results on

an ongoing basis.

In

February 2016, the FASB issued ASU 2016-02, Leases. The standard

requires lessees to recognize lease assets and lease liabilities on

the consolidated balance sheet and requires expanded disclosures

about leasing arrangements. We plan to adopt the standard on

January 1, 2019. We are currently assessing the impact that the new

standard will have on our consolidated financial statements, which

will consist primarily of a balance sheet gross up of our operating

leases to show equal and offsetting lease assets and lease

liabilities.

The Company adopted the new lease guidance effective January 1,

2019 using the modified retrospective transition approach,

applying the new standard to all of its leases existing at the date

of initial application which is the effective date of

adoption. Consequently, financial information will not be

updated and the disclosures required under the new standard will

not be provided for dates and periods before January 1,

2019. We elected the package of practical expedients which

permits us to not reassess (1) whether any expired or existing

contracts are or contain leases, (2) the lease classification for

any expired or existing leases, and (3) any initial direct costs

for any existing leases as of the effective date. We did not elect

the hindsight practical expedient which permits entities to use

hindsight in determining the lease term and assessing impairment.

The adoption of the lease standard did not change our previously

reported consolidated statements of operations and did not result

in a cumulative catch-up adjustment to opening equity. As of

March 31, 2019, the adoption of the standard had no impact on the

Company, as there were no leases in place longer than 12

months.

In June 2018, the FASB issued Accounting Standards Update

(“ASU”) 2018-07,

Compensation – Stock

Compensation (Topic 718) Improvements to Nonemployee Share-Based

Payment Accounting

. This ASU

expands the scope of Topic 718 to include share-based payment

transactions for acquiring goods and services from nonemployees.

The amendments in this ASU will become effective for us beginning

January 1, 2019, and early adoption is permitted. We do not

anticipate that this ASU will have a material effect on our

consolidated financial statements.

Note 2 – Going Concern

As

shown in the accompanying financial statements, the Company has no

revenues, incurred net losses from operations resulting in an

accumulated deficit of $59,532,770 and had limited working capital

at March 31, 2019. These factors raise substantial doubt about the

Company’s ability to continue as a going concern. Management

is actively pursuing new products and services to begin generating

revenues. In addition, the Company is currently seeking additional

sources of capital to fund short term operations. The Company,

however, is dependent upon its ability to secure equity and/or debt

financing and there are no assurances that the Company will be

successful; therefore, without sufficient financing it would be

unlikely for the Company to continue as a going

concern.

The

financial statements do not include any adjustments that might

result from the outcome of any uncertainty as to the

Company’s ability to continue as a going concern. The

financial statements also do not include any adjustments relating

to the recoverability and classification of recorded asset amounts

or amounts and classifications of liabilities that might be

necessary should the Company be unable to continue as a going

concern.

As of

December 31, 2018, the non-refundable deposit amount of $110,000

for the property located in Westfield, New York was recorded as a

loss on deposit due to the uncertainty of the acquisition. As of

March 31, 2019, the refundable deposit amount of $350,000 related

to the purchase of the Sugar Hill golf course property was returned

by the Law Office of Biltekoff.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 3 – Related Party

Notes Payable

From

time to time, the Company has received short term loans from

officers and directors as disclosed in Note 8 below. The Company

has a total of $12,000 and $12,000 of note payable on the

consolidated balance sheet as of March 31, 2019 and December 31,

2018, respectively.

Services

Nicole

M. Breen receives $1,500 a week in cash compensation for her

services rendered to the Company.

Glenn

E. Martin receives $8,000 a month in cash compensation for his

services rendered to the Company.

Capital Contributions

The

Company imputed interest on non-interest bearing, related party

loans, resulting in a total of $0 and $0 of contributed capital

during the three months ended March 31, 2019 and 2018,

respectively.

Common Stock Issued for Bartered Assets

On

January 18, 2017, the Company exchanged 66,000 units, consisting of

66,000 shares of common stock and warrants to purchase 66,000

shares of common stock at an exercise price of $3.00 per share,

exercisable until January 18, 2018, in exchange for a 2017 Audi Q7

and a 2017 Audi A4 driven by the Officers. The total fair value

received, based on the market price of the stock at $4.02 per

share, was allocated to the $105,132 purchase price of the vehicles

and the $160,188 excess value of the common stock and warrants was

expensed as stock-based compensation.

Common Stock

On

August 1, 2017, the Company granted 150,000 shares of common stock

to Mary Williams, a principal of Sangre AT, LLC, for services

performed. The fair value of the common stock was $154,500 based on

the closing price of the Company’s common stock on the date

of grant.

On

January 7, 2017, the Company granted 50,000 shares of common stock

to Pat Williams. PhD, a principal of Sangre AT, LLC, for services

performed. The total fair value of the common stock was $210,250

based on the closing price of the Company’s common stock on

the date of grant.

A total

of $8,000 and $0 of officer compensation was unpaid and outstanding

at March 31, 2019 and 2018, respectively.

Stock Options Issued for Services – related party

(2019)

On

February 1, 2018, in connection with executive employment

agreements, the Company granted non-qualified options to purchase

an aggregate of 6,000,000 shares of the Company’s common

stock at the exercise price of $10.55 per share. The options shall

become exercisable at the rate of 1/3 upon the six-month

anniversary, 1/3 upon the one-year anniversary and 1/3 upon the

second anniversary of the grant. The options were valued at

$45,987,970 using the Black-Scholes option pricing model. The

Company recognized expense of approximately, $9,680,572 relating to

these options during the three months ended March 31,

2019.

Note 4 – Fair Value of Financial Instruments

Under

FASB ASC 820-10-5, fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement

date (an exit price). The standard outlines a valuation framework

and creates a fair value hierarchy in order to increase the

consistency and comparability of fair value measurements and the

related disclosures. Under GAAP, certain assets and liabilities

must be measured at fair value, and FASB ASC 820-10-50 details the

disclosures that are required for items measured at fair

value.

The

Company has certain financial instruments that must be measured

under the new fair value standard. The Company’s financial

assets and liabilities are measured using inputs from the three

levels of the fair value hierarchy. The three levels are as

follows:

Level 1

- Inputs are unadjusted quoted prices in active markets for

identical assets or liabilities that the Company has the ability to

access at the measurement date.

Level 2

- Inputs include quoted prices for similar assets and liabilities

in active markets, quoted prices for identical or similar assets or

liabilities in markets that are not active, inputs other than

quoted prices that are observable for the asset or liability (e.g.,

interest rates, yield curves, etc.), and inputs that are derived

principally from or corroborated by observable market data by

correlation or other means (market corroborated

inputs).

Level 3

- Unobservable inputs that reflect our assumptions about the

assumptions that market participants would use in pricing the asset

or liability.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 4 – Fair Value of Financial Instruments

(continued)

The

following schedule summarizes the valuation of financial

instruments at fair value on a recurring basis in the balance

sheets as of March 31, 2019 and December 31, 2018,

respectively:

Fair Value Measurements at December 31, 2018

|

|

|

|

|

|

Assets

|

|

|

|

|

Cash

|

$

70,608

|

$

-

|

$

-

|

|

Total

assets

|

$

70,608

|

$

-

|

$

-

|

|

Liabilities

|

|

|

|

|

Notes payable,

related parties

|

$

-

|

12,,000

|

$

-

|

|

Total

liabilities

|

$

-

|

$

12,000

|

$

-

|

|

|

$

70,608

|

$

12,000

|

$

-

|

Fair Value Measurements at March 31, 2019

|

|

|

|

|

|

Assets

|

|

|

|

|

Cash

|

$

84,543

|

$

-

|

$

-

|

|

Total

assets

|

$

84,543

|

$

-

|

$

-

|

|

Liabilities

|

|

|

|

|

Notes payable,

related parties

|

$

-

|

12,000

|

$

-

|

|

Total

liabilities

|

$

-

|

$

12,000

|

$

-

|

|

|

$

84,543

|

$

12,000

|

$

-

|

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 4 – Fair Value of Financial Instruments

(continued)

The

fair values of our related party debts are deemed to approximate

book value and are considered Level 2 inputs as defined by ASC

Topic 820-10-35.

There

were no transfers of financial assets or liabilities between Level

1, Level 2 and Level 3 inputs for the three months ended March 31,

2019 and the year ended December 31, 2017.

Note 5 – Investment in Land and Property

On July

26, 2017, the Company closed on the purchase of property,

consisting of a home, recreational facility and RV park located at

5535 State Highway 12 in La Veta, Colorado to be developed into a

bioscience center. The home has 4 Bedrooms and 2 Baths, and the

recreational facility has showers, laundry, and reception area with

an additional equipment barn attached, in addition to another

facility with 9,500 square feet. The RV Park has 24 sites with full

hook-ups including water, sewer, and electric, which the Company

plans to convert into a series of small research pods. Under the

terms of the purchase agreement, the Company paid $525,000 down,

including 25,000 shares of our common stock, and Sangre took

immediate possession of the property. Under the terms of the

original purchase agreement, the Company was obligated to pay an

additional $400,000 in cash and issue an additional 75,000 shares

of our common stock over the next two years in order to pay the

entire purchase price. On January 12, 2018, the Company entered

into an Amendment No. 1 to the $475,000 principal amount promissory

note issued by the Company to the seller of the property, under

which both parties agreed to amend the purchase and the promissory

note to allow the Company to pay off the note in full if it paid

$100,000 in cash on or before January 15, 2018 and issued the

seller 125,000 shares of common stock, restricted in accordance

with Rule 144, on before January 20, 2018. Through an escrow

process, the Company paid the seller $100,000 in cash and issued

him 125,000 shares of common stock in accordance with the Amendment

No. 1, in exchange for a full release of the deed of trust that was

securing the promissory note, on January 17, 2018. As a result, the

$475,000 principal promissory note issued to the seller was deemed

paid-in-full and fully satisfied and the Company owned the property

without encumbrances as of that date. The Company recorded a loss

on extinguishment of debt of approximately $1,065,000 based on the

fair value of the consideration paid and the carrying value of the

note payable on the settlement date. The total purchase price was

as follows:

|

|

|

|

|

|

|

Common stock

payment of 25,000 shares (1)

|

$

30,000

|

|

Cash payment of

down payment

|

50,000

|

|

Cash paid at

closing

|

44,640

|

|

Short term

liabilities assumed and paid at closing (2)

|

5,360

|

|

Note payable

(3)

|

475,000

|

|

Total

purchase price

|

$

1,005,000

|

(1)Consideration

consisted of an advance payment of 25,000 shares of the

Company’s common stock valued at $30,000 based on the closing

price of the Company’s common stock on the July 18, 2017 date

of grant.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 5 – Investment in Land and Property

(Continued)

(2)

Purchaser’s shares of closing costs, including the

seller’s prepaid property taxes.

(3) As

noted above, the note was settled with a payment of $100,000 and

the issuance of 125,000 shares of common stock.

In

January 2018, the Company closed on the purchase of property,

consisting of a condominium in La Veta, Colorado to house Company

personnel and consultants for total consideration approximating

$140,000, which was paid in cash at the time of closing. The home

has 3 bedrooms and 2.5 baths.

Sangre took immediate possession

of the property. La Veta, Colorado is a small town and rental or

short-term housing is very difficult to obtain. The Compa ny

personnel and consultants are no longer residing at the property,

and it is

currently

vacant.

In

February 2018, the Company closed on the purchase of property,

consisting of a home in La Veta, Colorado to house Company

personnel and consultants for total consideration approximating

$1,200,000. The home has 5 Bedrooms and 3 Baths. Under the terms of

the purchase agreement, the Company paid $150,000 down, entered

into a note payable in the amount of approximately $1,041,000 (see

Note 8). The Company secured a below-market interest rate of 1.81%

based on the short-term nature of the term (due on August 15,

2018). Sangre took immediate possession of the property. La Veta,

Colorado is a small town and rental or short-term housing is very

difficult to obtain. The Company personnel and consultants are no

longer residing at the property, and it is currently vacant. On

October 10, 2018, a payment of $750,000 was made to Craig W. Clark

to pay off the note payable, and a loan discount of $125,475 was

given to the Company which was recorded as a gain.

A

settlement payment of $155,000 was received from an insurance

company related to a fire near one of our properties in La Veta,

Colorado.

Note 6 – Property and Equipment

Property

and equipment consist of the following at March 31, 2019 and

December 31, 2018, respectively:

|

|

|

|

|

|

|

|

|

Property

improvements

|

$

5,000

|

$

5,000

|

|

Automobiles

|

105,132

|

105,132

|

|

Office

equipment

|

4,933

|

4,933

|

|

Furniture &

Fixtures

|

2,979

|

0

|

|

Lab

equipment

|

65,769

|

65,769

|

|

Construction in

progress (2)

|

499,695

|

499,695

|

|

Property

(1)

|

1,887,802

|

1,887,802

|

|

Property and

equipment, gross

|

2,571,310

|

2,568,331

|

|

Less accumulated

depreciation

|

(264,208

)

|

(224,198

)

|

|

Property and

equipment, net

|

$

2,307,102

|

2,344,133

|

|

(1)

|

In

2018, the Company purchased two properties in La Veta, Colorado.

The property located on 169 Valley Vista was purchased for

$140,000, and the property located on 1390 Mountain Valley Road was

purchased for $1,200,000 (see Note 8).

|

|

(2)

|

HVAC/furnace system and research facility center are under

construction.

|

Depreciation

and amortization expense totaled $40,660 and $41,158 for the three

months ended March 31, 2019 and 2018, respectively.

Note 7 – Intangible Assets

In

accordance with FASB ASC 350, “Intangibles-Goodwill and

Other”, the Company evaluates the recoverability of

identifiable intangible assets whenever events or changes in

circumstances indicate that an intangible asset’s carrying

amount may not be recoverable. The impairment loss would be

calculated as the amount by which the carrying value of the asset

exceeds its fair value. The US and Europe trademarks were acquired

for $40,000 and $10,000, respectively, during the year ended

December 31, 2018. Trademarks are initially measured based on their

fair value and amortized by 10 and 25 years.

Amortization

expense totaled $650 and $0 for the three months ended March 31,

2019 and 2018, respectively.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 7 – Notes Payable, Related Parties

Notes

payable, related parties consist of the following at March 31, 2019

and December 31, 2018, respectively:

|

|

|

|

|

On various dates,

the Company received advances from the Company’s CEO, Glenn

Martin. Mr. Martin owns approximately 56.2% of the Company’s

common stock at March 31, 2018. Over various dates in 2017, the

Company received a total of $9,000

of advances from

Mr. Martin, and they were repaid by July 3, 2017. On January 19,

2018, the Company received an unsecured loan, bearing interest at

2%, in the amount of $25,000 from Mr. Martin, and the loan was paid

off in full on February 2, 2018. The Company also repaid an advance

of $7,000 on July 6, 2018 received from Mr. Martin on January 16,

2018.The unsecured non-interest-bearing loans were due on demand. A

detailed list of advances and repayments follows:

|

$

-

|

$

-

|

|

On December 29,

2017, the Company received an unsecured loan, bearing interest at

2% in the amount of $37,000, due on demand from Dr. Pat Williams,

PhD. The amount outstanding was $0 during the periods ended March

31, 2019 and December 31, 2018. Mr. Williams is a founding member

and principal of our wholly-owned subsidiary, Sangre AT,

LLC

|

-

|

-

|

|

|

|

|

|

On April 12, 2010,

the Company received an unsecured, non-interest-bearing loan in the

amount of $2,000, due on demand from Robert Leitzman. Interest is

being imputed at the Company’s estimated borrowing rate, or

10% per annum. The largest aggregate amount outstanding was $2,000

during the periods ended March 31, 2019 and December 31, 2018. Mr.

Leitzman owns less than 1% of the Company’s common stock,

however, the Mr. Leitzman is deemed to be a related party given the

non-interest-bearing nature of the loan and the materiality of the

debt at the time of origination.

|

2,000

|

2,000

|

|

|

|

|

|

Over various dates

in 2011 and 2012, the Company received unsecured loans in the

aggregate amount of $10,000, due on demand, bearing interest at

10%, from Sandra Orman. The largest aggregate amount outstanding

was $10,000 during the periods ended March 31, 2019 and December

31, 2018. Mrs. Orman owns less than 1% of the Company’s

common stock, however, Mrs. Orman is deemed to be a related party

given the nature of the loan and the materiality of the debt at the

time of origination.

|

10,000

|

10,000

|

|

|

|

|

|

Notes payable,

related parties

|

$

12,000

|

$

12,000

|

The

Company recorded interest expense in the amount of $249 and $193

for the three months ended March 31, 2019 and 2018, respectively,

including imputed interest expense in the amount of $249 and $151

during such periods related to notes payable, related

parties.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 8 – Notes Payable

Note

payable consist of the following at March 31, 2019 and December 31,

2018, respectively:

|

|

|

|

|

On July 26, 2017,

the Company issued a $475,000 note payable, bearing interest at 5%

per annum, to A.R. Miller (“Miller Note”) pursuant to

the purchase of land and property in La Veta, Colorado. The note is

to be paid in four consecutive semi-annual installments in the

amount of $118,750 plus accrued interest commencing on January 26,

2018 and continuing on the 26th day of July and the 26th day of

January each year until the debt is repaid on July 26, 2019. The

note carries a late fee of $5,937.50 in the event any installment

payment is more than 30 days late, and upon default the interest

rate shall increase to 12% per annum. During the three months ended

March 31, 2018, the Company issued 125,000 shares of common stock,

valued at $1,450,000 based on the closing price on the measurement

date. Accordingly, the Company recorded a loss on extinguishment of

$1,064,719.

|

$

-

|

$

-

|

|

|

|

|

|

On February 16,

2018, the Company issued a $1,040,662 note payable, bearing

interest at 1.81% per annum (the low interest rate was due to the

short-term nature of the note – six months. See Note 6), to

Craig and Carol Clark (“Clark Note”) pursuant to the

purchase of land and property in La Veta, Colorado. The note is to

be paid in consecutive monthly installments in the amount of

$5,000, including accrued interest commencing on March 15, 2018 and

continuing through August 15, 2018. The note carries a late fee of

3% in the event any installment payment is more than 10 days late,

and upon default the interest rate shall increase to 10% per annum.

As of September 12, 2018, a total of $171,300 was paid to the note

holder. On October 9, 2018, the Company entered into a settlement

agreement with the note holder to pay the settlement payment of

$750,000. The Company had already paid $650,000 by September 27,

2018 and made the remaining payment of $100,000 on October 10,

2018. The Company recorded a gain on extinguishment of

$121,475.

|

-

|

-

|

|

|

|

|

|

|

$

-

|

$

-

|

The

Company recognized interest expense of $0 and $2,200 related to the

note payables for the three months ended March 31, 2019 and 2018,

respectively.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 9 – Commitments and Contingencies

On

November 8, 2016, the Company entered into an agreement with

Gregory DiPaolo’s Pro Am Golf, LLC to acquire improved

property located in Westfield, New York. The total purchase price

of $1,600,000 is to be paid with a deposit of 50,000 shares of

common stock, followed by cash of $1,250,000 and 300,000 shares of

the Company’s common stock to be delivered at closing. The

deposit of 50,000 shares issued as a deposit was $42,500 based on

the closing price of the Company’s common stock on the date

of grant. Subsequently, we entered into an amended Purchase and

Sale Agreement on October 24, 2017, under which we amended the

total purchase price to Eight Hundred Thousand Dollars ($800,000)

and forfeited our previous deposit of stock. Under the terms of the

amended agreement, we paid an additional Ten Thousand Dollar

($10,000) deposit on October 26, 2017, with the remaining purchase

price to be paid on or before the date closing date, which was

scheduled on May 1, 2018. The property is approximately 43 acres

and has unlimited water extraction rights from the State of New

York. We plan to use this property as our inroads to the New York

hemp and infused beverage markets in the future. There are no

current plans or budget to proceed with operations in New York, and

there will not be until proper funding is secured after acquiring

this property. Currently, there will be an open bid for the

property, and there is no guarantee the Company will win the bid to

complete the acquisition. As a result, the $110,000 non-refundable

deposit for the property was recorded as a loss on deposit at the

end of December 31, 2018.

On

January 19, 2018, the Company was sued in the United States

District Court for the District of Arizona (

William Martin v. WEED, Inc..

, Case

No. 4:18-cv-00027-RM) by the listed Plaintiff. The Company was

served with the Verified Complaint on January 26, 2018. The

Complaint alleges claims for breach of contract-specific

performance, breach of contract-damages, breach of the covenant of

good faith and fair dealing, conversion, and injunctive relief. In

addition to the Verified Complaint, the Company was served with an

application to show cause for a temporary restraining order. The

Verified Complaint alleges the Company entered into a contract with

the Plaintiff on October 1, 2014 for the Plaintiff to perform

certain consulting services for the Company in exchange for 500,000

shares of its common stock up front and an additional 700,000

shares of common stock to be issued on May 31, 2015. The Plaintiff

alleges he completed the requested services under the agreement and

received the initial 500,000 shares of common stock, but not the

additional 700,000 shares. The request for injunctive relief asks

the Court to Order the Company to issue the Plaintiff 700,000

shares of its common stock, and possibly include them in its

Registration Statement on Form S-1, or, in the alternative, issue

the shares and have them held by the Court pending resolution of

the litigation, or, alternatively, sell the shares and deposit the

sale proceeds in an account that the Court will control. The

hearing on the Temporary Restraining Order occurred on January 29,

2018. On January 30, 2018, the Court issued its ruling denying the

application for a Temporary Restraining Order. Currently, there is

no further hearing scheduled in this matter

.

On February 13, 2018, the Company filed

an Answer to the Verified Complaint and Counterclaim. On February

15, 2018, the Company filed a Motion to Dismiss the Verified

Complaint. On February 23, 2018, the Company filed a Motion to

Amend Counterclaim to add W. Martin’s wife, Joanna Martin as

a counterdefendant. On March 9, 2018, William Martin filed a Motion

to Dismiss the Counterclaim. On March 12, 2018, William Martin

filed a Motion to Amend the Verified Complaint to, among other

things, add claims against Glenn Martin and Nicole and Ryan Breen.

On March 27, 2018, the Court granted both William Martin and WEED,

Inc.’s Motions to Amend. On March 27, 2018, the Company filed

an Amended Counterclaim adding Joanna Martin. On April 2, 2018, the

Company filed a Motion to Amend our Counterclaim to add a breach of

contract claim. On April 10, 2018, the Company filed an Answer to

First Amended Verified Complaint. On April 23, 2018, Glenn Martin

and Nicole and Ryan Breen filed their Answer to the First Amended

Complaint. On May 31, 2018, the Court issued an Order: (a) granting

the Company’s Motion to Dismiss thereby dismissing the

Plaintiff’s claims for breach of the covenant of good faith

and fair dealing and the claim for conversion, (b) denying William

Martin’s Motion to Dismiss the counterclaim as to the claims

for fraudulent concealment and fraudulent misrepresentation, but

granting the Motion to Dismiss only as to the claim for fraudulent

nondisclosure, and (c) granting the Company’s Motion to Amend

its Counterclaim to add a breach of contract claim. On June 1,

2018, William Martin and his wife filed their Answer to the First

Amended Counterclaim. On June 1, 2018, William Martin and his wife

filed their Answer to the Second Amended Counterclaim. In addition

to the above pleadings and motions, the parties have exchanged

disclosure statements and served and responded to written

discovery. The Company denies the Plaintiff’s allegations in

the Verified Complaint in their entirety and plan to vigorously

defend against this lawsuit. Due to the loss not being probable, no

accrual has been recorded for the 700,000 shares of common stock

the Plaintiff alleges he is owed under his agreement with the

Company.

Material Definitive Agreements

On May

1, 2018, the Company entered into a Fourth Addendum and Fifth

Addendum to that certain Purchase and Sale Agreement between the

Company and Greg DiPaolo’s Pro Am Golf, LLC, amending the

“Closing Date” under the Agreement to August 1, 2018,

in exchange for the Company paying $50,000 as a non-refundable

deposit to be applied against the purchase price once the property

sale is completed and $10,000 for maintenance, tree removal and

other grounds keeping in order to prepare the golf course for the

2018 season.

On July

23, 2018, the Company entered into a Sixth Addendum, extending the

“Closing Date” to November 1, 2018, in exchange for the

Company paying an additional $50,000 as a non-refundable deposit to

be applied against the purchase price.

On May

21, 2018, the Company entered into a Trademark Purchase Agreement

with Copalix Pty Ltd., a private South African company, to acquire

U.S. Trademark Registration No. 4,927,872 for the WEED TM mark, in

exchange for USD$40,000.

On July

27, 2018, the Company entered into a Trademark Purchase Agreement

with Copalix Pty Ltd., to acquire European Community Trademark

Registration No. 11953387 for WEED Registered Mark in exchange for

USD$10,000.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 10 – Stockholders’ Equity

Preferred Stock

On

December 5, 2014, the Company amended the Articles of

Incorporation, pursuant to which 20,000,000 shares of “blank

check” preferred stock with a par value of $0.001 were

authorized. No series of preferred stock has been designated to

date.

Common Stock

On

December 5, 2014, the Company amended the Articles of

Incorporation, and increased the authorized shares to 200,000,000

shares of $0.001 par value common stock.

2019 Common Stock Activity

Common Stock Sales (2019)

During

the quarter ended March 31, 2019, the Company issued 250,000 shares

of common stock for proceeds of $200,000. 300,000 shares valued at

$150,000 were not issued at March 31, 2019 and such amount has been

included in subscriptions payable.

Common Stock Issued for Services (2019)

During

the three months ended March 31, 2019, the Company agreed to issue

an aggregate of 410,000 shares of common stock to consultants for

services performed. 400,000 shares valued at $668,000 were based on

the closing price of the agreement date, and 10,000 shares valued

at $12,400 were based on the closing price of the Company’s

common stock earned on the measurement date.

Common Stock Cancellations

On

January 31, 2019, the Company cancelled a total of 200,000 shares

of common stock valued at $0 previously granted to a consultant,

David Johnson, for non-performance of services. The cancellation

was accounted as a repurchase for no consideration.

2018 Common Stock Activity

Common Stock Sales (2018)

During

the year ended December 31, 2018, the Company issued 3,899,450

shares of common stock for proceeds of $4,798,550. In connection

with certain of the share issuances, the Company issued warrants to

purchase an aggregate of $1,927,500 shares of the Company’s

common stock. The warrants to purchase 462,500 shares have an

exercise price of $5.00 per share, exercisable on various dates

through March 2019. Warrants to purchase 215,000 shares have an

exercise price of $12.50 per share and are exercisable on various

dates through

January 2020. The

warrants to purchase $1,250,000 shares have an exercise price of

$6.00 per share, exercisable on various dates through June 2019.

The proceeds received were allocated $3,361,832 to common stock and

$1,436,718 to warrants on a relative fair value basis. On January

12, 2018, a warrant holder exercised warrants to purchase 150,000

shares of common stock at a price of $1.50 in exchange for proceeds

of $225,000.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 10 – Stockholders’ Equity

(continued)

Common Stock Issued for Services (2018)

During

the year ended December 31, 2018, the Company agreed to issue an

aggregate of 915,000 shares of common stock to consultants for

services performed. The total fair value of common stock was

$3,042,940 based on the closing price of the Company’s common

stock earned on the measurement date. Shares valued at $200,400

were issued at December 31, 2018 and services will be performed in

2019 and has been included in unamortized stock-based

compensation.

Note 11 – Common Stock Warrants and Options

Common Stock Warrants Granted (2019)

No

common stock warrants were granted during the three months ended

March 31, 2019.

Common

stock warrants granted consist of the following at March 31, 2019

and December 31, 2018, respectively:

|

March 31, 2019

|

|

December 31, 2018

|

|

Issuance

|

Warrant

|

Name

|

# of Common

|

|

Issuance

|

Warrant

|

Name

|

# of Common

|

|

Date

|

#

|

Stock Warrants

|

|

Date

|

#

|

Stock Warrants

|

|

|

|

|

|

|

1/5/2018

|

1029

|

Lex Seabre

|

100,000.00

|

|

Total

|

|

|

-

|

|

1/21/2018

|

1031

|

Roger Forsyth

|

100,000.00

|

|

|

|

|

|

|

1/23/2018

|

1032

|

Roger Forsyth

|

100,000.00

|

|

|

|

|

|

|

2/9/2018

|

1033

|

Lawrence Wesigal

|

15,000.00

|

|

|

|

|

|

|

3/19/2018

|

1034

|

Donald Steinberg

|

150,000.00

|

|

|

|

|

|

|

3/15/2018

|

1035

|

Donald Harrington

|

12,500.00

|

|

|

|

|

|

|

4/26/2018

|

1036

|

Roger Seabre

|

100,000.00

|

|

|

|

|

|

|

4/26/2018

|

1037

|

Michael Kirk Wines

|

100,000.00

|

|

|

|

|

|

|

5/7/2018

|

1038

|

Donald Steinberg

|

400,000.00

|

|

|

|

|

|

|

5/15/2018

|

1039

|

Roger Seabre

|

200,000.00

|

|

|

|

|

|

|

6/13/2018

|

1040

|

Blue Ridge Enterprises

|

450,000.00

|

|

|

|

|

|

|

6/26/2018

|

1041

|

Dianna Steinberg

|

200,000.00

|

|

|

|

|

|

|

Total

|

|

|

1,927,500.00

|

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 11 – Common Stock Warrants and Options

(continued)

A

summary of the Company’s outstanding common stock warrants is

as follows as of March 31, 2019:

|

Issuance

|

Warrant

|

|

|

# of Common

|

Strike

|

Term

|

|

Date

|

#

|

Name

|

Document

|

Stock Warrants

|

Price

|

In Mos.

|

|

|

|

|

|

|

|

|

|

12/31/17

|

|

|

|

1,973,333

|

|

|

|

|

|

|

|

|

|

|

|

01/02/18

|

1009

|

Exercise

- Edward Matkoff

|

Subscription

Agreement

|

(50,000)

|

$

3.00

|

12

|

|

01/05/18

|

1029

|

Lex

Seabre

|

Subscription

Agreement

|

100,000

|

$

5.00

|

12

|

|

01/21/18

|

1031

|

Roger

Forsyth

|

Subscription

Agreement

|

100,000

|

$

12.50

|

24

|

|

01/23/18

|

1010

|

Expired

- Sandra Hogan

|

Subscription

Agreement

|

(2,000)

|

$

3.00

|

12

|

|

01/23/18

|

1032

|

Roger

Forsyth

|

Subscription

Agreement

|

100,000

|

$

12.50

|

24

|

|

02/09/18

|

1033

|

Lawrence

Wesigal

|

Subscription

Agreement

|

15,000

|

$

12.50

|

12

|

|

03/19/18

|

1034

|

Donald

Steinberg

|

Subscription

Agreement

|

150,000

|

$

5.00

|

12

|

|

03/15/18

|

1035

|

Donald

Harrington

|

Subscription

Agreement

|

12,500

|

$

5.00

|

12

|

|

04/20/17

|

1015

|

Expired

- Lex Seabre

|

Subscription

Agreement

|

(375,000)

|

$

3.00

|

12

|

|

04/20/17

|

1020

|

Expired

- Lex Seabre

|

Subscription

Agreement

|

(125,000)

|

$

3.00

|

12

|

|

04/26/18

|

1036

|

Roger

Seabre

|

Subscription

Agreement

|

100,000

|

$

5.00

|

12

|

|

04/26/18

|

1037

|

Michael

Kirk Wines

|

Subscription

Agreement

|

100,000

|

$

5.00

|

12

|

|

05/07/18

|

1038

|

Donald

Steinberg

|

Subscription

Agreement

|

400,000

|

$

6.00

|

12

|

|

05/15/18

|

1039

|

Roger

Seabre

|

Subscription

Agreement

|

200,000

|

$

6.00

|

12

|

|

06/13/18

|

1040

|

Blue

Ridge Enterprises

|

Subscription

Agreement

|

450,000

|

$

6.00

|

12

|

|

06/16/17

|

1019

|

Expired

- Black Mountain Equities

|

Debt

Exchange Agreement

|

(70,000)

|

$

3.00

|

12

|

|

06/26/18

|

1041

|

Dianna

Steinberg

|

Subscription

Agreement

|

200,000

|

$

6.00

|

12

|

|

12/31/18

|

|

|

|

3,278,833

|

|

|

|

|

|

|

|

|

|

|

|

01/05/18

|

1029

|

Expired

- Lex Seabre

|

Subscription

Agreement

|

(100,000)

|

$

5.00

|

12

|

|

02/09/18

|

1033

|

Expired

- Lawrence Wesigal

|

Subscription

Agreement

|

(15,000)

|

$

12.50

|

12

|

|

03/19/18

|

1034

|

Expired

- Donald Steinberg

|

Subscription

Agreement

|

(150,000)

|

$

5.00

|

12

|

|

03/15/18

|

1035

|

Expired

- Donald Harrington

|

Subscription

Agreement

|

(12,500)

|

$

5.00

|

12

|

|

03/31/19

|

|

|

|

3,001,333

|

|

|

Common Stock Warrants Expired (2019)

A total

of 277,500 warrants expired during the three months ended March 31,

2019.

Warrants Exercised (2019)

No warrants were exercised

during the three months ended

March 31, 2019.

2018 Common Stock Warrant Activity

Common Stock Warrants Granted (2018)

See

Note 10 for details on warrants issued during the year ended

December 31, 2018.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 11 – Common Stock Warrants and Options

(continued)

Common Stock Warrants Exercised (2018)

On

January 12, 2018, a warrant holder exercised warrants to purchase

150,000 shares of common stock at a price of $1.50 in exchange for

proceeds of $225,000.

Common Stock Warrants Expired (2018)

A total

of 572,000 warrants expired during the year ended December 31,

2018.

Common Stock Options (2018)

On

February 1, 2018, in connection with executive employment

agreements, the Company granted non-qualified options to purchase

an aggregate of 6,000,000 shares of the Company’s common

stock at the exercise price of $10.55 per share. The options shall

become exercisable at the rate of 1/3 upon the six-month

anniversary, 1/3 upon the one-year anniversary and 1/3 upon the

second anniversary of the grant. The options were valued at

$45,753,000 using the Black-Scholes option pricing model. The

Company recognized expense of approximately $21,201,397 relating to

these options during the year ended December 31, 2018.

WEED, INC. AND SUBSIDIARY

(Formerly

United Mines, Inc.)

Notes

to Financial Statements

March

31, 2019

Note 11 – Common Stock Warrants and Options

(continued)

The

assumptions used in the Black-Scholes model are as

follows:

|

|

For the period ended March 31, 2019

|

|

Risk-free

interest rate

|

1.75%

|

|

Expected

dividend yield

|

0%

|

|

Expected

lives

|

6.0

years

|

|

Expected

volatility

|

200%

|

A

summary of the Company’s stock option activity and related

information is as follows:

|

|

For the three months ended March 31,

2019

|

|

|

|

|

|

|

|

|

|

Outstanding at the

beginning of period

|

-

|

$

-

|

|

Granted

|

6,000,000

|

10.55

|

|

Exercised/Expired/Cancelled

|

-

|

-

|

|

Outstanding at the

end of period

|

6,000,000

|

$

10.55

|

|

Exercisable at the

end of period

|

1,250,000

|

$

10.55

|

Note 12 – Subsequent Events

On

April 21, 2019, the Company sold 100,000 shares of common stock in

exchange for total proceeds of $50,000.

On

April 22, 2019, the Company sold 200,000 shares of common stock in

exchange for total proceeds of $100,000.

The

Company is in the process of acquiring an exclusive license to

utilize the technology from Yissum Research Development Company for

a total of $1,000,000. The licensee fee is irrevocable,

non-creditable, and non-refundable and will be paid in three

installments with the first installment paid on February 26,

2019.

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

Disclaimer Regarding Forward Looking Statements

Our

Management’s Discussion and Analysis or Plan of Operations

contains not only statements that are historical facts, but also

statements that are forward-looking. Forward-looking statements

are, by their very nature, uncertain and risky. These risks and

uncertainties include international, national and local general

economic and market conditions; demographic changes; our ability to

sustain, manage, or forecast growth; our ability to successfully

make and integrate acquisitions; raw material costs and

availability; new product development and introduction; existing

government regulations and changes in, or the failure to comply

with, government regulations; adverse publicity; competition; the

loss of significant customers or suppliers; fluctuations and

difficulty in forecasting operating results; changes in business

strategy or development plans; business disruptions; the ability to

attract and retain qualified personnel; the ability to protect

technology; and other risks that might be detailed from time to

time in our filings with the Securities and Exchange

Commission.

Although the

forward-looking statements in this Quarterly Report reflect the

good faith judgment of our management, such statements can only be

based on facts and factors currently known by them. Consequently,

and because forward-looking statements are inherently subject to

risks and uncertainties, the actual results and outcomes may differ

materially from the results and outcomes discussed in the

forward-looking statements. You are urged to carefully review and

consider the various disclosures made by us in this report and in

our other reports as we attempt to advise interested parties of the

risks and factors that may affect our business, financial

condition, and results of operations and prospects.

Overview

We

are an early stage holding company currently focused on the

development and application of cannabis-derived compounds for the

treatment of human disease. Our wholly-owned subsidiary, Sangre AT,

LLC (“Sangre”), has begun a planned five-year Cannabis

Genomic Study to complete a genetic blueprint of the Cannabis plant

genus, by creating a global genomic classification of the entire

plant. By targeting cannabis-derived molecules that stimulate the

endocannabinoid system, Sangre’s research team plans to

develop scientifically-valid and evidence-based cannabis strains

for the production of disease-specific medicines. The goal of the

research is to identify, collect, patent, and archive a collection

of highly-active medicinal strains. We plan to conduct this study

only in states where cannabis has been legalized for medicinal

purposes.

Using

annotated genomic data and newly generated phenotypic data, Sangre

plans to identify and isolate regions of the plant genome which are

related to growth, synthesis of desired molecules, and drought and

pest resistance. This complex data set would then be utilized in a

breeding program to generate and establish new hybrid cultivars

which exemplify the traits that are desired by the medical and

patient community. This breeding program would produce new seed

stocks and clones, which we plan on patenting. If successful this

intellectual property should generate immense value for the

Company. After developing a comprehensive understanding of the

annotated genome of a variety of cannabis strains, and obtaining

intellectual property protection over the most promising strains,

we plan move forward either independently or with strategic

partners to develop medicinal products for the treatment of a

multitude of human diseases.

Our

current, short-term goals relate to the Cannabis Genomic Study and

the resulting development of a variety of new cannabis strains,

and, over the next 5 years, we plan to process those results in

order to become an international cannabis research and product

development company, with a globally-recognized brand focusing on

building and purchasing labs, land and building commercial grade

“Cultivation Centers” to consult, assist, manage &

lease to universities, state governments, licensed dispensary

owners and organic grow operators on a contract basis with a

concentration on the legal and medical cannabis

sector.

Our

long-term plan is to become a true “Seed-to-Sale”

global holding company providing infrastructure, financial

solutions, product development, and real estate options in this new

emerging market. Our long term growth may also come from the

acquisition of synergistic businesses, such as distilleries, to

make anything from infused beverages to super oxygenated water with

CBD and THC. Currently, we have formed WEED Australia Ltd.,

registered as an unlisted public company in Australia to address

this Global demand. We have also formed WEED Australia Ltd.,

registered as an unlisted public company in Australia, to address

future global demand, however the entity has been dormant since its

inception. We will look to conduct future research, marketing,

import/exporting, and manufacturing of our proprietary products on

an international level.

In

furtherance of our current, short terms goals, Sangre initiated the

cannabis genome project in April 2017, by extracting DNA from seven

cannabis strains in Tucson, Arizona. Sangre followed the initial

extraction with a second round of extractions in July 2017. The

extracted DNA is currently being sequenced by the Sangre team using

a binary sequencing approach based on the use of two distinct

sequencing technologies and a proprietary bioinformatics database.

Following the generation of genomic data, the sequences will be

annotated (compared) against over 300,000 plant genes to elucidate

specific de novo pathways responsible for the synthesis of specific

compounds and classes of compounds.

Under

the genome project directives, additional strains are slated for

sequencing and annotation as part of the overall expansion of this

research project. An integral part of this expansion is the

acquisition of additional DNA extraction, amplification, and

sequencing technologies. The expansion also includes the

installation of high-level IT networks for data acquisition,

analysis, and storage.

On

July 26, 2017, we acquired a property located in La Veta, Colorado

in order for Sangre to complete its 5-Year, $15+ million Cannabis

Genomic Study. The site includes a 10,000+ sq. ft. building that

will house Sangre’s genomic research facility, a 4,000+

square foot building for plant product analytics and plant product

extraction, a 3,500 sq. ft. corporate office center, and 25 RV

slots with full water and electric, which we plan to convert into a

series of small research pods. Under the terms of the purchase

agreement, we paid $525,000 down, along with 25,000 shares of our

common stock, and Sangre took immediate possession of the property.

We were obligated to pay an additional $400,000 in cash and issue

an additional 75,000 shares of our common stock over the two next

years in order to pay the entire purchase price. To date we have

spent $354,000 renovating the property and an additional $400,000

on extraction and analytical lab equipment. We plan to completethe

property renovations by Q3 of 2019, at an estimated cost of

$300,000. We will need additional extraction equipment and

analytical lab equipment, totaling approximately $700,000. We will

need to raise additional funds in order to complete the planned

renovations and pay the purchase price for the

equipment.

WEED

Inc. acquired the property in La Veta, Colorado in order to

facilitate the expansion of the genomic studies and the development

of new hybrid strains. The facility is currently under re-design

and renovation to convert the existing structures into a

world-class genetics research center.

A

gene-based breeding program will allow us to root out inferior

cultivars and replace them with fully-validated and patentable

cultivars which produce consistent plant products for the medicinal

markets. The gene-based breeding program will improve cultivars and

introduce integrity, stability, and quality to the market in the

following ways:

●

accelerated

and optimized growth rates; modern genomic resources will enhance

traditional breeding methods

●

generate new

cultivars, accelerating and perfecting the art of selective

breeding

●

provide the ability

to assay for specific genes within the crop, establish strain

tracking, and promote market quality assurance

●

improved disease,

pest, and drought resistance of the Cannabis plant

We

believe the gene-based breeding program will facilitate and

accelerate:

●

improved

therapeutic properties, i.e., increased THC/CBD concentration and

the production of specific classes of oils and

terpenses

●

enhanced

opportunities for new drug discovery

●

accelerated

breeding of super-cultivars: drought, pest, and mold resistant,

increased %THC

●

revenue generation

through our unique ability to breed and genetically fingerprint

new, super-cultivars: establish strong patent protection; and

provide these cultivars to the market on a favorable cost and

royalty basis.

Our

goal with this program is to develop a translational breeding

program to establish a new collection of Cannabis cultivars for the

Colorado, national, and international markets. Through the use of

genetic screening technology, cultivars can be up-selected for

specific traits and grown to address the needs of consumers in the

medicinal market.

Corporate Overview

We

were originally incorporated under the name Plae, Inc., in the

State of Arizona on August 20, 1999. At the time we operated under

the name Plae, Inc., no business was conducted. No books or records

were maintained and no meetings were held. In essence, nothing

wasdone after incorporation until Glenn E. Martin took possession

of Plae, Inc. in January 2005. On February 18, 2005, the corporate

name was changed to King Mines, Inc. and then subsequently changed

to its current name, United Mines, Inc., on March 30, 2005. No

shares were issued until the Company became United Mines, Inc. From

2005 until 2015, we were an exploration stage mineral exploration

company that owned a number of unpatented mining claims and Arizona

State Land Department claims.

On

November 26, 2014, our Board of Directors approved the

redomestication of our company from Arizona to Nevada (the

“Articles of Domestication”), and approved Articles of

Incorporation in Nevada, which differed from then-Articles of

Incorporation in Arizona, primarily by (a) changing our name from

United Mines, Inc. to WEED, Inc., (b) authorizing Twenty Million

(20,000,000) shares of preferred stock, with blank check rights

granted to our Board of Directors, and (c) authorizing Two Hundred

Million (200,000,000) shares of common stock (the “Nevada

Articles of Incorporation”). On December 19, 2014, the

holders of a majority of our outstanding common stock approved the

Articles of Domestication and the Nevada Articles of Incorporation

at a Special Meeting of Shareholders. On January 16, 2015, the

Articles of Domestication and the Nevada Articles of Incorporation

went effective with the Secretary of State of the State of Nevada.

On February 2, 2015, our name change to WEED, Inc., and a

corresponding ticker symbol change to “BUDZ” went

effective with FINRA and was reflected on the quotation of our

common stock on OTC Markets.

These

changes were affected in order to make our corporate name and

ticker symbol better align with our short-term and long-term

business focus. Our current, short-term goals relate to the

Cannabis Genomic Study and the resulting development of a variety

of new cannabis strains, and, over the next 5 years, we plan to

process those results in order to become an international cannabis

research and product development company, with a

globally-recognized brand focusing on building and purchasing labs,

land and building commercial grade “Cultivation

Centers” to consult, assist, manage & lease to

universities, state governments, licensed dispensary owners and

organic grow operators on a contract basis with a concentration on

the legal and medical cannabis sector.

Our

long-term plan is to become a true “Seed-to-Sale”

global holding company providing infrastructure, financial

solutions, product development, and real estate options in this new

emerging market. Our long term growth may also come from the

acquisition of synergistic businesses, such as distilleries, to

make anything from infused beverages to super oxygenated water with

CBD and THC. Currently, we have formed WEED Australia Ltd.,

registered as an unlisted public company in Australia to address

this Global demand. We have also formed WEED Israel Cannabis Ltd.,

an Israeli corporation, to address future global demand, and in

March 2019, WEED Israel Cannabis Ltd. was involved in the

transaction with Yissum discussed herein. We will look to conduct

future research, marketing, import/exporting, and manufacturing of

our proprietary products on an international level.

On

April 20, 2017, we entered into a Share Exchange Agreement with

Sangre AT, LLC, a Wyoming limited liability company, under which we

acquired all of the issued and outstanding limited liability

company membership units of Sangre in exchange for Five Hundred

Thousand (500,000) shares of our common stock, restricted in

accordance with Rule 144. As a result of this agreement, Sangre is

a wholly-owned subsidiary of WEED, Inc.

This

discussion and analysis should be read in conjunction with our

financial statements included as part of this Quarterly

Report.

Three Months Ended March 31, 2019 compared to Three Months Ended

March 31, 2018

Results of Operations

|

|

Three Months

Ended

March

31,

|

|

|

|

|

|

Revenue

|

$

-

|

$

-

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

General and

administrative

|

185,760

|