Filed pursuant to Rule 424(b)(3)

Registration No. 333-219922

Prospect Supplement No. 4

(To Prospectus dated August 9, 2018)

WEED, INC.

This

Prospectus Supplement No. 4 (this “Supplement”)

contains information that supplements and updates our Prospectus

dated August 9, 2018 (the “Prospectus”) and should be

read in conjunction with such prospectus and Prospectus Supplement

No. 1 dated September 7, 2018, Prospectus Supplement No. 2 dated

December 6, 2018, and Prospectus No. 3 dated May 16,

2019.

The

Prospectus relates to the resale by the Selling Shareholders

beginning on page 9 of the Prospectus of the 8,982,015shares of our

common stock held by the Selling Shareholders at a fixed price of

$1.00 per share unless our common stock is quoted on the OTCBB, or

the OTCQX or OTCQB tiers of OTC Markets, at which time the shares

may be sold at prevailing market prices or privately negotiated

prices.

I.

Amendment No. 1 to Annual Report on Form 10-K for the Year Ended

December 31, 2018

This Supplement is being filed to include the

information set forth in our Amendment No. 1 to Annual Report on

Form 10-K for the year ended December 31, 2018, which is

attached to this Supplement as

Exhibit

A

.

This

Supplement should be read in conjunction with the Prospectus, as

amended and supplemented, which is to be delivered with this

Supplement. This Supplement is qualified by reference to

the Prospectus, except to the extent that the information in this

Supplement updates or supersedes the information contained in the

Prospectus, including any supplements and amendments

thereto.

This

Supplement is not complete without, and may not be delivered or

utilized except in connection with, the Prospectus, including any

supplements and amendments thereto.

There

are significant risks associated with an investment in our common

stock. These risks are described under the caption “Risk

Factors” beginning on page 4 of the Prospectus, as the same

may be updated in prospectus supplements.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

determined if this prospectus supplement or the accompanying

Prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The date of this Supplement is May 16, 2019

EXHIBIT A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

☒

ANNUAL REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended December 31, 2018

OR

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____________ to

_____________.

Commission file number

000-53727

WEED, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

83-0452269

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

4920 N. Post Trail

Tucson, AZ

|

|

85750

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code

(520) 818-8582

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Name of

each exchange on which registered

|

|

None

|

|

None

|

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $0.001

(Title

of class)

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes

☐

No

☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the

Act. Yes

☐

No

☒

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes

☒

No

☐

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every

Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the

registrant was required to and post such files). Yes

☒

No ☐

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant's

knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated filer

☐

|

Accelerated filer

☐

|

|

|

|

|

Non-accelerated filer

☐

|

Smaller reporting company

☒

|

|

|

|

|

|

Emerging growth company

☐

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act). Yes

☐

No

☒

Aggregate

market value of the voting stock held by non-affiliates:

$101,344,700 as based on last reported sales price of such stock on

June 30, 2018. The voting stock held by non-affiliates on that date

consisted of 22,774,090 shares of common stock the closing stock

price was $4.45.

Applicable Only to Registrants Involved in Bankruptcy Proceedings

During the Preceding Five Years:

Indicate by check mark whether the registrant has

filed all documents and reports required to be filed by Sections

12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the

distribution of securities under a plan confirmed by a court.

Yes

☐

No

☐

Indicate the number of shares outstanding of each

of the registrant’s classes of common stock, as of the latest

practicable date. As of

April 5, 2019

there were

106,410,685

shares of common stock, $0.001 par value, issued

and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if

incorporated by reference and the Part of the Form 10-K (e.g., Part

I, Part II, etc.) into which the document is incorporated: (1) Any

annual report to security holders; (2) Any proxy or information

statement; and (3) Any prospectus filed pursuant to rule 424(b) or

(c) of the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report

to security holders for fiscal year ended December 24,

1980).

None.

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A (the

“

Amendment

”)

to our Annual Report on Form 10-K for the year ended December 31,

2018 (the “

Form

10-K

”), filed with the

United States Securities and Exchange Commission on April 16, 2019

(the “

Original

Filing Date

”), solely to

correct two errors on the cover page of the Form 10-K. Our original

Form 10-K did not check a box for the question as to whether we are

shell company due to an error in the edgarization process, and

incorrectly stated we had not posted our Interactive Data Files

(XBRL) pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to and post such files).

This Amendment accurately answers those questions by marking

“No” for the question as to whether we are shell

company, and marking “Yes” for the question as to

whether we have posted the required Interactive Data

Files.

No other changes have been made to the Form 10-K. This Amendment

speaks as of the Original Filing Date and does not reflect events

that may have occurred subsequent to the Original Filing Date, and

does not modify or update in any way the disclosures made in the

Form 10-K.

PART IV

ITEM

15 - EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

(a)(1)

|

Financial Statements

|

For a

list of financial statements and supplementary data filed as part

of this Annual Report, see the Index to Financial Statements

beginning at page F-1 of this Annual Report.

|

(a)(2)

|

Financial Statement Schedules

|

We

do not have any financial statement schedules required to be

supplied under this Item.

Refer

to (b) below.

ITEM

15 - EXHIBITS, FINANCIAL STATEMENT SCHEDULES

(CONTINUED)

|

101.INS

**

|

|

XBRL

Instance Document

|

|

|

|

|

|

101.SCH

**

|

|

XBRL

Taxonomy Extension Schema Document

|

|

|

|

|

|

101.CAL

**

|

|

XBRL

Taxonomy Extension Calculation Linkbase Document

|

|

|

|

|

|

101.DEF

**

|

|

XBRL

Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

101.LAB

**

|

|

XBRL

Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

101.PRE

**

|

|

XBRL

Taxonomy Extension Presentation Linkbase Document

|

* Filed herewith

** XBRL (Extensible Business Reporting Language) information is

furnished and not filed or a part of a registration statement or

prospectus for purposes of Sections 11 or 12 of the Securities Act

of 1933, as amended, is deemed not filed for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, and otherwise

is not subject to liability under these sections.

|

(1)

|

Incorporated

by reference from our Registration Statement on Form S-1 filed with

the Commission on August 11, 2017.

|

|

|

|

|

(2)

|

Incorporated

by reference from the Amendment No. 1 to our Registration Statement

on Form S-1 filed with the Commission on November 16,

2017.

|

|

|

|

|

(3)

|

Incorporated

by reference from the Amendment No. 2 to our Registration Statement

on Form S-1 filed with the Commission on February 1,

2018.

|

|

|

|

|

(4)

|

Incorporated

by reference from the Amendment No. 3 to our Registration Statement

on Form S-1 filed with the Commission on April 30,

2018.

|

|

|

|

|

(5)

|

Incorporated

by reference from the Current Report on Form 8-K filed with the

Commission on March 7, 2019.

|

|

|

|

|

(6)

|

Incorporated by reference from the Annual Report on Form 10-K filed

with the Commission on April 16, 2019.

|

SIGNATURES

In

accordance with Section 13 or 15(d) of the Exchange Act, the

registrant caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

WEED, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

May 14,

2019

|

/s/

Glenn E. Martin

|

|

|

By:

Glenn E.

Martin

|

|

|

Its:

Chief Executive Officer

(Principal Executive Officer), President, and Chief Financial

Officer (Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

May 14,

2019

|

/s/

Nicole M. Breen

|

|

|

By:

Nicole M.

Breen

|

|

|

Its:

Secretary and

Treasurer

|

In

accordance with the Exchange Act, this report has been signed below

by the following persons on behalf of the registrant and in the

capacities and on the dates indicated.

|

|

|

|

|

|

|

Dated:

May 14,

2019

|

/s/

Glenn E. Martin

|

|

|

By:

Glenn E. Martin, Director

|

|

|

|

|

|

|

|

Dated:

May 14, 2019

|

/s/

Nicole M. Breen

|

|

|

By:

Nicole M. Breen, Director

|

Rule 13a-14(a)/15d-14(a) Certification of Chief Executive

Officer

I, Glenn E. Martin, certify that:

1.

I have reviewed

this Amendment No. 1 to the Annual Report on Form 10-K/A of WEED,

Inc.;

2.

Based on my

knowledge, this report does not contain any untrue statement of a

material fact or omit to state a material fact necessary to make

the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period

covered by this report;

3.

Based on my

knowledge, the financial statements, and other financial

information included in this report fairly present in all material

respects the financial condition, results of operations and cash

flows of the registrant as of, and for, the periods presented in

this report;

4.

The

registrant’s other certifying officer(s) and I are

responsible for establishing and maintaining disclosure controls

and procedures (as defined in Exhibit Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as

defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the

registrant and have:

(a)

Designed such

disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to

ensure that material information relating to the registrant,

including its consolidated subsidiaries, is made known to us by

others within those entities, particularly during the period in

which this report is being prepared;

(b)

Designed such

internal control over financial reporting, or caused such internal

control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally

accepted accounting principles;

(c)

Evaluated the

effectiveness of the registrant’s disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures as of the

end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this

report any change in the registrant’s internal control over

financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal

quarter in the case of an annual report) that has materially

affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting;

and

5.

The

registrant’s other certifying officer(s) and I have

disclosed, based on our most recent evaluation of internal control

over financial reporting, to the registrant’s auditors and

the audit committee of the registrant’s board of directors

(or persons performing the equivalent functions):

All significant

deficiencies and material weaknesses in the design or operation of

internal control over financial reporting which are reasonably

likely to adversely affect the registrant’s ability to

record, process, summarize, and report financial information;

and

(b)

Any fraud, whether

or not material, that involves management or other employees who

have a significant role in the registrant’s internal control

over financial reporting.

|

Dated:

May 14

, 2019

|

|

|

|

|

|

/s/

Glenn E. Martin

|

|

|

By:

|

Glenn E.

Martin

|

|

|

|

Chief Executive

Officer

|

Rule 13a-14(a)/15d-14(a) Certification of Chief Financial

Officer

I, Glenn E. Martin, certify that:

1.

I have reviewed

this Amendment No. 1 to the Annual Report on Form 10-K/A of WEED,

Inc.;

2.

Based on my

knowledge, this report does not contain any untrue statement of a

material fact or omit to state a material fact necessary to make

the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period

covered by this report;

3.

Based on my

knowledge, the financial statements, and other financial

information included in this report fairly present in all material

respects the financial condition, results of operations and cash

flows of the registrant as of, and for, the periods presented in

this report;

4.

The

registrant’s other certifying officer(s) and I are

responsible for establishing and maintaining disclosure controls

and procedures (as defined in Exhibit Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as

defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the

registrant and have:

(a)

Designed such

disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to

ensure that material information relating to the registrant,

including its consolidated subsidiaries, is made known to us by

others within those entities, particularly during the period in

which this report is being prepared;

(b)

Designed such

internal control over financial reporting, or caused such internal

control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally

accepted accounting principles;

(c)

Evaluated the

effectiveness of the registrant’s disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures as of the

end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this

report any change in the registrant’s internal control over

financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal

quarter in the case of an annual report) that has materially

affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting;

and

5.

The

registrant’s other certifying officer(s) and I have

disclosed, based on our most recent evaluation of internal control

over financial reporting, to the registrant’s auditors and

the audit committee of the registrant’s board of directors

(or persons performing the equivalent functions):

(a)

All significant

deficiencies and material weaknesses in the design or operation of

internal control over financial reporting which are reasonably

likely to adversely affect the registrant’s ability to

record, process, summarize and report financial information;

and

(b)

Any fraud, whether

or not material, that involves management or other employees who

have a significant role in the registrant’s internal control

over financial reporting

.

|

Dated:

May

14, 2019

|

|

|

|

|

|

/s/ Glenn E.

Martin

|

|

|

By:

|

Glenn E.

Martin

|

|

|

|

Chief Financial

Officer and Principal Accounting Officer

|

CERTIFICATION

PURSUANT TO 18 USC, SECTION 1350,

AS

ADOPTED PURSUANT TO SECTION 906

OF

THE SARBANES-OXLEY ACT OF 2002

In connection with the Amendment No. 1 to the Annual Report of

WEED, Inc. (the “Company”) on Form 10-K/A for the year

ended December 31, 2018, as filed with the Securities and Exchange

Commission on or about the date hereof (the “Report”),

I, Glenn E. Martin, President of the Company, certify, pursuant to

18 U.S.C. Sec. 1350, as adopted pursuant to Sec. 906 of the

Sarbanes-Oxley Act of 2002, that:

(1)

The Report fully

complies with the requirements of Sections 13(a) or 15(d) of the

Securities Exchange Act of 1934; and

(2)

Information

contained in the Report fairly presents, in all material respects,

the financial condition and results of operations of the

Company.

|

Dated:

May 14

, 2019

|

|

|

|

|

|

/s/

Glenn E. Martin

|

|

|

By:

|

Glenn E.

Martin

|

|

|

|

Chief Executive

Officer

|

A signed original of this written statement required by Section 906

has been provided to WEED, Inc. and will be retained by WEED, Inc.

and furnished to the Securities and Exchange Commission or its

staff upon request.

CERTIFICATION

PURSUANT TO 18 USC, SECTION 1350,

AS

ADOPTED PURSUANT TO SECTION 906

OF

THE SARBANES-OXLEY ACT OF 2002

In connection with the Amendment No. 1 to the Annual Report of

WEED, Inc. (the “Company”) on Form 10-K/A for the year

ended December 31, 2018, as filed with the Securities and Exchange

Commission on or about the date hereof (the “Report”),

I, Glenn E. Martin, Chief Financial Officer of the Company,

certify, pursuant to 18 U.S.C. Sec. 1350, as adopted pursuant to

Sec. 906 of the Sarbanes-Oxley Act of 2002, that:

(1)

The Report fully

complies with the requirements of Sections 13(a) or 15(d) of the

Securities Exchange Act of 1934; and

(2)

Information

contained in the Report fairly presents, in all material respects,

the financial condition and results of operations of the

Company.

|

Dated:

May

14, 2019

|

|

|

|

|

|

/s/ Glenn E.

Martin

|

|

|

By:

|

Glenn E.

Martin

|

|

|

|

Chief Financial

Officer and Chief Accounting Officer

|

A signed original of this written statement required by Section 906

has been provided to WEED, Inc. and will be retained by WEED, Inc.

and furnished to the Securities and Exchange Commission or its

staff upon request.

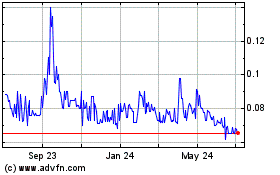

WEED (QB) (USOTC:BUDZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

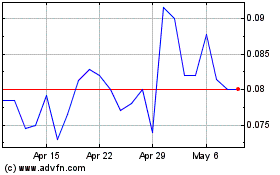

WEED (QB) (USOTC:BUDZ)

Historical Stock Chart

From Apr 2023 to Apr 2024