Current Report Filing (8-k)

June 04 2020 - 5:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 29, 2020

VYSTAR

CORPORATION

(Exact

Name of Registrant as Specified in Charter)

|

Georgia

|

|

000-53754

|

|

20-2027731

|

|

(State

or Other Jurisdiction

of

Incorporation

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

725

Southbridge St

Worcester,

MA

|

|

01609

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (508) 791-9114

n/a

(Former

Name or Former Address, if Changed Since Last Report)

Securities

registered pursuant to Section 12(b) of the Exchange Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

NONE

|

|

NONE

|

|

NONE

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[ ]

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

1.01

|

Entry

into a Material Definitive Agreement

|

Vystar

Libertas

Funding. On February 24, 2020, Vystar and Rotmans entered into an agreement with Libertas Funding LLC (“Libertas”)

to sell future receipts totaling $1,089,000 for a purchase price of $825,000. The sold amount of future receipts were to be delivered

weekly to Libertas at predetermined amounts over a period of nine months. At the time of the agreement, it was anticipated that

the payments would be made with retail sales from the Rotmans store, but the COVID-19 crisis has prevented the store from re-opening.

Vystar has made payments totaling approximately $300K to date. The agreement contains an early delivery discount fee for delivering

the future receivables before the end of the contract term and an origination fee. There are no convertible notes or warrants

attached to this agreement.

Rotmans

Vystar

owns 58% of the issued and outstanding shares of Rotmans.

Sales

Promotion Agreement and First Lien. As part of the loan payoff described in Item 1.02, Rotmans entered into a sale promotion

consulting agreement with a national furniture sales event company. Under the agreement, Rotmans appointed the third-party as

its exclusive agent to assist with a high-impact sale. The third party advanced funds for the agreement to pay off the bank loan

and to take a first position lien on Rotmans. Profits of the sale will be distributed according to the specific terms of the agreement.

The agreement will expire 240 days from the commencement date which is defined as the completion and signoff of the inventory

valuation. The commencement date of the sale will be dependent upon the re-opening of the state for retail sales due to the COVID-19

crisis. This new Sales Promotion Agreement loan removed a first lien position on approximately $16 million in Vystar’s assets

from the previous loan holder.

PPP

Loan. On April 16, 2020, Rotmans received $1,402,900 in loan funding from the Paycheck Protection Program (the “PPP”),

established pursuant to the recently enacted Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”)

and administered by the U.S. Small Business Administration (“SBA”). The unsecured loan (the “PPP Loan”)

is evidenced by a promissory note of the Company dated April 16, 2020 (the “Note”) in the principal amount of $1,402,900

with United Community Bank (the “Bank”), the lender. Under the terms of the Note and the PPP Loan, interest accrues

on the outstanding principal at the rate of 1.0% per annum. The term of the Note is two years, though it may be payable sooner

in connection with an event of default under the Note. To the extent the loan amount is not forgiven under the PPP, Rotmans is

obligated to make equal monthly payments of principal and interest, beginning seven months from the date of the Note, until the

maturity date. The Note may be prepaid in part or in full, at any time, without penalty. The Note provides for certain customary

events of default.

|

Item

1.02

|

Termination

of a Material Definitive Agreement

|

Fidelity

Co-Operative Bank Loan Payoff. On May 29, 2020, Rotmans and Vystar paid off its loan to Fidelity Co-Operative Bank. To repay

the loan, Rotmans entered into a sale promotion consulting agreement with a national furniture sales event company, described

in Item 1.01.

|

Item

7.01.

|

Regulation

FD Disclosure.

|

Vystar

Corporation is providing the following update on the filing of its Form 10-K for the year ended December 31, 2019. As result

of the global outbreak of the COVID-19 virus and by state order, employees and agents are no longer permitted to be on Rotmans

retail store premises. As such, the 10-K audit was delayed. While the audit is now completed and a draft 10-K has been prepared,

the auditors require additional time for their review and some derivative work by a third party. We currently project that the

Annual Report on Form 10-K within the next week.

As

a result of the recent COVID-19 outbreak and associated quarantines, statewide stay at home orders, and government regulation

of “social distancing”, in store sales of the Company’s subsidiary, Rotmans Furniture, have ceased, and the

store is closed. In the upcoming weeks, the Company hopes to reopen, pending state allowances, and will continue to explore its

options as it seeks to mitigate loss in revenue and defaults on loan payments.

(d)

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Stock Purchase Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.1 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.2

|

|

Master Credit Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.2 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.3

|

|

$3,000,000 Revolving Demand Line of Credit Note dated July 18, 2019 (incorporated by reference from Exhibit 10.3 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.4

|

|

Master Security Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.1 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.5

|

|

Libertas Agreement (attached hereto)

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

VYSTAR

CORPORATION

|

|

|

|

|

|

Date:

June 4, 2020

|

By:

|

/s/

Steven Rotman

|

|

|

Name:

|

Steven

Rotman

|

|

|

Title:

|

President/Chief

Executive Officer

|

EXHIBIT

INDEX

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Stock Purchase Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.1 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.2

|

|

Master Credit Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.2 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.3

|

|

$3,000,000 Revolving Demand Line of Credit Note dated July 18, 2019 (incorporated by reference from Exhibit 10.3 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.4

|

|

Master Security Agreement dated July 18, 2019 (incorporated by reference from Exhibit 10.1 of the Current Report on Form 8-K filed on July 22, 2019)

|

|

10.5

|

|

Libertas Agreement (attached hereto)

|

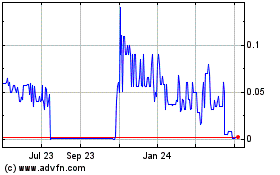

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Mar 2024 to Apr 2024

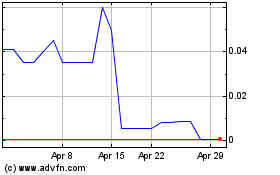

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Apr 2023 to Apr 2024