Current Report Filing (8-k)

July 05 2022 - 4:16PM

Edgar (US Regulatory)

0001376804

false

--12-31

0001376804

2022-06-29

2022-06-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): June 29, 2022

Vnue, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53462 |

|

98-0543851 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

104 West 29th Street, 11th Floor, New York, NY |

|

10001 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 937-5493

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

June 29, 2022, the Company entered a Securities Purchase Agreement (the “Securities Purchase Agreement”) with GHS

Investments, LLC (“GHS”) dated June 22, 2022, whereby GHS agreed to purchase, Thirty Thousand U.S. Dollars ($30,000) of the Company’s

Series B Convertible Preferred Stock in exchange for Thirty (30) shares of Series B Convertible Preferred Stock.

The Company issued to GHS commitment shares of Two (2) shares of Series B Convertible Preferred Stock, along with the 30 shares purchased and a warrant (the

“Warrant”) to purchase the number of shares of common stock issuable upon conversion of the Series B Convertible Preferred

Stock (the “Warrant Shares”). The Company has agreed to register the shares of common stock issuable pursuant to the conversion

of the Series B Convertible Preferred Stock and the Warrant Shares.

The

foregoing description of the Warrant and Securities Purchase Agreement does not purport to be complete and is qualified in its entirety

by reference to the full text of the form of the documents, which are attached as Exhibits 4.1 and 10.1 to this Current Report on Form

8-K,respectively, and are hereby incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

On

July 5, 2022, we issued 32 shares of Series B Preferred Stock to GHS.

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

The

securities were not registered under the Securities Act, but qualified for exemption under Section 4(a)(2) and/or Regulation D of the

Securities Act. The securities were exempt from registration under Section 4(a)(2) of the Securities Act because the issuance of such

securities by the Company did not involve a “public offering,” as defined in Section 4(a)(2) of the Securities Act, due to

the insubstantial number of persons involved in the transaction, size of the offering, manner of the offering and number of securities

offered. The Company did not undertake an offering in which it sold a high number of securities to a high number of investors. In addition,

the Investors had the necessary investment intent as required by Section 4(a)(2) of the Securities Act since the Investors agreed to,

and received, the securities bearing a legend stating that such securities are restricted pursuant to Rule 144 of the Securities Act.

This restriction ensures that these securities would not be immediately redistributed into the market and therefore not be part of a

“public offering.” Based on an analysis of the above factors, the Company has met the requirements to qualify for exemption

under Section 4(a)(2) of the Securities Act.

Item

3.03 Material Modification to Rights of Security Holders.

The

information set forth in Item 1.01 and Item 3.02 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

On

June 29, 2022, the Company filed a Second Amended and Restated Certificate of Designation with the Nevada Secretary of State, which clarified

that each new Securities Purchase Agreement will require a stock price at the lower of (1) a fixed price equaling the closing price of

the Common Stock on the trading day immediately preceding the date of the relevant Purchase Agreement and (2) 100% of the lowest VWAP

of the Common Stock during the fifteen (15) Trading Days immediately preceding, but not including, the Conversion Date.

The

foregoing description of the Second Amended and Restated Certificate of Designation does not purport to be complete and is qualified

in its entirety by reference to the full text of the form of the document, which is attached as Exhibit 3.1 to this Current Report on

Form 8-K, and is hereby incorporated herein by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

information set forth in Item 1.01, Item 3.02, and Item 3.03 of this Current Report on Form 8-K is incorporated by reference into this

Item 5.03.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Vnue,

Inc.

/s/

Zach Bair

Zach

Bair

Chief

Executive Officer

Date:

July 5, 2022

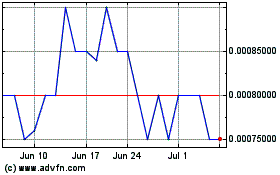

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Oct 2024 to Nov 2024

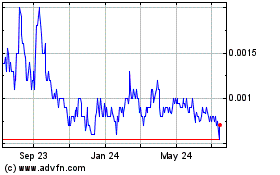

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Nov 2023 to Nov 2024