Current Report Filing (8-k)

July 29 2021 - 3:33PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 22, 2021

|

Veritas

Farms, Inc.

|

|

(Exact

name of registrant as specified in charter)

|

|

Nevada

|

|

333-210190

|

|

90-1254190

|

(State

or other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

|

1512

E. Broward Blvd., Suite 300, Fort Lauderdale, FL

|

|

33301

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (833) 691-4367

|

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Company under any of

the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

used in this Current Report on Form 8-K, and unless otherwise indicated, the terms “the Company,” “Veritas

Farms,” “we,” “us” and “our” refer to Veritas Farms, Inc. and its

subsidiary.

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

July 22, 2021, Veritas Farms, Inc. (the “Company”) issued secured convertible promissory notes in the aggregate principal

amount of $1,075,000 (the “Secured Convertible Promissory Notes”) in exchange for an aggregate amount of $1,075,000, which

Secured Convertible Promissory Notes were issued to the Cornelis F. Wit Revocable Living Trust (the “Wit Trust”), a principal

shareholder who holds securities of the Company that constitute a majority of the voting securities of the Company, in the amount of

$1,000,000, Stephen E. Johnson, Chief Executive Officer and President of the Company, in the amount of $50,000, and Ramon A. Pino, Executive

Vice President of Finance of the Company, in the amount of $25,000. The Secured Convertible Promissory Notes are secured by the Company’s

assets and contain certain covenants and customary events of default, the occurrence of which could result in an acceleration of the

Secured Convertible Promissory Notes. The Secured Convertible Promissory Notes are convertible as follows: prior to the Company closing

a financing through the sale and issuance of the Company’s equity securities, debt, convertible debt, a combination of the foregoing

or otherwise (“Conversion Securities”), on or prior to the due date of the Secured Convertible Promissory Note (the “Financing”),

the Holder has the right, in its sole discretion, to convert in whole or in part the principal and accrued but unpaid interest thereon

through and as of the date of the closing of the Financing, into the identical Conversion Securities issued at such Financing. The Notes

will accrue interest at 8% per annum, which is payable upon payment or conversion of the Secured Convertible Promissory Notes into the

Financing, at the option of the Holder. All unpaid principal, together with any then unpaid and accrued interest and other amounts payable

under the Secured Convertible Promissory Notes, is due and payable if not converted pursuant to the terms and conditions of the Secured

Convertible Promissory Notes on the earlier of (i) April 01, 2022, or October 1,2021 (ii) following an event of default. In addition,

the Secured Convertible Promissory Note issued to the Wit Trust provides that $500,000 of principal will be due and payable if not converted

pursuant to the terms and conditions of the Secured Convertible Promissory Note at such time as the Company raises a minimum amount of

$1,000,000 in additional capital.

The

foregoing description of the terms of the Secured Convertible Promissory Notes does not purport to be complete and is qualified in its

entirety by reference to the full text of the Form of Secured Convertible Promissory Note attached hereto as Exhibit 10.1.

|

|

Item

2.03

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant.

|

The

disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item

3.02.

|

|

Unregistered

Sale of Equity Securities.

|

The

disclosure set forth under Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the Secured Convertible

Promissory Notes is incorporated by reference into this Item 3.02. The Secured Convertible Promissory Notes issued to the investors were

offered and sold in a transaction exempt from registration under the Securities Act of 1933, as amended, in reliance on Section 4(a)(2)

thereof.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Dated:

July 29, 2021

|

VERITAS

FARMS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Ramon A. Pino

|

|

|

|

Ramon

A. Pino, Executive Vice President of Finance

|

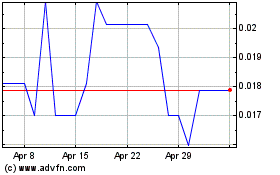

Veritas Farms (QB) (USOTC:VFRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Veritas Farms (QB) (USOTC:VFRM)

Historical Stock Chart

From Apr 2023 to Apr 2024