Current Report Filing (8-k)

September 27 2019 - 4:01PM

Edgar (US Regulatory)

U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) September 24, 2019

Commission File No. 001-33718

U.S. STEM CELL, INC.

(Name of small business issuer as specified in its charter)

|

Florida

|

65-0945967

|

|

State of Incorporation

|

IRS Employer Identification No.

|

13794 NW 4th Street, Suite 212, Sunrise, Florida 33325

(Address of principal executive offices)

(954) 835-1500

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

USRM

|

OTC

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐.

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Unless otherwise indicated or the context otherwise requires, all references in this Form 8-K to “we,” “us,” “our,” “our company,” or the “Company” refer to U.S. Stem Cell, Inc. and its subsidiaries.

Item 1.01. Entry Into A Material Definitive Agreement

See Item 2.01.

Item 2.01 – Acquisition Or Disposition Of Assets.

On March 3, 2017, the Company entered into an asset sale and lease agreement (sale/leaseback transaction, the “Asset Sale and Lease Agreement”) with General American Capital Partners (“GACP”), whereby the Company sold certain lab, medical and other equipment relating to the cell banking business for $400,000 and leased back the sold equipment over a three year term. In addition, the Company also entered into an asset purchase agreement of intellectual property with GACP whereby the Company agreed to sell all of the Company’s worldwide rights, title or interest in certain intellectual and other property (as defined) associated with the cell banking business and the Company entered into a customer purchase agreement with GACP, whereby the Company agreed to sell, the first 5,000 customers of the cell banking business[ after the effective date of the Asset Sale and Lease Agreement with rights to purchase additional customers.

On May 9, 2018, the U.S. Department of Justice filed an injunctive action, specifically United States of America v. U.S. Stem Clinic, LLC, U.S. Stem Cell, Inc., Kristin C. Comella, and Theodore Gradel. On June 3, 2019, the Court entered an order granting Summary Judgment for the government. The Court further ordered that the defendants (including the Company) ‘not sell, provide or otherwise engage in any SVF therapy or any other activities to be regulated by the FDA as explained in the Court’s Order on the Parties’ Motions for Summary Judgment.” (the “Court Order”).

As a consequence of the Court Order, the Company resolved to divest itself of certain equipment and other assets (the “Equipment Assets”) used in connection with the Company’s human tissue banking business, but consistent however with the requirements of the Court Order, and to adjust the business plan and operations to accommodate this potential divesture. To facilitate the above, the Company entered into the following agreements, which are not yet effective, as discussed below:

|

|

●

|

Termination and Release Agreement by and between GACP, the Company, and Michael Tomas and Kristin Comella dated September 24, 2019 (terminating the Non-Competition and Non-Solicitation Agreement between U.S. Stem Cell, Inc. and GACP Stem Cell Bank LLC., dated March 3, 2017).

|

|

|

●

|

Letter Agreement on Stem Cell Processing and Storage by and between the Company and American Cell Technology, LLC, dated September 24, 2019.

|

The foregoing agreements are qualified in their entirety by reference to such documents, which are attached as Exhibits hereto.

The FDA must be provided with fifteen days’ prior notice of the contemplated transactions, pursuant to the Court Order. Such notice has been sent.

Along with diversifying the portfolio of products distributed by the Company, including equipment and biologics, it is the intention of the Company to both continue to adhere to the Court Order as well as re -establish its good standing with the Agency (FDA). These points are not mutually exclusive nor negotiable and we believe that there are still business and patient goodness opportunities while still abiding by all legal requirements As a result, the Company shall be continuing with the development of US Stem Cell Training, Inc. , an operating division of our company, that is a content developer of regenerative medicine/cell therapy informational and training materials for physicians and patients and complies with both requirements--as well as Vet biologics, an operating division of our company, that is a veterinary regenerative medicine company committed to providing veterinarians with the ability to deliver the highest quality regenerative medicine therapies to dogs, cats and horses. In addition, our company is transitioning the current clinics to a more diversified regenerative medicine platform, while complying with recent court rulings. While not providing legal advice, the company may also engage in managing third-party clinics to ensure they too abide by recent regulatory requirements

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant

Date: September 27, 2019

|

|

U.S. Stem Cell, Inc.

By: /s/ Michael Tomas

|

|

|

|

Michael Tomas

|

|

|

|

Chief Executive Officer

|

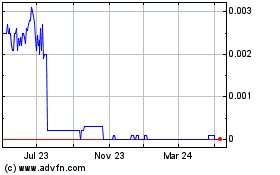

US Stem Cell (CE) (USOTC:USRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

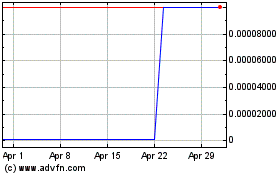

US Stem Cell (CE) (USOTC:USRM)

Historical Stock Chart

From Apr 2023 to Apr 2024