Current Report Filing (8-k)

April 20 2020 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

April 17, 2020

Date of Report (Date of earliest event reported)

TSS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-33627

|

20-2027651

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

110 E. Old Settlers Road

|

|

|

Round Rock, Texas

|

78664

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(512) 310-1000

|

|

(Registrant’s telephone number, including area code)

|

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of this Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

VTC, L.L.C. (the “Borrower”), a wholly-owned subsidiary of TSS, Inc. (“TSS” or the “Company”), applied to Texas Capital Bank, N.A. (the “Lender”) under the Small Business Administration Paycheck Protection Program of the Coronavirus Air, Relief and Economic Security Act of 2020 (the “CARES Act”) for a loan of $889,858 (the “Loan”). On April 17, 2020, the Loan was approved and the Borrower received the Loan proceeds, which the Borrower plans to use for covered payroll costs, rent and utilities in accordance with the relevant terms and conditions of the CARES Act.

The Loan, which took the form of a promissory note issued by the Borrower (the “Promissory Note”), has a two-year term, matures on April 12, 2022, and bears interest at a rate of 1.00% per annum. Monthly principal and interest payments, less the amount of any potential forgiveness (discussed below), will commence on October 12, 2020. The Borrower did not provide any collateral or guarantees for the Loan, nor did the Borrower pay any facility charge to obtain the Loan. The Promissory Note provides for customary events of default, including, among others, failure to make an payment when due, cross-defaults under any loan documents with the Lender, certain cross-defaults under agreements with third parties, events of bankruptcy or insolvency, certain change of control events, and material adverse changes in the Borrower’s financial condition. If an event of default occurs, the Lender will have the right to accelerate indebtedness under the Loan and/or pursue other remedies available to the Lender pursuant to the terms of the Promissory Note.

The Borrower may apply to the Lender for forgiveness of some or all of the Loan, with the amount which may be forgiven equal to the sum of eligible payroll costs, mortgage interest, covered rent, and covered utility payments, in each case incurred by the Borrower during the eight-week period following the Effective Date of the Promissory Note, calculated in accordance with the terms of the CARES Act. Certain reductions in Borrower payroll costs during the eight-week period may reduce the amount of the Loan eligible for forgiveness. There is no guarantee, and the Lender does not make any representation, that the Borrower will receive forgiveness for any fixed amount of any Loan proceeds received by the Borrower.

The above description of the Promissory Note and the transactions contemplated thereby is only a summary and does not purport to be complete and is qualified in its entirety by reference to the full text of the Promissory Note, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TSS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John Penver

|

|

|

|

John Penver

|

|

|

|

Chief Financial Officer

|

Date: April 20, 2020

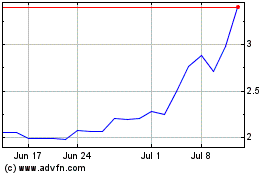

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TSS (QB) (USOTC:TSSI)

Historical Stock Chart

From Apr 2023 to Apr 2024