Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Transportation

and Logistics Systems, Inc.

(Name

of Issuer in Its Charter)

|

Nevada

|

|

4215

|

|

26-3106763

|

(State

or other jurisdiction of

incorporation)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(IRS

Employer

Identification No.)

|

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

Telephone:

(833) 764-1443

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

John

Mercadante

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

Telephone:

(833) 764-1443

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of communications to:

Akabas

& Sproule

11th

Floor

488

Madison Avenue

New

York, NY 10022

Attn:

Seth A. Akabas, Esq.

Telephone:

(212) 308-8505

Approximate

date of commencement of proposed sale to the public

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box: [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

|

[X]

|

Smaller

reporting company

|

[X]

|

|

|

|

|

Emerging

Growth Company

|

[ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION

OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered (1)(4)

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.001 per share, underlying Series E Convertible Preferred Stock

|

|

|

133,336,082

|

(2)(4)

|

$

|

0.01

|

(5)

|

$

|

1,333,360.82

|

(5)

|

$

|

145.47

|

|

|

Common Stock, par value $0.001 per share, underlying warrants

|

|

|

23,988,500

|

(3)(4)

|

$

|

0.01

|

(5)(6)

|

$

|

239,885.00

|

(5)(6)

|

$

|

26.17

|

|

|

Total

|

|

|

157,324,582

|

(1)(2)(3)(4)

|

|

|

|

$

|

1,573,245.82

|

|

$

|

171.64

|

|

|

(1)

|

The

shares of common stock being registered hereunder are being registered for resale by the selling stockholders named in the

accompanying prospectus.

|

|

|

|

|

(2)

|

Represents shares

of common stock issuable upon conversion of Series E Convertible Preferred Stock assuming a Triggering Event (as defined in

the Series E Certificate of Designation, Preferences, Rights and Limitations of Series E Convertible Preferred Stock) has

occurred and is continuing, resulting in the selling stockholders having the right to convert each share of Series E Convertible

Preferred Stock into shares of common stock having a value equal to 125% of the stated value of $13.34 per share of Series

E Convertible Preferred Stock at a conversion price equal to $0.006 per share of common stock.

|

|

|

|

|

(3)

|

Represents

shares of common stock issuable upon the exercise of warrants to purchase 23,988,500 shares of common stock at an exercise

price of $0.04 per share, offered by the selling stockholders.

|

|

|

|

|

(4)

|

Pursuant to Rule

416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder

include such indeterminate number of additional shares of common stock as may from time to time become issuable by reason

of anti-dilution provisions, stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

|

|

|

(5)

|

Estimated

solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of

1933, based on the average of the high and low prices of $0.01 for the registrant’s common stock on November 30,

2020, as reported on the OTC Pink Tier of the OTC Markets Group, Inc.

|

|

|

|

|

(6)

|

Estimated solely

for purposes of calculating the amount of the registration fee pursuant to Rule 457(g) of the Securities Act.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective

on such date as the Commission acting pursuant to said Section 8(a) may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

NOVEMBER [*], 2020

|

Transportation

and Logistics Systems, Inc.

157,324,582

Shares of Common Stock

This

prospectus relates to the sale or other disposition from time to time of up to 157,324,582 shares (“Shares”)

of our common stock, par value $0.001 per share (“Common Stock”), which consists of (i) 133,336,082 shares

issuable upon the conversion of 47,977 shares of outstanding Series E Convertible Preferred Stock, par value $0.001 per share

(the “Series E Stock”) currently outstanding assuming a Triggering Event (as defined in the Series E Certificate

of Designation, Preferences, Rights and Limitations of Series E Convertible Preferred Stock) has occurred and is continuing, resulting

in the selling stockholders having the right to convert each share of Series E Convertible Preferred Stock into shares of common

stock having a value equal to 125% of the stated value of $13.34 per share of Series E Convertible Preferred Stock at a conversion

price equal to $0.006 per share of common stock and (ii) 23,988,500 shares issuable upon the exercise of outstanding warrants

exercisable at $0.04 per share (“Warrants”)). Unless and until a Triggering Event (as defined in the Series

E Certificate of Designation, Preferences, Rights and Limitations of Series E Convertible Preferred Stock) has occurred and is

continuing, only 47,977,000 shares of our Common Stock are issuable upon conversion of the outstanding Series E Stock. All of

the shares of common stock being registered in this prospectus are being offered for resale by the selling stockholders named

in this prospectus (the “Selling Stockholders”).

We

are registering the offer and sale of the Shares by the Selling Stockholders to satisfy registration rights we have granted pursuant

to a registration rights agreement dated as of October 8, 2020 (the “Registration Rights Agreement”). We have

agreed to bear all of the expenses incurred in connection with the registration of the Shares. The Selling Stockholders will pay

or assume brokerage commission and similar charges, if any, incurred in the sale of the Shares.

We

are not selling any shares under this prospectus and will not receive any proceeds from the sale of the shares by the Selling

Stockholders. However, we will receive proceeds for any exercise of Warrants, but not for the subsequent sale of the shares underlying

the Warrants. The shares to which this prospectus relates may be offered and sold from time to time directly by the Selling Stockholders

or alternatively through underwriters, broker dealers or agents. The Selling Stockholders will determine at what price they may

sell the shares offered by this prospectus, and such sales may be made at fixed prices, at prevailing market prices at the time

of the sale, at varying prices determined at the time of sale, or at negotiated prices. For additional information on the methods

of sale that may be used by the Selling Stockholders, see the section entitled “Plan of Distribution.” For a list

of the Selling Stockholders, see the section entitled “Principal and Selling Stockholders.”

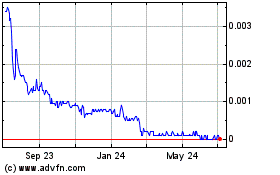

Our

common stock is quoted on the OTC Pink Tier of the OTC Markets Group, Inc. under the symbol “TLSS”. On November 30,

2020, the last reported sale price of our common stock was $0.01025 per share. Any over-the-counter market quotations

reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

As of the date of this prospectus, our common stock is subject to only limited quotation on the OTC Pink, and it is not otherwise

regularly quoted on any other over-the-counter market.

Investing

in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties

in the section entitled “Risk Factors” beginning on page 23 of this prospectus before making a decision to

purchase our stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _____________, 2020.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in this prospectus and any applicable prospectus supplement. We have not authorized

anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information,

you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as

information we have previously filed with the Securities and Exchange Commission (the “SEC” or the “Commission”)

and incorporated by reference herein, is accurate as of the date on the front of those documents only. Our business, financial

condition, results of operations and prospects may have changed since those dates.

For

investors outside the United States: we have not, and the Selling Stockholders have not, taken any action to permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about,

and observe any restrictions relating to, the offer and sale of the shares of Common Stock and the distribution of this prospectus

outside the United States.

This

prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond

our control. See “Risk Factors” and “Cautionary Notice Regarding Forward-Looking Statements.”

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

have filed with the SEC the Registration Statement under the Securities Act to register with the SEC the Shares being offered

in this prospectus. This prospectus, which constitutes a part of the Registration Statement, does not contain all of the information

set forth in the Registration Statement or the exhibits and schedules filed with it. For further information about us and the

Shares, reference is made to the registration statement and the exhibits and schedules filed with it. Statements contained in

this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the Registration Statement

are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract

or other document filed as an exhibit to the Registration Statement. We file annual, quarterly and current reports, proxy and

registration statements and other information with the SEC. You may read and copy any reports, statements or other information

that we file, including the registration statement, of which this prospectus forms a part, and the exhibits and schedules filed

with it, without charge at the Public Reference Room maintained by the SEC, located at 100 F Street NE, Washington D.C. 20549,

and copies of all or any part of the registration statement may be obtained from the SEC upon the payment of the fees prescribed

by the SEC. Please call the SEC at 1-800-SEC-0330 for further information about the Public Reference Room, including information

about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and

information statements and other information regarding registrants that file electronically with the SEC. The address of the site

is www.sec.gov.

INCORPORATION

BY REFERENCE OF CERTAIN DOCUMENTS

The

SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important

information to you by referring to those documents. The information incorporated by reference is an important part of this prospectus,

and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference

the following documents and all documents we file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) pursuant to the Exchange

Act on or after the date of this prospectus and prior to the termination of the offering under this prospectus (other than, in

each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules):

|

|

●

|

|

Annual

Report on Form 10-K for the year ended December 31, 2019, as filed on May 29, 2020, as amended by Amendment No. 1 to Annual

Report on Form 10-K for the year ended December 31, 2019, as filed on June 5, 2020;

|

|

|

|

|

|

|

|

●

|

|

Quarterly

Report on Form 10-Q for the quarter ended March 31, 2020, as filed on June 29, 2020;

|

|

|

|

|

|

|

|

●

|

|

Quarterly

Report on Form 10-Q for the quarter ended June 30, 2020 as filed on August 14, 2020;

|

|

|

|

|

|

|

|

●

|

|

Quarterly

Report on Form 10-Q for the quarter ended September 30, 2020 as filed on November 16,

2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Reports on Form 8-K filed with the SEC on March 26, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on April 27, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on May 4, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on May 8, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on May 11, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on June 9, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on July 21, 2020;

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on July 23, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on July 24, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on August 5, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on August 7, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on September 4, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on October 9, 2020;

|

|

|

|

|

|

|

|

●

|

|

Current

Report on Form 8-K filed with the SEC on November 16, 2020; and

|

|

|

|

|

|

|

|

●

|

|

our

Information Statement on Schedule 14C filed on June 30, 2020.

|

The

description of the Company’s capital stock is set forth herein beginning on page [●]. Any

statement contained herein or in any document incorporated or deemed to be incorporated by reference herein shall be deemed to

be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or replaces such statement.

Any such statement so modified or superseded shall not be deemed to constitute a part of this prospectus, except as so modified

or superseded.

We

hereby undertake to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is

delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated

by reference in this prospectus, other than exhibits to such documents, unless such exhibits have been specifically incorporated

by reference thereto. Requests for such copies should be directed to our Chief Executive Officer, John Mercadante, at the following

address:

Transportation

and Logistics Systems, Inc.

5500 Military Trail, Suite 22-357

Jupiter, Florida 33458

Our

filings with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

exhibits incorporated in and amendments to those reports, are available free of charge on our website (https://tlss-inc.com/regulatory-filings/)

as soon as reasonably practicable after they are filed with, or furnished to, the SEC. Our website and the information contained

on that site, or connected to that site, are not incorporated into and are not a part of this prospectus.

PROSPECTUS

SUMMARY

This

summary highlights certain selected information about us, this offering and the securities offered hereby. This summary is not

complete and does not contain all of the information that you should consider before deciding whether to invest in our common

stock. For a more complete understanding of our company and this offering, we encourage you to read the entire prospectus, including

the information presented under the section entitled “Risk Factors” and the financial data and related notes. Unless

we specify otherwise, all references in this prospectus to “TLSS,” “we,” “our,” “us,”

and “our company,” refer to Transportation and Logistics Systems, Inc. and its wholly-owned subsidiaries, Prime EFS,

LLC and Shypdirect LLC.

Unless

otherwise indicated, the information in this prospectus reflects a 1-for-250 reverse stock split of our common stock effected

on July 18, 2018. All share and per share data have been adjusted for the 1-for-250 reverse stock split for all periods presented.

OUR

COMPANY

Overview

Subsequent

to the termination of our Delivery Service Provider Agreement with Amazon Logistics, Inc, a subsidiary of Amazon.com, Inc. (“Amazon”),

on September 30, 2020, as discussed below, we focus primarily

on the transportation of packages, on pallets, which we pick up at an Amazon distribution center or other locations, in

box trucks, for a single customer, Amazon, which are delivered to post offices or, less frequently, to another distribution center.

This is our box-truck or “mid-mile business.” For the same customer, Amazon, we also pick up packages, on pallets,

in tractor trailers, from on-line retailers who market through Amazon, and deliver those packages to Amazon for

sale to the public (our tractor-trailer or “long-haul” business). Amazon is the largest E-commerce retailer in the

United States.

We

also do a limited amount of last-mile delivery (our minivan or “last mile” business) for a different customer.

Subsequent

to the termination of our Delivery Service Provider Agreement with Amazon on September 30, 2020, as discussed below, our

Mid-mile business currently accounts for approximately 80% of our revenues and our long-haul business accounts

for approximately 18-19% of our revenues. These percentages will fall slightly if we are able to grow our last-mile business.

Historically,

approximately 58% to 65% of our business consisted of last-mile services — transporting goods from a manufacturer or fulfillment

center to a delivery station, from a fulfillment center to a post office, or from the delivery station to an end user or retail

customer. Today, as noted, last-mile accounts for not more than 1-2% of our monthly revenues.

At

present, we are providing tractor-trailer and box truck deliveries of packages on the east coast of the United States, primarily

in and from New Jersey, Georgia, Florida, Ohio and Tennessee, primarily for Amazon and its customers, and for other customers.

We

also offer a number of logistics services to Amazon and storage solutions for Amazon’s customers with limited storage facilities,

in order to help manage such customer’s goods efficiently.

We

are primarily an asset-based point-to-point delivery company. An asset-based delivery company, as compared to a non-asset-based

delivery company, owns or leases its own transportation equipment and employs predominantly its own drivers, rather than depending

entirely on independent contractors who arrange for their own vehicles.

Between

June 18, 2018 and September 30, 2020, we operated through two New Jersey-based subsidiaries. Those subsidiaries were Prime EFS,

LLC, which conducted the last-mile business focused on deliveries to the retail consumer for our primary customer in New York,

New Jersey and Pennsylvania (“Prime EFS”), and Shypdirect LLC (“Shypdirect”), which formed in July 2018

and focused on, and which is still conducting, our long-haul and mid-mile delivery businesses.

The

great bulk of Prime EFS’s business prior to September 30, 2020 was conducted pursuant to the Delivery Service Provider program

(the “Prime EFS DSP Program”) of Amazon Logistics, Inc., a subsidiary of Amazon.com, Inc. (“Amazon”).

Shypdirect conducts its business as a carrier under a relay program service agreement with Amazon Logistics, Inc., last amended

on August 24, 2020 (the “Amazon Relay Carrier Terms of Service Agreement”). Under that agreement, Shypdirect provides

transportation services, including receiving, loading, storing, transporting, delivering, unloading and related services for Amazon

and its customers, with such contract currently set to expire on May 14, 2021.

Revenues

under the Prime EFS DSP Program agreement were approximately 67.8% of total revenues in 2019 and 97.0% of total revenue for the

period from June 18, 2018 (acquisition date of Prime) to December 31, 2018. Revenues for Shypdirect under the Amazon Relay Carrier

Terms of Service Agreement were approximately 30.9% of total revenues in 2019 and 1.5% of total revenues for the period from June

18, 2018 (acquisition date of Prime) to December 31, 2018.

Revenues

under the Prime EFS DSP Program for the nine months ended September 30, 2020 were $13,732,513, or approximately 58.5% of

total Company revenues. Revenues for Shypdirect under the Amazon Relay Carrier Terms of Service Agreement were $9,175,769, or

approximately 39.0% of total Company revenues for the nine months ended September 30, 2020.

In

June 2020, Amazon gave notice to Prime EFS that Amazon would not be renewing Prime EFS’s DSP Program agreement when that

agreement terminated effective September 30, 2020. Amazon made clear to Prime EFS that Amazon’s decision not to renew the

DSP agreement was part of a well-publicized initiative by Amazon to restructure how it would be delivering its last-mile services,

and did not reflect the quality of the services provided by Prime EFS.

As

a result of the termination of Prime EFS’s involvement with Amazon’s DSP Program, on or about October 20, 2020, Prime

EFS gave notice to its vendors and other creditors that Prime had ceased business operations effective September 30, 2020. As

a result of this action, effective October 1, 2020, and unless and until the Company, whether by acquisition or otherwise, augments

its current business and/or enters into new line(s) of business, the Company’s Shypdirect subsidiary will be the major

source of Company revenues through May 14, 2021, the date that the Amazon Relay Carrier Terms of Service is currently set

to expire. For last four (4) reported fiscal quarters, those revenues have been as follows: quarter ended September 30, 2020

- $2,398,098, quarter ended June 30, 2020 - $3,214,598, quarter ended March 31, 2020 - $3,563,074 and quarter ended December 31,

2019 - $3,435,317.

At

present, the overwhelming source of Shypdirect’s revenues is as a carrier under a relay program service agreement with Amazon

Logistics, Inc., last amended on August 24, 2020 (the “Amazon Relay Carrier Terms of Service”). Under that agreement,

Shypdirect provides transportation services, including receiving, loading, storing, transporting, delivering, unloading and related

services, for Amazon and its customers.

At

present, Shypdirect primarily serves Amazon distribution centers located in the following five (5) cities: Carteret, New Jersey

(serving the Tri-State area); Jacksonville, Florida; Jefferson, Georgia; Cleveland, Ohio; and Nashville, Tennessee. Each of the

last four (4) distribution centers mentioned serves a perimeter of approximately three (3) hours’ one-way drive time.

While

Shypdirect is attempting the grow its business in these other markets, there can be no assurance that Shypdirect will be successful

in doing so.

Although

Amazon recently extended the term of the Amazon Relay Carrier Terms of Service, at present, the contract expires May 14, 2021.

While the Company hopes to be able to extend the term of the Amazon Relay Carrier Terms of Service beyond May 14, 2021, there

can be no assurance that Shypdirect will be successful in doing so.

The

Company has a highly experienced and dedicated senior management team, which, with the assistance of a highly experienced restructuring

consultant, is currently evaluating various opportunities, whether by acquisition or otherwise, for the Company to augment its

current business and/or enter into new line(s) of business. While the Company is hopeful that it will be able to announce a plan

in this regard shortly, there can be no assurance that the Company will in fact be able to augment its current business and/or

enter into new line(s) of business or to do so profitably.

At

December 31, 2019, we owned or leased an aggregate of approximately 256 trucks or delivery vehicles and employed 588 drivers,

who worked in shifts that allowed us to utilize most of our transportation equipment on a 24/7 basis. We also utilized the

services of independent contractors to provide our delivery services. At December 31, 2019, 47 independent contractors

provided services to us on a full-time basis.

With

the termination of Prime EFS’s last-mile delivery business effective September 30, 2020, we currently employ approximately

126 drivers, who work in shifts that allow us to utilize most of our transportation equipment on a 24/7 basis. We currently own

or lease an aggregate of approximately 40 vehicles – approximately 25 box trucks, 10 tractor-trailers and 5 vans. These

vehicles are driven by our employees.

We

also continue to utilize the services of independent contractors to provide our delivery services. At present, with the termination

of Prime EFS’s last-mile delivery business effective September 30, 2020, approximately 17 independent contractors, with

access to approximately 50 of their own trucks, provide services to us on a full-time basis.

Corporate

History

We

were incorporated under the name “PetroTerra Corp.” in the State of Nevada on July 25, 2008. Prior to March 2017,

we were an independent oil or gas exploration and development company focused on the acquisition or lease of properties that potentially

contained extractable oil or gas. However, at that time, we had not generated any revenues and, due to a decline of the oil and

gas markets, elected to seek other business opportunities.

On

March 30, 2017, we entered into a Share Exchange Agreement, dated as of the same date, with Save on Transport Inc., a Florida-based

non-asset provider of integrated transportation management solutions, including brokerage and logistics services related to the

transportation of automobiles and other freight (“Save on Transport”), pursuant to which we acquired Save on Transport

as a wholly-owned subsidiary.

Our

acquisition of Save on Transport was treated as a reverse merger and recapitalization of Save on Transport for financial reporting

purposes because the Save on Transport shareholders retained an approximate 80% controlling interest in our consolidated company.

Save on Transport was considered the acquirer for accounting purposes, and our historical financial statements before the acquisition

transaction were replaced with the historical financial statements of Save on Transport before such acquisition. The balance sheets

at their historical cost basis of both entities were combined at the acquisition date and the results of operations from the acquisition

date forward included the historical results of Save on Transport and our combined results of operations from the acquisition

date forward.

On

June 18, 2018, we completed the acquisition of 100% of the issued and outstanding membership interests of Prime EFS from its members.

On

July 24, 2018, we formed Shypdirect LLC, a company organized under the laws of New Jersey. Shypdirect is a transportation company

with a focus on tractor trailer and box truck deliveries of product on the east coast of the United States from one distributor’s

warehouse to another warehouse or from a distributor’s warehouse to the post office.

Our

principal executive offices are located in the United States at 5500 Military Trail, Suite 22-357, Jupiter, Florida 33458, and

our telephone number is (833) 764-1443. References below to the “Company” are to TLSS and its wholly-owned

subsidiary, Shypdirect.

Company

Overview

Prior

to September 30, 2020, we generated our revenues through two subsidiaries, Prime EFS and Shypdirect. Effective October 1, 2020,

we are generating our revenues through Shypdirect only.

For

the period from January 1, 2018 to June 18, 2018, we operated in one reportable business segment consisting of brokerage and logistic

services such as transportation scheduling, routing and other value-added services related to the transportation of automobiles

and other freight.

From

June 18, 2018 to May 1, 2019, we operated in two reportable business segments - (1) the transportation of automobiles and other

freight (the “Save On” segment), and (2) a segment which, through Prime EFS and Shypdirect, concentrated on deliveries

for online retailers in New York, New Jersey and Pennsylvania and on tractor trailer and box truck deliveries of product on the

east coast of the United States from one distributor’s warehouse to another warehouse or from a distributor’s warehouse

to the post office.

On

May 1, 2019, we entered into a Share Exchange Agreement with Save On and Steven Yariv, whereby the Company returned all of the

stock of Save On to Steven Yariv in exchange for Mr. Yariv conveying 1,000,000 shares of common stock of the Company back to the

Company. Pursuant to Accounting Standard Codification (“ASC”) 205-20-45, the financial statement in which net

income or loss of a business entity is reported shall report the results of operations of the discontinued operation in the period

in which a discontinued operation either has been disposed of or is classified as held for sale. Accordingly, beginning in the

second quarter of 2019, the period that Save On was disposed of, we reflect Save On as a discontinued operation and such presentation

is retroactively applied to all periods presented in the accompanying consolidated financial statements.

Prior

to September 30, 2020, Prime EFS provided multiple services involving movement of goods through e-commerce. It focused primarily

on the transportation of packages that are ultimately to be delivered to the business or retail consumer, with transportation

services going from the manufacturer or fulfillment center to the delivery station and from the delivery station to the end user

(known as “last mile” deliveries). We are currently looking to offer the expertise and knowledge we have in this area

to customers other than Amazon.

Our

current services are priced based on whether a route is a mid-mile route, served by a box truck, or a long-haul route,

served by a tractor-trailer. Mid-mile services are priced either at a fixed rate or a variable rate, depending on length of route.

All our long-haul business is fixed fee, based solely on where we pick up a trailer and where we drop it off, not on the time

it takes for us to complete the delivery and return the trailer to our customer. The number of packages is not a factor in pricing

either mid-mile or long-haul.

E-Commerce

Fulfillment Expertise

The

rapid growth of e-commerce and the online retailing segment of e-commerce is well documented. Online retail companies have logistics

needs that differ from those of traditional businesses. Unlike traditional inventory management, e-commerce companies need to

ship items directly to customers, who expect their orders to arrive on time and as described. We have built our delivery services

to perform effectively in the “on demand” shipping environment that is part of the e-commerce fulfillment solutions

system. We are currently looking to offer the expertise and knowledge we have in this area to new customers.

We

have built a network operations center (“NOC”) in Carlstadt, New Jersey, which allows us to track the location

of each of our vehicles and address any on-road disruptions. Our NOC is designed to grow with our business as we add more vehicles

for additional routes and expand geographically. Presently, we utilize our NOC solely for our own business. We anticipate that

as our revenues grow and the reach and scope of our transportation activities expand (both geographically and within the tristate

area in which we currently operate) we will also generate revenues from services provided via our NOC to other logistics providers.

Our

Strategy and Competitive Strengths

Our

strategy is to be a leader in the transportation industry in providing on-time, high-quality pick-up, transportation and long-haul

and mid-mile delivery services. We will also attempt to grow our last-mile business. We attribute our growth and success

to date to the following competitive strengths.

Market

Knowledge and Understanding. While we have been operating our current business for only a few years, our senior management

personnel collectively have more than 40 years of experience in the transportation industry and broad knowledge in providing transportation

services. These solutions are in high demand, and we hope to resume the growth we experienced prior to September 30, 2020. Members

of our senior management team have e-commerce experience with online retailers and understand the dynamics of e-commerce growth,

demands and logistics since all or the vast majority of their careers have been in e-commerce businesses. We believe we understand

the various segments of the end-to-end solutions required to rapidly and accurately deliver goods between the various pick-up

and delivery points in the delivery chain.

Unwavering

Focus on Relationships and Superior Service. We aim to be the premier platform and partner of choice for our customers. We

believe we offer superior services and solutions due to our company-wide commitment to customer service.

Experienced

and Proven Management Team. We believe our management team is among the most experienced in the industry. Our senior management

team brings experience in transportation and logistics, mergers and acquisitions, information technology, e-commerce retailing

and fulfillment, and has an understanding of the cultural nuances of the e-commerce sectors we serve.

We

hope to leverage our competitive strengths to increase shareholder value through the following core strategies.

Build

Upon Strong Customer Relationships to Expand Organically. Prior to September 30, 2020, we built a strong relationship with

Amazon that allowed us to expand the size of our service area and add higher margin services to our service offerings. We are

continuing to build upon that relationship in the mid-mile and long-haul markets through Shypdirect.

During

2019, due to a decrease in “last mile” routes serviced related to our exit from certain areas in New York and Pennsylvania,

we decreased the number of “last mile” local routes we served for Amazon from approximately 200 routes at December

31, 2018 to approximately 150 routes at December 31, 2019. However, we were able to expand the type of transportation services

we render to Amazon to include “mid-mile” and long-haul transportation services in which we deliver packages from

one distribution center to another or from the distribution center to the U.S. post office. We hope to maintain our relationship

with Amazon through Shypdirect. However, even if that business also terminates in May 2021, we intend to utilize the experience

gained from that relationship to help us diversify and perform similar services for other customers and delivery service providers.

Expand

Our Operations to Other Regions of the U.S. Our mid-mile and long-haul delivery services are currently provided in the eastern

United States. As we continue to expand our marketing and customer relationships, we anticipate expanding our geographic footprint

to provide such services, and to capture market share, in other regions of the U.S. by opening our own operations centers and

warehouses, acquiring existing regional transportation and logistics companies operating in other areas and partnering with local

operators in other regions. We believe the expansion of our business in other regions of the U.S. will also allow us to expand

our relationships with existing customers who operate in those regions.

Pursue

Value-Enhancing Strategic Acquisitions. We intend to pursue strategic acquisitions as a means of adding new markets in the

United States, expanding our transportation and logistics service offerings, adding talented management and operational employees,

expanding and upgrading our technology platform and developing operational best practices. We are currently at various stages

of reviewing several potential acquisition targets and believe we have significant opportunities to grow our business through

our knowledge of our industry and possible acquisition targets.

Enhance

Our Operating Margins. We hope to enhance our operating margins through a combination of increased operational efficiencies,

leveraging our existing assets and distribution facilities and increasing our usage of technology to help us better plan, execute

and monitor the performance of our services and transportation assets.

Technology

An

integral part of our operating philosophy is the utilization of technology to support our transportation services and provide

our employees with real-time information on the status of our operations. We believe our focus on technology as a support to our

operations allows our employees to focus on performing at high levels for the benefit of our customers.

Each

of our vehicles contains a mobile communications device. By being “always-connected”, we are able to monitor the real

time location, performance and effectiveness of our drivers as well as the operating condition of the vehicles.

We

regularly collect data, generate automatic reporting and measure that information against key performance indicators such as routes

taken, travel time, destination arrival and departure time. Our NOC is designed to be scalable and will be expanded in reach and

performance capability if and when our revenues grow and our assets increase in number.

Customers

and Markets

Prior

to the fourth quarter of 2019, our package delivery services were provided primarily in New York, New Jersey and Pennsylvania;

however, during the fourth quarter of 2019, we expanded operations in four (4) new markets in Georgia, Florida, Ohio and Tennessee.

Prior

to September 30, 2020, we continued to operate in the foregoing markets. However, effective September 30, 2020, Prime’s

participation in Amazon’s Delivery Service Provider program terminated. As a result, as of October 1, 2020, our sole markets

are the long-haul and mid-mile markets, and currently our major customer for these services is Amazon.

As

a result, we continue to have customer concentration risk, which we hope to address by expanding our organic growth through

the addition of new customers and through the acquisition of businesses that provide transportation services for new customer

bases.

We

also hope to make our delivery and fulfillment solutions available to retailers besides Amazon.

Potential

Acquisition

On

November 11, 2020, our wholly owned subsidiary, TLSS Acquisition, Inc. (the “Acquisition Sub”), entered into an asset

purchase agreement dated as of November 6, 2020 (“APA”), to acquire substantially all of the assets and certain liabilities

of Cougar Express, Inc., a New York-based full service logistics provider specializing in pickup, warehousing and delivery services

in the tri-state area (“Cougar Express”).

Cougar

Express is a family-owned full-service transportation business that has been in operation for more than 30 years providing one-to-four

person deliveries and offering white glove services. It utilizes its own fleet of trucks, warehouse/driver/office personnel and

on-call subcontractors from its convenient and secure New York JFK airport area location, allowing it to pick-up and deliver throughout

the New York tri-state area. Cougar Express serves a diverse base of 50 commercial accounts, which are freight forwarders that

work with some of the most notable retail businesses in the country. Some of Cougar Express’s accounts have been customers

of Cougar Express for more than 20 years.

The

APA provides for a purchase price equal to $2,350,000 plus 50% of the difference between the accounts receivable acquired by the

Acquisition Sub and the accounts payable assumed by the Acquisition Sub. The Acquisition Sub will also assume indebtedness on

certain truck leases and other equipment and service plans for equipment and services that are used by Cougar Express and which

will continue to be used by the Acquisition Sub post-closing. After closing, the Acquisition Sub plans to change its name to Cougar

Express, Inc., and the seller (the current Cougar Express, Inc. corporation) and its owner would be barred from competing with

the Cougar Express business for five years.

The

transaction is scheduled to close no later than January 15, 2021, subject to the completion of satisfactory due diligence by us

to confirm the accuracy of all of Cougar Express’s representations and warranties in the APA and that Cougar Express has

not suffered a material adverse change in its business, and also subject to Cougar Express’s procuring an acceptable landlord’s

consent to Cougar Express’s assignment of the lease for its operating facility to the Acquisition Sub, and also subject

to our securing financing for the acquisition.

Consistent

with our primary strategy to become a leader in the transportation industry in providing on-time, high-quality pick-up, transportation

and delivery services, we expect to accomplish this goal, in part, by pursuing strategic acquisitions as a means of adding new

markets in the United States, expanding its transportation and logistics service offerings, adding talented management and operational

employees, expanding and upgrading its technology platform and developing operational best practices. Moreover, one factor in

assessing acquisition opportunities is the potential for subsequent organic growth post-acquisition.

We

believe that the acquisition of Cougar Express would fit our current business plan, given Cougar Express’s demographic location,

services offered, and diversified customer base, and given that it would provide us with a long-standing, well-run profitable

operation as a first step to begin replacing the revenue we lost as a result of Amazon’s terminating its delivery service

provider business. Furthermore, we believe that, because Cougar Express is strategically based in New York and serves the tri-state

area, organic growth opportunities will be available for expanding its footprint into our primary base of operations in New Jersey,

as well as efficiencies that could be derived by leveraging Shypdirect operational capabilities.

Competition

Transportation

services are highly competitive and composed of fragmented marketplaces, with multiple companies competing in the geographic region

in which we provide services. We compete on service, reliability, scope and scale of operations, technological capabilities and

price. Our competitors include local, regional and national companies that offer the same services we provide — some with

larger customer bases, significantly more resources and more experience than we have. Additionally, some of our customers have

internal resources that can perform services we offer. Due in part to the fragmented nature of the industry, we must strive daily

to retain existing business relationships and forge new relationships.

The

health of the transportation industry will continue to be a function of domestic economic growth, particularly in the e-commerce

marketplace. We believe that we have positioned the Company to grow with and benefit from the e-commerce expansion. Together with

our scale, technology and company-specific initiatives, we believe that our positioning should keep us growing faster than the

macro environment.

Seasonality

Our

business is affected by seasonality, which historically has resulted in higher sales volume during our calendar year fourth quarter,

which ends December 31st. Our gross revenue was approximately 24% higher during the fourth quarter of 2019 compared to the third

quarter of 2019. Our gross revenue was approximately 69% higher during the fourth quarter of 2018 compared to the third quarter

of 2018.

Regulation

Our

operations are regulated and licensed by various governmental agencies. These regulations impact us directly and indirectly by

regulating third-party transportation providers we use to transport freight for our customers.

Regulation

Affecting Motor Carriers, Owner-Operators and Transportation Brokers. In the United States, our subsidiaries that operate

as motor carriers have motor carrier licenses issued by the Federal Motor Carrier Safety Administration (“FMCSA”)

of the U.S. Department of Transportation (“DOT”). In addition, our subsidiaries acting as property brokers

have property broker licenses issued by the FMCSA. Our motor carrier subsidiaries and the third-party motor carriers that provide

services to us must comply with the safety and fitness regulations of the DOT, including those related to drug-testing, alcohol-testing,

hours-of-service, records retention, vehicle inspection, driver qualification and minimum insurance requirements. Weight and equipment

dimensions also are subject to government regulations. We also may become subject to new or more restrictive regulations relating

to emissions, drivers’ hours-of-service, independent contractor eligibility requirements, onboard reporting of operations,

air cargo security and other matters affecting safety or operating methods. Other agencies, such as the U.S. Environmental Protection

Agency (“EPA”), the Food and Drug Administration (“FDA”), and the U.S. Department of Homeland

Security (“DHS”), also regulate our equipment, operations and independent contractor drivers. Like our third-party

support carriers, we are subject to a variety of vehicle registration and licensing requirements in certain states and local jurisdictions

where we operate. In foreign jurisdictions where we operate, our operations are regulated by the appropriate governmental authorities.

In

2010, the FMCSA introduced the Compliance Safety Accountability program (“CSA”), which uses a Safety Management

System (“SMS”) to rank motor carriers on seven categories of safety-related data, known as Behavioral Analysis

and Safety Improvement Categories, or “BASICs.”

Although

the CSA scores are not currently publicly available, we believe such scores will be made public in the future. Our fleet could

be ranked worse or better than our competitors, and the safety ratings of our motor carrier operations could be impacted. Our

network of third-party transportation providers may experience a similar result. A reduction in safety and fitness ratings may

result in difficulty attracting and retaining qualified independent contractors and could cause our customers to direct their

business away from the Company and to carriers with more favorable CSA scores, which would adversely affect our results of operations.

Classification

of Independent Contractors. Tax and other federal and state regulatory authorities, as well as private litigants, continue

to assert that independent contractor drivers in the trucking industry are employees rather than independent contractors. Federal

legislators have introduced legislation in the past to make it easier for tax and other authorities to reclassify independent

contractors as employees, including legislation to increase the recordkeeping requirements and heighten the penalties for companies

who misclassify workers and are found to have violated overtime and/or wage requirements. Additionally, federal legislators have

sought to abolish the current safe harbor allowing taxpayers that meet certain criteria to treat individuals as independent contractors

if they are following a longstanding, recognized practice. Federal legislators also sought to expand the Fair Labor Standards

Act to cover “non-employees” who perform labor or services for businesses, even if said non-employees are properly

classified as independent contractors; require taxpayers to provide written notice to workers based upon their classification

as either an employee or a non-employee; and impose penalties and fines for violations of the notice requirement and/or for misclassifications.

Some states have launched initiatives to increase revenues from items such as unemployment, workers’ compensation and income

taxes, and the reclassification of independent contractors as employees could help states with those initiatives. Taxing and other

regulatory authorities and courts apply a variety of standards in their determinations of independent contractor status. If our

independent contractor drivers are determined to be employees, we would incur additional exposure under some or all of the following:

federal and state tax, workers’ compensation, unemployment benefits, and labor, employment and tort laws, including for

prior periods, as well as potential liability for employee benefits and tax withholdings.

Environmental

Regulations. Our facilities and operations and our independent contractors are subject to various environmental laws and regulations

dealing with the hauling, handling and disposal of hazardous materials, emissions from vehicles, engine-idling, fuel tanks and

related fuel spillage and seepage, discharge and retention of storm water, and other environmental matters that involve inherent

environmental risks. Similar laws and regulations may apply in many of the foreign jurisdictions in which we operate. We have

instituted programs to monitor and control environmental risks and maintain compliance with applicable environmental laws and

regulations. We may be responsible for the cleanup of any spill or other incident involving hazardous materials caused by our

operations or business. In the past, we have been responsible for the costs of cleanup of diesel fuel spills caused by traffic

accidents or other events, and none of these incidents materially affected our business or operations. We generally transport

only hazardous materials rated as low-to-medium-risk, and a small percentage of our total shipments contain hazardous materials.

We believe that our operations are in substantial compliance with current laws and regulations, and we do not know of any existing

environmental condition that reasonably would be expected to have a material adverse effect on our business or operating results.

Future changes in environmental regulations or liabilities from newly discovered environmental conditions or violations (and any

associated fines and penalties) could have a material adverse effect on our business, competitive position, results of operations,

financial condition or cash flows. U.S. federal and state governments, as well as governments in certain foreign jurisdictions

where we operate, have also proposed environmental legislation that could, among other consequences, potentially limit carbon,

exhaust and greenhouse gas emissions. If enacted, such legislation could result in higher costs for new tractors and trailers,

reduced productivity and efficiency, and increased operating expenses, all of which could adversely affect our results of operations.

Employees

As

of the date of this prospectus, the only employed individuals providing services to Transportation and Logistics Systems, Inc.

are its chief executive officer and, on a part-time basis, its chief development officer. Other professional and executive

services are procured by TLSS through independent contractors.

As

of the date of this prospectus, Shypdirect has 38 employees, all of whom are full-time.

In

addition to our chief executive officer, we have retained the services of a consultant, Ascentaur, LLC (“Ascentaur”),

pursuant to a Consulting Agreement between the Company and Ascentaur dated February 21, 2020, as amended (the “Consulting

Agreement”). Under the Consulting Agreement, Sebastian Giordano, the CEO and principal of Ascentaur, provides management

services to the Company in the role of chief executive under direction of the Board. Mr. Giordano devotes the majority of his

business attention to the Company, but he may spend time on other business ventures. The Consulting Agreement runs until January

31, 2023 (“Termination Date”), unless earlier terminated by an employment agreement between Mr. Giordano and the Company.

As

consideration for Mr. Giordano’s services, Ascentaur receives a base consulting fee of $300,000 annually, payable in installments

of $12,500 twice a month and is eligible for bonuses based on certain Company revenue, EBITDA, market capitalization or capital

raise milestones. In addition, upon approval by the Board, Ascentaur received nonqualified stock options to purchase up to 25,000,000

shares of Common Stock of the Company at an exercise price of $0.06 per share. Mr. Giordano is also eligible for the Company’s

standard medical and dental plans. Upon any termination of the Consulting Agreement by the Company without “Cause,”

by Mr. Giordano for “Good Reason,” or by expiration and non-renewal of the Consulting Agreement as of the Termination,

Mr. Giordano will receive (i) a separation payment equal to one year’s worth of the base consulting fee, (ii) all accrued

and unpaid bonuses and (iii) accelerated vesting of all unvested options he may have received.

The

Company and Mr. Giordano have also, as required by Nevada Revised Statutes Section 78.751, entered into an Indemnity Agreement

(the “Indemnity Agreement”) whereby the Company indemnifies Mr. Giordano and Ascentaur, to the fullest extent as provided

by Nevada corporate law, for all fees, costs and charges (including attorneys’ fees) for any actual or threatened claims

against him, except to the extent that Mr. Giordano’s actions constituted gross negligence; criminal, fraudulent or reckless

misconduct; or, with respect to any criminal actions, Mr. Giordano had reasonable cause to believe his actions were unlawful.

Information

Systems

Prime

EFS will use, if it resumes operations, and Shypdirect uses a suite of non-proprietary software programs and other technologies

to manage dispatching of vehicles, employees, DOT compliance, vehicle maintenance, and scheduling.

LEGAL

PROCEEDINGS

A

description of Legal Proceedings in which the Company is involved and claims against the Company that may legal proceedings is

incorporated by reference to the documents set forth in the Section entitled “INCORPORATION BY REFERENCE OF CERTAIN DOCUMENTS”

in this prospectus above. That information is supplemented and updated as follows.

Default

by Prime EFS on June 4, 2020 Settlement with Creditors

On

June 4, 2020, Prime EFS LLC (“Prime EFS”), a wholly-owned subsidiary of the Company, agreed with two related

creditors (the “Creditors”) to a payment plan (the “Payment Plan”) to settle, without interest,

a total outstanding balance of $2,038,556.06 (the “Outstanding Balance”) owed by Prime EFS to the Creditors.

Pursuant

to the Payment Plan, Prime EFS was obligated to pay $75,000.00 to the Creditors on or before June 5, 2020 and $75,000.00 to the

Creditors on or before June 12, 2020.

Thereafter,

under the Payment Plan, beginning on June 19, 2020, Prime EFS was obligated to make weekly payments of $15,000.00 to the Creditors

each Friday for 125 weeks ending with a final payment of $13,556.06 on November 18, 2022.

Under

the Payment Plan, Prime EFS also agreed that, if it fails to make a scheduled payment or otherwise defaults on its obligations,

the remaining Outstanding Balance would be accelerated and due, in full, within five business days after receipt by Prime EFS

of a notice of default from the Creditors.

Under

the Payment Plan, Prime EFS also agreed that, if Prime EFS does not pay the remaining Outstanding Balance within five business

days after receipt of a notice of default, then the Creditors will be entitled to 9% per annum simple interest on the remaining

Outstanding Balance from the date of default and to recover attorneys’ fees and costs for enforcement.

Prime

EFS made the $75,000 payments due on each of June 5, 2020 and June 12, 2020.

Prime

EFS also made each of the weekly payments due through Friday, September 18, 2020. However, Prime EFS did not make the payment

due Friday, September 25, 2020, did not make any further weekly payment due under the Payment Plan, and has no present plan or

intention to make any further payments under the Payment Plan because it lacks the cash-on-hand to do so.

By

letter dated October 16, 2020, attorneys for the Creditors gave Prime EFS notice of default (the “Notice of Default”)

under the settlement agreement that documents the Payment Plan and related terms and conditions. The Notice of Default correctly

states that Prime EFS did not make the payment due under the Payment Plan on September 25, 2020 and has not made any further weekly

payments since September 25, 2020. The Notice of Default correctly demands, under the settlement agreement that documents the

Payment Plan and related terms and conditions, that, as of the day of Prime EFS’s default, Prime EFS owed the Creditors

$1,678,556.06, which is accrued on the accompanying condensed consolidated balance at September 30, 2020. In the Notice of Default,

the Creditors reserve the right to institute legal proceedings against Prime EFS for its. In the Notice of Default, the Creditors

reserve the right to institute legal proceedings against Prime EFS for its defaults under the Payment Plan, to seek default interest

at 9% per annum and to seek the Creditors’ costs of collection.

To

date, Prime EFS has not responded to the Notice of Default and has no present plan or intention to respond.

Dispute

between Patrick Nicholson and Prime EFS

By

letter dated October 9, 2020, attorneys representing Patrick Nicholson allege that Prime EFS is in default of its payment obligations

under a “10% Senior Secured Demand Promissory Note” issued February 13, 2019, in the principal amount of $165,000,

and under a second promissory note issued April 24, 2019 in the principal amount of $55,000.

In

the demand, the attorneys for Mr. Nicholson allege the total balance owed, including interest, is $332,702.84 and that interest

is continuing to accrue on each promissory note.

In

the demand, the attorneys for Mr. Nicholson also contend that the Company is jointly and severally liable with Prime EFS for this

balance.

In

the demand, the attorneys for Mr. Nicholson also contend that the great bulk ($276,169) of the alleged balance due arises under

the “10% Senior Secured Demand Promissory Note” issued February 13, 2019. However, this promissory note is, by its

express terms, governed by New York law, and, in the opinion of Prime EFS’s counsel, such note is usurious on the face of

it and unenforceable.

Further,

in the opinion of counsel, formed after reasonable inquiry, neither promissory note is enforceable against any person or entity

other than Prime EFS. If, as threatened, Mr. Nicholson files suit for nonpayment under either or both promissory notes, it is

anticipated that the defendant(s) will mount a vigorous defense to the action.

Disputes

Between Prime EFS, ELRAC LLC, and Enterprise Leasing Company of Philadelphia, LLC

On

or about January 10, 2020, Prime EFS was named as sole defendant in a civil action captioned ELRAC LLC v. Prime EFS, filed

in the United States District Court for the Eastern District of New York, assigned Case No. 1 :20-cv-00211 (the “ELRAC

Action”). The complaint in the ELRAC Action alleged that Prime EFS failed to pay in full for repairs allegedly required

by reason of property damage to delivery vehicles leased by Prime EFS from ELRAC LLC (“ELRAC”) to conduct its

business. The complaint sought damages of not less than $382,000 plus $58,000 in insurance claims that ELRAC believes were collected

by the Company and not reimbursed to ELRAC.

ELRAC

subsequently moved for a default judgment against Prime EFS. By letter to the court dated March 9, 2020, Prime EFS opposed entry

of a default judgment and contended that all claims in the ELRAC Action were subject to mandatory arbitration clauses found in

the individual lease agreements. On March 19, 2020, ELRAC filed a stipulation dismissing the ELRAC Action without prejudice and

advised Prime EFS that it intends to file an arbitration at the American Arbitration Association alleging essentially identical

claims.

During

the period it was leasing vans and trucks from ELRAC and its affiliate, Enterprise Leasing Company of Philadelphia, LLC (“Enterprise

PA” and, with ELRAC, “Enterprise”), Prime EFS transferred $387,392 in deposits required by Enterprise

as security for the payment of deductibles and uninsured damage to Enterprise’s fleet. Despite due demand, Enterprise never

accounted to Prime EFS’s satisfaction regarding the application of these deposits. On June 10, 2020, Prime EFS therefore

initiated an arbitration (the “Arbitration”) against Enterprise at the American Arbitration Association seeking

the return of not less than $327,000 of these deposits.

On

October 9, 2020, Enterprise filed its Answer and Counterclaims in the Arbitration. In its Answer, Enterprise denies liability

to Prime EFS for $327,000 or any other sum. In its Counterclaims, ELRAC seeks $382,000 in damages and Enterprise PA seeks $256,000

in damages. Enterprise also seeks $62,000 in insurance payments allegedly made by Utica to Prime EFS.

Prime

EFS believes the Enterprise Answer and Counterclaims lack merit and intends to defend its position in the Arbitration vigorously.

Nevertheless, given the amount of the Counterclaim and the documentation which Enterprise has submitted in the arbitration in

support thereof, the Company continues to reflect a liability of $440,000, i.e., the amount originally claimed as damages by ELRAC

in the ELRAC’s federal action, as a contingency liability on the Company’s condensed consolidated balance sheet. Based

on our knowledge of the matter, as developed to date, we continue to agree with this estimate of probable total Company liability.

BMF

Capital v. Prime EFS LLC et al.

In

a settlement agreement entered into as of March 6, 2020, the Company’s wholly-owned subsidiary Prime EFS agreed to pay BMF

Capital (“BMF”) $275,000 on or by March 11, 2020, inter alia to discharge a convertible note, to cancel

certain warrants on 40,300 shares of TLSS common stock, and to settle certain claims made by BMF Capital under certain merchant

cash advance agreements (MCAs). Prime EFS did not pay a portion of the agreed $275,000 settlement amount by March 11, 2020, but

the Company has subsequently paid the $275,000 in full. As more than seven (7) months have now passed, and BMF has not again contacted

Prime EFS concerning this matter, Prime EFS believes this matter to now be closed.

Bellridge

Capital, L.P. and SCS, LLC v. TLSS

By

letter dated April 28, 2020, a prior investor in the Company, Bellridge Capital, L.P. (“Bellridge”), claimed

that the Company was in breach of its obligations under an August 29, 2019 letter agreement to issue a confession of judgment

and to pay Bellridge $150,000 per month against the amounts due under, inter alia, an April 2019 promissory note. In the

April 28, 2020 letter, Bellridge contended that TLSS owed Bellridge $1,978,557.76 as of that date. In a purported standstill agreement

subsequently proposed by Bellridge, Bellridge claimed that TLSS owed it $2,271,099.83, a figure which allegedly included default

rate interest. Bellridge also claimed that a subordination agreement it signed with the Company on August 30, 2019 was void ab

initio. Bellridge also demanded the conversion of approximately $20,000 in indebtedness into Common Stock, a conversion which

the Company had not effectuated at the time because the parties had not come to agreement on a conversion price. Such agreement

was required for Bellridge to exercise its conversion rights under an agreement dated April 9, 2019 between Bellridge and the

Company.

In

an agreement dated August 3, 2020, Bellridge and the Company resolved many of the disputes between them. Among other provisions,

Bellridge and the Company agreed upon the balance of all indebtedness owed to Bellridge as of August 3, 2020 ($2,150,000), a new

maturity date on the indebtedness (April 30, 2021), and a price of $0.02 for the conversion of all Bellridge indebtedness into

shares of Company Common Stock. In the agreement, Bellridge also agrees to release its claims against the Company and its senior

management in a definitive settlement agreement. However, the August 3 agreement did not contain a release of claims by either

party.

On

September 11, 2020, a civil action was filed against the Company, John Mercadante and Douglas Cerny in the U.S. District Court

for the Southern District of New York, captioned Bellridge Capital, L.P. v. Transportation and Logistics Systems, Inc., John

Mercadante and Douglas Cerny. The case was assigned Case No. 20-cv-7485. The complaint alleges two separate claims (the first

and second claims for relief) for purported violations of section 10(b) of the Securities and Exchange Act of 1934, as amended

(the “Exchange Act”), and SEC Rule 10b-5 promulgated thereunder, against the Company, Mr. Mercadante and/or

Mr. Cerny; a claim (the third claim for relief) purportedly for control person liability under section 20(a) of the Exchange Act

against Messrs. Mercadante and Cerny; a claim (the fourth claim for relief) purportedly for fraudulent inducement against the

Company; a claim (the fifth claim for relief) against the Company purportedly for breach of an exchange agreement between Bellridge

Capital, L.P. (“Bellridge”) and the Company allegedly dated April 13, 2019 (the “Purported Exchange

Agreement”); a claim (the sixth claim for relief) against the Company purportedly for specific performance of the Purported

Exchange Agreement; a claim against the Company (the seventh claim for relief) for purported nonpayment of a promissory note dated

December 26, 2018 pursuant to which the Company borrowed $300,000 and committed to pay Bellridge $330,000 on or by March 15, 2019

plus 10% interest per annum (the “December 2018 Note”); a claim (the eighth claim for relief) purportedly for

a declaratory judgment that the Company allegedly failed to comply with a condition precedent to the effectiveness of a subordination

agreement (the “Subordination Agreement”) executed and delivered in connection with the Purported Exchange

Agreement; and a claim (the ninth claim for relief) for breach of an assignment agreement, executed on or about July 20, 2018

(the “Partial Assignment Agreement”) in connection with a purchase of 50,000 shares of Company convertible

preferred stock, by Bellridge, from a third party.

The

damages sought under the first, second and third claims for relief are not specified in the complaint. The fourth claim for relief

seeks $128,394 in damages exclusive of interest and costs. The fifth claim for relief seeks $582,847 in damages exclusive of interest

and costs. The sixth claim for relief demands that the Company honor allegedly outstanding stock conversions served by Bellridge

at a price of $0.00545 per share. The seventh claim for relief seeks $267,970 in damages exclusive of interest and costs. The

eighth claim for relief seeks a declaration that the Subordination Agreement is null and void. The ninth claim for relief seeks

the difference between the conversion price of the shares at the time of the originally requested conversion and the price on

the actual date of conversion, plus liquidated damages of $57,960.

Briefly,

the complaint in this action alleges, among other things, that the Company failed to make payments required under two promissory

notes, namely the December 2018 Note and a convertible promissory note issued June 18, 2018 as amended by the Purported Exchange

Agreement (the “June 2018 Note”). The complaint also alleges that the Company and its senior officer gave false

assurances about a potential PIPE transaction in order to induce Bellridge to execute and deliver the Purported Exchange Agreement

and the Subordination Agreement. The complaint also alleges that the Company failed to honor certain conversion notices issued

by Bellridge and/or failed to negotiate an exercise price in good faith, allegedly as required by the Partial Assignment Agreement

and/or the Purported Exchange Agreement. The forgoing discussion does no more than summarize certain of the major allegations

of a complaint running 25 pages. Readers wishing additional information should review the complaint and/or discuss same with management.

The Company believes it has substantial defenses to some or all claims in the complaint, including without limitation the defense

of usury. Both the Company and Mr. Mercadante intend to defend this case vigorously.

On November 6, 2020, TLSI filed an answer

in this matter, denying all material allegations of the complaint.

Based on the early stage of this matter,

it is not possible to evaluate the likelihood of a favorable or unfavorable outcome, nor is it possible to estimate the amount

or range of any potential loss in the matter.

SCS,

LLC v. Transport and Logistics Systems, Inc.

On