0001661039trueThis Amendment No. 1 (“Amendment No. 1”) to Form S-1 is filed for the purpose of (i) this explanatory note along with amendments to the cover page; and (ii) adding “FirstFire Global Opportunities Fund, LLC” to column one of tables on pages 3, 30, and 31 of the Prospectus.. No other changes have been made to the Form S-1. This Amendment No. 1 speaks as of the original filing date of the Form S-1, does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way disclosures made in the original Form S-1.

619.0011250000000908029038177629939865564371100000030000003000000300000010000000100000000010000002588693000100000010000001000000100000010000001000000258869325886932588693300000025886932588693000030000000010000002588693046649000200000000010000000000280910010000000100000010000000010000000000.780.910018496308788770390341894964001.0076798202449726130471012446000006000000000000000.00040.25 to 2.7 years0.0272.9130.00410.0270.25 to 2.7 years00000.000.002021-03-212019-12-312021-03-202021-03-21P2Y.001.001.001.001.0010.001.001.0010.0010.022000750000030000001000000001000000000.0010.0010.0012588693003074901000000100000010000002588693003074905000000.850000005000000P5Y000.20.80.00062.002.002.000.156785000.847000008991113523317531674838603125069251P10Y00P0Y853336000000165000000The Company has redemption rights for the first year following the Issuance Date to redeem all or part of the principal amount of the Series D Preferred Stock at between 115% and 140%.60000038603000016610392021-01-012021-09-300001661039tptw:AugustTwoThousandTwentyOneMembertptw:MrOgrenMember2021-01-012021-09-300001661039tptw:PinnacleTowersLLCMember2021-09-300001661039tptw:PinnacleTowersLLCMember2021-01-012021-09-300001661039tptw:OctoberThirteenTwoThousandTwentyOneMembertptw:AuctusSPAMember2021-09-300001661039tptw:OctoberThirteenTwoThousandTwentyOneMembertptw:AuctusSPAMember2021-01-012021-09-300001661039tptw:InvestorsMember2019-03-180001661039tptw:SeriesEConvertiblePreferredStockMemberus-gaap:SubsequentEventMember2021-11-100001661039tptw:SeriesEConvertiblePreferredStockMemberus-gaap:SubsequentEventMember2021-11-012021-11-100001661039tptw:FirstFireGlobalOpportunitiesFundLLCMemberus-gaap:SecuritiesSoldUnderAgreementsToRepurchaseMemberus-gaap:SubsequentEventMember2021-09-152021-10-060001661039tptw:FirstFireGlobalOpportunitiesFundLLCMemberus-gaap:SecuritiesSoldUnderAgreementsToRepurchaseMemberus-gaap:SubsequentEventMember2021-10-060001661039tptw:ConsultantMember2020-04-012020-04-3000016610392021-03-202021-04-060001661039us-gaap:CorporateAndOtherMember2020-09-300001661039us-gaap:CorporateAndOtherMember2019-12-310001661039us-gaap:CorporateAndOtherMember2020-12-310001661039us-gaap:CorporateAndOtherMember2021-09-300001661039us-gaap:CorporateAndOtherMember2020-01-012020-09-300001661039us-gaap:CorporateAndOtherMember2020-07-012020-09-300001661039us-gaap:CorporateAndOtherMember2021-01-012021-09-300001661039us-gaap:CorporateAndOtherMember2019-01-012019-12-310001661039us-gaap:CorporateAndOtherMember2020-01-012020-12-310001661039us-gaap:CorporateAndOtherMember2021-07-012021-09-300001661039tptw:TptMedTechAndQuikLabsMember2019-12-310001661039tptw:TptMedTechAndQuikLabsMember2019-01-012019-12-310001661039tptw:TptMedTechAndQuikLabsMember2020-01-012020-12-310001661039tptw:TptMedTechAndQuikLabsMember2021-07-012021-09-300001661039tptw:BlueCollarMember2020-09-300001661039tptw:BlueCollarMember2020-07-012020-09-300001661039tptw:BlueCollarMember2021-07-012021-09-300001661039tptw:TPTSpeedConnectMember2020-09-300001661039tptw:TPTSpeedConnectMember2020-07-012020-09-300001661039tptw:TPTSpeedConnectMember2021-07-012021-09-300001661039tptw:LionPhoneMember2020-01-012020-12-310001661039tptw:FavorableLeasesMember2020-01-012020-12-310001661039tptw:TrademarksAndTradeNameMember2020-01-012020-12-310001661039tptw:FilmLibraryMember2020-01-012020-12-310001661039us-gaap:DevelopedTechnologyRightsMember2020-01-012020-12-310001661039us-gaap:CustomerRelationshipsMembertptw:MaximumOneMember2020-01-012020-12-310001661039us-gaap:CustomerRelationshipsMembertptw:MinimumOneMember2020-01-012020-12-310001661039tptw:OtherMember2021-01-012021-09-300001661039tptw:FavorableLeasesMember2019-01-012019-12-310001661039tptw:FavorableLeasesMember2021-01-012021-09-300001661039tptw:TrademarksAndTradeNameMember2019-01-012019-12-310001661039tptw:TrademarksAndTradeNameMember2021-01-012021-09-300001661039tptw:FilmLibraryMember2019-01-012019-12-310001661039tptw:FilmLibraryMember2021-01-012021-09-300001661039us-gaap:DevelopedTechnologyRightsMember2019-01-012019-12-310001661039us-gaap:DevelopedTechnologyRightsMember2021-01-012021-09-300001661039us-gaap:CustomerRelationshipsMembertptw:MaximumOneMember2019-01-012019-12-310001661039us-gaap:CustomerRelationshipsMembertptw:MaximumOneMember2021-01-012021-09-300001661039us-gaap:CustomerRelationshipsMembertptw:MinimumOneMember2019-01-012019-12-310001661039us-gaap:CustomerRelationshipsMembertptw:MinimumOneMember2021-01-012021-09-300001661039tptw:OtherMember2020-12-310001661039tptw:FavorableLeasesMember2020-12-310001661039tptw:TrademarksAndTradeNameMember2020-12-310001661039tptw:FilmLibraryMember2020-12-310001661039us-gaap:DevelopedTechnologyRightsMember2020-12-310001661039us-gaap:CustomerRelationshipsMember2020-12-310001661039us-gaap:CustomerRelationshipsMember2019-12-310001661039tptw:OtherMember2021-09-300001661039tptw:FavorableLeasesMember2019-12-310001661039tptw:FavorableLeasesMember2021-09-300001661039tptw:TrademarksAndTradeNameMember2019-12-310001661039tptw:TrademarksAndTradeNameMember2021-09-300001661039tptw:FilmLibraryMember2019-12-310001661039tptw:FilmLibraryMember2021-09-300001661039us-gaap:DevelopedTechnologyRightsMember2019-12-310001661039us-gaap:DevelopedTechnologyRightsMember2021-09-300001661039us-gaap:CustomerRelationshipsMember2021-09-300001661039tptw:BlueCollarMember2020-12-310001661039tptw:BlueCollarMember2019-12-310001661039tptw:MrReginaldThomasMember2020-12-310001661039tptw:MrReginaldThomasMember2020-01-012020-12-310001661039tptw:MrReginaldThomasMember2018-08-012018-08-310001661039tptw:AireFitnessMember2020-01-012020-12-310001661039tptw:SpeedConnectLlcMembertptw:JohnOgrenMember2020-01-012020-09-300001661039tptw:EmaFinancialLlcMembertptw:SecuritiesPurchaseAgreementMember2020-01-012020-09-300001661039tptw:RobertSerrettMember2020-01-012020-09-300001661039tptw:MrLittmanMember2020-12-3100016610392020-10-012020-12-3100016610392020-10-010001661039tptw:MrOgrenMember2020-01-012020-12-310001661039tptw:MrThomasMember2020-12-310001661039tptw:MrThomasMember2019-01-012019-12-310001661039tptw:MrThomasMember2020-01-012020-12-310001661039tptw:ConvertiblePromissoryNoteMember2020-01-012020-12-310001661039tptw:ConvertiblePromissoryNoteMember2021-01-012021-06-3000016610392021-01-012021-06-300001661039tptw:StockOptionsMember2021-01-012021-06-300001661039us-gaap:SeriesDPreferredStockMember2021-01-012021-06-300001661039us-gaap:SeriesBPreferredStockMember2021-01-012021-06-300001661039us-gaap:SeriesAPreferredStockMember2021-01-012021-06-300001661039tptw:FinanceLeaseObligationsMember2020-12-310001661039tptw:FinanceLeaseObligationsMember2021-09-300001661039us-gaap:SeriesDPreferredStockMember2020-01-012020-12-310001661039us-gaap:SeriesCPreferredStockMember2018-05-012018-05-310001661039us-gaap:SeriesBPreferredStockMember2015-02-012015-02-280001661039tptw:TPTStrategicMember2020-12-310001661039tptw:TPTStrategicMember2020-01-012020-12-310001661039tptw:QuikLABOneMember2021-09-300001661039tptw:QuikLABMember2021-09-300001661039tptw:CommonStockReservationsMember2021-01-012021-09-300001661039tptw:WarrantsMember2021-01-012021-09-300001661039tptw:WarrantsMember2021-09-300001661039tptw:MrLittmanMember2021-07-012021-09-300001661039tptw:MrLittmanMember2021-09-300001661039tptw:InnovaQorIncMember2021-01-012021-09-300001661039tptw:MrThomasMember2021-09-300001661039tptw:ArkadyShkolnikandReginaldThomasMember2021-09-300001661039tptw:MichaelALittmanAttyMember2021-01-012021-09-300001661039tptw:TPTStrategicMember2021-01-012021-09-300001661039tptw:TPTStrategicMember2021-07-012021-09-300001661039tptw:QuikLABMember2021-01-012021-09-300001661039tptw:QuikLABMember2021-07-012021-09-300001661039tptw:MrThomasMember2021-01-012021-09-300001661039tptw:ArkadyShkolnikandReginaldThomasMember2021-01-012021-09-300001661039srt:ChiefExecutiveOfficerMember2021-01-012021-09-300001661039tptw:WhiteLionCapitalLLCMemberus-gaap:SecuritiesSoldUnderAgreementsToRepurchaseMember2021-05-012021-05-280001661039us-gaap:SeriesAPreferredStockMember2015-02-012015-02-280001661039us-gaap:SeriesAPreferredStockMember2016-02-012016-02-280001661039tptw:PurchaseAgreementMembertptw:MrLittmanMembertptw:SeriesAPreferredStocksMember2020-09-300001661039tptw:MrLittmanMember2021-01-012021-09-300001661039tptw:WhiteLionCapitalLLCMemberus-gaap:SecuritiesSoldUnderAgreementsToRepurchaseMember2021-01-012021-09-300001661039tptw:PurchaseAgreementMembertptw:MrLittmanMembertptw:SeriesAPreferredStocksMember2020-12-012020-12-290001661039tptw:NoteholderMemberus-gaap:SeriesDPreferredStockMember2020-12-310001661039tptw:GeneralJohnWhartonMember2021-01-012021-09-300001661039us-gaap:SeriesCPreferredStockMember2015-02-280001661039us-gaap:SeriesBPreferredStockMember2015-02-280001661039us-gaap:SeriesAPreferredStockMember2015-02-280001661039us-gaap:SeriesCPreferredStockMember2018-05-310001661039us-gaap:SeriesAPreferredStockMember2016-02-280001661039tptw:MaximumOneMember2020-12-310001661039tptw:MinimumOneMember2020-12-310001661039tptw:MaximumOneMember2018-12-310001661039tptw:MaximumOneMember2019-01-012019-12-310001661039tptw:MaximumOneMember2020-01-012020-12-310001661039tptw:MinimumOneMember2020-01-012020-12-310001661039tptw:MinimumOneMember2021-01-012021-09-300001661039tptw:MinimumOneMember2018-12-310001661039tptw:MinimumOneMember2019-01-012019-12-310001661039tptw:DerivativeLiabilitiesMembertptw:MaximumOneMember2021-09-300001661039tptw:DerivativeLiabilitiesMembertptw:MaximumOneMember2021-01-012021-09-300001661039tptw:DerivativeLiabilitiesMembertptw:MinimumOneMember2021-09-300001661039tptw:DerivativeLiabilitiesMembertptw:MinimumOneMember2021-01-012021-09-300001661039tptw:DerivativeLiabilitiesMember2021-01-012021-09-300001661039us-gaap:WarrantyObligationsMember2021-01-012021-09-300001661039tptw:ConvertibleNotesMember2021-01-012021-09-300001661039us-gaap:FairValueInputsLevel3Member2021-09-300001661039us-gaap:FairValueInputsLevel3Member2020-01-012020-12-310001661039us-gaap:FairValueInputsLevel3Member2019-01-012019-12-310001661039us-gaap:FairValueInputsLevel3Member2021-01-012021-09-300001661039us-gaap:FairValueInputsLevel3Member2020-12-310001661039us-gaap:FairValueInputsLevel3Member2018-12-310001661039us-gaap:FairValueInputsLevel3Member2019-12-310001661039tptw:MarchTwentyFiveTwoThousandTwentyNineMembertptw:AuctusMember2021-01-012021-09-300001661039tptw:MarchTwentyFiveTwoThousandTwentyNineMembertptw:AuctusMember2021-09-300001661039tptw:GenevaRothMember2021-09-300001661039tptw:GenevaRothMember2019-04-120001661039tptw:GenevaRothMember2019-05-150001661039tptw:GenevaRothMember2019-06-300001661039tptw:GenevaRothMember2019-08-220001661039tptw:GenevaRothMember2019-03-150001661039tptw:GenevaRothMember2021-01-012021-09-300001661039tptw:FormerOfficerMember2017-12-310001661039tptw:TwoRelatedPartiesMember2017-12-310001661039tptw:TptMedTechAndQuikLabsMember2020-12-310001661039tptw:TptMedTechAndQuikLabsMember2021-01-012021-09-300001661039tptw:TptMedTechAndQuikLabsMember2021-09-300001661039tptw:TwoThouandTwentyNewCoFactoringAgreementMember2020-11-012020-11-130001661039tptw:TwoThouandTwentyFactoringAgreementMember2020-02-012020-02-210001661039tptw:TwoThouandNinteenFactoringAgreementMember2019-05-012019-05-080001661039tptw:CopperheadDigitalShareholdersMember2018-01-012018-12-310001661039tptw:CopperheadDigitalShareholdersMember2019-01-012019-12-310001661039tptw:CopperheadDigitalShareholdersMember2021-01-012021-09-300001661039tptw:NewCoFactoringAgreementThreeMember2021-06-012021-06-280001661039tptw:NewCoFactoringAgreementsMember2021-06-072021-06-140001661039tptw:QfsFactoringAgreementMembertptw:TransactionThreeMember2020-12-012020-12-100001661039tptw:QfsFactoringAgreementMembertptw:TransactionTwoMember2020-12-012020-12-100001661039tptw:QfsFactoringAgreementMembertptw:TransactionOneMember2020-12-012020-12-100001661039tptw:QfsFactoringAgreementMember2020-12-012020-12-100001661039tptw:JuneSixTwoThousandTwentyNineMembertptw:JSJMember2021-09-300001661039tptw:JuneSixTwoThousandTwentyNineMembertptw:JSJMember2021-01-012021-09-300001661039tptw:FebruaryFourteenTwoThousandTwentyMember2020-07-012020-07-310001661039tptw:FebruaryFourteenTwoThousandTwentyMember2020-06-012020-06-300001661039tptw:FebruaryFourteenTwoThousandTwentyMember2021-01-012021-09-300001661039tptw:FebruaryFourteenTwoThousandTwentyMember2021-09-300001661039tptw:JuneElevenTwoThousandTwentyNineMembertptw:EMAMember2019-05-150001661039tptw:JuneElevenTwoThousandTwentyNineMembertptw:EMAMember2019-06-300001661039tptw:JuneElevenTwoThousandTwentyNineMembertptw:EMAMember2021-09-300001661039tptw:JuneElevenTwoThousandTwentyNineMembertptw:EMAMember2021-01-012021-09-300001661039tptw:SamsonFactoringAgreementMember2020-12-012020-12-100001661039tptw:JuneFourTwoThousandTwentyNineMembertptw:OdysseyCapitalFundingLLCMember2021-01-012021-09-300001661039tptw:JuneFourTwoThousandTwentyNineMembertptw:OdysseyCapitalFundingLLCMember2021-09-300001661039tptw:PPPMember2021-09-300001661039tptw:MayTwentyEightTwoThousandTwentyNineMember2021-01-012021-09-300001661039tptw:MayTwentyEightTwoThousandTwentyNineMember2021-09-300001661039tptw:BlueCollarMember2021-09-300001661039tptw:OdysseyCapitalFundingLLCMembertptw:JuneEightTwoThousandTwentyNineMember2021-01-012021-09-3000016610392021-07-012021-07-2300016610392016-01-012016-12-3100016610392021-01-282021-02-0200016610392021-02-0100016610392020-08-252020-09-0200016610392020-05-012020-05-0600016610392017-01-012017-12-3100016610392018-01-012018-12-310001661039us-gaap:LeaseholdImprovementsMember2020-12-310001661039us-gaap:LeaseholdImprovementsMember2019-12-310001661039us-gaap:LeaseholdImprovementsMember2021-09-300001661039tptw:MedicalEquipmentMember2020-12-310001661039tptw:MedicalEquipmentMember2019-12-310001661039tptw:MedicalEquipmentMember2021-09-300001661039us-gaap:FurnitureAndFixturesMember2020-12-310001661039us-gaap:FurnitureAndFixturesMember2021-09-300001661039tptw:FilmProductionEquipmentMember2020-12-310001661039tptw:FilmProductionEquipmentMember2019-12-310001661039tptw:FilmProductionEquipmentMember2021-09-300001661039tptw:TelecommunicationsFiberAndEquipmentMember2020-12-310001661039tptw:TelecommunicationsFiberAndEquipmentMember2019-12-310001661039tptw:TelecommunicationsFiberAndEquipmentMember2021-09-300001661039tptw:CommonStockPurchaseAgreementMember2021-05-012021-05-2800016610392021-02-012021-02-2800016610392020-04-012020-04-300001661039tptw:SouthernPlainsOilCorpMember2020-09-012020-09-300001661039tptw:SouthernPlainsOilCorpMember2020-09-300001661039tptw:SouthernPlainsOilCorpMember2021-09-300001661039tptw:BridgeInternetAcquisitionMember2020-03-012020-03-060001661039tptw:InnovaQorMergerWithSouthernPlainsMember2020-01-012020-12-310001661039tptw:InnovaQorMergerWithSouthernPlainsMember2021-03-300001661039tptw:InnovaQorMergerWithSouthernPlainsMember2020-08-010001661039tptw:InnovaQorMergerWithSouthernPlainsMember2020-07-152020-08-010001661039tptw:BridgeInternetAcquisitionMember2020-03-060001661039tptw:RennovaAcquisitionAgreementMember2020-01-012020-12-310001661039tptw:EpicReferenceLabsIncAcquisitionMember2020-01-012020-12-310001661039tptw:EpicReferenceLabsIncAcquisitionMember2020-08-060001661039tptw:EpicReferenceLabsIncAcquisitionMember2020-07-202020-08-060001661039tptw:TheFitnessContainerLLCMember2020-12-310001661039tptw:SpeedConnectAssetAcquisitionMember2019-05-070001661039tptw:SpeedConnectAssetAcquisitionMember2019-04-030001661039tptw:SpeedConnectAssetAcquisitionMember2019-04-012019-04-300001661039tptw:SpeedConnectAssetAcquisitionMember2019-04-300001661039tptw:SpeedConnectAssetAcquisitionMember2019-05-012019-05-070001661039tptw:TheFitnessContainerLLCMember2020-06-010001661039tptw:TheFitnessContainerLLCMember2020-05-202020-06-020001661039tptw:TheFitnessContainerMember2019-01-012019-12-310001661039tptw:TheFitnessContainerLLCMember2019-01-012019-12-310001661039tptw:TheFitnessContainerLLCMember2021-09-300001661039tptw:TheFitnessContainerLLCMember2021-01-012021-09-300001661039tptw:TheFitnessContainerLLCMember2020-01-012020-12-310001661039tptw:TheFitnessContainerMember2020-12-310001661039tptw:SpeedConnectAssetAcquisitionMember2020-12-310001661039tptw:SpeedConnectAssetAcquisitionMember2020-01-012020-12-310001661039tptw:AllyPharmaMember2021-09-300001661039tptw:TelecommunicationsNetworkMember2020-01-012020-12-310001661039us-gaap:OfficeEquipmentMember2020-01-012020-12-310001661039us-gaap:EquipmentMembertptw:MinumumOneMember2020-01-012020-12-310001661039us-gaap:EquipmentMembertptw:MaximumOneMember2020-01-012020-12-310001661039tptw:TwoCustomersMemberus-gaap:AccountsReceivableMember2019-01-012019-12-310001661039tptw:TwoCustomersMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001661039tptw:AireFitnessMember2020-12-310001661039tptw:AireFitnessMember2021-09-300001661039us-gaap:SeriesDPreferredStockMember2020-06-150001661039tptw:TptMedTechMember2020-12-310001661039tptw:TptMedTechMember2021-09-300001661039tptw:TPTSpeedConnectMember2020-12-310001661039tptw:TPTSpeedConnectMember2019-12-310001661039tptw:TPTSpeedConnectMember2021-09-300001661039tptw:WarrantsIssuedWithTheDerivativeInstrumentsMember2020-12-310001661039tptw:WarrantsIssuedWithTheDerivativeInstrumentsMember2021-09-300001661039tptw:EMAFinancialConvertiblePromissoryNotesMember2020-12-310001661039tptw:EMAFinancialConvertiblePromissoryNotesMember2021-09-300001661039tptw:AuctusConvertiblePromissoryNotesMember2021-09-300001661039tptw:AuctusConvertiblePromissoryNotesMember2020-12-310001661039tptw:StockOptionsMember2019-01-012019-12-310001661039tptw:StockOptionsMember2020-01-012020-12-310001661039tptw:StockOptionsMember2021-01-012021-09-300001661039us-gaap:SeriesDPreferredStockMember2021-01-012021-09-300001661039us-gaap:SeriesBPreferredStockMember2019-01-012019-12-310001661039us-gaap:SeriesBPreferredStockMember2020-01-012020-12-310001661039us-gaap:SeriesBPreferredStockMember2021-01-012021-09-300001661039us-gaap:SeriesAPreferredStockMember2019-01-012019-12-310001661039us-gaap:SeriesAPreferredStockMember2020-01-012020-12-310001661039us-gaap:SeriesAPreferredStockMember2021-01-012021-09-300001661039tptw:ConvertibleDebtsMember2021-01-012021-09-300001661039tptw:ConvertibleDebtsMember2020-01-012020-12-310001661039tptw:ConvertibleDebtsMember2019-01-012019-12-310001661039tptw:KTelecomMember2020-01-012020-09-300001661039tptw:KTelecomMember2019-01-012019-12-310001661039tptw:OtherMember2019-01-012019-12-310001661039tptw:OtherMember2020-01-012020-12-310001661039tptw:CopperheadDigitalMember2019-01-012019-12-310001661039tptw:CopperheadDigitalMember2020-01-012020-12-310001661039tptw:KTelecomMember2020-01-012020-12-310001661039tptw:KTelecomMember2021-01-012021-09-300001661039tptw:AireFitnessMember2020-01-012020-09-300001661039tptw:AireFitnessMember2021-01-012021-09-300001661039tptw:SanDiegoMediaMember2020-01-012020-09-300001661039tptw:SanDiegoMediaMember2019-01-012019-12-310001661039tptw:SanDiegoMediaMember2020-01-012020-12-310001661039tptw:SanDiegoMediaMember2021-01-012021-09-300001661039tptw:TptMedTechMember2020-01-012020-09-300001661039tptw:TptMedTechMember2019-01-012019-12-310001661039tptw:TptMedTechMember2020-01-012020-12-310001661039tptw:TptMedTechMember2021-01-012021-09-300001661039tptw:BlueCollarMember2020-01-012020-09-300001661039tptw:BlueCollarMember2019-01-012019-12-310001661039tptw:BlueCollarMember2020-01-012020-12-310001661039tptw:BlueCollarMember2021-01-012021-09-300001661039tptw:TPTSpeedConnectMember2020-01-012020-09-300001661039tptw:TPTSpeedConnectMember2019-01-012019-12-310001661039tptw:TPTSpeedConnectMember2020-01-012020-12-310001661039tptw:TPTSpeedConnectMember2021-01-012021-09-300001661039tptw:TheFitnessContainerMember2020-01-012020-12-310001661039tptw:FitnessContainerLLCMember2021-01-012021-09-300001661039us-gaap:CommonStockMember2021-07-012021-09-300001661039us-gaap:NoncontrollingInterestMember2021-07-012021-09-300001661039us-gaap:RetainedEarningsMember2021-07-012021-09-300001661039us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001661039tptw:SubscriptionsPayableMember2021-07-012021-09-300001661039tptw:PreferredStockSeriesBMember2021-07-012021-09-300001661039tptw:PreferredStockSeriesAMember2021-07-012021-09-3000016610392021-06-300001661039us-gaap:NoncontrollingInterestMember2021-06-300001661039us-gaap:RetainedEarningsMember2021-06-300001661039us-gaap:AdditionalPaidInCapitalMember2021-06-300001661039tptw:SubscriptionsPayableMember2021-06-300001661039us-gaap:CommonStockMember2021-06-300001661039tptw:PreferredStockSeriesBMember2021-06-300001661039tptw:PreferredStockSeriesAMember2021-06-300001661039us-gaap:NoncontrollingInterestMember2021-09-300001661039us-gaap:RetainedEarningsMember2021-09-300001661039us-gaap:AdditionalPaidInCapitalMember2021-09-300001661039tptw:SubscriptionsPayableMember2021-09-300001661039us-gaap:CommonStockMember2021-09-300001661039tptw:PreferredStockSeriesBMember2021-09-300001661039tptw:PreferredStockSeriesAMember2021-09-300001661039us-gaap:NoncontrollingInterestMember2021-01-012021-09-300001661039us-gaap:RetainedEarningsMember2021-01-012021-09-300001661039us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001661039tptw:SubscriptionsPayableMember2021-01-012021-09-300001661039us-gaap:CommonStockMember2021-01-012021-09-300001661039tptw:PreferredStockSeriesBMember2021-01-012021-09-300001661039tptw:PreferredStockSeriesAMember2021-01-012021-09-300001661039us-gaap:CommonStockMember2020-07-012020-09-300001661039us-gaap:NoncontrollingInterestMember2020-07-012020-09-300001661039us-gaap:RetainedEarningsMember2020-07-012020-09-300001661039us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001661039tptw:SubscriptionsPayableMember2020-07-012020-09-300001661039tptw:PreferredStockSeriesBMember2020-07-012020-09-300001661039tptw:PreferredStockSeriesAMember2020-07-012020-09-3000016610392020-06-300001661039us-gaap:NoncontrollingInterestMember2020-06-300001661039us-gaap:RetainedEarningsMember2020-06-300001661039us-gaap:AdditionalPaidInCapitalMember2020-06-300001661039tptw:SubscriptionsPayableMember2020-06-300001661039us-gaap:CommonStockMember2020-06-300001661039tptw:PreferredStockSeriesBMember2020-06-300001661039tptw:PreferredStockSeriesAMember2020-06-300001661039us-gaap:NoncontrollingInterestMember2020-12-310001661039us-gaap:RetainedEarningsMember2020-12-310001661039us-gaap:AdditionalPaidInCapitalMember2020-12-310001661039tptw:SubscriptionsPayableMember2020-12-310001661039us-gaap:CommonStockMember2020-12-310001661039tptw:PreferredStockSeriesBMember2020-12-310001661039tptw:PreferredStockSeriesAMember2020-12-310001661039us-gaap:RetainedEarningsMember2020-01-012020-12-310001661039us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001661039us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001661039tptw:SubscriptionsPayableMember2020-01-012020-12-310001661039us-gaap:CommonStockMember2020-01-012020-12-310001661039tptw:PreferredStockSeriesBMember2020-01-012020-12-310001661039tptw:PreferredStockSeriesAMember2020-01-012020-12-3100016610392020-09-300001661039us-gaap:NoncontrollingInterestMember2020-09-300001661039us-gaap:RetainedEarningsMember2020-09-300001661039us-gaap:AdditionalPaidInCapitalMember2020-09-300001661039tptw:SubscriptionsPayableMember2020-09-300001661039us-gaap:CommonStockMember2020-09-300001661039tptw:PreferredStockSeriesBMember2020-09-300001661039tptw:PreferredStockSeriesAMember2020-09-300001661039us-gaap:CommonStockMember2020-01-012020-09-300001661039us-gaap:NoncontrollingInterestMember2020-01-012020-09-300001661039us-gaap:RetainedEarningsMember2020-01-012020-09-300001661039us-gaap:AdditionalPaidInCapitalMember2020-01-012020-09-300001661039tptw:SubscriptionsPayableMember2020-01-012020-09-300001661039tptw:PreferredStockSeriesBMember2020-01-012020-09-300001661039tptw:PreferredStockSeriesAMember2020-01-012020-09-300001661039us-gaap:NoncontrollingInterestMember2019-12-310001661039us-gaap:RetainedEarningsMember2019-12-310001661039us-gaap:AdditionalPaidInCapitalMember2019-12-310001661039tptw:SubscriptionsPayableMember2019-12-310001661039us-gaap:CommonStockMember2019-12-310001661039tptw:PreferredStockSeriesBMember2019-12-310001661039tptw:PreferredStockSeriesAMember2019-12-310001661039us-gaap:RetainedEarningsMember2019-01-012019-12-310001661039us-gaap:CommonStockMember2019-01-012019-12-310001661039us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001661039tptw:SubscriptionsPayableMember2019-01-012019-12-3100016610392018-12-310001661039us-gaap:NoncontrollingInterestMember2018-12-310001661039us-gaap:RetainedEarningsMember2018-12-310001661039us-gaap:AdditionalPaidInCapitalMember2018-12-310001661039tptw:SubscriptionsPayableMember2018-12-310001661039us-gaap:CommonStockMember2018-12-310001661039tptw:PreferredStockSeriesBMember2018-12-310001661039tptw:PreferredStockSeriesAMember2018-12-3100016610392020-01-012020-09-3000016610392020-01-012020-12-3100016610392019-01-012019-12-3100016610392020-07-012020-09-3000016610392021-07-012021-09-300001661039us-gaap:SeriesDPreferredStockMember2020-12-310001661039us-gaap:SeriesDPreferredStockMember2019-12-310001661039us-gaap:SeriesDPreferredStockMember2021-09-300001661039us-gaap:SeriesCPreferredStockMember2020-12-310001661039us-gaap:SeriesCPreferredStockMember2019-12-310001661039us-gaap:SeriesCPreferredStockMember2021-09-300001661039us-gaap:SeriesBPreferredStockMember2020-12-310001661039us-gaap:SeriesBPreferredStockMember2019-12-310001661039us-gaap:SeriesBPreferredStockMember2021-09-300001661039us-gaap:SeriesAPreferredStockMember2020-12-310001661039us-gaap:SeriesAPreferredStockMember2019-12-310001661039us-gaap:SeriesAPreferredStockMember2021-09-3000016610392020-12-3100016610392019-12-3100016610392021-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puretptw:integer

As filed with the Securities and Exchange Commission on March 1, 2022

Registration No. 333-263053

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TPT GLOBAL TECH, INC. |

(Exact name of registrant as specified in its charter) |

Florida | | 4899 | | 81-3903357 |

(State or jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

501 West Broadway, Suite 800, San Diego, CA 92101/ Phone (619) 301-4200

(Address and telephone number of principal executive offices)

Stephen Thomas, Chief Executive Officer

501 West Broadway, Suite 800, San Diego, CA 92101/ Phone (619) 301-4200

(Name, address and telephone number of agent for service)

COPIES OF ALL COMMUNICATIONS TO:

Christen Lambert, Attorney at Law

2920 Forestville Rd, Ste. 100 PMB 1155, Raleigh, North Carolina 27616 • Phone: 919-473-9130

Approximate date of commencement of proposed sale to the public: As soon as possible after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | | Amount To Be Registered | | | Proposed Maximum Offering Price Per Share(3) | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee(4) | |

Shares of Common Stock Underlying Convertible Notes, $0.001 par value | | | 468,628,332 | (1) | | $ | 0.0108 | | | $ | 5,061,185.99 | | | $ | 469.17 | |

Shares of Common Stock Underlying Warrants, $0.001 par value | | | 128,116,666 | (2) | | $ | 0.0108 | | | $ | 1,383,659.99 | | | $ | 128.27 | |

| (1) | In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover an indeterminate number of additional shares to be offered or issued from stock splits, stock dividends or similar transactions with respect to the shares being registered. This amount represents a good faith estimate of the shares of common stock underlying convertible notes issued by the registrant in private placements, with such amount equal to the maximum number of shares issuable upon conversion of such notes and accrued interest at 10% per annum until the maturity dates of the convertible notes, with the first twelve months of interest being guaranteed, assuming for purposes hereof that $2,717,500 such notes and $271,750 of accrued interest are convertible at $0.0075 per share, as adjusted, without taking into account the limitations on the conversion of such notes (as provided for therein). In addition, 70,061,665 of potential default shares are included in this amount. |

| (2) | This amount represents warrants issued pursuant to convertible notes which can be exercised generally at 110% of an uplist offering price per share. More specific details can be found at "PRIVATE PLACEMENT OF CONVERTIBLE NOTES WITH REGISTRATION RIGHTS". |

| (3) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933 (“the Securities Act”) based on the average of the 5-day average of the high and low prices of the common stock on February 22, 2022 as reported on the OTCQB. |

| (4) | Based on the average price per share of $0.0108 for TPT Global Tech, Inc.’s common stock on February 22, 2022 as reported by the OTC Markets Group. The fee is calculated by multiplying the aggregate offering amount by $0.0000927, pursuant to Section 6(b) of the Securities Act of 1933. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 1 (“Amendment No. 1”) to Form S-1 is filed for the purpose of (i) this explanatory note along with amendments to the cover page; and (ii) adding “FirstFire Global Opportunities Fund, LLC” to column one of tables on pages 3, 29, and 30, of the Prospectus. No other changes have been made to the Form S-1. This Amendment No. 1 speaks as of the original filing date of the Form S-1, does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way disclosures made in the original Form S-1.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED FEBRUARY 25, 2022

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TPT GLOBAL TECH, INC.

468,628,332 Shares of Common Stock Underlying Convertible Notes, Interest and Default Shares

128,116,666 Shares of Common Stock Underlying Warrants

This Prospectus relates to the resale from time to time of an aggregate of up to 468,628,332 shares of common stock par value $0.001 per share, (the “Common Shares”) of TPT Global Tech, Inc., a Florida corporation, by the Selling Shareholders (each a “Selling Shareholder”, and collectively, the “Selling Shareholders”), underlying, and pursuant to the conversion of convertible notes (the “Notes”) which were acquired from the Company pursuant to securities purchase agreements for an aggregate purchase price of $2,717,500. This amount represents a good faith estimate of the shares of common stock underlying convertible notes issued by the registrant in private placements, with such amount equal to the maximum number of shares issuable upon conversion of such notes and accrued interest at 10% per annum until the maturity dates of the convertible notes, with the first twelve months of interest being guaranteed, assuming for purposes hereof that $2,717,500 such notes and $271,750 of accrued interest are convertible at $0.0075 per share, as adjusted, without taking into account the limitations on the conversion of such notes (as provided for therein). In addition, 70,061,665 of potential default shares are included in this amount. (See Table on page 3 hereof).

Additionally, we are registering 128,116,666 shares of common stock underlying warrants (“Warrant Shares”) held by Selling Shareholders pursuant to the conversion of convertible notes. Warrants can be exercised at $0.025 per share. (See Table on page 3 hereof).

The Selling Shareholders have informed us that they are not “underwriters” within the meaning of the Securities Act, however, the Securities and Exchange Commission (“SEC”) may take the view that, under certain circumstances, any broker-dealers or agents that participate with the Selling Shareholders in the distribution of the Common Shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. The Selling Shareholders may sell Common Shares underlying the Notes from time to time in the principal market on which the Registrant’s Common Stock is quoted and traded at the prevailing market price or in negotiated transactions. We will not receive any of the proceeds from the sale of those Common Shares being sold by the Selling Shareholders. We did, however, receive net proceeds of approximately $2,272,518 pursuant to the sale of the Notes to the Selling Shareholders. We will pay the expenses of registering these Common Shares underlying the Notes.

Prior to this offering, there has been a limited market for our securities. While our common stock is traded actively on the OTCQB Market, there has been widely and fluctuating trading volume. There is no guarantee that an active trading market will remain or develop in our securities. Pursuant to registration rights granted to the Selling Shareholders, we are obligated to register the Common Shares underlying the Notes. We will not receive any proceeds from the sale of the Common Shares by the Selling Shareholders.

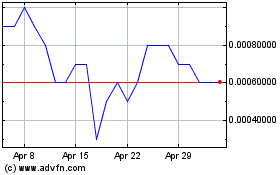

Our selling shareholders plan to sell common shares at market prices for so long as our Company is quoted on OTCQB and as the market may dictate from time to time. There is an active market for the common stock, which has been trading on the OTCQB (“TPTW”) at an average of $0.0108 in the past 5 days as of February 22, 2022. The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c).

The Selling Shareholders are offering the Common Shares underlying the Notes. The Selling Shareholders may sell all or a portion of these Common Shares from time to time in market transactions through any market on which the Common Stock is then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. The Selling Shareholders will receive all proceeds from such sales of the Common Shares. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

In aggregate, the Selling Shareholders may sell up to 596,744,998 Common Shares under this Prospectus, which includes 362,333,333 shares that may be issued pursuant to the conversion of the principal amount of the Notes, 36,233,333 shares into which accrued interest of $271,750 can be converted, assuming a conversion price of $0.0075 per share and 70,061,665 shares issued in reserve to cure any default.

We are obligated to file a supplemental registration statement or registration statements in order to register all of the Common Shares, in the event that the conversion price is lower than $0.0075 per share due to adjustments as is further described in this Registration Statement, resulting in additional shares being issued that have not been registered pursuant to this Registration Statement.

We have one class of authorized common stock, and the Company has also issued warrants for purchase of common stock. Outstanding shares of common stock represent approximately 40% of the voting power of our outstanding capital stock at the time of this registration. As of February 22, 2022, we had authorized one hundred million (100,000,000) shares of Preferred Stock, of which certain shares had been designated as Series A Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D Preferred Stock and Series E Preferred Stock. Outstanding shares of Series A Preferred Stock held by Stephen J. Thomas, our CEO, is guaranteed 60% of outstanding common stock upon conversion.

This offering will be on a delayed and continuous basis for sales of selling shareholders’ shares. The selling shareholders are not paying any of the offering expenses and we will not receive any of the proceeds from the sale of the shares by the selling shareholders. (See “Description of Securities – Shares”).

The information in this prospectus is not complete and may be changed. These securities may not be sold until the date that the registration statement relating to these securities, which has been filed with the Securities and Exchange Commission, becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THIS OFFERING IS HIGHLY SPECULATIVE AND THESE SECURITIES INVOLVE A HIGH DEGREE OF RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 6. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is February 25, 2022.

Table of Contents

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

ABOUT THIS PROSPECTUS

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized any person to give you any supplemental information or to make any representations for us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus is correct as of any time after its date. You should not rely upon any information about our company that is not contained in this prospectus. Information contained in this prospectus may become stale. You should not assume the information contained in this prospectus or any prospectus supplement is accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus, any prospectus supplement or of any sale of the shares. Our business, financial condition, results of operations, and prospects may have changed since those dates. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted.

References to “Management” in this Prospectus mean the senior officers of the Company; See “Directors and Executive Officers.” Any statements in this Prospectus made by or on behalf of Management are made in such persons’ capacities as officers of the Company, and not in their personal capacities.

TPT Global Tech, Inc. (“We,” “Us,” “Our,” “TPT,” or “TPT Global”) is incorporated in the State of Florida with operations located in San Diego, California, providing complete, communication and data services and products to small to mid-sized organizations (“SMB”).

PROSPECTUS SUMMARY

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes under the Financial Statements prior to making an investment decision.

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our Common Stock, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is December 31 and our fiscal years ended December 31, 2020 and 2019 are sometimes referred to herein as fiscal years 2020 and 2019, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our,” the “Company,” “TPT,” “our Company,” or “TPT Global Tech” refer to TPT Global Tech, Inc., a Florida corporation, and each of our subsidiaries.

PRIVATE PLACEMENT OF CONVERTIBLE NOTES WITH REGISTRATION RIGHTS

The following convertible promissory notes (“Convertible Notes”) and corresponding securities purchase agreements are those that contain registration rights and those which underlying shares are being registered for resale in this registration statement.

On October 6, 2021, TPT Global Tech, Inc. and FirstFire Global Opportunities Fund, LLC. entered into a convertible promissory note totaling $1,087,000 and a securities purchase agreement (“FirstFire Note”). The FirstFire Note has an original issue discount of 8% and bears interest at 10%, with a default rate of 24%, and is convertible into shares of the Company’s common stock. There is a mandatory conversion in the event a Nasdaq Listing prior to nine months from funding for which the Holder’s principal and interest balances will be converted at a price equal to 25% discount to the opening price on the first day the Company trades on Nasdaq. There is also a voluntary conversion of all principal and accrued interest at the discretion of the Holder at the lower of (1) 75% of the two lowest trade prices during the fifteen consecutive trading day period ending on the trading day immediately prior to the applicable conversion date or (2) discount to market based on subsequent financings with other investors. Subsequent debt issuances have lowered this price to $0.0075 per share. The Holder was given registration rights. The FirstFire Note may be prepaid in whole or in part of the outstanding balances at 115% prior to maturity. 225,000,000 common shares of the Company have been reserved with the transfer agent for possible conversion and exercise of warrants. Warrants to purchase 55,000,000 shares of common stock at 110% of the opening price on the first day the Company trades on the Nasdaq exchange were issued to the Holder. Details of the FirstFire Note and securities purchase agreement can be found in the Form 8-K and exhibits filed on October 19, 2021. The Company and the holder executed the securities purchase agreement in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

On October 13, 2021, TPT Global Tech, Inc. and Cavalry Investment Fund LP entered into a convertible promissory note totaling $271,250 and a securities purchase agreement (“Cavalry Investment Note”). The Cavalry Investment Note has an original issue discount of 8% and bears interest at 10%, with a default rate of 24%, and is convertible into shares of the Company’s common stock. There is a mandatory conversion in the event a Nasdaq Listing prior to nine months from funding for which the Holder’s principal and interest balances will be converted at a price equal to 25% discount to the opening price on the first day the Company trades on Nasdaq. There is also a voluntary conversion of all principal and accrued interest at the discretion of the Holder at the lower of (1) 75% of the two lowest trade prices during the fifteen consecutive trading day period ending on the trading day immediately prior to the applicable conversion date or (2) discount to market based on subsequent financings with other investors. Subsequent debt issuances have lowered this price to $0.0075 per share. The Holder was given registration rights. The Cavalry Investment Note may be prepaid in whole or in part of the outstanding balances at 115% prior to maturity. 56,250,000 common shares of the Company have been reserved with the transfer agent for possible conversion and exercise of warrants. Warrants to purchase 13,750,000 shares of common stock at 110% of the opening price on the first day the Company trades on the Nasdaq exchange were issued to the Holder. Details of the Cavalry Investment Note and securities purchase agreement can be found in the Form 8-K and exhibits filed on October 19, 2021. The Company and the holder executed the securities purchase agreement in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

On October 13, 2021, TPT Global Tech, Inc. and Cavalry Fund I, LP entered into a convertible promissory note totaling $271,250 and a securities purchase agreement (“Cavalry Fund I Note”). The Cavalry Fund I Note has an original issue discount of 8% and bears interest at 10%, with a default rate of 24%, and is convertible into shares of the Company’s common stock. There is a mandatory conversion in the event a Nasdaq Listing prior to nine months from funding for which the Holder’s principal and interest balances will be converted at a price equal to 25% discount to the opening price on the first day the Company trades on Nasdaq. There is also a voluntary conversion of all principal and accrued interest at the discretion of the Holder at the lower of (1) 75% of the two lowest trade prices during the fifteen consecutive trading day period ending on the trading day immediately prior to the applicable conversion date or (2) discount to market based on subsequent financings with other investors. Subsequent debt issuances have lowered this price to $0.0075 per share. The Holder was given registration rights. The Cavalry Fund I Note may be prepaid in whole or in part of the outstanding balances at 115% prior to maturity. 168,750,000 common shares of the Company have been reserved with the transfer agent for possible conversion and exercise of warrants. Warrants to purchase 41,250,000 shares of common stock at $110% of the opening price on the first day the Company trades on the Nasdaq exchange were issued to the Holder. Details of the Cavalry Fund I Note and securities purchase agreement can be found in the Form 8-K and exhibits filed on October 19, 2021. The Company and the holder executed the securities purchase agreement in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

On January 31, 2022, TPT Global Tech, Inc. and Talos Victory Fund, LLC entered into a convertible promissory note totaling $271,750 and a securities purchase agreement (“Talos Note”). The Talos Note is due twelve months from funding, has an original issue discount of 8% and interest rate at 10% per annum (default, as defined, at 16%). There is an optional conversion in the event a Nasdaq Listing prior to nine months from funding for which the Holder’s principal and interest balances will be converted at a price equal to 25% discount to the opening price on the first day the Company trades on Nasdaq. There is also a voluntary conversion of all principal and accrued interest at the discretion of the Holder at $0.0075. The Holder was given registration rights. The Talos Note may be prepaid in whole or in part of the outstanding balances at 100% prior to maturity unless the Holder chose to convert their balances into common stock which they have three days to do so. 73,372,499 common shares of the Company have been reserved with the transfer agent for possible conversion and exercise of warrants. Warrants, expiring five years from issuance, were issued to exercise up to 9,058,333 warrants to purchase 9,058,333 common shares at $0.015, provided, however, that if the company consumates an uplist offering on or before July 6, 2022 then the exercise price shall be 110% of the offering price at which the uplist offering is made. Details of the Talos Note and securities purchase agreement can be found in the Form 8-K and exhibits filed on February 8, 2022. The Company and the holder executed the securities purchase agreement in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

On January 31, 2022, TPT Global Tech, Inc. and Blue Lake Partners, LLC entered into a convertible promissory note totaling $271,750 and a securities purchase agreement (“Blue Lake Note”). The Blue Lake Note is due twelve months from funding, has an original issue discount of 8% and interest rate at 10% per annum (default, as defined, at 16%). There is an optional conversion in the event a Nasdaq Listing prior to nine months from funding for which the Holder’s principal and interest balances will be converted at a price equal to 25% discount to the opening price on the first day the Company trades on Nasdaq. There is also a voluntary conversion of all principal and accrued interest at the discretion of the Holder at $0.0075. The Holder was given registration rights. The Blue Lake Note may be prepaid in whole or in part of the outstanding balances at 100% prior to maturity unless the Holder chose to convert their balances into common stock which they have three days to do so. 73,372,499 common shares of the Company have been reserved with the transfer agent for possible conversion and exercise of warrants. Warrants, expiring five years from issuance, were issued to exercise up to 9,058,333 warrants to purchase 9,058,333 common shares at $0.015, provided, however, that if the Company consumates an uplist offering on or before July 6, 2022 then the exercise price shall equal 110% of the offering price at which the uplist offering is made. Details of the Blue Lake Note and securities purchase agreement can be found in the Form 8-K and exhibits filed on February 8, 2022. The Company and the holder executed the securities purchase agreement in accordance with and in reliance upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by Rule 506 under Regulation D as promulgated by the SEC under the 1933 Act, and/or Section 4(a)(2) of the 1933 Act.

The Company has entered into several other convertible note and promissory note financing arrangements over the past several years and all arrangements are discussed further in Information with Respect to the Registrant herein.

THE OFFERING

We are registering 468,628,332 shares of common stock underlying convertible notes, accrued interest and default shares for sale on behalf of selling shareholders (the “Common Shares”) and 128,116,666 shares of common stock issuable upon exercise of warrants (“Warrant Shares”) (collectively called “Resale Shares”).

Noteholder | | Conversion Price | | | Amount of Note | | | Guaranteed Interest | | | Principal Shares | | | Interest Shares | | | Default Shares | | | Percentage of Shares Outstanding | |

FirstFire Global Opportunities Fund, LLC | | $ | 0.0075 | | | $ | 1,087,000 | | | $ | 108,700 | | | | 144,933,333 | | | | 14,493,333 | | | | 10,573,334 | | | | 12.2 | % |

Cavalry Investment Fund LP | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,333 | | | | 3,623,333 | | | | 2,643,334 | | | | 3.1 | % |

Cavalry Fund I, LP | | $ | 0.0075 | | | $ | 815,250 | | | $ | 81,525 | | | | 108,700,000 | | | | 10,870,000 | | | | 7,930,000 | | | | 9.2 | % |

Talos Victory Fund, LLC | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,333 | | | | 3,623,333 | | | | 24,457,500 | | | | 4.6 | % |

Blue Lake Partners, LLC | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,334 | | | | 3,623,334 | | | | 24,457,498 | | | | 4.6 | % |

| | | | | | $ | 2,717,500 | | | $ | 271,750 | | | | 362,333,333 | | | | 36,233,333 | | | | 70,061,666 | | | | 33.7 | % |

Noteholder | | Conversion Price | | | Amount of Note | | | Guaranteed Interest | | | Principal Shares | | | Interest Shares | | | Default Shares | | | Percentage of Shares Outstanding | | | Warrant Shares | | | Total Number of Shares Assuming Exercise of Warrants (1) | | | Percentage of Shares Outstanding Assuming Exercise of Warrants (1) | |

FirstFire Global Opportunities Fund, LLC | | $ | 0.0075 | | | $ | 1,087,000 | | | $ | 108,700 | | | | 144,933,333 | | | | 14,493,333 | | | | 10,573,334 | | | | 12.2 | % | | | 55,000,000 | | | | 225,000,000 | | | | 14.8 | % |

Cavalry Investment Fund LP | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,333 | | | | 3,623,333 | | | | 2,643,334 | | | | 3.1 | % | | | 13,750,000 | | | | 56,250,000 | | | | 3.7 | % |

Cavalry Fund I, LP | | $ | 0.0075 | | | $ | 815,250 | | | $ | 81,525 | | | | 108,700,000 | | | | 10,870,000 | | | | 7,930,000 | | | | 9.2 | % | | | 41,250,000 | | | | 168,750,000 | | | | 11.1 | % |

Talos Victory Fund, LLC | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,333 | | | | 3,623,333 | | | | 24,457,500 | | | | 4.6 | % | | | 9,058,333 | | | | 73,372,499 | | | | 4.8 | % |

Blue Lake Partners, LLC | | $ | 0.0075 | | | $ | 271,750 | | | $ | 27,175 | | | | 36,233,334 | | | | 3,623,334 | | | | 24,457,498 | | | | 4.6 | % | | | 9,058,333 | | | | 73,372,499 | | | | 4.8 | % |

| | | | | | $ | 2,717,500 | | | $ | 271,750 | | | | 362,333,333 | | | | 36,233,333 | | | | 70,061,666 | | | | 33.7 | % | | | 128,116,666 | | | | 596,744,998 | | | | 39.3 | % |

| (1) | Assumes 923,029,038 outstanding shares in addition to all Resale Shares. |

Our common stock will be transferable immediately upon the effectiveness of the Registration Statement. (See “Description of Securities”)

Common shares outstanding before this registration statement1 | | | 923,029,038 | |

Maximum common shares being offered by Noteholders registered herein | | | 596,744,998 | |

Maximum common shares outstanding after this offering (assuming sale of all shares registered hereunder) | | | 1,519,774,036 | |

| 1) | There are additionally warrants outstanding for the purchase of 1,000,000 shares of common stock, not included in this figure. |

We will not receive any proceeds from the sale of our securities offered by the selling stockholders under this prospectus. All the shares sold under this prospectus will be sold or otherwise disposed of for the account of the selling stockholders, or their pledgees, assignees or successors-in-interest. See “Use of Proceeds” beginning on page 28 of this prospectus.

We are authorized to issue 2,500,000,000 shares of common stock with a par value of $0.001 and 100,000,000 shares of preferred stock. Our current shareholders, officers and directors collectively own 42,811,854 shares of common stock and 1,036,649 shares of preferred stock as of this date, with warrants outstanding for zero shares of common stock.

Currently there is a limited public trading market for our stock on OTCQB under the symbol “TPTW.”

OUR BUSINESS

We were originally incorporated in 1988 in the state of Florida. TPT Global, Inc., a Nevada corporation formed in June 2014, merged with Ally Pharma US, Inc., a Florida corporation, (“Ally Pharma,” formerly known as Gold Royalty Corporation) in a “reverse merger” wherein Ally Pharma issued 110,000,000 shares of Common Stock, or 80% ownership, to the owners of TPT Global, Inc. and Ally Pharma changed its name to TPT Global Tech, Inc. In 2014, we acquired all the assets of K Telecom and Wireless LLC (“K Telecom”) and Global Telecom International, LLC (“Global Telecom”). Effective January 31, 2015, we completed our acquisition of 100% of the outstanding stock of Copperhead Digital Holdings, Inc. (“Copperhead Digital”) and Subsidiaries, TruCom, LLC (“TruCom”), Nevada Utilities, Inc. (“Nevada Utilities”) and CityNet Arizona, LLC (“CityNet”). In October 2015, we acquired the assets of both Port2Port, Inc. (“Port2Port”) and Digithrive, Inc. (“Digithrive”). Effective September 30, 2016, we acquired 100% ownership in San Diego Media, Inc. (“SDM”). In December 2016, we acquired the Lion Phone technology. In October and November 2017, we entered into agreements to acquire Blue Collar, Inc. (“Blue Collar”), and certain assets of Matrixsites, Inc. (“Matrixsites”) which we have completed. On May 7, 2019, we completed the acquisition of a majority of the assets of SpeedConnect, LLC, which assets were conveyed into our wholly owned subsidiary TPT SpeedConnect, LLC (“TPT SC” or “TPT SpeedConnect”) which was formed on April 16, 2019. On January 8, 2020, we formed TPT Federal, LLC (“TPT Federal”). On March 30, 2020, we formed TPT MedTech, LLC (“TPT MedTech”) and on June 6, 2020, we formed InnovaQor, Inc (“InnovaQor”). In July and August 2020, the Company formed Quiklab 1 LLC, QuikLAB 2, LLC, QuikLAB 3, LLC and QuikLAB 4, LLC where the Company owns 80% (as agreed per the operating agreement) of all outside equity investments. Effective August 1, 2020, we closed on the acquisition of 75% of The Fitness Container, LLC (“Aire Fitness”). In July 2020, we invested in a Hong Kong company called TPT Global Tech Asia Limited of which we own 78%, and during 2020, InnovaQor did a reverse merger with Southern Plains of which there ended up being a non controlling interest of 6% as of September 30, 2021. The name of InnovaQor remained for the merged entities but was changed to TPT Strategic, Inc. on March 21, 2021.

We are based in San Diego, California, and operate as a technology-based company with divisions providing telecommunications, medical technology and product distribution, media content for domestic and international syndication as well as technology solutions. We operate as a Media Content Hub for Domestic and International syndication, Technology/Telecommunications company using our own proprietary Global Digital Media TV and Telecommunications infrastructure platform and also provide technology solutions to businesses domestically and worldwide. We offer Software as a Service (SaaS), Technology Platform as a Service (PAAS), Cloud-based Unified Communication as a Service (UCaaS) and carrier-grade performance and support for businesses over our private IP MPLS fiber and wireless network in the United States. Our cloud-based UCaaS services allow businesses of any size to enjoy all the latest voice, data, media and collaboration features in today’s global technology markets. We also operate as a Master Distributor for Nationwide Mobile Virtual Network Operators (MVNO) and Independent Sales Organization (ISO) as a Master Distributor for Pre-Paid Cellphone services, Mobile phones, Cellphone Accessories and Global Roaming Cellphones.

We anticipate needing an estimated $38,000,000 in capital to continue our business operations and expansion. We do not have committed sources for these additional funds and will need to be obtained through debt or equity placements or a combination of those. We are in negotiations for certain sources to provide funding but at this time do not have a committed source of these funds.

Our executive offices are located at 501 West Broadway, Suite 800, San Diego, CA 92101 and the telephone number is (619) 400-4996. We maintain a website at www.tptglobaltech.com, and such website is not incorporated into or a part of this filing.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion of revenue during our last fiscal year, we qualify as an emerging growth company as defined in the JOBS Act, and we may remain an emerging growth company for up to five years from the date of the first sale in this offering. However, if certain events occur prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.0 billion, or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold equity interests. However, we have irrevocably elected not to avail ourselves of the extended transition period for complying with new or revised accounting standards, and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

OTCQB Stock Symbol

Currently there is a limited public trading market for our stock on OTCQB under the symbol “TPTW.”

Our Business Segments

Our business segment consists generally of providing strategic, legacy and data integration products and services to small, medium and enterprise business, wholesale and governmental customers, including other communication providers. Our strategic products and services offered to these customers include our collocation, hosting, broadband, VoIP, information technology and other ancillary services. Our services offered to these customers primarily include local and long-distance voice, inducing the sale of unbundled network elements (“UNEs”), switched access and other ancillary services. Our product offerings include the sale of telecommunications equipment located on customers’ premises and related products and professional services, all of which are described further below.

Our products and services include local and long-distance voice, broadband, Ethernet, collocation, hosting (including cloud hosting and managed hosting), data integration, video, network, public access, VoIP, information technology and other ancillary services.

We offer our customers the ability to bundle together several products and services. For example, we offer integrated and unlimited local and long-distance voice services. Our customers can also bundle two or more services such as broadband, video (including through our strategic partnerships), voice services. We believe our customers value the convenience and price discounts associated with receiving multiple services through a single company.

Most of our products and services are provided using our telecommunications network, which consists of voice and data switches, copper cables, fiber-optic cables and other equipment.

Our key products and services are described in greater detail in the Information with Respect to the Registrant Section.

Government Regulation

Overview

As discussed further below, our operations are subject to significant local, state, federal and foreign laws and regulations.

We are subject to the significant regulations by the FCC, which regulates interstate communications, and state utility commissions, which regulate intrastate communications. These agencies (i) issue rules to protect consumers and promote competition, (ii) set the rates that telecommunication companies charge each other for exchanging traffic, and (iii) have traditionally developed and administered support programs designed to subsidize the provision of services to high-cost rural areas. In most states, local voice service, switched and special access services and interconnection services are subject to price regulation, although the extent of regulation varies by type of service and geographic region. In addition, we are required to maintain licenses with the FCC and with state utility commissions. Laws and regulations in many states restrict the manner in which a licensed entity can interact with affiliates, transfer assets, issue debt and engage in other business activities. Many acquisitions and divestitures may require approval by the FCC and some state commissions. These agencies typically have the authority to withhold their approval, or to request or impose substantial conditions upon the transacting parties in connection with granting their approvals.

The Center for Medicare & Medicaid Services (“CMS”) regulates all of our mobile laboratory testing activities performed on humans in the United States through Clinical Laboratory Improvement Amendments (‘CLIA’) which covers approximately 260,000 laboratory entities. We obtain CLIA licenses where necessary to operate our mobile laboratories. We also hire staffing agencies that work the health care industry with the appropriate health care workers to operate the mobile laboratories, which agencies and workers are regulated by state and local agencies like the agency for Health Care Administration in Florida (“AHCA”). Each state and local jurisdiction has their own agency or regulatory organization that we follow and adhere to their laws and guidelines in relation operating our mobile testing facilities.

The description beginning on page 61 discusses some of the major industry regulations that may affect our traditional operations, but numerous other regulations not discussed below could also impact us. Some legislation and regulations are currently the subject of judicial, legislative and administrative proceedings which could substantially change the manner in which the telecommunications industry operates and the amount of revenues we receive for our services.

Neither the outcome of these proceedings, nor their potential impact on us, can be predicted at this time. For additional information, see “Risk Factors.”

The laws and regulations governing our affairs are quite complex and occasionally in conflict with each other. From time to time, we are fined for failing to meet applicable regulations or service requirements.

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following summary consolidated statements of operations data for the fiscal years ended December 31, 2020 and 2019 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Additionally, the three and nine months ended September 30, 2021 and 2020 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of September 30, 2021 are derived from our consolidated financial statements that are included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the quarter ended September 30, 2021 is not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2021 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

| | September 30, | | | December 31, | |

| | 2021 | | | 2020 | | | 2019 | |

| | (Unaudited) | | | (Audited) | | | (Audited) | |

Total Assets | | $ | 11,768,748 | | | $ | 12,836,688 | | | $ | 15,453,753 | |

Current Liabilities | | $ | 38,807,443 | | | $ | 32,836,215 | | | $ | 30,850,885 | |

Long-term Liabilities | | $ | 3,937,998 | | | $ | 3,716,529 | | | $ | 3,398,737 | |

Stockholders’ Deficit | | $ | (36,004,410 | ) | | $ | (28,510,529 | ) | | $ | (18,795,869 | ) |

| | Three Months Ended | | | Nine Months Ended | | | Years Ended | |

| | September 30, 2021 (Unaudited) | | | September 30, 2021 (Unaudited) | | | December 31, 2020 (Audited) | | | December 31, 2019 (Audited) | |

Revenues | | $ | 2,519,426 | | | $ | 7,810,956 | | | $ | 11,094,170 | | | $ | 10,212,377 | |

Net Loss Attributable to TPTG Shareholders | | $ | (4,716,356 | ) | | $ | (8,600,605 | ) | | $ | (8,071,851 | ) | | $ | (14,028,165 | ) |

At September 30, 2021, the accumulated deficit was $49,503,549. At December 31, 2020, the accumulated deficit was $40,902,944. At December 31, 2019, the accumulated deficit was $32,831,093. We anticipate that we will operate in a deficit position and continue to sustain net losses for the foreseeable future.

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment. You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this document that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. Moreover, additional risks not presently known to us or that we currently deem less significant also may impact our business, financial condition or results of operations, perhaps materially. For additional information regarding risk factors, see “Forward-Looking Statements.”

Special Information Regarding Forward-Looking Statements

The information herein contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

We desire to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. This filing contains a number of forward-looking statements that reflect management’s current views and expectations with respect to our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than statements of historical fact, including statements addressing operating performance, clinical developments which management expects or anticipates will or may occur in the future, including statements related to our technology, market expectations, future revenues, financing alternatives, statements expressing general optimism about future operating results, and non-historical information, are forward looking statements. In particular, the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties, including those discussed below. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated, or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks to be discussed in this Form S-1 Registration and in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For additional information regarding forward-looking statements, see “Forward-Looking Statements.

RISK FACTORS RELATED TO OUR BUSINESS

Many of our competitors are better established and have resources significantly greater than we have, which may make it difficult to attract and retain subscribers.

We will compete with other providers of telephony service, many of which have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition and more established relationships in the industry. In addition, a number of these competitors may combine or form strategic partnerships. As a result, our competitors may be able to offer, or bring to market earlier, products and services that are superior to our own in terms of features, quality, pricing or other factors. Our failure to compete successfully with any of these companies would have a material adverse effect on our business and the trading price of our common stock.

The market for broadband and VoIP services is highly competitive, and we compete with several other companies within a single market:

| · | cable operators offering high-speed Internet connectivity services and voice communications; |

| · | incumbent and competitive local exchange carriers providing DSL services over their existing wide, metropolitan and local area networks; |