Current Report Filing (8-k)

September 17 2021 - 2:12PM

Edgar (US Regulatory)

0001661039false--12-3100016610392021-09-152021-09-15iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: September 15, 2021

|

TPT Global Tech, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Florida

|

|

333-222094

|

|

81-3903357

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

501 West Broadway, Suite 800, San Diego, CA 92101

(Address of Principal Executive Offices) (Zip Code)

(619)301-4200

Registrant’s telephone number, including area code

_________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

|

Title of each Class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws

|

On September 15, 2021, the Board of Directors of TPT Global Tech, Inc. (the “Company”) in accordance with the provisions of the Certificate of Incorporation, as amended, and by-laws of the Company amended the Certificate of Incorporation around the voluntary and involuntary conversion features of the Series D Preferred Stock. Those voluntary and involuntary conversion features, as well as other features of the Series D Preferred Stock include the following, as amended:

(i) 6% Cumulative Annual Dividends payable on the purchase value in cash or common stock of the Company at the discretion of the Board and payment is also at the discretion of the Board, which may decide to cumulate to future years; (ii) Any time after 12 months from issuance an option to convert to common stock at the election of the holder @ 75% of the 30 day average market closing price (for previous 30 business days) divided into $5.00; (iii) Automatic conversion of the Series D Preferred Stock shall occur without consent of holders upon any national exchange listing approval and the registration effectiveness of common stock underlying the conversion rights. The automatic conversion to common from Series D Preferred shall be @75% of the 30 day average market closing price (for previous 30 business days) divided into $5.00, which shall be post-reverse split as may be necessary for any Exchange listing (iv) Registration Rights – the Company has granted Piggyback Registration Rights for common stock underlying conversion rights in the event it files any other Registration Statement (other than an S-1 that the Company may file for certain conversion common shares for the convertible note financing that was arranged and funded in 2019). Further, the Company will file and pursue to effectiveness a Registration Statement or offering statement for common stock underlying the Automatic Conversion event triggered by an exchange listing. (v) Liquidation Rights - $5.00 per share plus any accrued unpaid dividends – subordinate to Series A, B, and C Preferred Stock receiving full liquidation under the terms of such series. The Company has redemption rights for the first year following the Issuance Date to redeem all or part of the principal amount of the Series D Preferred Stock at between 115% and 140%.

On September 16, 2021, the Board of Directors of the Company also in accordance with the provisions of the Certificate of Incorporation, as amended, and by-laws of the Company amended the Certificate of Incorporation to increase the authorized number of common shares by TWO HUNDRED FIFTY MILLION (250,000,000) which increase will then make the total authorized common shares to be ONE BILLION TWO HUNDRED AND FIFTY MILLION (1,250,000,000) with all common shares having the then existing rights powers and privileges as per the existing amended Certificate of Incorporate and By laws of the Company.

Item 9.01 Exhibits

The following exhibits are filed with this report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

TPT GLOBAL TECH, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen J. Thomas, III

|

|

|

|

|

Stephen J. Thomas III,

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

Date: September 17, 2021

|

|

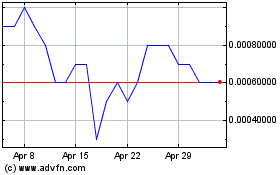

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Apr 2023 to Apr 2024