Securities Registration Statement (s-1/a)

July 06 2021 - 5:20PM

Edgar (US Regulatory)

Registration

No. 333-257551

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

TPT GLOBAL TECH, INC.

(Exact

name of registrant as specified in its charter)

|

FLORIDA

(State

or jurisdiction of

incorporation

or organization)

|

4899

(Primary

Standard Industrial

Classification

Code Number)

|

81-3903357

(I.R.S.

Employer

Identification

No.)

|

501 West Broadway, Suite 800, San Diego, CA 92101/ Phone (619)

301-4200

(Address

and telephone number of principal executive offices)

Stephen

Thomas, Chief Executive Officer

501 West Broadway, Suite 800, San Diego, CA 92101/ Phone (619)

301-4200

(Name,

address and telephone number of agent for service)

COPIES

OF ALL COMMUNICATIONS TO:

Christen

Lambert, Attorney at Law

3201 Edwards Mill Rd, Ste 141-557 ● Raleigh, North Carolina 27612 ● Phone:

919-473-9130

Approximate

date of commencement of proposed sale to the public: As soon as

possible after this Registration Statement becomes

effective.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. [X]

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. [ ]

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer

|

[___]

|

|

Accelerated

filer

|

[___]

|

|

Non-accelerated

filer

|

[_X_]

|

|

Smaller

reporting company

|

[_X_]

|

|

|

|

|

Emerging

growth company

|

[_X_]

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

[__]

CALCULATION OF REGISTRATION FEE

|

Title of Each

Class of Securities To Be Registered

|

Amount To Be

Registered(1)

|

Proposed Maximum

Offering Price Per Share(2)

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee(3)

|

|

|

|

|

|

|

|

Common stock to be

offered for resale by selling stockholders

|

75,000,000

|

$0.0145

|

$1,087,500

|

$118.65(3)(4)

|

|

|

|

|

|

|

|

|

(1)

|

Consists

of up to 75,000,000 shares of common stock to be sold to White Lion

Capital, LLC under the Purchase Agreement dated May 28,

2021.

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the

registration fee in accordance with Rule 457(c) under the

Securities Act of 1933 ("the Securities Act") based on the average

of the 5-day average of the high and low prices of the common stock

on June 21, 2021 as reported on the OTCQB.

|

|

|

(3)

|

Based

on the average price per share of $0.0145 for TPT Global Tech,

Inc.’s common stock on June 21, 2021 as reported by the OTC

Markets Group. The fee is calculated by multiplying the aggregate

offering amount by .0001091, pursuant to Section 6(b) of the

Securities Act of 1933.

|

|

|

(4)

|

Previously

paid.

|

The

Registrant hereby amends this registration statement on such date

or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such

date as the Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY NOTE

References throughout this Amendment No. 1 to “we,”

“us,” the “Company” or “our

company” are to TPT Global Tech, Inc., unless the context

otherwise indicates.

This Amendment No. 1 (“Amendment No. 1”) to Form S-1 is

filed solely for the purpose of amending the Signature page to the

Registration Statement on Form S-1 (Registration Statement No.

333-257551) filed by TPT Global Tech, Inc. with the Securities and

Exchange Commission (the “Registration Statement”). The

Amendment No. 1 consists of this explanatory note as well as the

revised versions of the cover page and Part II of the Registration

Statement. It does not contain a copy of the preliminary prospectus

included in the Registration Statement, nor is it intended to amend

or delete any part of the preliminary prospectus.

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

We have

expended, or estimate to expend fees in relation to this

registration statement as detailed below:

|

Expenditure

Item

|

|

|

Attorney

Fees

|

$2,000

|

|

Audit

Fees

|

$4,000

|

|

Transfer Agent

Fees

|

$1,000

|

|

SEC Registration

and Blue Sky Registration fees (estimated)

|

$3000

|

|

Printing Costs and

Miscellaneous Expenses (estimated)

|

$4,000

|

|

Total

|

$14,000

|

INDEMNIFICATION OF

DIRECTORS AND OFFICERS

Our

officers and directors are indemnified as provided by the Florida

Revised Statutes and the bylaws.

Under

the Florida Revised Statutes, director immunity from liability to a

company or its shareholders for monetary liabilities applies

automatically unless it is specifically limited by a company's

Articles of Incorporation. Our Articles of Incorporation do not

specifically limit the directors’ immunity. Excepted from

that immunity are: (a) a willful failure to deal fairly with us or

our shareholders in connection with a matter in which the director

has a material conflict of interest; (b) a violation of criminal

law, unless the director had reasonable cause to believe that his

or her conduct was lawful or no reasonable cause to believe that

his or her conduct was unlawful; (c) a transaction from which the

director derived an improper personal profit; and (d) willful

misconduct.

Our

bylaws provide that it will indemnify the directors to the fullest

extent not prohibited by Florida law; provided, however, that we

may modify the extent of such indemnification by individual

contracts with the directors and officers; and, provided, further,

that we shall not be required to indemnify any director or officer

in connection with any proceeding, or part thereof, initiated by

such person unless such indemnification: (a) is expressly required

to be made by law, (b) the proceeding was authorized by the board

of directors, (c) is provided by us, in sole discretion, pursuant

to the powers vested under Florida law or (d) is required to be

made pursuant to the bylaws.

Our

bylaws provide that it will advance to any person who was or is a

party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil,

criminal, administrative or investigative, by reason of the fact

that he is or was a director or officer of us, or is or was serving

at the request of us as a director or executive officer of another

company, partnership, joint venture, trust or other enterprise,

prior to the final disposition of the proceeding, promptly

following request therefore, all expenses incurred by any director

or officer in connection with such proceeding upon receipt of an

undertaking by or on behalf of such person to repay said amounts if

it should be determined ultimately that such person is not entitled

to be indemnified under the bylaws or otherwise.

Our

bylaws provide that no advance shall be made by us to an officer

except by reason of the fact that such officer is or was our

director in which event this paragraph shall not apply, in any

action, suit or proceeding, whether civil, criminal, administrative

or investigative, if a determination is reasonably and promptly

made: (a) by the board of directors by a majority vote of a quorum

consisting of directors who were not parties to the proceeding, or

(b) if such quorum is not obtainable, or, even if obtainable, a

quorum of disinterested directors so directs, by independent legal

counsel in a written opinion, that the facts known to the

decision-making party at the time such determination is made

demonstrate clearly and convincingly that such person acted in bad

faith or in a manner that such person did not believe to be in or

not opposed to the best interests of us.

RECENT SALES OF UNREGISTERED SECURITIES

None

EXHIBIT INDEX

|

|

|

Incorporated by Reference

|

|

Exhibit Number

|

Exhibit Description

|

Form

|

Exhibit

|

Filing

Date/Period

End Date

|

|

3.1

|

|

S-1

|

3.1

|

12/15/17

|

|

3.2

|

|

S-1

|

3.2

|

12/15/17

|

|

3.3

|

|

S-1

|

3.3

|

12/15/17

|

|

3.4

|

|

S-1

|

3.4

|

12/15/17

|

|

3.5

|

|

S-1

|

3.5

|

12/15/17

|

|

3.6

|

|

S-1

|

3.6

|

12/15/17

|

|

3.7

|

|

S-1

|

3.7

|

12/15/17

|

|

3.8

|

|

S-1

|

3.8

|

12/15/17

|

|

3.9

|

|

S-1

|

3.9

|

12/15/17

|

|

3.10

|

|

S-1

|

3.10

|

12/15/17

|

|

3.11

|

|

S-1

|

3.11

|

12/15/17

|

|

3.12

|

|

S-1

|

3.12

|

12/15/17

|

|

3.13

|

|

S-1

|

3.13

|

12/15/17

|

|

3.14

|

|

S-1

|

3.14

|

12/15/17

|

|

3.15

|

|

S-1

|

3.15

|

12/15/17

|

|

3.16

|

|

S-1

|

3.16

|

12/15/17

|

|

3.17

|

|

S-1

|

3.17

|

12/15/17

|

|

3.18

|

|

S-1

|

3.18

|

12/15/17

|

|

3.19

|

|

S-1

|

3.19

|

12/15/17

|

|

3.20

|

|

S-1

|

3.20

|

12/15/17

|

|

3.21

|

|

S-1

|

3.21

|

12/15/17

|

|

3.22

|

|

1-A

|

3.22

|

7/2/20

|

|

3.23

|

|

1-A

|

3.23

|

7/2/20

|

|

3.24

|

|

1-A

|

3.24

|

7/2/20

|

|

3.25

|

|

1-A/A

|

3.25

|

8/28/20

|

|

3.26

|

|

1-A/A

|

3.26

|

8/28/20

|

|

3.27

|

|

1-A/A

|

3.27

|

8/28/20

|

EXHIBIT INDEX

|

|

|

Incorporated by Reference

|

|

Exhibit Number

|

Exhibit Description

|

Form

|

Exhibit

|

Filing

Date/Period

End Date

|

|

3.28

|

|

1-A/A

|

3.28

|

8/28/20

|

|

3.29

|

|

1-A/A

|

3.29

|

8/28/20

|

|

3.30

|

|

1-A/A

|

3.30

|

8/28/20

|

|

3.31

|

|

1-A/A

|

3.31

|

8/28/20

|

|

4.1

|

|

S-1

|

4.1

|

12/15/17

|

|

4.2

|

|

S-1

|

4.2

|

12/15/17

|

|

4.3

|

|

S-1

|

4.3

|

12/15/17

|

|

4.4

|

|

S-1

|

4.4

|

12/15/17

|

|

4.5

|

|

S-1

|

4.5

|

12/15/17

|

|

4.6

|

|

S-1

|

4.6

|

12/15/17

|

|

4.7

|

|

S-1/A

|

4.7

|

2/23/18

|

|

4.8

|

|

S-1/A

|

4.8

|

2/23/18

|

|

4.9

|

|

S-1/A

|

4.9

|

10/2/18

|

|

4.10

|

|

S-1/A

|

4.10

|

10/2/18

|

|

4.11

|

|

S-1/A

|

4.11

|

10/2/18

|

|

4.12

|

|

8-K

|

|

3/10/20

|

|

4.13

|

|

1-A

|

4.13

|

7/2/20

|

|

5.1

|

Opinion

re: Legality

|

|

|

|

|

10.1

|

|

S-1

|

10.1

|

12/15/17

|

|

10.2

|

|

S-1

|

10.2

|

12/15/17

|

|

10.3

|

|

S-1

|

10.3

|

12/15/17

|

|

10.4

|

|

S-1

|

10.4

|

12/15/17

|

|

10.5

|

|

S-1

|

10.5

|

12/15/17

|

|

10.6

|

|

S-1

|

10.6

|

12/15/17

|

|

10.7

|

|

S-1

|

10.7

|

12/15/17

|

|

10.8

|

|

S-1

|

10.8

|

12/15/17

|

EXHIBIT INDEX

|

|

|

Incorporated by Reference

|

|

Exhibit Number

|

Exhibit Description

|

Form

|

Exhibit

|

Filing

Date/Period

End Date

|

|

10.9

|

|

S-1

|

10.9

|

12/15/17

|

|

10.10

|

|

S-1

|

10.10

|

12/15/17

|

|

10.11

|

|

S-1

|

10.11

|

12/15/17

|

|

10.12

|

|

S-1

|

10.12

|

12/15/17

|

|

10.13

|

|

S-1

|

10.13

|

12/15/17

|

|

10.14

|

|

S-1

|

10.14

|

12/15/17

|

|

10.15

|

|

S-1/A

|

10.15

|

2/23/18

|

|

10.16

|

|

S-1/A

|

10.16

|

2/23/18

|

|

10.17

|

|

S-1/A

|

10.17

|

10/2/18

|

|

10.18

|

|

S-1/A

|

10.18

|

10/2/18

|

|

10.19

|

|

S-1/A

|

10.19

|

10/2/18

|

|

10.20

|

|

S-1/A

|

10.20

|

10/2/18

|

|

10.21

|

|

S-1/A

|

10.21

|

10/2/18

|

|

10.22

|

|

S-1/A

|

10.22

|

10/2/18

|

|

10.23

|

|

S-1/A

|

10.23

|

11/5/18

|

|

10.24

|

|

S-1/A

|

10.24

|

11/5/18

|

|

10.25

|

|

8-K

|

10.1

|

3/22/19

|

|

10.26

|

|

8-K

|

10.1

|

3/27/19

|

|

10.27

|

|

8-K

|

10.2

|

3/27/19

|

|

10.28

|

|

8-K

|

10.3

|

3/27/19

|

|

10.29

|

|

8-K

|

10.1

|

4/8/19

|

|

10.30

|

|

8-K

|

10.1

|

3/3/20

|

|

10.31

|

|

8-K

|

10.1

|

3/19/20

|

|

10.32

|

|

8-K

|

10.1

|

6/10/20

|

|

10.33

|

|

1-A/A

|

6.33

|

8/28/20

|

|

10.34

|

|

1-A/A

|

6.34

|

8/28/20

|

EXHIBIT INDEX

|

|

|

Incorporated by Reference

|

|

Exhibit Number

|

Exhibit Description

|

Form

|

Exhibit

|

Filing

Date/Period

End Date

|

|

10.35

|

|

1-A/A

|

6.35

|

8/28/20

|

|

10.36

|

|

8-K

|

10.1

|

8/17/20

|

|

10.37

|

|

8-K

|

10.1

|

9/9/20

|

|

10.38

|

|

8-K

|

10.2

|

9/9/20

|

|

10.39

|

|

8-K

|

|

9/10/20

|

|

10.40

|

|

S-1

|

10.40

|

10/28/20

|

|

10.41

|

|

S-1

|

10.41

|

10/28/20

|

|

10.42

|

|

S-1

|

10.42

|

10/28/20

|

|

10.43

|

|

S-1

|

10.43

|

10/28/20

|

|

10.44

|

|

S-1/A

|

10.44

|

1/15/21

|

|

10.45

|

|

S-1/A

|

10.45

|

1/15/21

|

|

10.46

|

|

S-1/A

|

10.46

|

1/15/21

|

|

10.47

|

|

S-1

|

10.47

|

6/30/21

|

|

10.48

|

|

S-1

|

10.48

|

6/30/21

|

|

|

|

|

|

|

|

21.1

|

|

S-1

|

21.1

|

6/30/21

|

|

23.1

|

|

S-1

|

23.1

|

6/30/21

|

|

23.2

|

|

S-1

|

23.2

|

6/30/21

|

|

99.1

|

|

S-1

|

99.1

|

12/15/17

|

|

99.2

|

|

S-1

|

99.2

|

12/15/17

|

UNDERTAKINGS

The undersigned registrant hereby undertakes

1. To file, during any period in which offers or sales are being

made, a post-effective amendment to this registration

statement:

i.

To include any Prospectus required by section 10(a)(3) of the

Securities Act of 1933;

ii.

To reflect in the Prospectus any facts or events arising after the

effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the

total dollar value of securities offered would not exceed that

which was registered) and any deviation from the low or high end of

the estimated maximum offering range may be reflected in the form

of Prospectus filed with the Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more

than 20% change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the

effective registration statement. iii. To include any material

information with respect to the plan of distribution not previously

disclosed in the registration statement or any material change to

such information in the registration statement;

2. That, for the purpose of determining any liability under the

Securities Act of 1933, each such post-effective amendment shall be

deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering

thereof.

3. To remove from registration by means of a post-effective

amendment any of the securities being registered which remain

unsold at the termination of the offering.

4. That, for the purpose of determining liability of the registrant

under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities: The undersigned registrant

undertakes that in a primary offering of securities of the

undersigned registrant pursuant to this registration statement,

regardless of the underwriting method used to sell the securities

to the purchaser, if the securities are offered or sold to such

purchaser by means of any of the following communications, the

undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such

purchaser:

i.

Any Preliminary Prospectus or Prospectus of the undersigned

registrant relating to the offering required to be filed pursuant

to Rule 424;

ii.

Any free writing Prospectus relating to the offering prepared by or

on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

iii.

The portion of any other free writing Prospectus relating to the

offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the

undersigned registrant; and

iv.

Any other communication that is an offer in the offering made by

the undersigned registrant to the purchaser.

5. That, for the purpose of determining liability under the

Securities Act of 1933 to any purchaser: Each Prospectus filed

pursuant to Rule 424(b) as part of a registration statement

relating to an offering, other than registration statements relying

on Rule 430B or other than Prospectuses filed in reliance on Rule

430A, shall be deemed to be part of and included in the

registration statement as of the date it is first used after

effectiveness. Provided, however, that no statement made in a

registration statement or Prospectus that is part of the

registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or

Prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such first use,

supersede or modify any statement that was made in the registration

statement or Prospectus that was part of the registration statement

or made in any such document immediately prior to such date of

first use.

Insofar as indemnification for liabilities arising under the

Securities Act of 1933 may be permitted to our directors, officers

and controlling persons, we have been advised that in the opinion

of the Securities and Exchange Commission, such indemnification is

against public policy as expressed in the Securities Act of 1933

and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by

us of expenses incurred or paid by a director, officer or

controlling person of the corporation in the successful defense of

any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities

being registered, we will, unless in the opinion of our counsel the

matter has been settled by a controlling precedent, submit to a

court of appropriate jurisdiction the question of whether such

indemnification by us is against public policy as expressed in the

Securities Act of 1933, as amended, and will be governed by the

final adjudication of such case.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant

has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized on July 6,

2021.

TPT GLOBAL TECH, INC.

|

/s/

Stephen J. Thomas, III

|

|

July 6,

2021

|

|

Stephen

J. Thomas, III

|

|

|

|

(Chief

Executive Officer, Chairman of the Board and Principal Executive

Officer)

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Gary Cook

|

|

July 6, 2021

|

|

Gary

Cook

|

|

|

|

(Chief

Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

|

In

accordance with the requirements of the Securities Act of 1933,

this Registration Statement has been signed by the following

persons in the capacities and on the dates stated.

|

/s/

Stephen J. Thomas, III

|

|

July 6, 2021

|

|

Stephen

J. Thomas, III, President, Director, Chief Executive

Officer

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Gary Cook

|

|

July 6, 2021

|

|

Gary Cook, Chief

Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Richard Eberhardt

|

|

July 6, 2021

|

|

Richard

Eberhardt, Director

|

|

|

|

|

|

|

|

/s/

Arkady Shkolnik

|

|

July 6, 2021

|

|

Arkady

Shkolnik, Director

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Reginald Thomas

|

|

July 6, 2021

|

|

Reginald

Thomas, Director

|

|

|

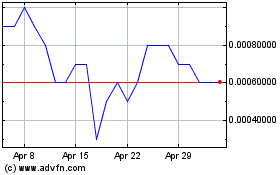

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Apr 2023 to Apr 2024