Current Report Filing (8-k)

September 10 2021 - 7:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 3, 2021

|

THC Therapeutics, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-55994

|

|

26-0164981

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

11700 W Charleston Blvd. #73

Las Vegas, Nevada

|

|

89135

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(833)-420-8428

(Registrant’s telephone number, including area code)

Not applicable

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Precommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Precommencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreement.

On September 3, 2021, THC Therapeutics, Inc. (the “Company”) and Shefford Capital Partners, LLC, a Delaware limited liability company (the “Investor”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) pursuant to which (i) the Investor agreed to purchase from the Company $25,000,000 of the Company’s restricted common stock (the “Stock”) at future closings during a three-year term, and (ii) the Investor agreed to arrange a $25,000,000 traditional debt facility for the Company to position the Company with a 1:1 debt-to-equity ratio.

The proceeds of each closing can only be used to acquire businesses in or related to the marijuana and psychedelic industries, or other modern healthcare-related industries, and the Investor is required to approve each acquisition (each an “Acquisition”). The purchase price for the common stock at each closing will be closing price of the Company’s common stock on the date immediately preceding the earlier of the closing of each Acquisition, or the announcement of that Acquisition.

The obligation of the Investor to purchase Stock pursuant to the Purchase Agreement is subject to several conditions, including (i) that the Company shall have delivered a draw-down notice to the Investor, (ii) that the Investor shall have approved the Acquisition in connection with a closing, (iii) that the representations and warranties in the Purchase Agreement shall be true and correct in all material respects, (iv) that no event shall have occurred which could reasonably be expected to have a material adverse effect on the Company, (v) that the Company’s common stock shall continue to be quoted on the OTC Link ATS (or a replacement quotation system), and (iv) that trading in the Company’s common stock shall not have been suspended.

The foregoing description of the Purchase Agreement is qualified in its entirety by the full text of the Purchase Agreement, which is filed as Exhibit 10.1 to, and incorporated by reference in, this report.

Item 3.02 Unregistered Sales of Equity Securities.

The information in Item 1.01 above is incorporated by reference into this Item 3.02. The Company will be selling the Stock to the Investor in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder, as there has been and will be no general solicitation in connection with the offering to the Investor, the Investor is an accredited investor, and the transaction will not involve a public offering.

Item 9.01 Financial Statements and Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

* Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THC Therapeutics, Inc.

|

|

|

|

|

|

|

|

Dated: September 9, 2021

|

By:

|

/s/ Brandon Romanek

|

|

|

|

|

Brandon Romanek

|

|

|

|

|

Chief Executive Officer

|

|

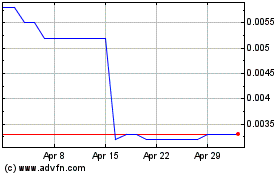

THC Therapeutics (CE) (USOTC:THCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

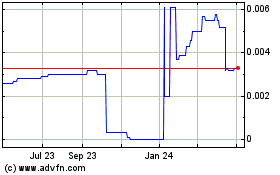

THC Therapeutics (CE) (USOTC:THCT)

Historical Stock Chart

From Apr 2023 to Apr 2024