By Shan Li and Anthony Shevlin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 7, 2019).

BEIJING -- Tencent Holdings Ltd. is negotiating to buy 10% of

Universal Music Group, the world's largest music company, from

Vivendi SA for about EUR3 billion ($3.36 billion) -- a deal that

would strengthen the Chinese internet giant's growing clout in the

global record industry.

The investment, if consummated, also gives Tencent an option to

double its stake. A deal would give it a seat at one of the world's

music giants. Los Angeles-based Universal has signed blockbuster

artists like Ariana Grande, Drake and Billie Eilish. Its stable

also includes classic acts like Queen and the Beatles.

It would also tighten Tencent's dominance of the music industry

in China, where consumers have quickly adopted streaming platforms

and shown increasing willingness to pay for music.

Tencent Music Entertainment Group, the tech giant's

music-streaming business, went public in December in one of the

biggest U.S.-listed debuts in recent years. Tencent Music operates

several popular apps, including QQ Music and an online karaoke

platform.

Tencent wants to be seen as "the leading music platform in

China," said Shawn Yang, managing director of research firm Blue

Lotus Capital Advisors.

Vivendi last year said it was considering selling up to 50% of

Universal, but ruled out an initial public offering, seeking to

cash in on a resurgent music industry. The talks with Tencent

represent a less ambitious step -- at least initially. The

potential deal values all of Universal at EUR30 billion.

Under the terms of the deal, announced Tuesday by the French

media company, the Chinese internet giant would have a one-year

option to acquire an additional 10% stake in Universal at the same

terms.

"Vivendi is eager to explore enhanced cooperation which could

help UMG capture growth opportunities offered by the digitization

and the opening of new markets," the company said. It added that it

hoped the deal would improve the promotion of Universal's

artists.

Vivendi's investors welcomed the move, with shares up 7% in

trading in Paris, despite analysts at Citi saying the valuation was

below their expectations.

"While there is no doubt the implied equity value is above what

is currently implied by the market price -- around EUR25 billion --

it is also below the top end of the range," Citi said. It added

that bulls were expecting a valuation between EUR30 billion and

EUR40 billion.

As for Tencent, Citi said having a stake in one of the three big

music labels will offer it strategic insights on how the industry

could develop.

Aside from boosting Tencent's position in China's online music

world, a stake in Universal helps the Chinese company block rival

Bytedance Inc. from music licensing deals, some analysts said.

Bytedance's wildly popular short video apps TikTok and Douyin

have challenged Tencent's dominant social networking app WeChat for

advertising revenue and user time. TikTok and Douyin allow users to

add snippets of music to their videos -- a process that depends on

licenses from Universal and other major music companies.

"If there is anything that can create pressure on TikTok, it's

music," said Blue Lotus's Mr. Yang. "It still relies heavily on

music copyright."

Tencent has amassed stakes in hundreds of companies in recent

years, from fresh startups to publicly listed technology firms. The

company has taken high-profile stakes in overseas companies

including Spotify Technology SA, Tesla and Epic Games, creator of

the hit videogame "Fortnite." In 2016, Tencent and its partners

paid $8.6 billion for a majority stake in Supercell Oy, the Finnish

game maker behind "Clash of Clans."

But the company has reined in its overseas deal-making this year

as economic growth has slowed at home and potential investments

face greater regulatory scrutiny in the U.S. amid escalating trade

tensions, analysts said.

The transaction is subject to due diligence and Vivendi said it

plans to continue seeking other potential buyers for an additional

minority stake in Universal.

Tencent's interest in Universal shows how the music industry is

turning the page on an era of technological disruption that once

bedeviled it.

Universal now benefits from subscription-based streaming

services like Spotify and Apple Inc.'s Apple Music, which have

emerged as revenue growth drivers. Their growth is outpacing

declines in physical music sales and digital downloads.

Universal and its rivals -- Warner Music Group Corp. and Sony

Corp.'s Sony Music Entertainment -- rake in royalty payments

whenever listeners access their songs through the streaming

services. Last year, Spotify sold shares to the public via direct

listing in April that illustrated a rekindling of investor interest

in the music business

Against this backdrop, Universal has become a bright spot for

Vivendi. The company last month said its first-half net profit more

than tripled, boosted by the growth of its music business.

Write to Shan Li at shan.li@wsj.com

(END) Dow Jones Newswires

August 07, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

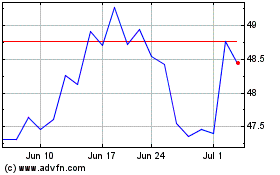

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

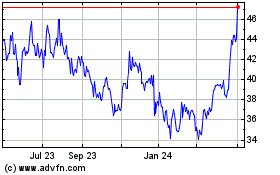

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024