Current Report Filing (8-k)

March 30 2022 - 8:31AM

Edgar (US Regulatory)

0001737372

false

0001737372

2022-03-24

2022-03-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 24, 2022

SYSOREX, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-55924 |

|

68-0319458 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

13880 Dulles Corner Lane

Suite 120

Herndon, Virginia |

|

20171 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 800-929-3871

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

On March 24, 2022, Sysorex, Inc. (“Company”)

executed Heads of Terms (“Heads of Terms”) with Ostendo Technologies, Inc.

(“Ostendo”) which includes certain binding and non-binding provisions. Pursuant

to the Heads of Terms, the Company and Ostendo agreed to certain terms related to the Company’s sale of approximately 75% of its

Ethereum mining assets and certain associated real property (“Assets”) to

Ostendo for $68,400,000 of Ostendo preferred stock (“Purchase Price”). The

Assets to be sold will not include the Company’s Ether funds generated prior to and held at Closing (as hereinafter defined) and

any graphics processing units or associated assets maintained and operated by the Company at a co-located facility in North Carolina.

The definitive terms of the sale of Assets will be set forth in definitive transaction agreements (the “Definitive

Documentation”) to be executed by the parties.

The Purchase Price shall be comprised of the issuance

to the Company of 7,125,000 fully paid, non-assessable shares of Ostendo preferred stock valued at $68,400,000 (“Shares”).

The Shares shall be of a newly created series of preferred stock. The Shares shall not be transferable by the Company and may not be distributed

by dividend or otherwise by the Company until such time as the earlier of the following shall occur: (i) Ostendo completes an underwritten

initial public offering of its common stock pursuant to a registration statement under the Securities Act of 1933, as amended, or similar

law of a foreign jurisdiction, (ii) Ostendo’s outstanding shares of capital stock are exchanged for or otherwise converted into

securities that are publicly listed, pursuant to a transaction governing such exchange or conversion, on a national securities exchange,

including through a merger (including a reverse merger), acquisition, business combination or similar transaction, in one transaction

or series of related transactions, and including a transaction or series of related transactions involving a vehicle commonly known as

a special purpose acquisition company (SPAC) (“Public Listing”), (iii) a “change in control” event with

at least 50% plus 1 share of Ostendo’s issued and outstanding capital stock being sold to an unaffiliated third-party, or (iv) Ostendo

undergoing a liquidity or other event that necessitates the transfer of the Shares (each, a “Transfer Event”). Upon

the occurrence of a Transfer Event, the Company shall have the right to transfer the Shares.

Additionally, pursuant to the Heads of Terms, the Company has agreed to

make a non-refundable deposit of $1,600,000 (“Deposit”) to be credited toward

the purchase of an additional 166,667 shares of Ostendo’s preferred stock, which will be of the same series as the Shares and will

have the same terms (“Purchased Shares”). The Purchased Shares will be issued

to the Company at closing and at the same time the other Shares are issued in accordance with a standard securities purchase agreement.

In the event the sale of the Assets does not occur, Ostendo has agreed to issue the Purchased Shares within five (5) business days of

the parties’ mutual agreement that the Closing will not occur. Failure to issue the Purchased Shares in the subject time frame will

result in a “share delivery failure” and the obligation of Ostendo to immediately refund the full Deposit amount. The Deposit

will not be held in escrow and may be used by Ostendo for working capital.

The Closing of the Asset sale transaction (the “Closing”)

shall occur, subject to the satisfaction or waiver of the Closing conditions set forth in Definitive Documentation no later than May 24,

2022, unless mutually extended in writing by the parties, subject to the parties’ meeting certain Closing conditions to be agreed

upon in the Definitive Documentation. Notwithstanding the foregoing, the Definitive Documentation shall also include an outside date that

is not more than three (3) months after the date of the execution thereof unless mutually extended in writing by the parties to allow

the parties to obtain regulatory approvals, required consents, and shareholders approvals.

The Definitive Documentation will include certain

other terms and conditions which are customary in asset sale and real property sale agreements.

The foregoing description of the Heads of Terms

is qualified in its entirety by reference to the Heads of Terms, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and

incorporated by reference into this Item 8.01.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed as part of this report.

| Exhibit

No. |

|

Description |

| 99.1 |

|

Heads of Terms |

| 104 |

|

Cover Page Interactive

Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: March 30, 2022 |

SYSOREX, INC. |

| |

|

|

| |

By: |

/s/ Wayne Wasserberg |

| |

Name: |

Wayne Wasserberg |

| |

Title: |

Chief Executive Officer |

2

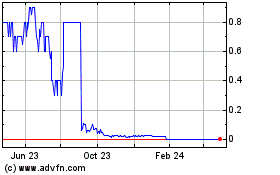

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

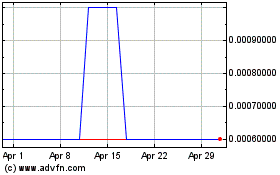

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Apr 2023 to Apr 2024