Current Report Filing (8-k)

January 13 2022 - 5:30PM

Edgar (US Regulatory)

0001737372

false

0001737372

2022-01-07

2022-01-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 7, 2022

SYSOREX, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-55924

|

|

68-0319458

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

13880 Dulles Corner Lane

Suite 175

Herndon, Virginia

|

|

20171

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: 800-929-3871

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol

|

|

Name

of Each Exchange on Which Registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry

into a Material Definitive Agreement.

As previously disclosed on

the Current Report on Form 8-K filed by Sysorex, Inc., a Nevada corporation (the “Company”), with the Securities and Exchange

Commission (“SEC”) on December 20, 2021, a judgment (the “Judgment”) in connection with a Promissory Judgment

Note dated as of August 15, 2018, entered into by and between the Company and Tech Data Corporation (“Tech Data”), has been

entered in favor of Tech Data against the Company for a total sum of $5,942,559.05 (the “Award”).

Following a negotiation with

Tech Data, the Company was able to reduce the Award by in excess of $4.2 million, and on January 13, 2022, the Company and Tech Data

entered into a Settlement and Release Agreement (the “Settlement Agreement”). Pursuant to the Settlement Agreement, the Company

will pay $1,375,000.00 (the “Settlement Amount”) in full within twenty-four (24) hours after the full execution of the Settlement

Agreement, and upon receipt of the Settlement Amount by Tech Data, the Award will be deemed satisfied in full. Among other things, Tech

Data agreed to file an acknowledgment of full satisfaction of judgment attached as an exhibit to the Settlement Agreement, not take any

further action against the Company in connection with or relating to the Judgment, and release the Company and its representatives from

any and all claims, including the Judgment, which Tech Data may have against the Company based upon any transaction that occurred at

any time before the date of the Settlement Agreement.

The foregoing summary of the

material terms of the Settlement Agreement is not complete and is qualified in its entirety by reference to the text of the Settlement

Agreement, a copy of which is filed herewith as Exhibit 10.1, the terms of which are incorporated herein by reference.

Item 2.04 Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As previously disclosed on

the Current Reports on Form 8-K filed by the Company with the SEC on July 12, 2021 and August 19, 2021, the Company entered into a Securities

Purchase Agreement dated as of July 7, 2021 (the “Purchase Agreement”), and certain purchasers thereto, pursuant to which

the Company issued (i) 12.5% Original Issue Discount Senior Secured Convertible Debentures (the “Debentures”), and (ii) warrants

(the “Warrants” and together with the Debentures, the “Securities”) on July 7, 2021, and August 13, 2021.

On January 7, 2022, the Company

received a notice of default (the “Default Notice”) from Joseph Gunnar & Co., LLC, which acted as a placement agent in

connection with the offering of the Securities, stating that the Company defaulted under the Purchase Agreement as a result of: (i) the

Company failing to disclose certain material indebtedness of the Company outstanding as of the date of the Purchase Agreement; and (ii)

the filing of a judgment relating to such material indebtedness. Due to such events of default, (i) the Debentures are now deemed to have

begun bearing interest at the default interest rate of 18% per annum from the date of the issuance of the Debentures; and (ii) the holders

of the Debentures are entitled to receive in satisfaction of the amounts owing under the Debentures an amount equal to 130% of the amounts

owing under the Debentures, in accordance with the terms of the Debentures. In addition, as a result of the events of default, the exercise

price for the Warrant is the lower of: (A) $18.00 and (B) an amount equal to fifty percent (50%) of the average of volume-weighted average

price for the common stock of the Company over the five (5) trading days preceding the date of the delivery of the applicable exercise

notice or (C) the qualified offering price as explained in greater detail in the Purchase Agreement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Date: January 13, 2022

|

SYSOREX, INC.

|

|

|

|

|

|

|

By:

|

/s/ Wayne Wasserberg

|

|

|

Name:

|

Wayne Wasserberg

|

|

|

Title:

|

Chief Executive Officer

|

2

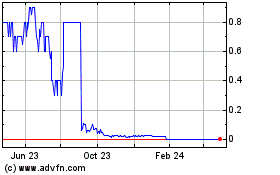

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

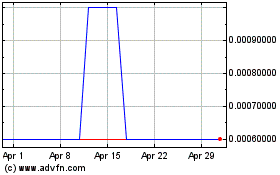

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Apr 2023 to Apr 2024