Swedbank Review Criticizes Ex-CEOs For Anti-Money Laundering Failings -- Update

March 23 2020 - 4:46AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--The law firm hired by Swedbank AB to investigate

potential historical money laundering said Monday that it found the

lender had inadequate systems to manage risk but didn't conclude

that Swedbank engaged in money laundering.

The law firm found payments to customer accounts worth 17.8

billion euros ($19.03 billion) and payments from customer accounts

worth EUR18.9 billion in the bank's Baltic subsidiaries between

2014 and 2019 that represented a high risk for money

laundering.

However, it said it cannot conclude that money laundering

actually took place.

Swedbank came under scrutiny in February last year after a

Swedish TV show reported that billions of dollars of potentially

illicit funds may have passed through the bank's Estonian branch.

In response, it hired law firm Clifford Chance to investigate

customers, transactions and activities from 2007 to March 2019 and

how the bank handled internal and external information

disclosures.

Clifford Chance on Monday presented its findings, saying it had

found a number of shortcomings in Swedbank's anti-money laundering

work.

It said Swedbank Estonia and Swedbank Latvia actively pursued

high-risk customers and Swedbank Estonia accepted certain high-risk

customers who had been customers of another bank in Estonia.

High-risk customers in Baltic banking were also allowed to open

accounts in the bank's other business areas in Sweden.

The bank took on high-risk customers without proper

documentation and some employees kept client information outside of

Swedbank's regular customer databases and repeatedly overlooked

potentially suspicious transactions, Clifford Chance said.

In addition, the law firm said that Swedbank CEOs appeared to

lack an adequate appreciation for the risk posed by the high risk

non-resident business in the Baltics.

It said that former CEO Michael Wolf, who served from 2009

through 2016, failed to focus on anti-money laundering deficiencies

in the Baltics, despite recurring reports and a Swedish FSA report

indicating such deficiencies.

It said Birgitte Bonnesen, the CEO who served from 2016 through

2019, took significant steps to de-risk the non-resident business

in the Baltics and launched internal investigations.

"However, the CEO did not direct sufficient resources,

attention, or urgency to the remediation of the issues identified,

and did not ensure that information regarding these issues was

shared between relevant Swedbank control functions or with the

management," Clifford Chance said.

"Nor did this CEO ensure that the board was adequately educated

or apprised of the significant legal and reputational risk that

these anti-money laundering deficiencies...presented to

Swedbank."

As a result, Swedbank said Monday it had decided to cancel its

severance pay agreement with Ms. Bonnesen but will not make claims

against her.

Finally, the Clifford Chance probe identified a number of

employees whose actions or inaction caused or contributed to the

failures. These employees ranged from senior managers to

relationship managers and have subsequently been fired, the bank

said.

Following early findings from the probe, Swedbank recently

notified the U.S. Treasury Department's Office of Foreign Assets

Control of potential sanctions violations regarding $4.8 million of

transactions.

Last week, the Swedish financial supervisory authority handed

Swedbank a four billion-Swedish kronor ($384.5 million) fine after

finding the lender's Baltic operations had serious deficiencies in

its anti-money laundering measures as well as shortcomings in its

cooperation with the investigation.

The bank said Monday it won't dispute the FSA's decision.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

March 23, 2020 04:31 ET (08:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

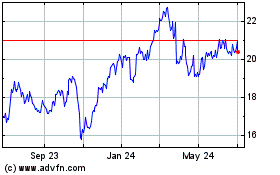

Swedbank A B (PK) (USOTC:SWDBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

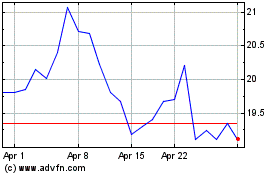

Swedbank A B (PK) (USOTC:SWDBY)

Historical Stock Chart

From Apr 2023 to Apr 2024