UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive Information Statement

|

SUGARMADE, INC.

(Exact name of Registrant as specified in its

Charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

750 Royal Oaks Drive, Monrovia, CA 91016

|

|

(Address of Principal Executive Offices)

|

|

|

|

(626) 961-8619

|

|

(Registrant’s Telephone Number, including area code)

|

|

|

Payment of Filing Fee (Check the appropriate box):

☒ No

fee required

☐ Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

1.

|

|

Title of each class of securities to which transaction applies:

|

|

2.

|

|

Aggregate number of securities to which transaction applies:

|

|

3.

|

|

Per unit price or other underlying value of transaction, computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4.

|

|

Proposed maximum aggregate value of transaction:

|

☐ Fee

paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

1.

|

|

Amount Previously Paid: None

|

|

2.

|

|

Form Schedule or Registration Statement No.: 14C

|

|

3.

|

|

Filing Party: Sugarmade, Inc.

|

|

4.

|

|

Date Filed: May 28, 2020

|

SUGARMADE, INC.

750 Royal Oaks Drive

Monrovia, CA 91016

Phone Number: (888) 982-1628

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT

OF OUR MAJORITY STOCKHOLDERS

To Our Stockholders:

We are writing to advise you that the stockholder

representing approximately 72.83% of our voting stock approved by written consent (the “Written Consent”) on April

21, 2020 the proposal to increase the number of authorized common shares in our Company from 1,990,000,000 to 10,000,000,000 (the

“Common Share Increase”).

On April 21, 2020, our board of directors unanimously

approved the above proposal and to appropriately amend our Third Amended and Restated Certificate of Incorporation to reflect the

change.

PLEASE NOTE THAT THE NUMBER OF VOTES RECEIVED

FROM THE STOCKHOLDERS IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR THIS ACTION UNDER DELAWARE LAW AND NO ADDITIONAL

VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THE ACTIONS.

No action is required by you. The accompanying

Information Statement is being furnished only to inform our stockholders of the action taken by Written Consent described above

before it takes effect in accordance with Rule 14c-2, promulgated under the Securities Exchange Act of 1934, as amended.

THIS IS NOT A NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH IS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A CONSENT OR PROXY

AND YOU ARE REQUESTED NOT

TO SEND US A CONSENT OR PROXY.

The accompanying Information Statement is solely

for information purposes only and does not require or request you to do anything. You are encouraged to carefully read the accompanying

information regarding the Common Share Increase.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY

OF THIS INFORMATION STATEMENT

A copy of this Notice of Action and the accompanying

Information Statement is available to you free of charge at our website: https://sugarmade.com.

May 28, 2020

By Order of the Board of Directors,

/s/ Jimmy Chan

Jimmy Chan

Chairman and Chief Executive Officer

SUGARMADE, INC.

750 ROYAL OAKS DRIVE

MONROVIA, CA 91016

INFORMATION STATEMENT PURSUANT TO SECTION

14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934 AND

REGULATION 14C THEREUNDER

INTRODUCTION

This Information Statement is being provided

to all record and beneficial owners of the common stock, par value $0.001 (the “common stock”) of Sugarmade, Inc.,

a Delaware corporation, which we refer to herein as the “Company,” “we,” “our” or “us.”

The mailing date of this Information Statement

is on or about May 28, 2020. The Information Statement has been filed with the Securities and Exchange Commission (the “SEC”)

and is being furnished, pursuant to Regulation 14C of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), to notify our stockholders of actions we are taking pursuant to Written Consent representing a majority of the voting

power of our common and the preferred stock entitled to vote in lieu of a meeting of stockholders.

On April 21,

2020, the record date for determining the identity of stockholders who are entitled to receive this Information Statement (the

“Record Date”), we had:

|

|

(i)

|

1,002,860,820 shares of common stock issued and outstanding, and

|

|

|

(ii)

|

2,000,000 shares of preferred stock Series A, par value $0.001 per share (the “The Series A preferred stock”), and

|

|

|

(iii)

|

2,541,500 shares of preferred stock Series B, par value $0.001 per share (the “The Series B preferred stock”), issued or outstanding.

|

These

securities constitute the outstanding classes of Sugarmade, Inc.’s voting securities, as follows:

|

|

(i)

|

Each share of common stock entitles the holder thereof to one vote on all matters submitted to stockholders.

|

|

|

(ii)

|

Each share of Series A preferred stock entitles the holder thereof to zero votes on all matters submitted to stockholders.

|

|

|

(iii)

|

Each share of Series B preferred stock entitles the holder thereof to one thousand (1,000) votes on all matters submitted to stockholders.

|

NO

VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS IS SOLICITED IN

CONNECTION

WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU

FOR

A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On April

21, 2020, our board of directors approved the Common Share Increase. No other corporate actions to be taken by Written Consent

were considered.

As of

April 21, 2020, Jimmy Chan (the “Majority Voting Stockholder”) who beneficially holds in the aggregate voting power

equal to 2,519,063,502 shares, or approximately 71.07% of the voting power of our outstanding voting securities, had executed and

delivered to the board of directors a Written Consent approving the action to effect the Common Share Increase. Because the action

was approved by the Written Consent of our Majority Stockholder of our outstanding voting securities, no proxies are being solicited

with this Information Statement. A form of the amendment to our Third Amended and Restated Certificate of Incorporation is attached

hereto.

We are not aware of any substantial interest,

direct or indirect, by security holders or otherwise, that is in opposition to matters of action being taken. In addition, pursuant

to the General Corporation Laws of the State of Delaware (the “DGCL”), the action to be taken by majority Written Consent

in lieu of a special stockholder meeting does not create appraisal or dissenters’ rights.

Our board of directors determined to pursue

stockholder action by majority Written Consent of those shares entitled to vote to reduce the costs and management time required

to hold a special meeting of stockholders and to implement the above action in a timely manner.

Under Section 14(c) of the Exchange Act,

actions taken by Written Consent without a meeting of stockholders cannot become effective until 20 days after the definitive

information statement is mailed to stockholders, or as soon thereafter as is practicable. We are not seeking written consent from

any stockholders other than as set forth above and our other stockholders will not be given an opportunity to vote with respect

to the actions taken. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely

for the purpose of advising stockholders of the actions taken by Written Consent and giving stockholders advance notice of the

actions taken.

FORWARD-LOOKING INFORMATION

This Information Statement contains statements

not purely historical and which may be considered forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, including statements regarding

our expectations, beliefs, future plans and strategies, anticipated events or trends concerning matters that are not historical

facts or that necessarily depend upon future events. In some cases, you can identify forward-looking statements by terms such as

“may,” “will,” “should,” “could,” “would,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,”

and similar expressions. This Information Statement contains, among others, forward-looking statements based upon current expectations

that involve numerous risks and uncertainties, including those described in our quarterly report on Form 10-Q for the most recently

ended quarterly period and in our other public filings.

Investors are cautioned that any such forward-looking

statements are not guarantees of future performance, involve risks and uncertainties and that actual results may differ materially

from those possible results discussed in the forward-looking statements as a result of various factors.

Do not place undue reliance on such forward-looking

statements as they speak only as of the date they are made. Except as required by law, we assume no obligation to publicly update

or revise any forward-looking statement even if experience or future changes make it clear that any projected results expressed

or implied therein will not be realized.

COMMON SHARE INCREASE

Our board of directors and Majority Voting

Stockholder approved on April 21, 2020 an increase to the number of common shares of the corporation from 1,990,000,000 to

10,000,000,000. The effective date of the Common Share Increase will be established by our board, which we anticipate will be on

or about May 25, 2020.

Except as otherwise provided by the DGCL or

our Third Amended and Restated Certificate of Incorporation and subject to the rights of holders of any series of preferred stock,

the voting power of our stockholders is vested in the holders of the common stock and in the holders of Series B preferred stock.

Each share of common stock entitles the holder thereof to one vote for each share held by such holder on all matters voted upon

by our stockholders and each share of the Series B preferred stock entitles the holder thereof to 1,000 votes for each share held

by such holder on all matters voted upon by our stockholder; provided, however, that, except as otherwise required by law, holders

of common stock, as such, shall not be entitled to vote on any amendment to the Third Amended and Restated Certificate of Incorporation

(including any certificate of designation relating to any series of preferred stock) that relates solely to the terms of any outstanding

series of preferred stock if the holders of such affected series are entitled, either separately or together with the holders of

one or more other such series, to vote thereon pursuant to the Third Amended and Restated Certificate of Incorporation (including

any certificate of designation relating to any series of preferred stock) or pursuant to the DGCL. Except as otherwise required

by law or expressly provided in the Third Amended and Restated Certificate of Incorporation, each share of common stock has the

same powers, rights and privileges and ranks equally, shares ratably and is identical in

all respects as to all matters. Subject to the rights of the holders of any preferred stock and to the other provisions of applicable

law and the Third Amended and Restated Certificate of Incorporation, holders of common stock are entitled to receive equally, on

a per share basis, such dividends and other distributions in cash, securities or other property of ours if, as and when declared

thereon by the board of directors from time to time out of our assets or funds legally available therefor. Subject to the rights

of holders of any preferred stock, in the event of any liquidation, dissolution or winding up of the affairs of us, whether voluntary

or involuntary, after payment or provision for payment of our debts and any other payments required by law and amounts payable

upon shares of any preferred stock ranking senior to the shares of common stock upon such dissolution, liquidation or winding up,

if any, the remaining net assets of us shall be distributed to the holders of shares of common stock and the holders of shares

of any other class or series ranking equally with the shares of common stock upon such dissolution, liquidation or winding up,

equally on a per share basis.

Amendment to Third Amended and Restated

Certificate of Incorporation

In connection with the Common Share Increase,

we will file with the State of Delaware an amendment to our Third Amended and Restated Certificate of Incorporation to reflect

the increase in the number of authorized common shares. A form of this amendment is attached hereto. Thus:

Our

current authorized capitalization will change from 1,990,000,000 shares of common stock with a par value of $0.001

to 10,000,000,000 million shares of common stock with a par value of $0.001.

Under the DGCL, we are permitted to take an

action without a meeting of stockholders if we obtain the written consent specifying the action from stockholders holding at least

a majority of the voting power of our common stock. Thus, the Common Share Increase and amendment to our Third Amended and Restated

Certificate of Incorporation was approved on April 21, 2020 as follows:

|

|

(a)

|

the board of directors adopted a resolution setting forth the proposed Common Shares Increase and filing with the State of Delaware an amendment to our Third Amended and Restated Certificate of Incorporation setting forth the actions; and

|

|

|

(b)

|

the proposal was approved by the Written Consent of our Majority Stockholder.

|

The amendment to our Third Amended and Restated

Certificate of Incorporation will reflect the Common Share Increase.

Effect

of the Common Share Increase

The Common

Share Increase will not affect any rights, privileges or obligations with respect to the shares of common stock existing prior

to the Common Share Increase, nor will it increase or decrease our market capitalization, except in the circumstances discussed

in the following paragraph. The number of stockholders will remain unchanged as a result of the Common Share Increase. The par

value of our common stock will remain unchanged.

Interests of Certain Persons in Matters Acted Upon

As of the Record Date, Jimmy Chan, the

Majority Stockholder, and his affiliates beneficially owned approximately 72.83% of the voting rights relative to all matters

put forth to shareholders. Jimmy Chan is the Chief Executive Office of the Company and Chairman of the board of directors.

Jimmy Chan has the right to nominate for election to the board of directors or appoint to fill a vacancy on the board of

directors, as outlined in the Company’s Articles and bylaws.

Security Ownership of Certain Beneficial

Directors, Officers, Owners and Other Beneficial Owners

As of the date of this filing, information

with respect to the securities holdings of (i) our officers and directors, and (ii) all persons which, pursuant to filings with

the SEC and our stock transfer records, we have reason to believe may be deemed the beneficial owner of more than five percent

(5%) of the Common stock.

The securities "beneficially owned"

by an individual are determined in accordance with the definition of "beneficial ownership" set forth in the regulations

promulgated under the Exchange Act and, accordingly, may include securities owned by or for, among others, the spouse and/or minor

children of an individual and any other relative who resides in the same home as such individual, as well as other securities as

to which the individual has or shares voting or investment power or which each person has the right to acquire within 60 days through

the exercise of options or otherwise. Beneficial ownership may be disclaimed as to certain of the securities. The below table has

been prepared based on the number of shares outstanding totaling 1,002,860,820 common shares.

|

Officers and Directors

|

|

Amount and Nature of Beneficial Ownership

|

|

Percentage of Class

Beneficially Owned

|

|

Jimmy Chan

|

|

|

2,519,063,502

|

(1)

|

|

|

71.07

|

%(1)

|

|

Christopher H. Dieterich

|

|

|

0

|

|

|

|

0.0

|

%

|

|

(2 Persons)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Greater than 5% Shareholders

|

|

|

|

|

|

|

|

|

|

Jimmy Chan

|

|

|

2,519,063,502

|

|

|

|

71.07

|

%

|

|

|

(1)

|

Includes 19,063,502 common shares, which yield 19,063,502 votes for all matters put forth to shareholders and 2,500,000 Series B Preferred shares, which vote on all matters put forth to shareholders at a ratio of 1,000 votes for each share of Series B preferred held. Thus, Jimmy Chan’s voting power total 2,519,063,502 common share equivalents consisting of 19,063,502 relative to common shares ownership and 2,500,000,000 votes relative to Jimmy Chan’s Series B preferred ownership.

|

WHERE YOU CAN FIND MORE INFORMATION

The SEC maintains a website that contains reports,

proxy and information statements and other information regarding us and other issuers that file electronically with the SEC at

https://www.sec.gov/edgar.shtml. Our quarterly reports on Form 10-Q and other current reports, as well as any amendments to those

reports, are available free of charge through the SEC’s website.

EFFECTIVE DATE

Pursuant to Rule 14c-2 under the Exchange

Act, the above action to effect the Common Share Increase will not be effective until a date at least twenty (20) days after the

date on which the definitive Information Statement has been mailed to the stockholders. We anticipate that the actions contemplated

hereby will be effected on or about the close of business on June 18, 2020.

PROPOSALS BY SECURITY HOLDERS

No stockholder proposals are included in this Information Statement.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by

reference” into this Information Statement documents we file with the SEC. This means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is an important part of this Information

Statement, and information that we file later with the SEC will automatically update and supersede this information.

Therefore, you should check for reports that

we may have filed with the SEC after the date of this Information Statement. We incorporate by reference the following filings

(except for information therein furnished to the SEC that is not deemed to be “filed” for purposes of the Exchange

Act):

The Company’s Annual Report on Form 10-K;

The Company’s Quarterly Reports on Form 10-Q

for quarterly periods; and

The Company’s other filings with the

SEC, including those on Form 8-K.

You can obtain the documents incorporated by

reference in this Information Statement through the SEC at its website, www.sec.gov or by contacting us at the above reference

address.

Any statement contained in a document incorporated

or deemed to be incorporated by reference in this Information Statement will be deemed modified, superseded or replaced for purposes

of this Information Statement to the extent that a statement contained in this Information Statement or in any subsequently filed

document that also is or is deemed to be incorporated by reference in this Information Statement modifies, supersedes or replaces

such statement.

CONCLUSION

As a matter of regulatory compliance, we are

sending you this Information Statement that describes the purpose and effect of the above actions. Your consent to the above action

is not required and is not being solicited in connection with this action. This Information Statement is intended to provide our

stockholders information required by the rules and regulations of the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR INFORMATIONAL PURPOSES ONLY.

BY ORDER OF THE BOARD OF DIRECTORS

By: /s/ Jimmy Chan

Jimmy Chan

Chief Executive Officer and Chairman

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT

OF AMENDED CERTIFICATE OF INCORPORATION

Sugarmade, Inc.,

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That

at a meeting of the Board of Directors on April 21, 2020, resolutions were duly adopted setting forth a proposed Amendment of the

Third Amended Certificate of Incorporation of said corporation, declaring said Amendment to be advisable and calling for a vote

of the stockholders of said corporation for consideration thereof. The resolution setting forth the proposed Amendment is as follows:

RESOLVED:

That the Third Amended and Restated Certificate of Incorporation of this corporation be amended by changing Article VI, first sentence,

to read in full as follows:

The total

number of shares of stock which the Corporation shall have authority to issue is 2,010,000,000; 10,000,000,000 shares shall be

designated Common Stock, par $0.001 per share and 10,000,000 shares shall be designated as Preferred Stock, par value $0.001 per

share.

SECOND: That

thereafter, pursuant to resolution of its Board of Directors, the written consent of the stockholders in accordance with Section

228 and 242 of the General Corporation Law of the State of Delaware at which signed consent was obtained that contained the necessary

number of shares as required by statute were voted in favor of the Amendment.

THIRD: That

said Amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of

Delaware.

IN WITNESS WHEREOF,

said corporation has caused this certificate to be signed this 18th day of June 2020.

By:____________________________________

Jimmy Chan

President and Chief Executive Officer

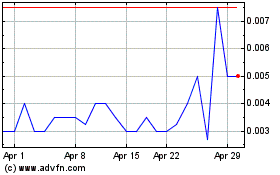

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

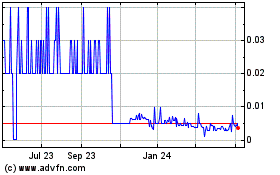

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024