Sugarmade Targets Additional

Acquisitions in Hydroponics Roll-Up Strategy

NEW YORK, NY -- December 3, 2019 -- InvestorsHub NewsWire

-- Sugarmade, Inc. (OTCQB:SGMD) ("Sugarmade", "SGMD", or the

"Company"), a major supplier to the hydroponic cultivation and hemp

sectors, is excited to announce that the

Company continues to pursue an aggressive M&A roll-up

strategy as it positions Sugarmade as the dominant entity in the

hydroponics marketplace. Specifically, the Company is

currently in preliminary talks with six hydroponic and

agricultural supply targets in the US and central Europe.

Management notes that ideal targets should have an EBITDA margin

of at least 8%. The Company prefers to

pay a reasonable multiple to revenue, with 10% in

cash and 90% in stock for potential acquisitions, with precise

terms dependent on market conditions. Sugarmade

closed on its acquisition of BZRTH Inc., a marketer and

manufacturer of hydroponic growth supplies, on October 30,

2019, for roughly 1x revenue,

integrating an annualized $33 million in

revenues and an EBITDA margin of 5%, with revenues

anticipated to continue to grow over coming quarters.

Sugarmade CEO, Jimmy Chan, noted, "We continue to position

Sugarmade as a dominant entity in a market that promises aggressive

growth as margins tighten for larger producers in the hemp and

hemp-related space. The return on investment in this space is

extremely appealing right now, and we believe that will continue to

be the case as we pursue this strategy."

In addition, the Company intends to revive its October

2018 Letter of Intent ("LOI") to pursue the acquisition of Sky

Unlimited (dba Athena United), a supplier of cannabis cultivation

materials in the near term. Sugarmade plans to close

the deal in Q1 2020. Sky Unlimited has annualized revenues of

$33-35 million and EBITDA margin of 11%.

Chan continued, "When we close the Sky

Unlimited acquisition, we expect to have

around $70 million in annualized revenues."

Management notes that this strategy is also predicated on a

planned uplisting to either the New York Stock

Exchange or the Nasdaq before mid-year 2020.

Chan concluded, "The capital market is valuing publicly-traded

hemp ancillary companies at 3x-5x revenue, while most of these

companies are in the red. GrowGeneration [NASDAQ:GRWG] just started trading on

Nasdaq a few days ago with a market cap of $172 million. Our

financial performance is tracking in a very similar profile at a

discount of $160 million. We are targeting shareholder value and

believe we have a strategy in place that offers a tremendous path

forward."

About Sugarmade, Inc.

Sugarmade, Inc. (OTCQB: SGMD) is a product and branding

marketing company investing in operations and technologies with

disruptive potential. The Company is becoming a leading supplier to

the growing hemp industry and is benefitting from the growth of the

hydroponic marketplace. The Company is in the process of acquiring

several leading hydroponic and agricultural supply companies that

are currently producing in excess of $70 million in annual

revenues. Sugarmade is also an investor in fast

growing Hempistry, Inc., a Kentucky-based

cultivator, operates Carryoutsupplies.com a leader provider to

the quick service restaurant industry and Zenhydro.com a

leading supplier in the online hydroponic industry.

FORWARD-LOOKING STATEMENTS: This release contains

"forward-looking statements" within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements also may be included in other

publicly available documents issued by the Company and in oral

statements made by our officers and representatives from time to

time. These forward-looking statements are intended to provide

management's current expectations or plans for our future operating

and financial performance, based on assumptions currently believed

to be valid. They can be identified by the use of words such as

"anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "would," "could," "will" and other words of

similar meaning in connection with a discussion of future operating

or financial performance. Examples of forward

looking statements include, among others, statements relating

to future sales, earnings, cash flows, results of operations, uses

of cash and other measures of financial performance.

Because forward-looking statements relate to the future, they

are subject to inherent risks, uncertainties and other factors that

may cause the Company's actual results and financial condition to

differ materially from those expressed or implied in the

forward-looking statements. Such risks, uncertainties and other

factors include, among others. such as, but not limited to economic

conditions, changes in the laws or regulations, demand for products

and services of the company, the effects of competition and other

factors that could cause actual results to differ materially from

those projected or represented in the forward

looking statements.

Any forward-looking information provided in this release should

be considered with these factors in mind. We assume no obligation

to update any forward-looking statements contained in this

report.

Corporate Contact:

Jimmy Chan

+1-(888)-982-1628

info@Sugarmade.com

Press & Media Inquiries:

EHC Branding Agency

Info@EHCBrandingAgency.Com

(626) MJ-BRAND

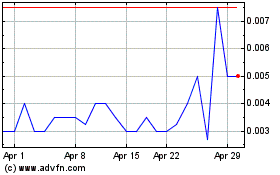

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

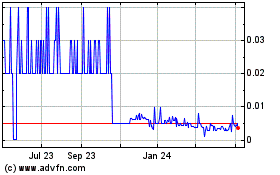

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024