Current Report Filing (8-k)

June 17 2021 - 8:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 11, 2021

SUGARMADE,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

750

Royal Oaks Dr., Suite 108

Monrovia,

CA

|

|

91016

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (888) 982-1628

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement.

On

June 11, 2021 SWC Group, Inc. (“SWC”), a California corporation and

wholly-owned subsidiary of Sugarmade, Inc. (the “Company’’) entered into a Standard Offer, Agreement and Escrow

Instructions for Purchase of Real Estate (Non-Residential) (the “Purchase Agreement”) of same date with Paredes Diana K Tr

/ Shalom Trust (“Seller”), pursuant to which the SWC agreed to purchase an approximately 1,175 square foot property located

at 5058 Valley Blvd., Los Angeles, CA 90032 (the “Real Property”) from Seller, for a total purchase price of $830,000 (the

“Purchase Price”). The Purchase Price is payable $249,000 in a cash down payment for an earnest money deposit, which as has

been deposited in escrow as of the date of this Current Report on Form 8-K. The remaining $581,000 will be paid at the closing of the

Purchase Agreement (the “Closing”), at which time, Real Property will be purchased by SWC from the Seller.

The

Closing of the transaction is subject to certain closing customary closing conditions for a transaction of this type, and is expected

to close fifteen (15) days after the waiver or satisfaction of SWC’s “Buyer Contingencies” set forth in the Purchase

Agreement. Notwithstanding anything to the contrary in the Purchase Agreement, SWC has 30 days from the receipt of all disclosures and

reports set forth in the Purchase Agreement to conduct its due diligence of any such “Buyer Contingencies”, of which SWC

may approve or disapprove at its sole and absolute discretion. If Buyer disapproves any such “Buyer Contingencies”, Seller

shall have ten (10) days to cure such disapproval. If Seller cannot cure such disapproval of the Buyer at the end of this period, then

Buyer may either accept the Real Property as is, or terminate the Agreement, at which point the deposit of $249,000 will be returned

to SWC, minus any applicable fees.

The

description of the Purchase Agreement set forth in this Item 1.01 of this Current Report on Form 8-K is s not complete and is qualified

in its entirety by reference to the terms of the Purchase Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report

on Form 8-K and is incorporated by reference into this Item 1.01.

The

Real Property is being purchased by SWC in connection with the MOU between the Company described in the Company’s Current Report

on Form 8-K filed on June 10, 2021 with the SEC (and filed as Exhibit 10.1 thereto), and is intended to be a location at which a Licensed

Entity (as defined in the MOU) can be established.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statement and Exhibits.

(d)

Exhibits

The

following exhibits are filed or furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

SUGARMADE,

INC.

|

|

|

|

|

|

Date:

June 17, 2021

|

By:

|

/s/

Jimmy Chan

|

|

|

Name:

|

Jimmy

Chan

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer

|

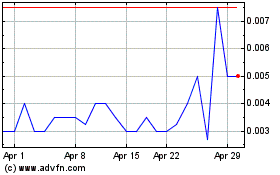

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

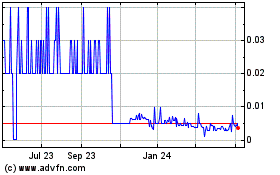

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024