Amendment to Annual Report Pursuant to Regulation a (1-k/a)

June 07 2022 - 6:05AM

Edgar (US Regulatory)

Form 1-K Issuer Information

UNITED STATE

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

1-K: Filer Information

Is filer a shell company?

o

Yes

x

No

Is the electronic copy of an official filing

submitted in

paper

format?

o

Is this filing by a successor company pursuant to

Rule 257(b)(5)

resulting from a merger or other business

combination?

o

Yes

x

No

Is this a LIVE or TEST Filing?

x

LIVE

o

TEST

Would you like a Return Copy?

o

Submission Contact Information

Notify via Filing Website only?

o

1-K: Tab 1 Notification

This Form 1-K is to provide an

x

Annual Report

o

Special Financial Report for the fiscal year

Exact name of issuer as specified in the issuer's

charter

Jurisdiction of Incorporation / Organization

I.R.S. Employer Identification Number

Address of Principal Executive Offices

Title of each class of securities issued pursuant to

Regulation A

1-K: Summary Information Regarding Prior Offering and Proceeds

Summary Information

oThe following information must be provided for any Regulation A

offering that has terminated or completed prior to the filing of

this Form 1-K, unless such information has been previously reported

in a manner permissible under Rule 257. If such information has been

previously reported, check this box and leave the rest of Part I

blank.

Commission File Number of the offering statement

Date of qualification of the offering statement

Date of commencement of the offering

Amount of securities qualified to be sold in the

offering

Amount of securities sold in the offering

The portion of aggregate sales attributable to

securities sold on behalf of the issuer

The portion of the aggregate sales attributable to

securities sold on behalf of selling securityholders

Fees in connection with this offering and names of service

providers.

Underwriters - Name of Service Provider

Underwriters - Fees

Sales Commissions - Name of Service Provider

Sales Commissions - Fee

Finders' Fees - Name of Service Provider

Finders' Fees - Fees

Audit - Name of Service Provider

Audit - Fees

Legal - Name of Service Provider

Legal - Fees

Promoters - Name of Service Provider

Promoters - Fees

Blue Sky Compliance - Name of Service Provider

Blue Sky Compliance - Fees

CRD Number of any broker or dealer listed

Net proceeds to the issuer

Clarification of responses (if necessary)

Certain investors were entitled to bonus shares, effectively paying a lower price per security

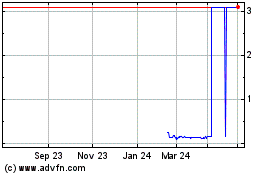

Startengine Crowdfunding (PK) (USOTC:STGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

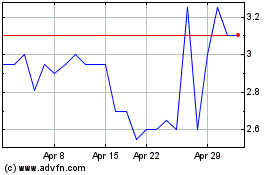

Startengine Crowdfunding (PK) (USOTC:STGC)

Historical Stock Chart

From Apr 2023 to Apr 2024