SSE Reaffirms Fiscal Year 2020 Dividend Guidance, Sees No Material Hit From Coronavirus

March 27 2020 - 4:04AM

Dow Jones News

By Jaime Llinares Taboada

SSE PLC on Friday reaffirmed its dividend guidance for fiscal

2020 and said that it expects adjusted earnings at the lower end of

its previous guided range despite having avoided a material impact

from the coronavirus pandemic so far.

The FTSE 100 energy company said it expects adjusted earnings

per share--one of the company's preferred metrics which excludes

disposed and for-sale assets--at the bottom tier of the 83-88 pence

(99.5-105.5 cents) range for the year ending March 31. This would

be up from 67.1 pence in fiscal 2019.

The group said the pandemic hasn't yet had a material impact on

its performance and therefore it still intends to recommend a

full-year dividend of 80 pence pence per share, down from 97.5

pence a year earlier. However, SSE could reconsider the "timing of

dividend payments" if the coronavirus were to hurt its business, it

said.

The company also estimated capital and investment expenditure

will be slightly above forecasts, at GBP1.5 billion, whereas net

debt and hybrid capita is seen reaching around GBP10.7 billion at

the end of the fiscal year, reflecting project development and

foreign exchange rates.

In addition, SSE expects that adjusted operating profit for its

renewable generation business will rise around 25% in fiscal 2020

due to the contribution of the Beatrice offshore wind farm, while

SSEN Transmission, SSEN Distribution and investment in SGN will be

down at a high single-digit percentage.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

March 27, 2020 03:49 ET (07:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

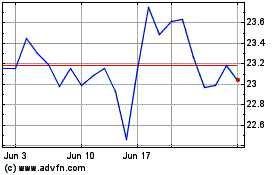

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Apr 2024

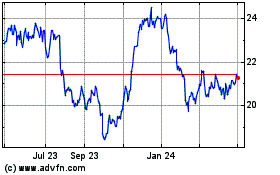

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Apr 2023 to Apr 2024