SSE PLC Fiscal Year 2018 Pretax Profit Fell 39%

May 25 2018 - 3:00AM

Dow Jones News

By Oliver Griffin

SSE PLC (SSE.LN) said Friday that its pretax profit in fiscal

2018 fell 39% but that operational performance was generally very

robust.

The utility company said profit for the year ended March 31 fell

to 1.09 billion pounds ($1.45 billion) from GBP1.78 billion in the

previous fiscal year.

Revenue in financial 2018 rose 8% to GBP31.23 billion, SSE said.

Accounting for exceptional and one-off items, the company said that

its adjusted pretax profit for the year fell 6% to GBP1.45

billion.

The utility company proposed an increase to its final dividend

to 66.3 pence a share from 63.9 pence in the prior year. This takes

the total dividend for fiscal 2018 up 3.7% to 94.7 pence a

share.

SSE, which is planning a demerger of its household energy and

services business in Great Britain, said it was recommending a

total dividend of 97.5 pence a share for fiscal 2019.

However, the company also said it was planning to set the first

post-transaction dividend, in fiscal 2020, at 80 pence a share.

This will reflect the impact of the expected changes on SSE.

From fiscal 2021 onward, the company is targeting annual

dividend increases that keep the pace with retail-price-index

inflation. Over the five years to March 2023, the company said it

expects capital and investment expenditure to total around GBP6

billion.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

May 25, 2018 02:45 ET (06:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

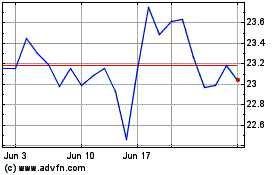

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Aug 2024 to Sep 2024

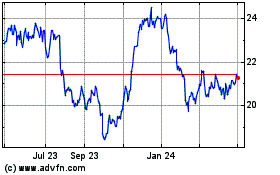

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Sep 2023 to Sep 2024