Current Report Filing (8-k)

October 15 2020 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

October 8, 2020 (October 15, 2020)

Date of Report (Date of earliest event reported)

|

|

|

|

Sonic Foundry, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Maryland

(State or other jurisdiction

of incorporation)

|

|

000-30407

(Commission

File Number)

|

|

39-1783372

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

222 W. Washington Ave

Madison, WI 53703

(Address of principal executive offices)

|

(608) 443-1600

(Registrant's telephone number)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

¨

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

¨

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

¨

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

¨

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Item 1.01 Entry into a Material Definitive Agreement.

On October 8, 2020, the Company entered into an employment agreement with Kelsy Boyd for Ms. Boyd to serve as Chief Financial Officer of the Company. The employment agreement was effective as of June 1, 2020 (the “Effective Date”). Pursuant to such employment agreement, Ms. Boyd receives an annual base salary of $200,000. Ms. Boyd will also receive a bonus of up to $50,000 provided that the Company meets certain metrics to be determined, but which will be primarily based on the Company’s earnings. In addition, pursuant to the employment agreement, Ms. Boyd will also receive an initial stock option grant of options to purchase 40,000 shares of common stock, exercisable at the market price of the common stock on the date of grant, of which options to purchase 10,000 shares will vest six months from the Effective Date, and of which options to purchase 30,000 shares will vest ratably over a three (3) year period. Ms. Boyd is also entitled to incidental benefits of employment under the agreement. The employment agreement further provides that if Ms. Boyd’s employment by the Company is terminated without cause, an amount equal to Ms. Boyd’s base compensation earned over the previous six (6) months, shall be paid through equal bi-weekly installments made over a twelve-month period beginning on the day immediately following the date of Ms. Boyd’s termination of employment (the “Severance Period”). In addition, Ms. Boyd will have the right to voluntarily terminate her employment, and receive the same severance arrangement detailed above following (i) any “person” becoming a “beneficial” owner of stock of the Company representing 50% or more of the total voting power of the Company’s then outstanding stock; or, (ii) is acquired by another entity through the purchase of substantially all of its assets or securities; or (iii) is merged with another entity, consolidated with another entity or reorganized in a manner in which any “person” is or becomes a “beneficial” owner of stock of the surviving entity representing 50% or more of the total voting power of the surviving entity’s then outstanding stock; and, within sixty days of such event, one of the following occurs: a material diminution of Ms. Boyd’s title, authority, status, duties or responsibilities; a reduction

in Ms. Boyd’s salary; a material breach by the Company of the employment agreement, or; the principal office of the Company is relocated to a location which is more than 50 miles outside the Madison metropolitan area. Pursuant to the employment agreement, Ms. Boyd has agreed not to disclose the Company’s confidential information and not to compete against the Company during the term of her employment agreement and for a period of one year thereafter. Such non-compete clause may not be enforceable, or may only be partially enforceable, in state courts of relevant jurisdictions.

The foregoing description of Ms. Boyd’s Employment Agreement is qualified in all respects by reference to the full text of such Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report and incorporated by references in this Item 1.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On October 8, 2020, the Company entered into the Employment Agreement referenced in Item 1.01. Reference is made to Section 1.01 for a description of the Employment Agreement which does not purport to be complete and is subject to, and qualified in its entirety by the full text of the Employment Agreement which is incorporated by reference into this Item 5.02 by reference to Exhibit 10.1 to this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

10.1

|

Employment Agreement dated as of October 8, 2020 by and between Sonic Foundry, Inc. and Kelsy Boyd

|

EXHIBIT LIST

NUMBER DESCRIPTION

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Sonic Foundry, Inc.

(Registrant)

October 15, 2020

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kelsy Boyd

|

|

By:

|

|

Kelsy Boyd

|

|

Title:

|

|

Chief Financial Officer

|

|

|

|

|

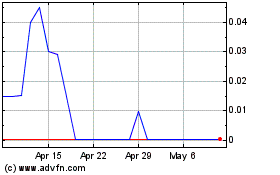

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Apr 2023 to Apr 2024