As filed with the U.S. Securities and Exchange Commission on February 28, 2019

Registration No.

333-

222809

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Post-Effective Amendment No. 1 to

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

SOLARWINDOW TECHNOLOGIES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

3674

|

|

59-3509694

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code number)

|

|

(I.R.S. Employer

Identification No.)

|

|

9375 East Shea Blvd., Suite 107-B

Scottsdale, Arizona 85260

(800) 213-0689

|

|

Corporate Creations Network, Inc.

3260 N. Hayden Road, #210

Scottsdale, Arizona 85251

(480) 993-2162

|

|

(Address and telephone number of principal executive offices)

|

|

(Name, address and telephone number of agent for service)

|

Copy to:

Joseph Sierchio, Esq.

Satterlee Stephens LLP

230 Park Avenue

Suite 1130

New York, New York 10169

Telephone: (212) 818-9200

Facsimile: (212) 818-9606

Approximate date of commencement of proposed sale to the public

: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933 Act, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

|

Large accelerated filer

|

¨

|

Accelerated filer

|

x

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

(Do not check if a smaller reporting company)

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

This filing constitutes a Post-Effective Amendment to the Registration Statement on Form S-1, File No. 333-

222809

, (the “Prior Registration Statement”), which was declared effective on May 11, 2018. The Post-Effective Amendment to the Prior Registration Statement shall hereafter become effective in accordance with Section 8(c) of the Securities Act of 1933 on such date as the Securities and Exchange Commission, acting pursuant to Section 8(c), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No.1 to Form S-1 (this "Post-Effective Amendment") is being filed pursuant to Section 10(a)(3) of the Securities Act to update our registration statement on Form S-1 (Registration No. 333-

222809

) (the "Registration Statement"), which was previously declared effective by the Securities and Exchange Commission on May 11, 2018 to (i) include the consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K, for the fiscal year ended August 31, 2018, (ii) update certain other information in the Registration Statement and to withdraw from registration 1,000,000 shares registered for resale (none of which have been sold) on behalf of one selling stockholder. No additional securities are being registered under this Post-Effective Amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

PROSPECTUS

SUBJECT TO COMPLETION, DATED February 28, 2019

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sales is not permitted.

|

|

PROSPECTUS

1,790,700 SHARES OF COMMON STOCK

|

This prospectus relates to the resale by certain of our stockholders named in the section of this prospectus titled “Selling Stockholders” (collectively, the “

Selling Stockholders

”) of up to 1,790,700 shares (collectively, the “

Shares

”) of our common stock, par value $0.001. The Shares being offered under this prospectus are comprised of:

|

|

(a)

|

969,100 shares of common stock that were purchased by the Selling Stockholders in transactions with us or with our affiliates pursuant to exemptions from the registration requirements of the Securities Act;

|

|

|

|

|

|

|

(b)

|

821,600 shares of common stock issuable upon exercise outstanding Series S Warrants allowing the holders to purchase shares of common stock at an exercise price of $3.42 per share through September 29, 2022.

|

Although we will pay substantially all the expenses incident to the registration of the Shares, we will not receive any proceeds from the sales by the Selling Stockholders. We may however receive proceeds, if any, from the exercise of warrants. The Selling Stockholders and any underwriter, broker-dealer or agent that participates in the sale of the Shares or interests therein may be deemed “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions, profit or other compensation any of them earns on any sale or resale of the shares, directly or indirectly, may be underwriting discounts and commissions under the Securities Act. If the Selling Stockholders is determined to be an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act it will be subject to the prospectus delivery requirements of the Securities Act.

Our common stock is presently quoted for trading under the symbol “

WNDW

” on the OTC Markets Group Inc. Pink Sheets (the “

OTCPINK

”). On February 27, 2019 the closing price of the common stock, as reported on the OTCPINK was $2.16 per share. The Selling Stockholders has advised us that it will sell the shares of common stock registered hereunder from time to time in the open market, on the OTCPINK, in privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or otherwise as described under the section of this prospectus titled “

Plan of Distribution

.”

The purchase of the Shares offered through this prospectus involves a high degree of risk.

Please refer to “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 28, 2019

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus or incorporated by reference herein is accurate only on the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of new information, future events or any other reason.

This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS SUMMARY

This summary highlights certain information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before investing in the securities offered pursuant to this prospectus. You should read the entire prospectus carefully, including the “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, before making an investment decision.

Except where the context otherwise requires and for purposes of this prospectus only, “we,” “us,” “our,” “Company,” “our Company,” and “SolarWindow” refer to SolarWindow Technologies, Inc., a Nevada corporation, and its consolidated subsidiaries.

Our Company

We were incorporated in the State of Nevada on May 5, 1998, under the name “Octillion Corp.” On December 2, 2008, we amended our Articles of Incorporation to effect a change of name to New Energy Technologies, Inc. Effective as of March 9, 2015, we amended our Articles of Incorporation to change our name to SolarWindow Technologies, Inc.

We are exclusively focused on the commercialization, continued development and refinement of, and the marketing of our SolarWindow™ technology including, but not limited to, the development and design of, and the bringing to market of, products derived from our SolarWindow™ technology.

At the time of this filing, our proprietary patent-pending SolarWindow™ see-through (“transparent”) electricity-generating coatings are the subject of over ninety (90) U.S. and international patent and trademark filings.

Our SolarWindow™ technology provides the ability to harvest light energy from the sun and artificial sources and generate electricity from a transparent, coating of organic photovoltaic (“

OPV

”) solar cells, applied to glass and plastics, thereby creating a “photovoltaic” effect. Photovoltaics are best known as a method for generating electric power by using solar cells to convert energy from the sun into a flow of electrons. Typically, conventional PV power is generated by making use of solar modules composed of a number of cells containing PV and electricity-conducting materials. These materials are usually opaque (i.e., not see-through) and only effectively generate electricity with sun light, Our researchers have replaced these materials with compounds that allow our SolarWindow™ technology to remain see-through or “transparent,” while generating electricity when exposed to either sun or artificial light.

We have achieved numerous important milestones and overcome major technical challenges in the development of our SolarWindow™ technology, including the ability to generate electricity on glass while remaining transparent. In early 2017, our SolarWindow™ transparent electricity-generating coatings on glass were successfully processed through the rigorous autoclave system for window glass lamination at a commercial window fabricator. Layered with SolarWindow™ electricity-generating liquid coatings, glass modules were subjected to the extremely high heat and pressure of autoclave equipment located at the fabricator’s facility. Despite the SolarWindow™ modules being subjected to the harsh pressure and temperature conditions, subsequent performance testing confirmed that the modules continued to produce power. This validated that our materials could be used in a fully industrialized window autoclave manufacturing process.

Additionally, we have scaled-up our technology from a single solar cell – only one-quarter the size of a grain of rice – to a working array of solar cells which form a one-foot by one-foot working prototype – our largest-ever SolarWindow™.

To advance the technical development and commercialization of our SolarWindow™ products, we are actively seeking technology and product licensing and joint venture arrangements with additional research institutions, commercial partners, and organizations with established technical competencies, market reach, and mature distribution networks in the solar PV, building-integrated PV, and alternative and renewable energy market industries.

Corporate Information

Our corporate headquarters is located at 9375 East Shea Blvd., Suite 107-B, Scottsdale, Arizona 85260. Our telephone number is (800) 213-0689; our fax number is (240) 554-2316. Our website is www.solarwindow.com. Information contained on our web site (or any other website) does not constitute part of this prospectus.

Risk Factors

Our business operations are subject to numerous risks, including the risk of delays in or discontinuation of our research and product development due to lack of financing, inability to obtain necessary regulatory approvals to market the products, unforeseen safety issues relating to the products and dependence on third party collaborators to conduct research and development of the products. Because we are an early stage company with a limited history of operations, we are also subject to many risks associated with early-stage companies. For a more detailed discussion of some of the risks you should consider, you are urged to carefully review and consider the section entitled “

Risk Factors

” beginning on page 9 of this prospectus.

THE OFFERING

|

Securities Being Registered:

|

|

Up to 1,790,700 shares of common stock, comprised of:

|

|

|

|

|

|

|

|

(a) 969,100 shares of common stock that were purchased by the Selling Stockholders in transactions with us or with our affiliates pursuant to exemptions from the registration requirements of the Securities Act;

|

|

|

|

|

|

|

|

(b) 821,600 shares of common stock issuable upon exercise outstanding Series S Warrants allowing the holders to purchase shares of common stock at an exercise price of $3.42 per share through September 29, 2022.

|

|

|

|

|

|

Offering Price:

|

|

The Selling Stockholders will determine at what price it may sell the offered shares, and such sales may be made at prevailing market prices, or at privately negotiated prices.

|

|

|

|

|

|

Selling Stockholders:

|

|

The Selling Stockholders are existing stockholders who purchased or otherwise acquired shares, or warrants to purchase shares, of our common stock from us in private transactions pursuant to exemptions from the registration requirements of the Securities Act. Please refer to the section titled “

Selling Stockholders

” of this prospectus.

|

|

|

|

|

|

Shares Outstanding Prior to Completion of the Offering:

|

|

As of the date of this prospectus there were 52,959,323 shares of our common stock issued and outstanding.

|

|

|

|

|

|

Shares Outstanding upon Closing of the Offering:

|

|

Assuming all shares registered for resale are sold, including the maximum number of shares issued upon exercise of the Series S Warrants, upon closing of this offering there will be 53,780,923 shares issued and outstanding (without giving effect to the exercise of any outstanding options or warrants).

|

|

|

|

|

|

Authorized Capital Stock:

|

|

Our authorized capital stock consists of stock of 300,000,000 shares of common stock, each with a par value of $0.001, and 1,000,000 shares of preferred stock, each with a par value of $0.10. No preferred shares were issued and outstanding.

|

|

OTCPINK Symbol:

|

|

WNDW

|

|

|

|

|

|

Transfer Agent:

|

|

Worldwide Stock Transfer, LLC, One University Plaza, Suite 505, Hackensack, NJ 07601.

|

|

|

|

|

|

Risk Factors:

|

|

Our business operations are subject to numerous risks, including the risk of delays in or discontinuation of our research and product development due to lack of financing, inability to obtain necessary regulatory approvals to market the products, unforeseen safety issues relating to the products and dependence on third party collaborators to conduct research and development of the products. Because we are an early stage company with a limited history of operations, we are also subject to many risks associated with early-stage companies. For a more detailed discussion of some of the risks you should consider, you are urged to carefully review and consider the section titled “

Risk Factors

” of this prospectus.

|

|

|

|

|

|

Use of Proceeds:

|

|

Although we will pay substantially all the expenses incident to the registration of the Shares, we will not receive any proceeds from the sales by the Selling Stockholders.

|

|

|

|

|

|

Duration of Offering:

|

|

Pursuant to the terms of applicable registration rights agreements between us and the Selling Stockholders (the “

Registration Rights Agreement

”) we agreed to register for resale all of the shares issued to such selling stockholders, including shares issuable upon exercise of warrants purchased by them from us in offerings exempt from the registration requirements of the Securities Act, and to keep the registration statements, of which this prospectus is a part of, until the earlier of: (a) the date such Selling Stockholders securities have been sold in accordance with this prospectus; (b) such securities become eligible for resale without volume or manner-of-sale restrictions and without current public information requirements pursuant to Rule 144, as set forth in a written opinion letter to such effect, addressed, delivered and acceptable to our transfer agent as reasonably determined by us, upon the advice of our counsel; or (c) such securities have otherwise been disposed of by the investor pursuant to an applicable exemption from the registration requirements of the Securities Act.

|

Selected Financial Data

The following tables set forth a summary of certain selected consolidated financial data for the three months ended November 30, 2018 and 2017 and for the fiscal years ended August 31, 2018, 2017 and 2016. This information is derived from our consolidated financial statements. Historical results are not necessarily indicative of the results that may be expected for any future period. The consolidated financial data below should be read in conjunction with “

Management's Discussion and Analysis of Financial Condition and Results of Operations

” and the consolidated financial statements and notes included elsewhere in this prospectus.

|

Statements of Operations Data

|

|

For the Three Months

Ended

November 30,

2018

Unaudited

|

|

|

For the Three Months

Ended

November 30,

2017

Unaudited

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Loss from operations

|

|

$

|

(894,759

|

)

|

|

$

|

(2,259,990

|

)

|

|

Net loss

|

|

$

|

(1,686,916

|

)

|

|

$

|

(2,699,153

|

)

|

|

Basic and diluted net loss per share

|

|

$

|

(0.03

|

)

|

|

$

|

(0.08

|

)

|

|

Weighted average shares outstanding used in basic and diluted net loss per share calculation

|

|

|

52,887,931

|

|

|

|

35,373,077

|

|

|

Statements of Operations Data

|

|

For the Year Ended

August 31,

2018

|

|

|

For the Year Ended

August 31,

2017

|

|

|

For the Year Ended

August 31,

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Loss from operations

|

|

$

|

(5,553,583

|

)

|

|

$

|

(3,729,795

|

)

|

|

$

|

(3,141,365

|

)

|

|

Net loss

|

|

$

|

(6,854,547

|

)

|

|

$

|

(5,353,425

|

)

|

|

$

|

(4,637,313

|

)

|

|

Basic and diluted net loss per share

|

|

$

|

(0.19

|

)

|

|

$

|

(0.17

|

)

|

|

$

|

(0.17

|

)

|

|

Weighted average shares outstanding used in basic and diluted net loss per share calculation

|

|

|

36,020,453

|

|

|

|

31,299,979

|

|

|

|

27,295,540

|

|

|

Balance Sheet Data

|

|

As of

November 30, 2018

(Unaudited)

|

|

|

As of

August 31, 2018

|

|

|

As of

August 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

19,961,808

|

|

|

$

|

696,826

|

|

|

$

|

670,853

|

|

|

Working capital

|

|

$

|

20,026,930

|

|

|

$

|

796,004

|

|

|

$

|

548,571

|

|

|

Total assets

|

|

$

|

20,235,239

|

|

|

$

|

929,234

|

|

|

$

|

831,708

|

|

|

Total liabilities

|

|

$

|

160,828

|

|

|

$

|

4,553,641

|

|

|

$

|

4,463,184

|

|

|

Total Stockholders’ equity (deficit)

|

|

$

|

(20,074,411

|

)

|

|

$

|

(3,624,407

|

)

|

|

$

|

(3,631,476

|

)

|

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before purchasing any of the securities offered hereunder. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected, the trading price of our common stock could decline, and you may lose all or part of your investment. You should acquire the securities offered hereunder only if you can afford to lose your entire investment. You should also refer to the other information contained in this prospectus, including our financial statements and the notes to those statements, and the information set forth under the caption “Forward Looking Statements.” The risks described below and contained in our other periodic reports are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business operations.

Risks Related To Our Business

We have experienced significant losses, have not generated any revenues and expect losses to continue for the foreseeable future.

We have not generated any revenue since inception and do not expect to generate any substantial amounts of revenue for the foreseeable future. We had a net loss of $6,854,547, $5,353,425 and $4,637,313 for our fiscal years ended August 31, 2018, 2017 and 2016, respectively, and we have incurred a cumulative deficit of $45,884,299 from inception (May 5, 1998) through August 31, 2018.

The sale by our stockholders of restricted shares, either pursuant to a resale prospectus or Rule 144, may adversely affect our ability to raise the funds we will require to effectuate our business plan.

As of the date of this prospectus, we had 52,959,323 shares issued and outstanding, of which 31,358,872 are deemed “restricted” or “control” securities within the meaning of Rule 144, as promulgated under the Securities Act (“

Rule 144

”). The possibility that substantial amounts of our common stock may be sold into the public market, either under Rule 144, or pursuant to a resale registration statement, may adversely affect prevailing market prices for the common stock and could impair our ability to raise capital in the future through the sale of equity securities because of the perception that future stock sales could decrease our stock price and because of the availability of resale shares to those interested in investing in our common stock.

We will require additional financing in the future to expand operations into advanced stages of product development and fabrication, and failure to obtain such financing would have a material adverse effect on our business, operating results, financial condition and prospects.

We are currently in the advanced stages of our research and early stages of product development and have come to the point where larger, faster, and more precise equipment is necessary for development to continue and to be able to come to market with a commercially viable product. On November 26, 2018, the Company completed a self-directed offering of equity securities resulting in proceeds of $19,800,000. Based on management’s assessment, the Company had sufficient cash to meet its funding requirements through December of 2021, and possibly beyond to meet product development and fabrication goals.

We have experienced and continue to experience negative cash flows from operations. We expect that we will need to raise substantial additional capital to accomplish our business plan over the next several years. We expect to seek additional funding through private equity or convertible debt. If adequate funds are not available on reasonable terms, or at all, it would result in a material adverse effect our business, operating results, financial condition and prospects. In particular, the Company may be required to delay; reduce the scope of or terminate its research and development programs; sell rights to its SolarWindow™ technology and/or MotionPower™ technology, or other technologies or products based upon these technologies; or license the rights to these technologies or products on terms that are less favorable to us than might otherwise be available.

If adequate funds are not available on reasonable terms or at all, it would result in a material adverse effect on our business, operating results, financial condition and prospects. In particular, we may be required to delay, reduce the scope of or terminate one or more of our research programs, sell rights to our SolarWindow™ technology or other technologies or products based upon such technologies, or license the rights to such technologies or products on terms that are less favorable to us than might otherwise be available. If we raise additional funds by issuing equity or debt securities, further dilution to stockholders may result and new investors could have rights superior to existing stockholders.

Even if financing is available to us, because we cannot currently estimate the amount of funds or time required to commercialize our technologies, we may secure less funding than is actually required to effectuate our business plan.

We are currently in the advanced stages of our research and early stages of product development and have come to the point where larger, faster, and more precise equipment is necessary for development to continue and to be able to come to market with a commercially viable product; however, we cannot accurately predict the amount of funding or the time required to successfully commercialize the SolarWindow™ technology. The actual cost and time required to commercialize these technologies may vary significantly depending on, among other things, the results of our research and product development efforts; the cost of developing, acquiring, or licensing various enabling technologies, changes in the focus and direction of our research and product development programs; competitive and technological advances; the cost of filing, prosecuting, defending and enforcing claims with respect to patents; the regulatory approval process; process manufacturing; marketing and other costs associated with commercialization of these technologies. Because of this uncertainty, even if financing is available to us, we may secure insufficient funding to effectuate our business plan.

Due to the fact that all but one of our five directors conduct outside business activities and are not our employees, attention and efforts will not be focused solely on our business activities which may hinder our achieving our business objectives.

Currently we have five directors, only one of whom is an employee. Mr. John A. Conklin, our President and Chief Executive Officer, does and will continue to provide his full time efforts to our business activities. While our other four directors intend to devote as much time as necessary to the success and development of SolarWindow™ technology, currently each has other business interests or employment obligations requiring their time and attention. While each has generally agreed to provide such time and attention to our business activities as may be reasonably required, and have done so to date, there can be no assurance that their priorities will not shift in the future and that the amount of time that each devotes to our activities will be sufficient for us to meet our business objectives. In the event that their outside interests begin to take precedence over their positions in SolarWindow Technologies, Inc., our business will suffer and we may not achieve our goal of achieving profitability through the commercialization of SolarWindow. In this event, if effective corrective action is not taken, investors could lose all or part of their investment.

The success of our research and development activities is uncertain. If such efforts are not successful, we will be unable to generate revenues from our operations and we may have to cease doing business.

Commercialization of the SolarWindow™ technology will require significant further research, development and testing as we must ascertain whether the SolarWindow™ technology can form the basis for a commercially viable technology or product. If our research and development fails to prove the commercial viability of the SolarWindow™ technology, we may need to abandon our business model and/or cease doing business, in which case our shares may have no value and you may lose your investment. We anticipate we will remain engaged in technology and product development through at least June 2020.

The development of the SolarWindow™ technology is subject to the risks of failure inherent to the development of any novel technology

.

Ultimately, the development and commercialization of the SolarWindow™ technology is subject to a number of risks that are particular to the development and commercialization of any novel technology. These risks include, but are not limited to, the following:

|

|

·

|

our research and development efforts may not produce a commercially viable product;

|

|

|

|

|

|

|

·

|

we may fail to maintain license rights to the SolarWindow™ technology (or any of its derivatives);

|

|

|

|

|

|

|

·

|

we may fail to develop, acquire, market, or license various enabling technologies that may be integral to the commercialization of the SolarWindow™ (or any of its derivatives);

|

|

|

|

|

|

|

·

|

we may fail to integrate or market our process into an industrial setting for the manufacturing of SolarWindow™ Products;

|

|

|

|

|

|

|

·

|

the SolarWindow™ technology (or any of its derivatives) may ultimately prove to be ineffective, unsafe or otherwise fail to receive necessary regulatory approvals;

|

|

|

|

|

|

|

·

|

the SolarWindow™ technology (or any of its derivatives), even if safe and effective, may be difficult to manufacture on a large scale or be uneconomical to market;

|

|

|

|

|

|

|

·

|

our marketing license or proprietary rights to products derived from the SolarWindow™ technology may not be sufficient to protect our products from competitors;

|

|

|

|

|

|

|

·

|

the proprietary rights of third parties may preclude us or our collaborators from making, using or marketing products utilizing the SolarWindow™ technology; or,

|

|

|

|

|

|

|

·

|

third parties may market superior, more effective, or less expensive technologies or products having comparable performance and appearance characteristics to the SolarWindow™ coatings (or any of its derivatives).

|

If we ultimately do not obtain the necessary regulatory approvals for the commercialization of the SolarWindow™ technology, we will not achieve profitable operations and your investment may be lost.

In order to commercialize the SolarWindow™ technology, we may need to obtain regulatory approval from various local, state, federal or international agencies. At this time, we do not have a product to submit for regulatory approval. The process for obtaining such regulatory approvals may be time consuming and costly, and there is no guaranty that we will be able to obtain such approvals. The failure to obtain any necessary regulatory approvals could delay or prevent us from achieving revenue or profitability, which could result in the partial or total loss of your investment.

Our ability to operate profitably is directly related to our ability to develop, protect and perfect rights in and to our proprietary technology.

We rely on a combination of trademark, trade secret, nondisclosure, know-how, copyright and patent law to protect our SolarWindow™ technology, which may afford only limited protection.

We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity, scope or enforceability of our proprietary rights. Any such claims could be time consuming, result in costly litigation, or force us to enter into royalty or license agreements rather than dispute the merits of such claims, requiring us to pay royalties and/or license fees to third parties. There is always a risk that patents, if issued, may be subsequently invalidated, either in whole or in part and this could diminish or extinguish protection for any technology we may license or may adversely affect our ability to fully commercialize our technologies.

We generally require our subsidiaries and our employees, consultants, advisors and collaborators to execute appropriate agreements with us, regarding the confidential information developed or made known to such persons during the course of their engagement by us. These agreements provide that any proprietary technologies developed during such engagement are owned by us and that confidential information pertaining to such technologies will be kept confidential and not disclosed to third parties except in specific circumstances. These agreements also provide for the assignment to us by any such person of any patents issued with respect to any such technologies. If these provisions are breached, we may not be able to fully perfect our rights to the technologies in question, and in some instances, we may not have an appropriate remedy available for the damages that we may incur as a result of any such breach.

Our proprietary rights may not adequately protect our technologies and products.

Our commercial success will depend, in part, on our ability to obtain patents and/or regulatory exclusivity and maintain adequate protection for our technologies and products in the United States and other countries. We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies and products are covered by valid and enforceable patents or are effectively maintained as trade secrets.

We intend to apply for additional patents for our SolarWindow™ technologies and products, as we deem appropriate. We may, however, fail to apply for patents on important technologies or products in a timely fashion, if at all. Our existing patents and any future patents we obtain may not be sufficiently broad to prevent others from practicing our technologies or from developing competing products and technologies. In addition, the patent positions of alternative energy technology companies are highly uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. As a result, the validity and enforceability of our patents cannot be predicted with certainty. In addition, we cannot guarantee that:

|

|

·

|

we were the first to make the inventions covered by each of our issued patents and pending patent applications;

|

|

|

|

|

|

|

·

|

we were the first to file patent applications for these inventions;

|

|

|

|

|

|

|

·

|

others will not independently develop similar or alternative technologies or duplicate any of our technologies;

|

|

|

|

|

|

|

·

|

any of our pending patent applications will result in issued patents;

|

|

|

|

|

|

|

·

|

any of our patents will be valid or enforceable;

|

|

|

|

|

|

|

·

|

any patents issued to us will provide us with any competitive advantages, or will not be challenged by third parties; and

|

|

|

|

|

|

|

·

|

we will develop additional proprietary technologies that are patentable, or the patents of others will not have an adverse effect on our business.

|

The actual protection afforded by a patent varies on a product-by-product basis, from country to country and depends on many factors, including the type of patent, the scope of its coverage, the availability of regulatory related extensions, the availability of legal remedies in a particular country and the validity and enforceability of the patents. Our ability to maintain and solidify our proprietary position for our products will depend on our success in obtaining effective claims and enforcing those claims once granted. Our issued patents and those that may be issued in the future, or those licensed to us, may be challenged, invalidated, unenforceable or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages against competitors with similar products. We also rely on trade secrets to protect some of our technology, especially where it is believed that patent protection is inappropriate or unobtainable. However, trade secrets are difficult to maintain. While we use reasonable efforts to protect our trade secrets, our employees, consultants, contractors or scientific and other advisors may unintentionally or willfully disclose our proprietary information to competitors. Enforcement of claims that a third party has illegally obtained and is using trade secrets is expensive, time consuming and uncertain. In addition, non-U.S. courts are sometimes less willing than U.S. courts to protect trade secrets. If our competitors independently develop equivalent knowledge, methods and know-how, we would not be able to assert our trade secrets against them and our business could be harmed.

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting and defending patents on all of our products in every jurisdiction would be prohibitively expensive. Competitors may use our technologies, to develop their own products, in jurisdictions where we have not obtained patent protection. These products may compete with our products, and may not be covered by any patent claims or other intellectual property rights in the United States or abroad.

The laws of some non-U.S. countries do not protect intellectual property rights to the same extent as the laws of the United States, and many companies have encountered significant problems in protecting and defending such rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents and other intellectual property protection, which could make it difficult for us to stop the infringement of our patents. Proceedings to enforce our patent rights in foreign jurisdictions could result in substantial cost and divert our efforts and attention from other aspects of our business.

If we fail to protect our intellectual property rights, our competitors may take advantage of our ideas and compete directly against us.

Our success will depend, to a significant degree, on our ability to secure and protect intellectual property rights and enforce patent and trademark protections relating to our technology. While we believe that the protection of patents and trademarks is important to our business (and as a result we have over 90 U.S. and International patent and trademark filings), we also rely on a combination of copyright, trade secret, nondisclosure and confidentiality agreements, know-how and continuing technological innovation to maintain our competitive position. From time to time, litigation may be advisable to protect our intellectual property position. However, these legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep any competitive advantage. Any litigation in this regard could be costly, and it is possible that we will not have sufficient resources to fully pursue litigation or to protect our intellectual property rights. This could result in the rejection or invalidation of our existing and future patents. Any adverse outcome in litigation relating to the validity of our patents, or any failure to pursue litigation or otherwise to protect our patent position, could materially harm our business and financial condition. In addition, confidentiality agreements with our employees, consultants, customers, and key vendors may not prevent the unauthorized disclosure or use of our technology. It is possible that these agreements will be breached or that they will not be enforceable in every instance, and that we will not have adequate remedies for any such breach. Enforcement of these agreements may be costly and time consuming. Furthermore, the laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States.

We may be accused of infringing the intellectual property rights of others.

We cannot guarantee that we will not become the subject of infringement claims or legal proceedings by third parties with respect to our current or future technology developments. Any such claims could be time consuming, result in costly litigation and could ultimately lead to a determination that the SolarWindow™ technology, or any of its derivatives, infringe on a third party's patent rights.

If we fail to obtain additional licenses in the future required to maintain our rights to market products developed, if any

,

we may need to curtail or cease operations.

We may not retain all rights to developments, inventions, patents and other proprietary information resulting from any collaborative arrangements, whether in effect as of the date hereof or which may be entered into at some future time with third parties. As a result, we may be required to license such developments, inventions, patents or other proprietary information from such third parties, possibly at significant cost to us. Our failure to obtain and maintain any such licenses could have a material adverse effect on our business, financial condition and results of our operations. In particular, the failure to obtain a license could prevent us from using or commercializing our technology.

Compliance with environmental regulations, or dealing with harmful or hazardous materials involved in our research and development, may require us to divert our limited capital resources.

Our research and product development programs involve the handling of chemicals. These chemicals have the potential to be harmful or hazardous. Accordingly, we may become subject to federal, state and local laws and regulations governing the use, handling, storage and disposal of dangerous and hazardous materials. If violations of environmental, and/or safety & health laws or standards occur, we could be held liable for damages, penalties and costs of remedial actions. These expenses or this liability could have a significant negative impact on our business, financial condition and results of operations. We may violate environmental, and/or safety & health laws or standards in the future as a result of human error, equipment failure or other causes. Environmental, and safety & health laws and standards could become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with violations. We may be subject to potentially conflicting and changing regulatory agendas of political, business and environmental groups. Changes to or restrictions on permitting requirements or processes, harmful or hazardous material storage, or chemical handling might require an unplanned capital investment or relocation of our research or product development programs. Failure to comply with new or existing laws or regulations could harm our business, financial condition and results of operations. We do not have any insurance coverage with respect to damages or liabilities we may incur as a result of these activities.

In seeking to acquire or develop technologies, we are operating in highly competitive markets and our competitors have several competitive advantages over us.

Our commercial success will depend on our ability to compete effectively in product development areas such as, but not limited to, building integration, safety, efficacy, ease of use, customer compliance, price, marketing and distribution. Our competitors may succeed in developing products that are more effective than any products derived from our research and development efforts or that would render such products obsolete and non-competitive. The alternative and renewable energy industry is characterized by intense competition, rapid product development and technological change. Most of the competition that we encounter is expected to come from companies, research institutions and universities who are researching and developing technologies and products similar to, or are competitive with, any technology we may develop.

These companies have several competitive advantages, including:

|

|

·

|

significantly greater name recognition;

|

|

|

|

|

|

|

·

|

established relations with customers;

|

|

|

|

|

|

|

·

|

established distribution networks;

|

|

|

|

|

|

|

·

|

more advanced technologies and product development;

|

|

|

|

|

|

|

·

|

additional lines of products, and the ability to offer rebates, higher discounts or incentives to gain a competitive advantage;

|

|

|

|

|

|

|

·

|

greater experience in conducting research and development, manufacturing, obtaining regulatory approval for products, and marketing approved products;

|

|

|

|

|

|

|

·

|

significantly greater financial and human resources (HR) for product development, sales and marketing, and

|

|

|

|

|

|

|

·

|

the ability to endure potentially prolonged patent litigation.

|

As a result, we may not be able to compete effectively against these companies or their products.

Any products developed from our SolarWindow™ technology will face competition from other companies producing solar power and/or energy harvesting or storage products.

The solar power market is intensely competitive and rapidly evolving. The energy harvesting market is not well-defined, immature, and evolving with uncertainty. When, or if, this market matures, it may also be intensely competitive.

Our competitors are better capitalized, have established market positions, and if we fail to attract and retain customers and establish a successful distribution network for our solar products, we may be unable to achieve adequate sales and market share. There are a number of major multi-national corporations that produce solar power and alternative energy products, which may be competitive with those that we are seeking to develop, including Heliatek, Dyetec Solar, Dysol, Solarmer Energy, BP Solar, Kyocera, Sharp, GE, Mitsubishi, Solar World AG and Sanyo, Eight19, Ubiquitous Energy, Oxford Photovoltaics, ONYX Solar, among others. We also expect that future competition will include new entrants to the solar power market offering new technological solutions. Further, many of our competitors are developing and are currently producing products based on new solar power and alternative energy technologies that may have a cost basis similar to, or lower than, our SolarWindow™ Product projected costs.

Technological changes could render our products uncompetitive or obsolete, which could prevent us from achieving market share and sales.

Our failure to refine or advance our technologies, and to develop and introduce new products could cause our products to become uncompetitive or obsolete, which could prevent us from achieving market share and sales. The alternative and renewable energy industry is rapidly evolving and highly competitive. We will need to invest significant financial resources in research and product development to keep pace with technological advances in the industry and to compete in the future; we may be unable to secure such financing. We believe that a variety of competing solar and alternative or renewable energy technologies may be in development by other companies that could result in lower manufacturing costs and/or higher product performance than those expected for our products. Our development efforts may be rendered obsolete by the technological advances of others, and other technologies may prove more advantageous for the commercialization of products.

To the extent we are able to develop and commercialize products based upon or derived from the SolarWindow™ technology, if such products do not gain market acceptance, we may not achieve sales and market share.

The development of a successful market for our products may be adversely affected by a number of factors, some of which are beyond our control, including:

|

|

·

|

customer acceptance of our products;

|

|

|

|

|

|

|

·

|

our failure to produce products that compete favorably against other alternative or renewable energy and solar-photovoltaic power products on the basis of cost, quality, reliability, and performance;

|

|

|

|

|

|

|

·

|

our failure to produce products that compete favorably against conventional energy sources and distributed-generation technologies on the basis of cost, quality and performance;

|

|

|

|

|

|

|

·

|

our failure to qualify for and secure government grants, tax incentives and any other financial subsidies that may be available to consumers for the implementation of alternative or renewable energy technologies such as solar systems at such time as our products become available for commercial sale, and which potential customers for our products may reasonably expect; and

|

|

|

|

|

|

|

·

|

our failure to develop and maintain successful partnerships with manufacturers, distributors, and other resellers, as well as strategic partners.

|

|

|

|

|

|

|

·

|

if our products fail to gain market acceptance, we will be unable to achieve sales and market share.

|

If organic solar photovoltaic harvesting technologies are not suitable for widespread adoption or sufficient demand for such products does not develop or takes longer to develop than we anticipate, we may not be able to profitably exploit the SolarWindow™ technology.

The market for OPV solar-energy related products is emerging and rapidly evolving, and the market for energy harvesting products is generally unproven and not yet established. The success of products for these markets is uncertain.

If our SolarWindow™ OPV solar power or energy harvesting technologies prove unsuitable for widespread commercial deployment or if demand for such power products fails to develop sufficiently, we would be unable to achieve sales and market share. In addition, demand for such products in the particular markets and geographic regions we target may not develop or may develop more slowly than we anticipate. Many factors will influence the widespread adoption of organic solar photovoltaic light energy capture and conversion products, including:

|

|

·

|

cost-effectiveness of such technologies as compared with conventional and competitive alternative energy technologies;

|

|

|

|

|

|

|

·

|

performance and reliability of such products as compared with conventional and competitive alternative energy products;

|

|

|

|

|

|

|

·

|

success of other alternative or renewable energy technologies such as hydrogen fuel cells, wind turbines, bio-diesel generators and solar thermal technologies;

|

|

|

|

|

|

|

·

|

public concern regarding energy security, the potential risks associated with global warming, the environmental and social impacts of fossil fuel extraction and use;

|

|

|

|

|

|

|

·

|

fluctuations in economic and market conditions that impact the viability of conventional and competitive alternative or renewable energy sources;

|

|

|

|

|

|

|

·

|

fluctuations in the prices of oil, coal and natural gas;

|

|

|

|

|

|

|

·

|

capital expenditures by customers, which tend to decrease when domestic or foreign economies slow;

|

|

|

|

|

|

|

·

|

continued deregulation of the electric power industry and broader energy industry initiatives; and

|

|

|

|

|

|

|

·

|

availability of government subsidies and incentives.

|

Our growth and success, and that of the SolarWindow™ technologies and products, depends on our ability to develop new products and services and adapt to market and customer needs.

The sectors in which we operate experience rapid and significant changes due to the introduction of innovative technologies. Introducing new technology products and innovative services, which we must do on an ongoing basis to meet customers' needs, requires a significant commitment to research and development, which may not result in success. The company is pre-revenue and may suffer if it invests in technologies that do not function as expected or are not accepted in the marketplace; its products, systems or service offers are not brought to market in a timely manner; or products become obsolete or are not responsive to our customers' needs or requirements.

Our business model and strategy involves growth through acquisitions, joint ventures and mergers that may be difficult to execute.

Our business model and strategy involves growth through acquisitions, joint ventures and mergers. External growth transactions are inherently risky because of the difficulties that may arise in integrating people, operations, technologies and products, and the related acquisition, administrative and other costs.

We are dependent upon hiring and retaining highly qualified management and technical personnel.

Competition for highly qualified management and technical personnel is intense in our industry. Future success depends in part on our ability to hire, assimilate and retain engineers and scientists, sales and marketing personnel, and other qualified personnel, especially in the area of OPV with focus in our SolarWindow™ technologies and products. A key risk is our ability to anticipate their needs for certain key competences and to implement human resource solutions to recruit or improve these competences. We believe that two (2) key competences required in the near term will be a PhD OPV Scientist and a Process Engineer.

We may be the subject of product liability claims and other adverse effects due to defective products, design faults or harm caused to persons and property.

Despite our development, testing, fabrication, and quality procedures, SolarWindow™ products might not operate properly or might contain design faults or defects, which could give rise to disputes in respect of its performance, giving rise to liability. Product liability related to defective products could lead to a loss of revenue, claims under warranty, and legal proceedings. Such disputes could result in a fall-off in demand or harm our reputation for product performance, safety, and/or quality.

Our SolarWindow™ technology and products will be subject to environmental, occupational safety & hygiene, Underwriter Laboratory (UL) Certification, European Conformity (CE) Certification, electrical codes, and other state and federal, European Union (EU), and other Country regulations.

Our SolarWindow™ technologies and products will be subject to extensive and increasingly stringent environmental, occupational safety & health, Underwriter Laboratory, electrical codes, and other state and federal, EU laws, regulations, and standards (“

Laws & Regulations

”). There can be no guarantee that we will not be required to pay significant fines or compensation as a result of past, current or future breaches of Laws & Regulations. This exposure exists even if we are not responsible for the breaches, in cases where they were committed in the past by companies or businesses that were not part of ours that may be exposed to the risk of claims for breaches of these Laws & Regulations. Such claims could adversely affect our financial position and reputation, despite the efforts and investments made to comply at all times with all applicable Laws & Regulations. If we fail to conduct our business in full compliance with the applicable Laws & Regulations, the judicial or regulatory authorities could require us to conduct investigations and/or implement costly curative measures.

Our business faces significant financial risks related to interest rate, State & Federal subsidies, modified accelerated cost recovery system, taxes, depreciation, etc.

Our Power, and Financial and Revenue Modeling and Estimates (the “

Model

”) are exposed to risks associated with the effect of changing interest rates, State & Federal subsidies, modified accelerated cost recovery system (MACRS), taxes, depreciation and renewable energy tax credits. These risks affect borrowings; return on investment (ROI), internal rate of return (IRR) or economic rate of return (ERR), etc. and the ability to borrow or raise capital to secure deployment funding. If any of these Financial and Revenue Modeling and Estimation parameters fail to exist, cease to be available, or diminish in any way, our Financial and Revenue Modeling and Estimates may not be accurate or reveal profitability, or favorable ROI and/or IRR necessary for SolarWindow™ technology or related product deployment.

Our financial model may prove to be inaccurate and our SolarWindow™ technology or related products may not be cost effective.

Although our independently verified Model has shown that our SolarWindow™ technology can provide a one-year payback, it is based upon a number of assumptions that may not prove accurate. If the Model is inaccurate our SolarWindow™ technology or related product may not provide potential customers with sufficient ROI to be a cost effective alternative to other available competing products.

An increase in raw material prices could have negative consequences on our long-term profitability.

We face exposure to fluctuations in energy, raw materials, chemicals, and glass and plastic film prices. If we are not able to hedge, compensate or pass on our increased costs through a supply-chain or to customers, this could have an adverse impact on its financial results and stability, and deployment of SolarWindow™ technologies or products.

We lack sales and marketing experience and will likely rely on third party marketers.

We have limited experience in sales, marketing or distribution of photovoltaic and energy capture and conversion, and generating products. We expect to market and sell or otherwise commercialize the SolarWindow™ technology (or any of its derivatives) through distribution and supply-chain channels, co-marketing, co-promotion or licensing arrangements with third parties. Therefore, any revenues received by us will be dependent on the efforts of third parties. If any such parties breach or terminate their agreements with us or otherwise fail to conduct marketing activities successfully and in a timely manner, the commercialization of the SolarWindow™ technology (or any of its derivatives) would be delayed or terminated, which would adversely affect our ability to generate revenues and our profitability.

We may not be able to integrate our process and/or technologies into a manufacturing process necessary to produce a manufacturable product.

Without sufficient capital, human resources, the appropriate process equipment, or required supply chain, the Company may not be capable of integrating its process and/or technologies into a manufacturing process necessary to produce a manufacturable product. The innovation of SolarWindow™ processes and technologies is a crucial strategic concern, with mounting pressure to meet anticipated power, financial, and return on investment (ROI) for our manufacturers. If we are unable to integrate of process and/or technologies into industry, SolarWindow™ product innovation can rapidly become obsolete. SolarWindow™ processes and supply chains are highly complex and continuously exposed to a variety of risks such as macroeconomic, face geopolitical pressures, regulatory requirements, environmental risk and responsibilities, and emerging markets. Integration of the company SolarWindow™ processes is critical to product development and revenue generation. If the process cannot be integrated into industry and products brought to market in a timely manner, the Company, its potential SolarWindow™ products, and ability to operate may be threatened. At this time, the integration of SolarWindow™ technologies into industrial manufacturing processes is uncertain.

Our plan to remediate the identified material weaknesses in our internal control over financial reporting may not be sufficient to correct all material weaknesses and deficiencies.

Our independent registered public accounting firm (“Marcum LLP”) issued an adverse opinion on our internal control over financial reporting dated November 29, 2018 as filed with our Form 10-K filed with the SEC on November 29, 2018. In their opinion, Marcum LLP identified the following material weaknesses in our internal control over financial reporting:

·

Ineffective control environment due to an insufficient number of independent board members, insufficient oversight of work performed, and the lack of compensating controls over financial reporting due to limited personnel;

·

Ineffective design, implementation, and documentation of internal controls impacting financial statement accounts and general controls over technology pertaining to user access and segregation of duties, banking and disbursements, and financial accounting system applications; and

·

Ineffective monitoring controls related to the financial close and reporting process, including management’s risk assessment process and its identification, evaluation, and timely remediation of control deficiencies

The Company began implementing internal controls during our fiscal year ended August 31, 2018 and continues to take actions to remediate the material weaknesses in our internal controls over financial reporting, including implementing additional processes and controls designed to address the underlying causes associated with the above mentioned material weaknesses. The Company’s internal control implementation and remediation efforts include the following:

·

On June 6, 2018, we engaged the services of a risk and compliance consulting firm to assist in our evaluation and implementation of internal controls and remediation of identified control deficiencies.

·

On October 22, 2018, we appointed Steve Yan-Klassen, CPA, CMA as our CFO.

·

Performing more extensive reviews of critical estimates, journal entries, complex calculations and the financial close and reporting process.

·

Realigning certain roles to provide better segregation of duties and implementing stronger user access controls.

To the extent reasonably possible, we will continue to utilize the services of a risk and compliance consulting firm to assist us in our remediation plan and we will utilize internal resources to implement additional internal controls as deemed necessary. We have and will continue to take the necessary steps to implement additional review and approval procedures as applicable to strengthen our controls over the financial reporting and disclosure process. In addition, we continue to create and implement new information technology policies and procedures related to controls over information technology operations and security. To the extent necessary, we may hire additional staff or reassign duties of existing staff in connection with our remediation efforts.

Risks Related To Ownership of Our Common Stock

We are not a fully reporting company under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act; therefore, we are subject only to the reporting requirements of Section 15(d) of the Exchange Act.

We are not a fully reporting company under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”); therefore, we are subject only to the reporting requirements of Section 15(d) of the Exchange Act. Until our Common Stock is registered under the Exchange Act, we will be subject only to the reporting obligations imposed by Section 15(d) of the Exchange Act, which we refer to as Section 15(d). Section15(d) requires that issuers file periodic and current reports with the U.S. Securities and Exchange Commission (the “

Commission

” or the “

SEC

”) when they have issued any class of securities for which a registration statement was filed and became effective pursuant to the Securities Act. The purpose of Section 15(d) is to ensure that investors who buy securities in registered offerings are provided with the same information on an ongoing basis that they would receive if the securities they purchased were listed on a securities exchange or the issuer were otherwise subject to periodic reporting obligations. However, companies that are required to report only under Section 15(d) are not subject to some of the Exchange Act reporting requirements. For example, companies that are required to report only under Section 15(d) are not subject to the short-swing profit reporting requirements contained in Section 16 of the Exchange Act, the beneficial ownership reporting requirements contained in Section 13 of the Exchange Act, the institutional investor reporting rules or the third-party tender offer rules, or the Exchange Act’s proxy rules contained in Section 14 of the Exchange Act.

The reporting obligations under Section15(d) of the Exchange Act are automatically suspended when: (i) any class of securities of the issuer reporting under Section 15(d) is registered under Section 12 of the Exchange Act; or (ii) at the beginning of the issuer’s fiscal year, other than the year in which the applicable registration statement became effective, if the class of securities covered by the registration statement is held of record by fewer than 300 persons. In the latter case, the Company would no longer be subject to periodic reporting obligations so long as the number of holders remained below 300 unless we filed a registration statement with the Securities and Exchange Commission under Section 12 of the Exchange Act. If our obligation to file reports under Section 15(d) is suspended (other than due to our having registered our common stock under Section 12 of the Exchange Act), then investors will have reduced visibility with respect to the Company, its financial condition and results of operations.

Until our Common Stock is listed on an exchange, we expect to remain eligible for quotation on the OTCPINK or on another over-the-counter quotation system. In those venues, however, an investor may find it difficult to obtain accurate quotations for our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of your shares. This would also make it more difficult for us to raise additional capital or attract qualified employees or partners. Please refer to “

Our common stock is currently quoted on the OTCPINK which may make it more difficult for you to purchase or sell shares of the Company’s Common Stock”

below.

Our common stock is currently quoted on the OTCPINK which may make it more difficult for you to purchase or sell shares of the Company’s Common Stock.

Prior to February 26, 2018, our stock was included for trading on the OTCQB; on February 23, 2018 we received an email notification from OTC Markets Group, Inc. (the “

OTC Markets

”), which regulates the OTCQB, informing us that effective immediately, our stock would be quoted on the OTCPINK and that a caveat emptor designation would be assigned to our stock. This action was taken by OTC Markets pursuant to Section 4.2 of the OTCQB Standards, which generally provide that the OTC Markets may remove the Company’s securities from trading on the OTCQB market immediately and at any time, without notice, if OTC Markets, in its sole and absolute discretion, believes that the continued inclusion of the Company’s securities would impair the reputation or the integrity of OTC Markets or be detrimental to the interests of investors. Such concerns may include but are not limited to promotion, spam or disruptive corporate actions even when adequate current information is available.

Although facts and circumstances may differ, generally, OTC Markets will not remove the caveat emptor designation until such time as an issuer demonstrates that it meets the qualifications for OTCPINK (which we have done), has updated and verified the information in its profile on www.otcmarkets.com (which we have done), and demonstrates that there is no longer a public interest concern (which we have done).

Removal of the caveat emptor designation does not mean that trading in our stock will automatically be resumed on the OTCQB. Once removed, we will need to reapply for listing on the OTCQB, which application may or may not be approved. If not approved, we expect that our stock will continue to trade on the OTCPINK

To be eligible for OTCQB, companies will be required to at least:

|

|

·

|

meet a minimum bid price test of $0.01. Securities that do not meet the minimum bid price test will be downgraded to OTC Pink;

|

|

|

|

|

|

|

·

|

submit an application to OTCQB and pay an application and annual fee; and

|

|

|

|

|

|

|

·

|

submit an OTCQB “annual certification” confirming the Company Profile displayed on www.otcmarkets.com is current and complete and providing additional information on officers, directors, and controlling shareholders.

|

In the event we do not submit an application for listing on the OTCQB or if we do and the application is not approved, we expect that our stock will continue to trade on the OTCPINK, which could adversely affect the market liquidity of our common stock. At the time of this filing, the company has elected to not reapply for an OTCQB listing and currently trades stock on the OTCPINK.

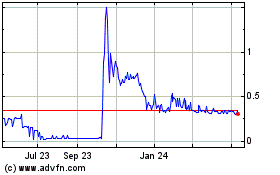

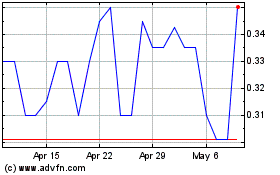

The trading price of our common stock historically has been volatile and may not reflect its actual value.

The trading price of our common stock has, from time to time, fluctuated widely and in the future may be subject to similar fluctuations. The trading price may be affected by a number of factors including the risk factors set forth herein, as well as our operating results, financial condition, general economic our control. In recent years, broad stock market indices in general, and smaller capitalization companies in particular, have experienced substantial price fluctuations. In a volatile market, we may experience wide fluctuations in the market price of our common stock. These fluctuations may have a negative effect on the market price of our common stock. In addition, the sale of our common stock into the public market upon the effectiveness of this registration statement could put downward pressure on the trading price of our common stock.

Our common stock is a penny stock and is not traded on a national securities exchange; therefore you may find it difficult to sell the shares of our common stock.

Our common stock is traded on the OTCPINK. The OTCPINK is viewed by most investors as a less desirable, and less liquid, marketplace. As a result, an investor may find it more difficult to purchase, dispose of or obtain accurate quotations as to the value of our common stock.

Additionally, our common stock is subject to regulations of the SEC applicable to “penny stock.” Penny stock includes any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Rules 15g-1 through 15g-9 under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), imposes certain sales practice requirements on broker-dealers who sell our common stock to persons other than established customers and “accredited investors” (as defined in Rule 501(c) of the Securities Act). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and purchasers of our common stock to sell their shares of our common stock.