Current Report Filing (8-k)

December 13 2018 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): December 13, 2018 (December 7, 2018)

SMG INDUSTRIES INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

000-54391

|

|

51-0662991

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

710 N. Post Oak Road, Suite 400

|

|

|

|

Houston, Texas

|

|

77024

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code:

(713-821-3153)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

ITEM

2.01

|

COMPLETION

OF ACQUISITION OR DISPOSITION OF ASSETS

|

On December

7, 2018 (“

Closing Date

”), we entered into an Agreement and Plan of Share Exchange dated as of such date (the

“

Exchange Agreement

”) with Momentum Water Transfer Services LLC, a Texas limited liability company (“

MWTS

”)

and the sole member of MWTS (the “

MWTS Member

”). On the Closing Date, pursuant to the Exchange Agreement, we

acquired one hundred percent (100%) of the issued and outstanding membership interests of MWTS (“

MWTS Membership Interests

”)

from the MWTS Member pursuant to which MWTS became our wholly owned subsidiary (“

Acquisition

”). In accordance

with the terms of the Exchange Agreement, and in connection with the completion of the Acquisition, on the Closing Date we issued

550,000 shares of our common stock, par value $0.001 per share, paid $361,710 in cash and issued a note to the MWTS Member in the

amount of $800,000 in exchange for all of the issued and outstanding MWTS Membership Interests. Principal and interest on the note

shall be repaid in sixty (60) equal monthly payments of $7,500.00 (“Installment Payments”) and a final balloon payment

for the remaining principal and accrued interest due on the maturity date. The note bears interest at a rate of 6% per annum. The

note and the repayment thereof shall be secured by all of the Company’s assets, subject to prior security interests which

includes the Crestmark Bank line of credit, up to $2,000,000 of 8.5% Secured Promissory Notes to be issued by the Company, and

other previously issued and outstanding notes.

All of the shares

of our common stock issued in connection with the Acquisition are restricted securities, as defined in paragraph (a) of Rule 144

under the Securities Act of 1933, as amended (the “

Securities Act

”). Such shares were issued pursuant to an

exemption from the registration requirements of the Securities Act, under Section 4(a)(2) of the Securities Act and the rules and

regulations promulgated thereunder.

The

summary of the Exchange Agreement set forth above does not purport to be a complete statement of the terms of such document. The

summary is qualified in its entirety by reference to the full text of the document, a copy of which is being filed with this Current

Report on Form 8-K as

Exhibit 2.1

, and is incorporated herein by reference.

|

|

ITEM 3.02

|

UNREGISTERED SALES OF EQUITY SECURITIES

|

The shares of

our Common Stock issued in connection with the Purchase Agreement were issued in a private transaction in reliance upon exemptions

from registration pursuant to Section 4(2) of the Securities Act and the rules and regulations promulgated thereunder. Our reliance

on Section 4(a)(2) of the Securities Act was based upon the following factors: (a) the issuance of the securities was an isolated

private transaction by us which did not involve a public offering; (b) there were only several offerees; (c) there were no subsequent

or contemporaneous public offerings of the securities by us; and (d) the negotiations for the sale of the stock took place directly

between the offerees and us.

On December

7, 2018, the Company issued and sold secured promissory notes in the aggregate principal amount of $300,000 (“Notes”)

to three (3) separate purchasers. In addition to the issuance of the Notes an aggregate of 500,000 warrants (“Warrants”)

were issued to the purchasers of the Notes. The Warrants are exercisable for a period of five (5) years and are exercisable at

$0.40 per share. Interest on the Notes shall be paid to the purchasers at a rate of 10.0% per annum, paid on a quarterly basis,

and the maturity date of the Note is one year after the issuance date. The Notes are secured by all of the assets of the Company

and the assets of MWTS, subject to prior liens and security interests. The Notes were issued to the purchasers in a private transaction

in reliance upon exemptions from registration pursuant to Section 4(2) of the Securities Act and the rules and regulations promulgated

thereunder.

|

|

ITEM

9.01

|

FINANCIAL

STATEMENTS AND EXHIBITS

|

|

(a)

|

Financial Statements of Business Acquired

. SMG Industries Inc. intends to file financial statements required by this

Item 9.01(a)

under the cover of an amendment to this Current Report on Form 8-K no later than seventy-one (71) calendar days after the date on which this Form 8-K was required to be filed.

|

|

(b)

|

Pro Forma Financial Information

. SMG Industries Inc. intends to file the pro forma financial information that is required by this

Item 9.01(b)

under the cover of an amendment to this Current Report on Form 8-K no later than seventy-one (71) calendar days after the date on which this Form 8-K was required to be filed.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

Dated: December 13, 2018

|

SMG Industries Inc.

|

|

|

|

|

|

|

By:

|

/s/ Matthew Flemming

|

|

|

Name:

|

Matthew Flemming

|

|

|

Title:

|

Chief Executive Officer and President

|

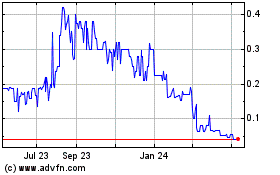

SMG Industries (QB) (USOTC:SMGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

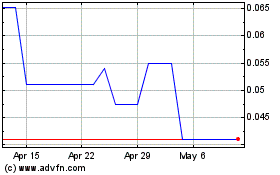

SMG Industries (QB) (USOTC:SMGI)

Historical Stock Chart

From Apr 2023 to Apr 2024