Current Report Filing (8-k)

April 23 2020 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 23, 2020 (April 21, 2020)

|

Singlepoint Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-53425

|

|

26-1240905

|

|

(State or other jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

2999 North 44th Street, Suite 530 Phoenix, AZ

|

|

85018

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (855) 711-2009

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8 K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Item 3.02 Unregistered Sales of Equity Securities.

On April 21, 2020 Singlepoint Inc. (the “Company”) entered an Equity Financing Agreement (the “Equity Financing Agreement”) and Registration Rights Agreement (the “Registration Rights Agreement”) with GHS Investments LLC (“GHS”). Pursuant to the Equity Financing Agreement GHS agreed to purchase up to Seven Million Dollars ($7,000,000) in shares of the Company’s common stock, from time to time over the course of twenty four (24) months after effectiveness of a registration statement on Form S-1 (the “Registration Statement”) of the underlying shares of Common Stock (the “Contract Period”).

The Equity Financing Agreement grants the Company the right, from time to time at its sole discretion (subject to certain conditions) during the Contract Period, to direct GHS to purchase shares of Common Stock on any business day (a “Put”), provided that at least ten trading days has passed since the most recent Put. The purchase price of the shares of Common Stock contained in a Put shall be eighty percent (80%) percent of the lowest volume weighted average price (VWAP) of the Company’s Common Stock for ten (10) consecutive trading days preceding the Put. No Put will be made in an amount less than twenty-five thousand dollars ($25,000) or greater than five hundred thousand dollars ($500,000). In no event is the Company entitled to make a Put or is Investor be entitled to purchase that number of shares of Common Stock of the Company, which when added to the sum of the number of shares of Common Stock beneficially owned (as such term is defined under Section 13(d) and Rule 13d-3 of the 1934 Act), by GHS, would exceed 4.99% of the number of shares of Common Stock outstanding on such date, as determined in accordance with Rule 13d-1(j) of the 1934 Act.

The Equity Financing Agreement shall terminate upon any of the following events: when GHS has purchased an aggregate of Seven Million Dollars ($7,000,000) in the Common Stock of the Company pursuant to the Equity Financing Agreement; on the Date that is twenty-four (24) calendar months from the date the Registration Statement is declared "Effective"; at such time that the Registration Statement is no longer in effect; by the Company at any time, after ninety (90) calendar days notice following the closing of any Put; or upon thirty (30) calendar days after written notice by the Company if no Put Notices have been delivered. Actual sales of shares of Common Stock to the Investor under the Equity Financing Agreement will depend on a variety of factors to be determined by the Company from time to time, including, among others, market conditions, the trading price of the Common Stock and determinations by the Company as to the appropriate sources of funding for the Company and its operations. The net proceeds under the Equity Financing Agreement to the Company will depend on the frequency and prices at which the Company sells shares of its stock to GHS.

The Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration Statement within 30 days of the date of the Registration Rights Agreement; and (ii) have the Registration Statement declared effective by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than 90 days after the Registration Statement is filed.

The foregoing descriptions of the Equity Financing Agreement and the Registration Rights Agreement are qualified in their entirety by reference to the full text of such agreements, copies of which are attached hereto as Exhibit 10.01 and 10.02, respectively, and each of which is incorporated herein in its entirety by reference. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements, and may be subject to limitations agreed upon by the contracting parties.

Item 7.01 Regulation FD Disclosure.

Further clarifying certain remarks of CEO Gregory Lambrecht, the Company is reporting that its subsidiary Singlepoint Direct Solar, LLC (“Direct Solar of America”) has expanded its national footprint and is currently covering thirty states. The commercial division of Direct Solar of America is currently involved in active discussions and is working toward participating in a municipal project with indicated interest of approximately 140 residential locations in phase one of the proposed project which has an estimated total phase one project costs of $5.3M.

Item 8.01 Other Events.

On April 23, 2020, the Company issued a press release announcing the Equity Financing Agreement and Registration Rights Agreement, as discussed in Item 1.01 above. A copy of the press release that discusses this matter is filed as Exhibit 99.01 to, and incorporated by reference in, this report.

The information contained in Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.01, is furnished pursuant to, and shall not be deemed to be "filed" for the purposes of, Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in Item 8.01 of this Current Report shall not be incorporated by reference into any registration statement or any other document filed pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following documents are filed as Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SinglePoint Inc.

|

|

|

|

|

|

|

|

Dated: April 23, 2020

|

By:

|

/s/ William Ralston

|

|

|

|

|

William Ralston

|

|

|

|

|

President

|

|

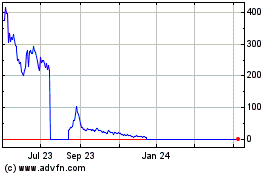

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Mar 2024 to Apr 2024

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Apr 2023 to Apr 2024