false

0000818677

0000818677

2024-10-30

2024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 30, 2024

SECURITY FEDERAL CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

South Carolina

(State or Other Jurisdiction of Incorporation)

| 000-16120 |

|

57-0858504 |

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

238 Richland Avenue NW, Aiken, SC

|

|

29801

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

803-641-3000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: NONE

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item2.02 Results of Operations and Financial Condition

On October 30, 2024, Security Federal Corporation issued its earnings release for the quarter ended September 30, 2024. A copy of the earnings release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

| 99.1 |

|

Press Release of Security Federal Corporation dated October 30, 2024 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Security Federal Corporation

|

| |

|

|

|

Date: October 30, 2024

|

By:

|

/s/Darrell Rains

|

| |

|

Darrell Rains

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

NEWS RELEASE

SECURITY FEDERAL CORPORATION ANNOUNCES THIRD QUARTER INCOME

Aiken, South Carolina (October 30, 2024) - Security Federal Corporation (the “Company”) (OTCBB: SFDL), the holding company for Security Federal Bank (the “Bank”), today announced earnings and financial results for the three and nine months ended September 30, 2024.

The Company reported net income available to common shareholders of $2.0 million, or $0.62 per share, for the quarter ended September 30, 2024, compared to $2.1 million, or $0.65 per share, for the third quarter of 2023. Year-to-date net income available to common shareholders was $5.9 million, or $1.83 per common share, for the nine months ended September 30, 2024, compared to $6.6 million, or $2.02 per common share, during the nine months ended September 30, 2023. Both the quarterly and year-to-date decreases in net income available to common shareholders were primarily due to increases in the provision for credit losses and non-interest expense, as well as the payment of preferred stock dividends during 2024, which were partially offset by increases in net interest income and non-interest income.

Third Quarter Comparative Financial Highlights

| |

●

|

Net interest income increased $964,000, or 10.2%, to $10.4 million during the quarter ended September 30, 2024, compared to $9.4 million during the third quarter of 2023.

|

| |

●

|

Total interest income increased $2.7 million, or 16.1%, to $19.5 million while total interest expense increased $1.7 million, or 23.7%, to $9.1 million during the quarter ended September 30, 2024 compared to the same quarter the prior year. The increase in interest income and interest expense was the result of higher market interest rates and increased average interest-earning assets and interest-bearing liabilities.

|

| |

●

|

Non-interest income increased $457,000, or 21.1%, to $2.6 million during the quarter ended September 30, 2024 compared to the same quarter in the prior year primarily due to $263,000 and $74,000 increases in trust income and gain on sale of loans, respectively.

|

| |

●

|

Non-interest expense increased $389,000, or 4.4%, to $9.3 million during the quarter ended September 30, 2024 compared to the same quarter in the prior year primarily due to an increase in salaries and employee benefits expense.

|

| |

|

Quarter Ended

|

|

|

(Dollars in Thousands, except for Earnings per Share)

|

|

9/30/2024

|

|

|

9/30/2023

|

|

|

Total interest income

|

|

$ |

19,531 |

|

|

$ |

16,822 |

|

|

Total interest expense

|

|

|

9,121 |

|

|

|

7,376 |

|

|

Net interest income

|

|

|

10,410 |

|

|

|

9,446 |

|

|

Provision for credit losses

|

|

|

580 |

|

|

|

- |

|

|

Net interest income after provision for credit losses

|

|

|

9,830 |

|

|

|

9,446 |

|

|

Non-interest income

|

|

|

2,625 |

|

|

|

2,168 |

|

|

Non-interest expense

|

|

|

9,313 |

|

|

|

8,924 |

|

|

Income before income taxes

|

|

|

3,142 |

|

|

|

2,690 |

|

|

Provision for income taxes

|

|

|

732 |

|

|

|

568 |

|

|

Net income

|

|

|

2,410 |

|

|

|

2,122 |

|

|

Preferred stock dividends

|

|

|

415 |

|

|

|

- |

|

|

Net income available to common shareholders

|

|

$ |

1,995 |

|

|

$ |

2,122 |

|

|

Earnings per common share (basic)

|

|

$ |

0.62 |

|

|

$ |

0.65 |

|

Year to Date (Nine Months) Comparative Financial Highlights

| |

●

|

Net interest income increased $1.8 million, or 6.1%, to $30.6 million during the nine months ended September 30, 2024 compared to the same period in the prior year.

|

| |

●

|

Total interest income increased $10.5 million, or 22.5%, to $57.1 million while total interest expense increased $8.7 million, or 49.0%, to $26.5 million during the nine months ended September 30, 2024 compared to the same period in the prior year.

|

| |

●

|

Non-interest income increased $780,000, or 11.8%, to $7.4 million during the nine months ended September 30, 2024 compared to the same period in the prior year primarily due to a $480,000 increase in trust income.

|

| |

●

|

Non-interest expense increased $1.8 million, or 6.5%, to $28.6 million for the nine months ended September 30, 2024 compared to the same period in 2023.

|

| |

|

Nine Months Ended

|

|

|

(Dollars in Thousands, except for Earnings per Share)

|

|

9/30/2024

|

|

|

9/30/2023

|

|

|

Total interest income

|

|

$ |

57,071 |

|

|

$ |

46,593 |

|

|

Total interest expense

|

|

|

26,497 |

|

|

|

17,780 |

|

|

Net interest income

|

|

|

30,574 |

|

|

|

28,813 |

|

|

Provision for credit losses

|

|

|

1,090 |

|

|

|

221 |

|

|

Net interest income after provision for credit losses

|

|

|

29,484 |

|

|

|

28,592 |

|

|

Non-interest income

|

|

|

7,400 |

|

|

|

6,620 |

|

|

Non-interest expense

|

|

|

28,617 |

|

|

|

26,863 |

|

|

Income before income taxes

|

|

|

8,267 |

|

|

|

8,349 |

|

|

Provision for income taxes

|

|

|

1,878 |

|

|

|

1,775 |

|

|

Net income

|

|

|

6,389 |

|

|

|

6,574 |

|

|

Preferred stock dividends

|

|

|

512 |

|

|

|

- |

|

|

Net income available to common shareholders

|

|

$ |

5,877 |

|

|

$ |

6,574 |

|

|

Earnings per common share (basic)

|

|

$ |

1.83 |

|

|

$ |

2.02 |

|

Credit Quality

| |

●

|

The Bank recorded a $1.2 million provision for credit losses on loans and a $110,000 reversal of provision for credit losses on unfunded commitments, resulting in a total provision for credit losses of $1.1 million for the first nine months of 2024, compared to $376,000 in provision for credit losses on loans and a $155,000 reversal of provision for credit losses on unfunded commitments, resulting in a total provision for credit losses of $221,000 for the first nine months of 2023.

|

| |

●

|

Non-performing assets were $6.8 million at both September 30, 2024 and December 31, 2023, compared to $6.3 million at September 30, 2023.

|

| |

●

|

The allowance for credit losses to gross loans was 1.95%, 1.98% and 2.03% at September 30, 2024, December 31, 2023, and September 30, 2023, respectively.

|

|

At Period End (dollars in thousands):

|

|

9/30/2024

|

|

|

12/31/2023

|

|

|

9/30/2023

|

|

|

Non-performing assets

|

|

$ |

6,770 |

|

|

$ |

6,825 |

|

|

$ |

6,339 |

|

|

Non-performing assets to total assets

|

|

|

0.43 |

% |

|

|

0.44 |

% |

|

|

0.43 |

% |

|

Allowance for credit losses

|

|

$ |

13,604 |

|

|

$ |

12,569 |

|

|

$ |

12,348 |

|

|

Allowance for credit losses to gross loans

|

|

|

1.95 |

% |

|

|

1.98 |

% |

|

|

2.03 |

% |

Balance Sheet Highlights and Capital Management

| |

●

|

Total assets were $1.6 billion at September 30, 2024, a year-over-year increase of $99.0 million, or 6.7%.

|

| |

●

|

Total loans receivable, net were $686.7 million at September 30, 2024, an increase of $64.2 million during the first nine months of 2024 and a year-over-year increase of $88.7 million.

|

| |

●

|

Investment securities decreased $28.7 million during the first nine months of 2024 to $672.1 million at September 30, 2024, as maturities and principal paydowns of investment securities exceeded purchases during the nine-month period.

|

| |

●

|

Deposits were $1.3 billion at September 30, 2024, an increase of $62.3 million, or 5.2% during the nine months ended September 30, 2024, and a year-over-year increase of $71.3 million, or 6.0%.

|

| |

●

|

Borrowings decreased $49.1 million, or 28.9%, during the nine months ended September 30, 2024 to $121.0 million due to the repayment of borrowings with the Federal Reserve Bank Term Funding Program.

|

|

Dollars in thousands (except per share amounts)

|

|

9/30/2024

|

|

|

12/31/2023

|

|

|

9/30/2023

|

|

|

Total assets

|

|

$ |

1,576,326 |

|

|

$ |

1,549,671 |

|

|

$ |

1,477,330 |

|

|

Cash and cash equivalents

|

|

|

132,376 |

|

|

|

128,284 |

|

|

|

84,224 |

|

|

Total loans receivable, net

|

|

|

686,708 |

|

|

|

622,529 |

|

|

|

598,029 |

|

|

Investment securities

|

|

|

672,054 |

|

|

|

700,712 |

|

|

|

705,558 |

|

|

Deposits

|

|

|

1,257,313 |

|

|

|

1,194,997 |

|

|

|

1,186,053 |

|

|

Borrowings

|

|

|

120,978 |

|

|

|

170,035 |

|

|

|

119,898 |

|

|

Total shareholders' equity

|

|

|

185,081 |

|

|

|

172,362 |

|

|

|

158,996 |

|

|

Common shareholders' equity

|

|

|

102,132 |

|

|

|

89,413 |

|

|

|

76,047 |

|

|

Common equity book value per share

|

|

$ |

31.97 |

|

|

$ |

27.69 |

|

|

$ |

23.46 |

|

|

Total risk based capital to risk weighted assets (1)

|

|

|

19.21 |

% |

|

|

19.49 |

% |

|

|

19.33 |

% |

|

CET1 capital to risk weighted assets (1)

|

|

|

17.96 |

% |

|

|

18.24 |

% |

|

|

18.08 |

% |

|

Tier 1 leverage capital ratio (1)

|

|

|

10.27 |

% |

|

|

9.83 |

% |

|

|

10.11 |

% |

|

(1) - Ratio is calculated using Bank only information and not consolidated information

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Federal Bank has 19 full-service branches located in Aiken, Ballentine, Clearwater, Columbia, Graniteville, Langley, Lexington, North Augusta, Ridge Spring, Wagener and West Columbia, South Carolina and Augusta and Evans, Georgia. A full range of financial services, including trust and investments, are provided by the Bank and insurance services are provided by the Bank’s wholly owned subsidiary, Security Federal Insurance, Inc.

For additional information contact Darrell Rains, Chief Financial Officer, at (803) 641-3000.

Forward-looking statements:

Certain matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to, among other things, expectations of the business environment in which the Company operates, projections of future performance, perceived opportunities in the market, potential future credit experience, and statements regarding the Company’s mission and vision. These forward-looking statements are based upon current management expectations and may, therefore, involve risks and uncertainties. The Company’s actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety or range of factors including, but not limited to: potential adverse impacts to economic conditions in our local market area or other aspects of the Company’s business, operations or financial markets, including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a potential recession or slowed economic growth; economic conditions in the Company’s primary market area; demand for residential, commercial business and commercial real estate, consumer, and other types of loans; success of new products; competitive conditions between banks and non-bank financial service providers; changes in management’s business strategies, including expectations regarding key growth initiatives and strategic priorities; legislative or regulatory changes that adversely affect the Company’s business, including the interpretation of regulatory capital or other rules; the ability to attract and retain deposits; the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions; adverse changes in the securities markets; changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; technology factors affecting operations, including disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform critical processing functions for us; pricing of products and services; environmental, social and governance goals and targets; the effects of climate change, severe weather events, natural disasters, pandemics, epidemics and other public health crises, acts of war or terrorism, and other external events on our business; and other risks detailed in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These factors should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. The Company does not undertake any responsibility to update or revise any forward-looking statement.

v3.24.3

Document And Entity Information

|

Oct. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

SECURITY FEDERAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 30, 2024

|

| Entity, Incorporation, State or Country Code |

SC

|

| Entity, File Number |

000-16120

|

| Entity, Tax Identification Number |

57-0858504

|

| Entity, Address, Address Line One |

238 Richland Avenue NW

|

| Entity, Address, City or Town |

Aiken

|

| Entity, Address, State or Province |

SC

|

| Entity, Address, Postal Zip Code |

29801

|

| City Area Code |

803

|

| Local Phone Number |

641-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000818677

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

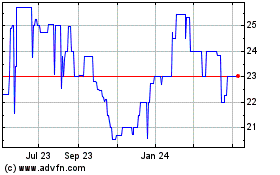

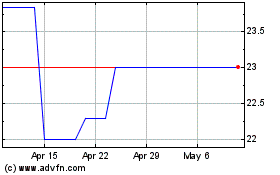

Security Federal (PK) (USOTC:SFDL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Security Federal (PK) (USOTC:SFDL)

Historical Stock Chart

From Dec 2023 to Dec 2024