Current Report Filing (8-k)

March 24 2021 - 4:06PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): March 22, 2021

SCOUTCAM

INC.

(Exact

name of registrant as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation)

|

333-188920

|

|

847-4257143

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

Suite

7A, Industrial Park

P.O.

Box 3030, Omer, Israel 8496500

(Address

of principal executive offices) (Zip Code)

Tel:

+972 73 370-4691

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.02. Unregistered Sale of Equity Securities

On

March 22, 2021, ScoutCam Inc. (the “Company”) undertook to issue to certain investors (the “Investors”)

22,222,223 units (the “Units”) in exchange for an aggregate purchase price of $20 million (the “Private

Placement”). Each Unit consists of (i) one share of the Company’s common stock par value US$0.001 per share (the

“Common Stock”) and (ii) one warrant to purchase one share of Common Stock with an exercise price of US$1.15

per share (the “Warrant” and the “Exercise Price”). Each Warrant is exercisable

until the close of business on March 31, 2026.

Pursuant

to the terms of the Warrants, following April 1, 2024, if the closing price of the Common Stock equal or exceeds 135% of the Exercise

Price (subject to appropriate adjustments for stock splits, stock dividends, stock combinations and other similar transactions

after the issue date of the Warrants) for any thirty (30) consecutive trading days, the Company may force the exercise of the

Warrants, in whole or in part, by delivering to the Investors a notice of forced exercise.

The

shares of Common Stock and the Warrants were issued to the Investors pursuant to Regulation S of the Securities Act of 1933, as

amended.

In

connection with the Private Placement, the Company undertook to file with the Securities and Exchange Commission, within sixty

(60) days of the closing of the Private Placement, a registration statement covering the resale of the shares of Common Stock

to be issued in the Private Placement and the shares of Common Stock underlying the Warrants. The closing of the Private Placement

is expected to occur by March 31, 2021.

Item

7.01 Regulation FD Disclosure.

On

March 24, 2021, the Company issued a press release announcing the Private Placement. A copy of the press release is furnished

hereto as Exhibit 99.1.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities

under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities

Act of 1933, as amended or the Exchange Act, regardless of any general incorporation language in such filings.

Forward-Looking

Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. The Company’s actual results may differ from its expectations,

estimates and projections and consequently, you should not rely on these forward looking

statements as predictions of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,”

“will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking

statements include, without limitation, the Company’s expectations with respect to the timing of the completion of the Private

Placement. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to

differ materially from the expected results. Most of these factors are outside the Company’s control and are difficult to

predict. Factors that may cause such differences include, but are not limited to the occurrence of any event, change or other

circumstances that could cause the Private Placement to fail to close, The Company cautions readers not to place undue reliance

upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation

or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations

or any change in events, conditions or circumstances on which any such statement is based.

Item

9.01. Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

SCOUTCAM

INC.

|

|

|

|

|

|

|

By:

|

/s/

Tanya Yosef

|

|

|

Name:

|

Tanya

Yosef

|

|

|

Title:

|

Chief

Financial Officer

|

|

|

|

|

|

Date:

March 24, 2021

|

|

|

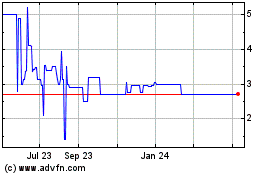

Scoutcam (QB) (USOTC:SCTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Scoutcam (QB) (USOTC:SCTC)

Historical Stock Chart

From Apr 2023 to Apr 2024