Current Report Filing (8-k)

July 07 2021 - 6:01AM

Edgar (US Regulatory)

0001058330

false

0001058330

2021-06-30

2021-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, DC

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): June 30, 2021

-----------------------

ROGUE

ONE, INC.

(Exact name of registrant

as specified in its charter)

|

Nevada

|

|

00-24723

|

|

88-0393257

|

|

(State or

other jurisdiction of

Incorporation

or organization)

|

|

(Commission File No.)

|

|

(I.R.S. Employer Identification

No.)

|

3416

Shadybrook Drive, Midwest

City, Oklahoma

73110

(Address of Principal

Executive Office)

Registrant's telephone number including

area code: (405) 733-1567

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

[

] Written communication pursuant to Rule 425 under

the Securities Act (17 CFR 230.425).

[

] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12).

[

] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

[

] Pre-commencement communications pursuant to Rule

13e-4(c) under the exchange Act (17 CFR 240.13e-4(c)).

As

used herein, the term “we,” “us,” “our,” and the “Company” refers to Rogue One, Inc.

a Nevada corporation.

MATTER OF FORWARD-LOOKING

STATEMENTS

THIS FORM 8-K CONTAINS

"FORWARD-LOOKING STATEMENTS" THAT CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING WORDS SUCH AS "BELIEVES," "EXPECTS,"

"MAY," "WILL," "SHOULD," OR "ANTICIPATES," OR THE NEGATIVE OF THESE WORDS OR OTHER VARIATIONS

OF THESE WORDS OR COMPARABLE WORDS, OR BY DISCUSSIONS OF PLANS OR STRATEGY THAT INVOLVE RISKS AND UNCERTAINTIES. MANAGEMENT WISHES TO

CAUTION THE READER THAT THESE FORWARD-LOOKING STATEMENTS, INCLUDING, BUT NOT LIMITED TO, STATEMENTS REGARDING THE COMPANY’S MARKETING

PLANS, GOALS, COMPETITIVE AND TECHNOLOGY TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS ARE ONLY PREDICTIONS. NO ASSURANCES CAN

BE GIVEN THAT SUCH PREDICTIONS WILL PROVE CORRECT OR THAT THE ANTICIPATED FUTURE RESULTS WILL BE ACHIEVED. ACTUAL EVENTS OR RESULTS MAY

DIFFER MATERIALLY EITHER BECAUSE ONE OR MORE PREDICTIONS PROVE TO BE ERRONEOUS OR AS A RESULT OF OTHER RISKS FACING THE COMPANY. FORWARD-LOOKING

STATEMENTS SHOULD BE READ IN LIGHT OF THE CAUTIONARY STATEMENTS. THE RISKS INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH

AN EARLY-STAGE COMPANY THAT HAS ONLY A LIMITED HISTORY OF OPERATIONS, THE COMPARATIVELY LIMITED FINANCIAL AND MANAGERIAL RESOURCES OF

THE COMPANY, THE RECENT AND UNPREDECENTED GLOBAL COVID-19 VIRUS CONDITIONS THAT DIRECTLY AND ADVERSELY HAVE HAD A SERIOUS NEGATIVE IMPACT

UPON THE COMPANY AND ITS PLANS AND WILL LIKELY CONTINUE TO HAVE THAT IMPACT FOR THE FORESEEABLE FUTURE, THE INTENSE COMPETITION THE COMPANY

FACES FROM OTHER ESTABLISHED COMPETITORS, TECHNOLOGICAL CHANGES THAT MAY LIMIT THE ABILITY OF THE COMPANY TO MARKET AND SELL ITS PRODUCTS

AND SERVICES OR ADVERSELY IMPACT THE PRICING OF OUR PRODUCTS AND SERVICES, AND MANAGEMENT THAT HAS ONLY LIMITED EXPERIENCE IN DEVELOPING

SYSTEMS AND MANAGEMENT PRACTICES. ANY ONE OR MORE OF THESE OR OTHER RISKS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE FUTURE

RESULTS INDICATED, EXPRESSED, OR IMPLIED IN SUCH FORWARD-LOOKING STATEMENTS. FURTHER, THERE CAN BE NO ASSURANCE THAT WE WILL ACHIEVE

ANY OF THE OBJECTIVES OF ANY ONE OR MORE OF THE AGREEMENTS THAT WE ENTER INTO INCLUDING, BUT NOT LIMITED TO, THE AGREEMENT WITH THE STOCKHOLDERS

OF HUMAN BRANDS INTERNATIONAL, INC. (THE “ACQUISITION”). AND WHILE WE BELIEVE THAT WE CONDUCTED A SUFFICIENT DUE DILIGENCE

INVESTIGATION INTO THE AFFAIRS OF HUMAN BRANDSS INTERNATIONAL, INC. PRIOR TO THE ACQUISITION, WE MAY DISCOVER THAT WE ARE EXPOSED TO

LIABILITIES AND CLAIMS THAT WERE NOT IDENTIFIED DURING OUR PRE-ACQUISITION DUE DILIGENCE INVESTIGATION WITH THE RESULT THAT WE MAY EXPERIENCE

SIGNIFICANT LOSSES THEREBY. WE ARE ALSO INSOLVENT IN THAT OUR TOTAL LIABILITIES EXCEED OUR TOTAL ASSETS. WE UNDERTAKE NO OBLIGATION TO

UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENT TO REFLECT EVENTS, CIRCUMSTANCES, OR NEW INFORMATION AFTER THE DATE OF THIS FORM 8-K OR

TO REFLECT THE OCCURRENCE OF UNANTICIPATED OR OTHER SUBSEQUENT EVENTS.

Item 1.01 Entry

into a Material Definitive Agreement.

On June 30, 2021

we entered into that certain Merger Agreement and Plan of Reorganization (the “Acquisition Agreement”) with each of the stockholders

of Human Brands International, Inc., a Nevada corporation (the “Acquired Company”).

Under the terms of

the Acquisition Agreement, we agreed to issue an aggregate of forty-four (44) shares of our Series D Preferred Stock (par value $0.001)

(the “Preferred Shares”) and an aggregate of One Hundred Seventy-Six Million Seven Hundred Seventy-One Thousand Nine Hundred

Sixty-Two (176,771,962) shares of our Common Stock (par value $0.001)(the “Common Shares”) to acquire all of the outstanding

capital stock of the Acquired Company.

The Acquisition Agreement

was the product of several months of meetings and due diligence conducted by our officers and directors that resulted in successful negotiations

with the officers and directors of the Acquired Company and the stockholders of the Acquired Company.

We did not employ

or utilize the services of any investment banker, advisor, or other third party in connection with the Acquisition Agreement, the transactions

underlying the Acquisition Agreement or both of them. As a result, we did not incur or pay any fees to any investment banker, advisor,

or other third party.

All of the Preferred

Shares and all of the Common Shares to be issued in accordance with the Acquisition Agreement are “unregistered securities”

in that they will be issued pursuant to claims of exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended

(the “1933 Act”) and Rule 506(b) promulgated by the Securities and Exchange Commission thereunder as well as certain claims

to the qualification requirements under state securities laws in the states wherein the holders of all of the outstanding capital stock

of the Acquired Company. Moreover, all of the Preferred Shares and all of the Common Shares that we anticipate issuing pursuant to the

Acquisition Agreement will be issued with a restricted securities legend and only upon our receipt of certain additional written assurances

from each of the stockholders of the Acquired Company.

Item 2.01 Completion

of Acquisition or Disposition of Assets.

On June 30, 2021

we entered into that certain Merger Agreement and Plan of Reorganization (the “Acquisition Agreement”) with each of the stockholders

of Human Brands International, Inc., a Nevada corporation (the “Acquired Company”) with the result that we acquired all of

the outstanding capital stock of the Acquired Company and the Acquired Company became a wholly-owned subsidiary.

We did not employ

or utilize the services of any investment banker, advisor, or other third party in connection with the Acquisition Agreement, the transactions

underlying the Acquisition Agreement or both of them. As a result, we did not incur or pay any fees to any investment banker, advisor,

or other third party.

Item 3.02 Unregistered

Sales of Equity Securities.

In accordance with

the Acquisition Agreement, we agreed to issue an aggregate of forty-four (44) shares of our Series D Preferred Stock (par value $0.001)

(the “Preferred Shares”) and an aggregate of One Hundred Seventy-Six Million Seven Hundred Seventy-One Thousand Nine Hundred

Sixty-Two (176,771,962) shares of our Common Stock (par value $0.001)(the “Common Shares”) to acquire all of the outstanding

Thirty-Nine Million Six Hundred Seventy-Seven Thousand One Hundred Ninety-Six (39,677,196) shares of the Common Stock (the “Subsidiary

Shares”) of Human Brands International, Inc., a Nevada corporation (the “Acquired Company”).

We did not employ

or utilize the services of any investment banker, advisor, or other third party in connection with the Acquisition Agreement, the transactions

underlying the Acquisition Agreement or both of them. As a result, we did not incur or pay any fees to any investment banker, advisor,

or other third party.

Thus and under the

terms of the Acquisition Agreement, we acquired the Subsidiary Shares in exchange for our issuance of our Preferred Shares and our Common

Shares.

All of the Preferred

Shares and all of the Common Shares to be issued in accordance with the Acquisition Agreement are “unregistered securities”

in that they will be issued pursuant to claims of exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended

(the “1933 Act”) and Rule 506(b) promulgated by the Securities and Exchange Commission thereunder as well as certain claims

to the qualification requirements under state securities laws in the states wherein the holders of all of the outstanding capital stock

of the Acquired Company. Moreover, all of the Preferred Shares and all of the Common Shares that we anticipate issuing pursuant to the

Acquisition Agreement will be issued with a restricted securities legend and only upon our receipt of certain additional written assurances

from each of the stockholders of the Acquired Company.

We did not receive

and do not expect to receive any proceeds as a result of the transactions underlying the Acquisition Agreement.

Item 7.01 Regulation

FD Disclosure.

On June 30, 2021

we entered into that certain Merger Agreement and Plan of Reorganization (the “Acquisition Agreement”) with each of the stockholders

of Human Brands International, Inc., a Nevada corporation (the “Acquired Company”).

Under the terms of

the Acquisition Agreement, we agreed to issue an aggregate of forty-four (44) shares of our Series D Preferred Stock (par value $0.001)

(the “Preferred Shares”) and an aggregate of One Hundred Seventy-Six Million Seven Hundred Seventy-One Thousand Nine Hundred

Sixty-Two (176,771,962) shares of our Common Stock (par value $0.001)(the “Common Shares”) to acquire all of the outstanding

capital stock of the Acquired Company.

The Acquisition Agreement

was the product of several months of meetings and due diligence conducted by our officers and directors that resulted in successful negotiations

with the officers and directors of the Acquired Company and the stockholders of the Acquired Company.

We did not employ

or utilize the services of any investment banker, advisor, or other third party in connection with the Acquisition Agreement, the transactions

underlying the Acquisition Agreement or both of them. As a result, we did not incur or pay any fees to any investment banker, advisor,

or other third party.

All of the Preferred

Shares and all of the Common Shares to be issued in accordance with the Acquisition Agreement are “unregistered securities”

in that they will be issued pursuant to claims of exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended

(the “1933 Act”) and Rule 506(b) promulgated by the Securities and Exchange Commission thereunder as well as certain claims

to the qualification requirements under state securities laws in the states wherein the holders of all of the outstanding capital stock

of the Acquired Company. Moreover, all of the Preferred Shares and all of the Common Shares that we anticipate issuing pursuant to the

Acquisition Agreement will be issued with a restricted securities legend and only upon our receipt of certain additional written assurances

from each of the stockholders of the Acquired Company.

Risk

Factors Related to the Agreement and Our Financial Condition

Any

person who seeks to acquire our Common Stock, our Preferred Stock, or any other instrument that we may issue should be aware that any

such investment should be considered only by those persons who can afford the total loss of their investment and in addition to the above,

these risks include, but are not limited to, the risks set forth in our most recent 2020 Annual Report on Form 10-K under Item 1A together

with the following:

-

We are insolvent

in that our Total Liabilities are greater than our Total Assets and we cannot assure you that we will become solvent at any time

in the future.

-

We have limited

financial and managerial resources to implement our business plan and otherwise conduct our corporate affairs and there can be no guarantee

that we will have sufficient financial and managerial resources to do so in the future.

-

We need to raise

a significant amount of additional capital to support our current financial needs and the capital that we are likely to need if we are

to sustain our corporate existence and otherwise conduct our intended business as contemplated by the Acquisition Agreement and otherwise.

-

At present we have

not received any commitment from any capable and qualified third party to provide a sufficient amount of additional funds that will allow

us to meet our current and projected needs and there can be no assurance that we will receive a sufficient amount of funds at any time

in the near future or, if we do receive such funds, that the funds will be provided on reasonable terms and in sufficient amounts and

on a timely basis given our current financial condition. If we are not successful in obtaining such funds, in sufficient amounts, on

reasonable terms, and on a timely basis, any person who acquires our Common Stock, our Preferred Stock, or any other instrument that

we may issue or any combination of them, will likely lose their entire investment.

-

Holders of our Common

Stock face an almost certain prospect of immediate and substantial dilution since even if a qualified and capable prospective

investor were willing to assume the extraordinary risks involved in making an investment into our Company, existing investors would very

likely suffer dilution in ownership, in destruction of the current book value per share, and the destruction of the extent of their voting

rights that likely would be permanent and without recourse. Thus, any person who acquires our Common Stock should be prepared to lose

all or substantially all of their investment.

-

There is no continuous

and liquid trading market for our Common Stock and there is no likelihood that any such trading market will ever develop or, if it

does develop, that it can be sustained. As a result, any person who acquires our Common Stock is not acquiring that has or will have

at any time in the future, any liquidity that would allow them to sell our Common Stock without significant delays and/or difficulties.

Further, there is no trading market for our Preferred Stock and there is no prospect that our Preferred Stock will ever be traded in

any market.

-

We have not achieved

profitability, positive cash flow or both of them and there can be no assurance that we will ever achieve profitability, positive cash

flow, or both of them in the future or if we do, that either or both of them can be sustained.

-

We have no history

of paying dividends on our Common Stock and given our lack of profitability and lack of positive cash flow, it is highly unlikely

that we will ever be paying any dividends at any time in the near future.

-

We have not received

any independent third party evaluation of our business plan and the strategies that our Board of Directors has adopted and we have no

present plans to secure any such evaluation. We may discover that notwithstanding our efforts that we expended to secure the Acquisition

Agreement and otherwise conduct our business, all or a significant part of our plans and strategies may not be financially feasible for

any one or more reasons. As a result, our stockholders would likely suffer the total loss of their investment.

-

We face intense

competition from many other larger and well-established competitors who possess significantly greater financial resources than we have

currently and at any time in the foreseeable future.

-

For these reasons

and in view of the high risks and continuing unmitigated uncertainties involved, we cannot assure you that we will ever expect to gain

any financial or other benefits as a result of the Acquisition Agreement. As a result, we may incur further protracted losses and negative

cash flow thereby with the likelihood that our creditors could exercise their rights by way of a petition that would subject us to proceedings

in U.S. Bankruptcy Court and, in that scenario, any holder of our Common Stock and any holder of our Preferred Stock would very likely

suffer the total loss of their investment.

-

All of our securities

should be considered HIGH RISK investments. For these reasons, any person who seeks to acquire our securities should be prepared to lose

all of their investment.

Item 9.01 Financial Tables and Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

ROGUE ONE, INC.

|

|

|

|

|

|

Date: July 2, 2021

|

By:

|

/s/ Joe

E. Poe, Jr.

|

|

|

Name:

|

Joe E. Poe, Jr.

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

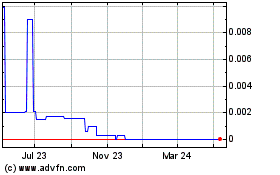

Rogue One (CE) (USOTC:ROAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

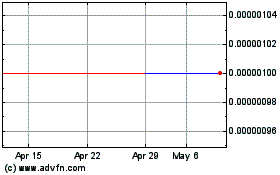

Rogue One (CE) (USOTC:ROAG)

Historical Stock Chart

From Apr 2023 to Apr 2024