UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities

Exchange

Act of 1934 (Amendment No. ____)

Check

the appropriate box:

[ ]

Preliminary Information Statement

[ ]Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[X]Definitive

Information Statement

RESPIRERX

PHARMACEUTICALS INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

[X]

No fee required

[ ]Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

[ ]Fee

paid previously with preliminary materials.

[ ]Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

NOTICE

OF STOCKHOLDER ACTION BY WRITTEN CONSENT

RESPIRERX

PHARMACEUTICALS INC.

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

To

the Stockholders of RespireRx Pharmaceuticals Inc.:

We

Are Not Asking You for a Proxy and You are Requested Not to Send Us a Proxy.

This

Notice and accompanying Information Statement serve to notify the stockholders of RespireRx Pharmaceuticals Inc. (the “Company”)

that a requisite number of stockholders of the Company have approved an increase in the number of authorized shares of common

stock of the Company (“Common Stock”) from 65,000,000 to 1,000,000,000. This increase was approved by written

consents of (i) the holders of a majority of shares of outstanding stock of the Company entitled to vote and (ii) the holders

of a majority of shares of Common Stock, on March 22, 2020. The par value of the shares of Common Stock will not be changed.

The

Company will file a Certificate of Amendment to our Certificate of Incorporation (the “Certificate of Amendment”)

to effect this increase, pursuant to the provisions of the Delaware General Corporation Law. The proposed Certificate of Amendment

will become effective when filed with the Delaware Secretary of State. Such filing will occur no earlier than 20 days after the

Information Statement accompanying this Notice is first mailed to stockholders of record as of March 22, 2020, as required by

Rule 14c-2 of the Securities Exchange Act of 1934, as amended.

Your

vote or consent is not requested or required to approve these matters. The accompanying Information Statement is provided solely

for your information.

|

|

Sincerely,

|

|

|

|

|

|

[ELECTRONIC

SIGNATURE]

|

|

|

|

|

|

/s/ Jeff

Eliot Margolis

|

|

|

Jeff

E. Margolis

|

|

|

SVP,

CFO, Secretary and Treasurer

|

Dated:

April 10, 2020

RESPIRERX

PHARMACEUTICALS INC.

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

INFORMATION

STATEMENT

April

10, 2020

We

Are Not Asking You for a Proxy and You Are Requested Not to Send Us a Proxy.

This

Information Statement is available at www.respirerx.com.

click

on the investors tab and then click on SEC reports

and

then click on the link to this Information Statement.

This

filing is being made as a matter of record only. The corporate action described herein has been completed and is effective in

accordance with Section 228(a) of the Delaware General Corporation Law (the “DGCL”) and the Bylaws of RespireRx

Pharmaceuticals Inc. (the “Company”). Section 228 of the DGCL generally provides that any action required or

permitted to be taken at a meeting of the stockholders may be taken without a meeting upon the written consent of the holders

of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted. No further authorization,

vote or consent is necessary to effect the corporate action, no vote or consent is sought herewith, and no meeting of the stockholders

is sought or required.

The

Company is sending you this Information Statement for the purpose of informing our stockholders of record as of March 22, 2020

(the “Record Date”) in the manner required by Regulation 14C of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). It is also being provided pursuant to Section 228(e) of the DGCL, which requires the

Company to provide prompt notice of the taking of a corporate action by written consent to the Company’s stockholders who

have not consented in writing to such action. This Information Statement is being filed with the Securities and Exchange Commission

on or about April 10, 2020 and will be mailed on or about April 10, 2020, or as soon as practicable thereafter,

to the Company’s stockholders of record. The Company will bear all expenses incurred in connection with the distribution

of the Information Statement and will reimburse brokers and other nominees for expenses that they incur in forwarding this material

to beneficial owners.

Summary

of Corporate Actions

On

March 21, 2020, the Board of Directors of the Company approved a Certificate of Amendment to our Certificate of Incorporation

(the “Certificate of Amendment”), subject to approval by the stockholders, that would increase the number

of authorized shares of common stock of the Company, par value $0.001 per share (“Common Stock”), from 65,000,000

to 1,000,000,000. The Certificate of Amendment does not change the number of authorized shares of preferred stock, which will

remain at 5,000,000. As noted above, under the DGCL and the Company’s Bylaws, the approval of the stockholders for

this increase may be obtained by written consent of holders of a majority of shares of Common Stock, with the Common Stock holders

being the only stockholders of the Company entitled to vote on such measure.

On

March 22, 2020, the Company received written consents from holders of a majority of shares of Common Stock approving the Certificate

of Amendment to increase the number of authorized shares. A copy of the form of the Certificate of Amendment is attached

as Exhibit A to this Information Statement.

The

Company will file the Certificate of Amendment to effect this increase, pursuant to the provisions of the DGCL. The Certificate

of Amendment will become effective when filed with the Delaware Secretary of State. Such filing will occur no earlier than 20

days after this Information Statement is first mailed to stockholders, as required by Rule 14c-2 of the Exchange Act.

Voting

Securities and Principal Holders Thereof

As of the Record Date,

the Company had 31,740,333 shares of Common Stock outstanding and entitled to vote and none of the Company’s outstanding

Preferred Shares were entitled to vote on this matter. Each share of Common Stock is entitled to one vote. The signatories to

the applicable written consents owned 26,052,424 of the then-outstanding shares of Common Stock or approximately 82.1%

of the Company’s total voting power and voting power of Common Stock, voting as a separate class. As of March 23, 2020,

due to the issuance of 259,000 shares of Common Stock processed on that date with respect to an additional conversion

by a holder of a convertible note who did not participate in an exchange agreement, the Company had 31,999,333 shares of Common

Stock outstanding.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth certain information regarding the beneficial ownership of the Company’s common stock as of March

22, 2020, by (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding common

stock, (ii) each of the Company’s directors, (iii) each of the Company’s named executive officers, and (iv) all of

the Company’s executive officers and directors as a group. Except as indicated in the footnotes to this table, the Company

believes that the persons named in this table have sole voting and investment power with respect to the shares of common stock

indicated. In computing the number and percentage ownership of shares beneficially owned by a person, shares of common stock that

a person has a right to acquire within sixty (60) days of March 22, 2020 pursuant to options, warrants or other rights

are considered as outstanding, while these shares are not considered as outstanding for computing the percentage ownership of

any other person or group.

|

Directors, Officers and 5% Stockholders(1)

|

|

Number of Shares

of Beneficial

Ownership

of Common Stock

|

|

|

Percent of Class

|

|

|

|

|

|

|

|

|

|

|

Todd

Binder(2)

15933 Asilomar Blvd.

Pacific Palisades, CA 90272

|

|

|

5,525,017

|

|

|

|

17.16

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Arnold Lippa Family

Trust of 2007(3)

|

|

|

5,641,081

|

|

|

|

17.09

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Dariusz

Naziek(4)

55 Hardwick Lane

Wayne, NJ 07470

|

|

|

5,378,135

|

|

|

|

16.68

|

%

|

|

|

|

|

|

|

|

|

|

|

|

John Safranek MD(5)

3508 Poppleton Avenue

Omaha, NE 68105

|

|

|

3,651,748

|

|

|

|

11.25

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey

Harvey(6)

3521

Rockaway Avenue

Annapolis,

MD 21403

|

|

|

1,634,573

|

|

|

|

5.08

|

%

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTORS AND OFFICERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeff E. Margolis(7)

|

|

|

5,215,867

|

|

|

|

15.87

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Arnold S. Lippa, Ph.D.(8)

|

|

|

1,416

|

|

|

|

0.00

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Timothy Jones(9)

|

|

|

-

|

|

|

|

-

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Kathryn MacFarlane(10)

|

|

|

140,421

|

|

|

|

0.43

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Richard Purcell(11)

|

|

|

263,077

|

|

|

|

0.81

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All directors and officers as a group

|

|

|

5,620,781

|

|

|

|

15.16

|

%

|

|

(1)

|

Except

as otherwise indicated, the address of such beneficial owner is c/o RespireRx Pharmaceuticals Inc., 126 Valley Road, Suite

C, Glen Rock, New Jersey 07452.

|

|

|

|

|

(2)

|

All

of these holdings were acquired on March 22, 2020 pursuant to an exchange agreement resulting in the cancellation of a convertible

promissory note and the issuance of this amount of common stock.

|

|

|

|

|

(3)

|

All

of these holdings were acquired by Dr. Arnold Lippa and subsequently transferred to the Trust, or are held by an entity owned

by the Trust. Dr. Lippa is neither the trustee nor the beneficiary of the Trust. Linda Lippa, his wife, is a beneficiary of

the Trust.

|

|

|

|

|

(4)

|

5,165,371

of these holdings were acquired on March 22, 2020 pursuant to an exchange agreement resulting in the cancellation of a convertible

promissory note and the issuance of this amount of common stock. Additionally, Dr. Nasiek’s holdings include 168,697

shares acquired by the conversion of Series G Convertible Preferred Stock or by exchange of his Convertible Note and the related

Warrant and Extension Warrant and by exchange in respect to the 2015 unit offering. Dr. Nasiek also holds 44,067 warrants.

Some of Dr. Nasiek’s holdings are owned jointly with his spouse.

|

|

|

|

|

(5)

|

3,393,333

of these holdings were acquired on March 22, 2020 pursuant to an exchange agreement resulting in the cancellation of a convertible

promissory note and the issuance of this amount of common stock. Additionally, Dr. Safranek’s holdings include 216,138

shares of common stock acquired in various private placement unit offerings, some of which shares of common stock are held

jointly with his spouse. Also included in Dr. Safranek’s holdings are warrants to purchase 42,277 shares of common stock,

also acquired in various private placement unit offerings. Excluded from Dr. Safranek’s holdings are warrants to purchase

240,000 shares of common stock due to certain blocker provisions prohibiting exercise of such warrant in part or in whole

if such exercise were to increase the investor’s holding above 4.99%.

|

|

|

|

|

(6)

|

1,491,296

of these holdings were acquired on March 22, 2020 pursuant to an exchange agreement resulting

in the cancellation of a convertible promissory note and the issuance of this amount

of common stock. 143,277 of these holdings were acquire in previous exempt private placements.

105,000 are represented by warrants acquired in 2017. Excluded from Mr. Harvey’s

holdings are warrants to purchase 20,000 shares of common stock due to certain blocker

provisions prohibiting exercise of such warrant in part or in whole if such exercise

were to increase the investor’s holding above 4.99%.

|

|

|

|

|

(7)

|

Mr.

Margolis’s holdings were transferred to six trusts of which Mr. Margolis is the trustee of three of those trusts and

Mr. Margolis’ spouse is the trustee of the other three trusts. In the aggregate, the holdings of the trusts include:

(i) 4,546,565 shares of common stock, (ii) options to acquire an additional 664,457 shares of common stock, and (iii)

the 4,845 warrants to purchase shares of common received as an owner of Aurora Capital LLC from the warrants Aurora received

as a placement agent in the sale of the Company’s Common Stock and Warrant Financing.

|

|

|

|

|

(8)

|

Dr.

Lippa’s holdings include: (i) 598 shares of common stock, and (ii) 818 warrants to purchase shares of common stock.

In addition, Dr. Lippa no longer beneficially owns many of the shares of the Company that were initially awarded to him because

he has transferred these shares into family trusts, of which he is neither the trustee nor the beneficiary, including the

Arnold Lippa Family Trust of 2007 as noted in footnote 3 above. In addition, Dr. Lippa has been awarded options to

acquire an additional 15,385 shares of common stock which have been assigned to another family trust for the benefit of other

family members. Dr. Lippa is neither the trustee nor the beneficiary of that trust.

|

|

|

|

|

(9)

|

Timothy

Jones was appointed to the Board of Directors on January 28, 2020. Mr. Jones does not currently own any shares of common stock,

options or warrants or any other securities convertible in common stock.

|

|

|

|

|

(10)

|

Dr.

MacFarlane’s holdings include: (i) 6,153 shares of common stock, and (ii) options to purchase 134,268 shares of common

stock.

|

|

|

|

|

(11)

|

Mr.

Purcell’s holdings include: (i) 6,153 shares of common stock, and (ii) options to purchase 256,924 shares of common

stock.

|

Reason

for Taking Corporate Action

As

described above, the Company has approved the increase in the number of authorized shares of Common Stock. As described in further

detail below, the principal purpose of the increase is to provide the Company with adequate shares to reserve pursuant to contractual

provisions requiring the Company to maintain a number of reserved shares of Common Stock with respect to certain of the Company’s

outstanding convertible notes. Further, the Company has recently effected certain exchange agreements with existing stockholders

resulting in share issuances that have increased the need for an increase in the number of shares available for these share reserves.

The Company also issued shares March 22, 2020 to two officers and directors in exchange for the forgiveness of a portion of their

accrued and unpaid compensation further increasing the need for an increase in the number of shares available for these share

reserves with respect to the Company’s outstanding convertible notes. As a result of these exchanges, and the shares issued

in connection with compensation forgiveness, as of March 22, 2020, the Company had 31,740,333 shares of Common Stock issued and

outstanding, and as of March 23, 2020, due to the issuance of 259,000 shares of Common Stock processed on that date with respect

to an additional conversion by a holder of a convertible note who did not participate in an exchange agreement, the Company had

31,999,333 shares of Common Stock issued and outstanding. The stockholders receiving shares of common stock in these exchanges

as well as the two officers voted in favor of approval of the Certificate of Amendment; however, the consents received from the

shareholders excluding the officers of the Company were sufficient to approve the action.

Given these share issuances

and the resulting decrease in the number of authorized shares of Common Stock available, the approved increase in authorized shares

of Common Stock is intended to ensure compliance going forward with the share reserve covenants contained in the outstanding notes

previously issued by the Company, including convertible notes issued in April, May, August, October and November of 2019. Such

increase in the number of authorized shares of the Company’s Common Stock will also provide for an adequate number

of shares for potential future securities offerings raising equity capital.

The

rights of existing stockholders of Common Stock will not be altered as a result of the increase in authorized shares.

Anti-Takeover

Effects of the Common Stock Increase

A

possible effect of the increase in authorized shares is to discourage a merger, tender offer or proxy contest, or the assumption

of control by a holder of a large block of the Company’s voting securities and the removal of incumbent management. Our

management could use the additional shares of Common Stock available for issuance to resist or frustrate a third-party takeover

effort favored by a majority of the independent stockholders that would provide an above-market premium by issuing additional

shares of Common Stock. As discussed above, the reason for the increase in the number of authorized shares of Common Stock is

to comply with the reserve covenants under its existing convertible notes and so that the Company is able to issue Common Stock

in conjunction with equity financings in the future. Any issuance of the additional authorized shares of Common Stock

could have the effect of diluting any future earnings per share and book value per share of the outstanding shares of our Common

Stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain control

of the Company.

Interests

of Certain Persons in or Opposition to Matters to be Acted Upon

No

officer or director or any associate of such person has any substantial interest in the matters acted upon by our Board and stockholders,

other than his role as a stockholder, officer or director.

Delivery

of Documents to Security Holders Sharing an Address

The

Company will deliver only one copy of this Information Statement to multiple stockholders sharing an address unless the Company

has received contrary instructions from one or more of the stockholders. The Company undertakes to deliver promptly upon written

or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the

Information Statement is delivered. A stockholder can notify us that the stockholder wishes to receive a separate copy of the

Information Statement by contacting the Company at: RespireRx Pharmaceuticals Inc., 126 Valley Road, Suite C, Glen Rock, New Jersey

07452, Attention: Corporate Secretary, or by contacting the Company at its telephone number, 201-444-4947. If multiple stockholders

sharing an address receive multiple Information Statements and wish to receive only one, such stockholders can notify the Company

at the address set forth above.

Financial

and Other Information

We

file reports with the SEC. These reports include annual and quarterly reports, as well as other information the Company is required

to file pursuant to the Exchange Act. For more detailed information on the Company, including financial statements, you may refer

to our periodic filings made with the SEC from time to time, including those in the Company’s Annual Reports on Form

10-K. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC at http://www.sec.gov.

Exhibit

A

Fourth

Certificate of Amendment

of

Second

Restated Certificate of Incorporation

of

RespireRx

Pharmaceuticals Inc.

RespireRx

Pharmaceuticals Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of

the State of Delaware (the “DGCL”), hereby adopts this Fourth Certificate of Amendment (this “Certificate of

Amendment”), which amends its Second Restated Certificate of Incorporation (as amended by the Certificate of Designation

filed March 14, 2014, the Certificate of Amendment filed April 17, 2014, the Second Certificate of Amendment filed December 16,

2015, and the Third Certificate of Amendment filed September 1, 2016, the “Certificate of Incorporation”), as described

below, and does hereby further certify that:

1.

The Board of Directors of the Corporation duly adopted a resolution proposing and declaring advisable the amendment to the Certificate

of Incorporation described herein, and the Corporation’s stockholders duly adopted such amendment, all in accordance with

the provisions of Sections 228 and 242 of the DGCL.

2.

Article FOURTH (A)(1) of the Certificate of Incorporation is hereby amended and restated in its entirety as follows:

FOURTH:

(A)(1) - AUTHORIZED CAPITAL. The total number of shares of capital stock which the Corporation has the authority to issue is 1,005,000,000

consisting of 1,000,000,000 shares of Common Stock, $0.001 par value per share (the “Common Stock”), and 5,000,000

shares of Preferred Stock, $0.001 par value per share (the “Preferred Stock”).

3.

All other provisions of the Certificate of Incorporation shall remain in full force and effect.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by Jeff Margolis, its Secretary, this

[●] day of [●], 2020.

|

|

By:

|

|

|

|

Name:

|

Jeff

Margolis

|

|

|

Title:

|

SVP,

CFO, Secretary and Treasurer

|

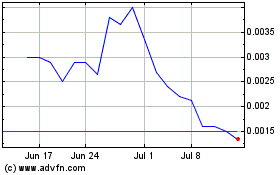

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

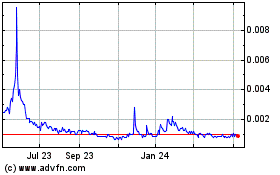

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024