Filed

pursuant to Rule 424(b)(3)

Registration

Statement No. 333-249469

Prospectus

Supplement DATED NOVEMBER 24, 2020

(to

the Prospectus dated October 28, 2020)

RespireRx

Pharmaceuticals Inc.

This

Prospectus Supplement No. 1 supplements and amends the final prospectus dated October 28, 2020 (the “Final Prospectus”)

relating to the resale of up to 115,000,000 shares of our common stock, $0.001 par value per share, issuable to White Lion Capital,

LLC (the “Selling Stockholder”), pursuant to a “put right” under an equity purchase agreement, dated July

28, 2020, as amended, by and between us and the Selling Stockholder. This Prospectus Supplement No. 1 should be read in conjunction

with the Final Prospectus and is qualified by reference to the Final Prospectus except to the extent that the information in this

Prospectus Supplement No. 1 supersedes the information contained in the Final Prospectus.

On

November 23, 2020, we filed with the U.S. Securities and Exchange Commission the attached Quarterly Report on Form 10-Q.

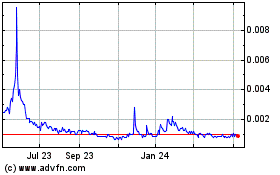

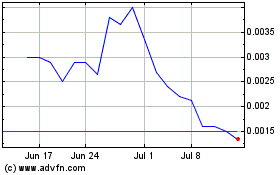

Our

Common Stock is quoted by the OTCQB Venture Market operated by the OTC Markets Group, Inc. (“OTCQB”) under the symbol

“RSPI.” On November 23, 2020, the closing price of our Common Stock was $0.0033 per share.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” beginning on page 7 of the Final Prospectus, and under similar headings in any amendments or

supplements to this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 1 is November 24, 2020

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

[X]

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended September 30, 2020

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

file number: 1-16467

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

33-0303583

|

|

(State

or other jurisdiction of

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Identification

Number)

|

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

(Address

of principal executive offices)

(201)

444-4947

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Yes

[X] No [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer [ ]

|

Accelerated

filer [ ]

|

|

|

|

|

Non-accelerated

filer [X]

|

Smaller

reporting company [X]

|

|

|

|

|

|

Emerging

growth company [ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

[ ] No [X]

As

of November 20, 2020, the Company had 645,649,410, shares of common stock, $0.001 par value, issued and outstanding.

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

TABLE

OF CONTENTS

Cautionary

Note Regarding Forward-Looking Statements

This

Quarterly Report on Form 10-Q of RespireRx Pharmaceuticals Inc. (“RespireRx” and together with RespireRx’s wholly

owned subsidiary, Pier Pharmaceuticals, Inc. (“Pier”), the “Company, “we,” or “our,”

unless the context indicates otherwise) contains certain forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and the Company intends that such forward-looking statements be subject to the safe harbor created

thereby. These might include statements regarding the Company’s future plans, targets, estimates, assumptions, financial

position, business strategy and other plans and objectives for future operations, and assumptions and predictions about research

and development efforts, including, but not limited to, preclinical and clinical research design, execution, timing, costs and

results, future product demand, supply, manufacturing, costs, marketing and pricing factors.

In

some cases, forward-looking statements may be identified by words including “assumes,” “could,” “ongoing,”

“potential,” “predicts,” “projects,” “should,” “will,” “would,”

“anticipates,” “believes,” “intends,” “estimates,” “expects,” “plans,”

“contemplates,” “targets,” “continues,” “budgets,” “may,” or the negative

of these terms or other comparable terminology, although not all forward-looking statements contain these words, and such statements

may include, but are not limited to, statements regarding (i) future research plans, expenditures and results, (ii) potential

collaborative arrangements, (iii) the potential utility of the Company’s products candidates, (iv) reorganization plans,

and (v) the need for, and availability of, additional financing. Forward-looking statements are based on information available

at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results,

levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking

statements in this report.

These

factors include but are not limited to, regulatory policies or changes thereto, available cash, research and development results,

issuance of patents, competition from other similar businesses, interest of third parties in collaborations with us, and market

and general economic factors, and other risk factors disclosed in “Item 1A. Risk Factors” in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on April 14, 2020 (the “2019 Form

10-K”) and in Item 1A. Risk Factors in this report.

You

should read these risk factors and the other cautionary statements made in the Company’s filings as being applicable to

all related forward-looking statements wherever they appear in this report. We cannot assure you that the forward-looking statements

in this report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking

statements. You should read this report completely. Other than as required by law, we undertake no obligation to update or revise

these forward-looking statements, even though our situation may change in the future.

We

caution investors not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize

that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ

materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties

described in the 2019 Form 10-K and in this report, as well as others that we may consider immaterial or do not anticipate

at this time. These forward-looking statements are based on assumptions regarding the Company’s business and technology,

which involve judgments with respect to, among other things, future scientific, economic, regulatory and competitive conditions,

collaborations with third parties, and future business decisions, all of which are difficult or impossible to predict accurately

and many of which are beyond the Company’s control. Although we believe that the expectations reflected in our forward-looking

statements are reasonable, we do not know whether our expectations will prove correct. Our expectations reflected in our forward-looking

statements can be affected by inaccurate assumptions that we might make or by known or unknown risks and uncertainties, including

those described in the 2019 Form 10-K and in this report. These risks and uncertainties are not exclusive and further information

concerning us and our business, including factors that potentially could materially affect our financial results or condition,

may emerge from time to time.

This

discussion should be read in conjunction with the condensed consolidated financial statements (unaudited) and notes thereto included

in Item 1 of this report and in the 2019 Form 10-K, including the section titled “Item 1A. Risk Factors.” Forward-looking

statements speak only as of the date they are made. We advise investors to consult any further disclosures we may make on related

subjects in our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that we file with

or furnish to the SEC.

PART

I - FINANCIAL INFORMATION

ITEM

1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED BALANCE SHEETS

|

|

|

September

30, 2020

|

|

|

December

31, 2019

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

216

|

|

|

$

|

16,690

|

|

|

Prepaid

expenses

|

|

|

56,024

|

|

|

|

28,638

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current

assets

|

|

|

56,240

|

|

|

|

45,328

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

56,240

|

|

|

$

|

45,328

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

DEFICIENCY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

and accrued expenses, including $634,166 and $476,671 payable to related parties at September 30, 2020 and December

31, 2019, respectively

|

|

$

|

4,607,590

|

|

|

$

|

3,772,030

|

|

|

Accrued compensation

and related expenses

|

|

|

1,091,682

|

|

|

|

2,083,841

|

|

|

Convertible notes

payable, currently due and payable on demand, including accrued interest of $79,724 and $113,304 at September 30, 2020

and December 31, 2019, respectively of which $47,526 and $43,666, was deemed to be in default at September 30, 2020

and December 31, 2019 (Note 4)

|

|

|

426,326

|

|

|

|

551,591

|

|

|

Note payable to

SY Corporation, including accrued interest of $399,293 and $363,280 at September 30, 2020 and December 31, 2019, respectively

(payment obligation currently in default – Note 4)

|

|

|

795,098

|

|

|

|

766,236

|

|

|

Notes payable to

officer, including accrued interest of $43,869 and $35,388 as of September 30, 2020 and December 31, 2019, respectively (Note

4)

|

|

|

210,219

|

|

|

|

142,238

|

|

|

Notes payable to

former officer, including accrued interest of $54,691 and $41,977 as of September 30, 2020 and December 31, 2019, respectively

(Note 4)

|

|

|

182,291

|

|

|

|

169,577

|

|

|

Other

short-term notes payable

|

|

|

31,219

|

|

|

|

4,634

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current

liabilities

|

|

|

7,344,425

|

|

|

|

7,490,147

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note

8)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficiency: (Note

6)

|

|

|

|

|

|

|

|

|

|

Series B convertible

preferred stock, $0.001 par value; $0.6667 per share liquidation preference; aggregate liquidation preference $25,001; shares

authorized: 37,500; shares issued and outstanding: 11; common shares issuable upon conversion at 0.00030 common shares per

Series B share

|

|

|

21,703

|

|

|

|

21,703

|

|

|

Common stock, $0.001

par value; shares authorized: 1,000,000,000; shares issued and outstanding: 577,842,003 at September 30, 2020 and 4,175,072

at December 31, 2019, respectively (Note 2 and Note 9)

|

|

|

577,842

|

|

|

|

4,175

|

|

|

Additional paid-in

capital

|

|

|

161,863,565

|

|

|

|

159,038,388

|

|

|

Accumulated

deficit

|

|

|

(169,751,295

|

)

|

|

|

(166,509,085

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’

deficiency

|

|

|

(7,288,185

|

)

|

|

|

(7,444,819

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

and stockholders’ deficiency

|

|

$

|

56,240

|

|

|

$

|

45,328

|

|

See

accompanying notes to condensed consolidated financial statements (unaudited).

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three

Months Ended

|

|

|

Nine

Months Ended

|

|

|

|

|

September

30,

|

|

|

September

30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2020

|

|

|

2019

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General

and administrative, including $492,900 and $121,600 to related parties for the three months ended September

30, 2020 and 2019, respectively, and $725,780 and $364,825 to related parties for the nine months ended September

30, 2020 and 2019, respectively

|

|

$

|

1,140,204

|

|

|

$

|

279,930

|

|

|

$

|

1,969,223

|

|

|

$

|

874,834

|

|

|

Research

and development, including $144,900 and $122,400 to related parties for the three months ended September 30,

2020 and 2019, respectively, and $389,700 and $367,200 to related parties for the nine months ended September

30, 2020 and 2019, respectively

|

|

|

171,776

|

|

|

|

150,527

|

|

|

|

480,242

|

|

|

|

447,877

|

|

|

Total operating

expenses

|

|

|

1,311,980

|

|

|

|

430,457

|

|

|

|

2,449,465

|

|

|

|

1,322,711

|

|

|

Loss from operations

|

|

|

(1,311,980

|

)

|

|

|

(430,457

|

)

|

|

|

(2,449,465

|

)

|

|

|

(1,322,711

|

)

|

|

Loss on extinguishment of debt and other

liabilities in exchange for equity

|

|

|

(65,906

|

)

|

|

|

-

|

|

|

|

(389,902

|

)

|

|

|

-

|

|

|

Interest expense, including $2,848

and $2,589 to related parties for the three months ended September 30, 2020 and 2019, respectively, and $8,481

and $7,683 to related parties for the nine months ended September 30, 2020 and 2019, respectively

|

|

|

(78,678

|

)

|

|

|

(70,168

|

)

|

|

|

(409,994

|

)

|

|

|

(221,813

|

)

|

|

Foreign currency

transaction gain (loss)

|

|

|

(22,791

|

)

|

|

|

30,781

|

|

|

|

7,151

|

|

|

|

57,135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable

to common stockholders

|

|

$

|

(1,479,355

|

)

|

|

$

|

(469,844

|

)

|

|

$

|

(3,242,210

|

)

|

|

$

|

(1,487,389

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per

common share - basic and diluted

|

|

$

|

(0.01

|

)

|

|

$

|

(0.12

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.38

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average

common shares outstanding - basic and diluted

|

|

|

224,352,033

|

|

|

|

3,874,465

|

|

|

|

131,793,037

|

|

|

|

3,873,097

|

|

See

accompanying notes to condensed consolidated financial statements (unaudited).

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIENCY

(Unaudited)

Nine

months Ended September 30, 2020

|

|

|

Series

B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

|

|

Preferred

Stock

|

|

|

Common

Stock

|

|

|

Paid-in

|

|

|

Accumulated

|

|

|

Stockholders’

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Par

Value

|

|

|

Capital

|

|

|

Deficit

|

|

|

Deficiency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2019

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

4,175,072

|

|

|

$

|

4,175

|

|

|

$

|

159,038,388

|

|

|

$

|

(166,509,085

|

)

|

|

$

|

(7,444,819

|

)

|

|

Issuances of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

29,518,781

|

|

|

|

29,519

|

|

|

|

910,599

|

|

|

|

-

|

|

|

|

940,118

|

|

|

Net loss for the three months ended

March 31, 2020

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(946,718

|

)

|

|

|

(946,718

|

)

|

|

Balance, March 31, 2020

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

33,693,853

|

|

|

$

|

33,694

|

|

|

$

|

159,948,987

|

|

|

$

|

(167,455,803

|

|

|

$

|

(7,451,419

|

)

|

|

Issuances of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

188,613,528

|

|

|

|

188,613

|

|

|

|

142,195

|

|

|

|

-

|

|

|

|

330,808

|

|

|

Note discounts

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

90,000

|

|

|

|

-

|

|

|

|

90,000

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(816,137

|

)

|

|

|

(816,137

|

)

|

|

Balance, June 30, 2020

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

222,307,381

|

|

|

$

|

222,307

|

|

|

$

|

160,181,182

|

|

|

$

|

(168,271,940

|

)

|

|

$

|

(7,846,748

|

)

|

|

Issuances of common stock (after issuance

and full conversion of Series H Preferred Stock)

|

|

|

-

|

|

|

|

-

|

|

|

|

253,774,260

|

|

|

|

253,774

|

|

|

|

1,435,910

|

|

|

|

-

|

|

|

|

1,685,234

|

|

|

Note payable conversions

|

|

|

-

|

|

|

|

-

|

|

|

|

13,550,801

|

|

|

|

13,551

|

|

|

|

(2,817

|

)

|

|

|

-

|

|

|

|

10,734

|

|

|

Option grants

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

337,500

|

|

|

|

-

|

|

|

|

337,500

|

|

|

Warrant exercises

|

|

|

-

|

|

|

|

-

|

|

|

|

88,209,561

|

|

|

|

88,210

|

|

|

|

(88,210

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,479,355

|

)

|

|

|

(1,479,355

|

)

|

|

Balance, September 30, 2020

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

577,842,003

|

|

|

$

|

577,842

|

|

|

$

|

161,863,565

|

|

|

$

|

(169,751,295

|

)

|

|

$

|

(7,288,185

|

)

|

Nine

months Ended September 30, 2019

|

|

|

Series

B

Convertible

Preferred Stock

|

|

|

Common

Stock

|

|

|

Additional

Paid-in

|

|

|

Accumulated

|

|

|

Total

Stockholders’

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Par

Value

|

|

|

Capital

|

|

|

Deficit

|

|

|

Deficiency

|

|

|

Balance, December 31, 2018

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

3,872,076

|

|

|

$

|

3,872

|

|

|

$

|

158,635,222

|

|

|

$

|

(164,394,052

|

)

|

|

$

|

(5,733,255

|

)

|

|

Fair value of common stock warrants

issued in connection with convertible notes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

45,812

|

|

|

|

-

|

|

|

|

45,812

|

|

|

Net loss for the three months ended

March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(540,332

|

)

|

|

$

|

(540,332

|

)

|

|

Balance at March 31, 2019

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

3,872,076

|

|

|

$

|

3,872

|

|

|

$

|

158,681,034

|

|

|

$

|

(164,934,384

|

)

|

|

$

|

(6,227,775

|

)

|

|

Fair value of common stock warrants

and beneficial conversion feature associated with convertible notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

87,950

|

|

|

|

|

|

|

$

|

87,950

|

|

|

Net loss for the three months ended

June 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(477,213

|

)

|

|

|

(477,213

|

)

|

|

Balance, June 30, 2019

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

3,872,076

|

|

|

$

|

3,872

|

|

|

$

|

158,768,984

|

|

|

$

|

(165,411,597

|

)

|

|

$

|

(6,617,038

|

)

|

|

Fair value of common stock, warrants

and beneficial conversion feature associated with convertible notes

|

|

|

|

|

|

|

|

|

|

|

7,500

|

|

|

|

8

|

|

|

|

47,493

|

|

|

|

|

|

|

|

47,501

|

|

|

Net loss for the three months ended

September 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(469,844

|

)

|

|

|

(469,844

|

)

|

|

Balance, September 30, 2019

|

|

|

37,500

|

|

|

$

|

21,703

|

|

|

|

3,879,576

|

|

|

$

|

3,880

|

|

|

$

|

158,816,477

|

|

|

$

|

(165,881,441

|

)

|

|

$

|

(7,039,381

|

)

|

See

accompanying notes to condensed consolidated financial statements (unaudited).

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Nine

Months

Ended

September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(3,242,210

|

)

|

|

$

|

(1,487,389

|

)

|

|

Adjustments to reconcile

net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Amortization of debt

discounts and debt issuance costs

|

|

|

301,515

|

|

|

|

122,373

|

|

|

Loss on extinguishment

of debt and other liabilities

|

|

|

389,902

|

|

|

|

-

|

|

|

Stock-based compensation

|

|

|

337,500

|

|

|

|

|

|

|

Foreign currency

transaction (gain) loss

|

|

|

(7,151

|

)

|

|

|

(57,135

|

)

|

|

Changes in operating

assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

(27,385

|

)

|

|

|

(15,743

|

)

|

|

Accounts payable

and accrued expenses

|

|

|

1,062,163

|

|

|

|

432,579

|

|

|

Accrued compensation

and related expenses

|

|

|

700,540

|

|

|

|

585,900

|

|

|

Accrued interest

payable

|

|

|

134,402

|

|

|

|

105,724

|

|

|

Net cash used in

operating activities

|

|

|

(350,724

|

)

|

|

|

(313,691

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from convertible

notes borrowings

|

|

|

274,750

|

|

|

|

263,501

|

|

|

Debt issuance costs

|

|

|

-

|

|

|

|

(8,000

|

)

|

|

Proceeds from issuance

of note payable to officer

|

|

|

59,500

|

|

|

|

25,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided

by financing activities

|

|

|

334,250

|

|

|

|

280,501

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents:

|

|

|

|

|

|

|

|

|

|

Net decrease

|

|

|

(16,474

|

)

|

|

|

(33,190

|

)

|

|

Balance at beginning of period

|

|

|

16,690

|

|

|

|

33,284

|

|

|

Balance at end of period

|

|

$

|

216

|

|

|

$

|

94

|

|

(Continued)

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Continued)

|

|

|

Nine

Months

Ended September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|

Cash paid for -

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

4,506

|

|

|

$

|

4,936

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash financing activities:

|

|

|

|

|

|

|

|

|

|

Beneficial

Conversion Feature associated with convertible debt

|

|

$

|

90,000

|

|

|

|

-

|

|

|

Debt

and accrued interest converted to common stock

|

|

$

|

975,660

|

|

|

$

|

-

|

|

|

Issuance

of common stock for accrued compensation and benefits

|

|

$

|

1,684,218

|

|

|

$

|

-

|

|

|

Issuance of common stock for accounts payable

|

|

$

|

307,015

|

|

|

$

|

-

|

|

|

Issuance

of warrants for with Series H conversion

|

|

$

|

1,268,871

|

|

|

|

|

|

|

Issuance

of common stock with 10% convertible notes

|

|

|

-

|

|

|

$

|

1,588

|

|

|

Warrants

issued with convertible debt

|

|

$

|

44,451

|

|

|

|

80,968

|

|

|

Cashless

warrant exercises

|

|

$

|

103,848

|

|

|

$

|

-

|

|

|

Original

issue discounts associated with convertible debt

|

|

$

|

19,250

|

|

|

$

|

15,500

|

|

|

Issuance of note payable for equity raising costs

|

|

$

|

40,000

|

|

|

$

|

-

|

|

See

accompanying notes to condensed consolidated financial statements (unaudited).

RESPIRERX

PHARMACEUTICALS INC.

AND

SUBSIDIARY

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1.

Organization and Basis of Presentation

Organization

RespireRx

Pharmaceuticals Inc. (“RespireRx”) was formed in 1987 under the name Cortex Pharmaceuticals, Inc. to engage in the

discovery, development and commercialization of innovative pharmaceuticals for the treatment of neurological and psychiatric disorders.

On December 16, 2015, RespireRx filed a Certificate of Amendment to its Second Restated Certificate of Incorporation (as amended,

the “Certificate of Incorporation”) with the Secretary of State of the State of Delaware to amend its Second Restated

Certificate of Incorporation to change its name from Cortex Pharmaceuticals, Inc. to RespireRx Pharmaceuticals Inc. In August

2012, RespireRx acquired Pier Pharmaceuticals, Inc. (“Pier”), which is now a wholly owned subsidiary. Pier was a clinical

stage biopharmaceutical company developing a pharmacologic treatment for obstructive sleep apnea (“OSA”) and had been

engaged in research and clinical development activities which activities are now in RespireRx.

Basis

of Presentation

The

condensed consolidated financial statements are of RespireRx and its wholly owned subsidiary, Pier (collectively referred to herein

as the “Company,” “we” or “our,” unless the context indicates otherwise). The condensed consolidated

financial statements of the Company at September 30, 2020 and for the three months and nine months ended September 30, 2020 and

2019, are unaudited. In the opinion of management, all adjustments (including normal recurring adjustments) have been made that

are necessary to present fairly the consolidated financial position of the Company as of September 30, 2020, the results of its

consolidated operations for the three months and nine months ended September 30, 2020 and 2019, changes in its consolidated statements

of stockholders’ deficiency for the nine months ended September 30, 2020 and 2019 and its consolidated cash flows for the

nine months ended September 30, 2020 and 2019. Consolidated operating results for the interim periods presented are not necessarily

indicative of the results to be expected for a full fiscal year. The consolidated balance sheet at December 31, 2019 has been

derived from the Company’s audited consolidated financial statements at such date.

The

condensed consolidated financial statements and related notes have been prepared pursuant to the rules and regulations of the

Securities and Exchange Commission (the “SEC”). Accordingly, certain information and note disclosures normally included

in financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP”)

have been omitted pursuant to such rules and regulations. These condensed consolidated financial statements should be read in

conjunction with the consolidated financial statements and other information included in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC.

2.

Business

The

mission of the Company is to develop innovative and revolutionary treatments to combat disorders caused by disruption of neuronal

signaling. We are developing treatment options that address conditions that affect millions of people, but for which there are

limited or poor treatment options, including OSA, attention deficit hyperactivity disorder (“ADHD”) epilepsy, chronic

pain, including inflammatory and neuropathic pain, recovery from spinal cord injury (“SCI”), as well as other areas

of interest based on results of animal studies to date.

RespireRx

is developing a pipeline of new drug products based on our broad patent portfolios across two distinct drug platforms:

|

|

(i)

|

our

pharmaceutical cannabinoids platform (which we refer to as ResolutionRx), including dronabinol (a synthetic form of ∆9-tetrahydrocannabinol

(“Δ9-THC”)), which acts upon the nervous system’s endogenous cannabinoid receptors, and

|

|

|

|

|

|

|

(ii)

|

our

neuromodulators platform (which we refer to as EndeavourRx) is made up of two

programs: (a) our ampakines program, including proprietary compounds that are

positive allosteric modulators (“PAMs”) of AMPA-type glutamate

receptors to promote neuronal function and (b) our GABAkines program, including proprietary

compounds that are PAMs of GABAA receptors, which was recently

established pursuant to our entry with the University of Wisconsin-Milwaukee Research

Foundation, Inc., an affiliate of the University of Wisconsin-Milwaukee (“UWMRF”),

into a patent license agreement (the UWMRF Patent License Agreement”).

|

Financing

our Platforms

Our

major challenge has been to raise substantial equity or equity-linked financing to support research and development plans for

our cannabinoid and neuromodulator platforms, while minimizing the dilutive effect to pre-existing stockholders. At present, we

believe that we are hindered primarily by our public corporate structure, our OTCQB listing, and low market capitalization as

a result of our low stock price. For this reason, the Company is considering an internal restructuring plan that contemplates

spinning out our two drug platforms into separate operating businesses or subsidiaries.

We

believe that by creating one or more subsidiaries to further the aims of Project ResolutionRx and Project EndeavourRx, it may

be possible, through separate finance channels, to optimize the asset values of both the cannabinoid platform and the neuromodulator

platform.

Going

Concern

The

Company’s condensed consolidated financial statements have been presented on the basis that it is a going concern, which

contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company has incurred

net losses of $3,242,210 for the nine months ended September 30, 2020 and $2,115,033 for the fiscal year ended December 31, 2019

respectively, as well as negative operating cash flows of $350,724 for the nine months ended September 30, 2020 and $487,745

for the fiscal year ended December 31, 2019. The Company also had a stockholders’ deficiency of $7,288,185 at September

30, 2020 and expects to continue to incur net losses and negative operating cash flows for at least the next few years. As a result,

management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern, and

the Company’s independent registered public accounting firm, in its audit report on the Company’s consolidated financial

statements for the year ended December 31, 2019, expressed substantial doubt about the Company’s ability to continue as

a going concern.

The

Company is currently, and has for some time, been in significant financial distress. It has extremely limited cash resources and

current assets and has no ongoing source of sustainable revenue. Management is continuing to address various aspects of the Company’s

operations and obligations, including, without limitation, debt obligations, financing requirements, establishment of new and

maintenance and improvement of existing and in-process intellectual property, licensing agreements, legal and patent matters and

regulatory compliance, and has taken steps to continue to raise new debt and equity capital to fund the Company’s business

activities from both related and unrelated parties to fund the Company’s business activities.

The

Company is continuing its efforts to raise additional capital in order to be able to pay its liabilities and fund its business

activities on a going forward basis, including the pursuit of the Company’s planned research and development activities.

The Company regularly evaluates various measures to satisfy the Company’s liquidity needs, including development and other

agreements with collaborative partners and, when necessary, seeking to exchange or restructure the Company’s outstanding

securities. The Company is evaluating certain changes to its operations and structure to facilitate raising capital from sources

that may be interested in financing only discrete aspects of the Company’s development programs. Such changes could include

a significant reorganization, which may include the formation of one or more subsidiaries into which one or more of our programs

may be contributed. As a result of the Company’s current financial situation, the Company has limited access to external

sources of debt and equity financing. Accordingly, there can be no assurances that the Company will be able to secure additional

financing in the amounts necessary to fully fund its operating and debt service requirements. If the Company is unable to access

sufficient cash resources, the Company may be forced to discontinue its operations entirely and liquidate.

3.

Summary of Significant Accounting Policies

Principles

of Consolidation

The

accompanying condensed consolidated financial statements are prepared in accordance with United States generally accepted accounting

principles (“GAAP”) and include the financial statements of RespireRx and its wholly owned subsidiary, Pier. Intercompany

balances and transactions have been eliminated in consolidation.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions. These estimates

and assumptions affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates

include, among other things, accounting for potential liabilities, and the assumptions used in valuing stock-based compensation

issued for services. Actual amounts may differ from those estimates.

Concentration

of Credit Risk

Financial

instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents.

The Company limits its exposure to credit risk by investing its cash with high quality financial institutions. The Company’s

cash balances may periodically exceed federally insured limits. The Company has not experienced a loss in such accounts to date.

Value

of Financial Instruments

The

authoritative guidance with respect to value of financial instruments established a value hierarchy that prioritizes the inputs

to valuation techniques used to measure value into three levels and requires that assets and liabilities carried at value be classified

and disclosed in one of three categories, as presented below. Disclosure as to transfers into and out of Levels 1 and 2, and activity

in Level 3 value measurements, is also required.

Level

1. Observable inputs such as quoted prices in active markets for an identical asset or liability that the Company has the ability

to access as of the measurement date. Financial assets and liabilities utilizing Level 1 inputs include active-exchange traded

securities and exchange-based derivatives.

Level

2. Inputs, other than quoted prices included within Level 1, which are directly observable for the asset or liability or indirectly

observable through corroboration with observable market data. Financial assets and liabilities utilizing Level 2 inputs include

fixed income securities, non-exchange based derivatives, mutual funds, and fair-value hedges.

Level

3. Unobservable inputs in which there is little or no market data for the asset or liability which requires the reporting entity

to develop its own assumptions. Financial assets and liabilities utilizing Level 3 inputs include infrequently traded, non-exchange-based

derivatives and commingled investment funds, and are measured using present value pricing models.

The

Company determines the level in the value hierarchy within which each value measurement falls in its entirety, based on the lowest

level input that is significant to the value measurement in its entirety. In determining the appropriate levels, the Company performs

an analysis of the assets and liabilities at each reporting period end.

The

carrying amounts of financial instruments (consisting of cash, cash equivalents, and accounts payable and accrued expenses) are

considered by the Company to be representative of the respective values of these instruments due to the short-term nature of those

instruments. With respect to the note payable to SY Corporation (as defined below) and the convertible notes payable, management

does not believe that the credit markets have materially changed for these types of borrowings since the original borrowing date.

The Company considers the carrying amounts of the notes payable to officers, inclusive of accrued interest, to be representative

of the respective values of such instruments due to the short-term nature of those instruments and their terms.

Deferred

Financing Costs

Costs

incurred in connection with ongoing debt and equity financings, including legal fees, are deferred until the related financing

is either completed or abandoned.

Costs

related to abandoned debt or equity financings are charged to operations in the period of abandonment. Costs related to completed

equity financings are netted against the proceeds.

Capitalized

Financing Costs

The

Company presents debt issuance costs related to debt obligations in its consolidated balance sheet as a direct deduction from

the carrying amount of that debt obligation, consistent with the presentation for debt discounts.

Convertible

Notes Payable

Convertible

notes are evaluated to determine if they should be recorded at amortized cost. To the extent that there are associated warrants

or a beneficial conversion feature, the convertible notes and warrants are evaluated to determine if there are embedded derivatives

to be identified, bifurcated and valued in connection with and at the time of such financing.

Notes

Exchanges

In

cases where debt or other liabilities are exchanged for equity, the Company compares the carrying value of debt, inclusive of

accrued interest, if applicable, being exchanged, to the value of the equity issued and records any loss or gain as a result of

such exchange. See Note 4. Notes Payable.

Extinguishment

of Debt and Settlement of Liabilities

The

Company accounts for the extinguishment of debt and settlement of liabilities by comparing the carrying value of the debt or liability

to the value of consideration paid or assets given up and recognizing a loss or gain in the condensed consolidated statement of

operations in the amount of the difference in the period in which such transaction occurs.

Prepaid

Insurance

Prepaid

insurance represents the premium paid in March 2020 for directors and officers insurance, as well as the amortized amount of an

April 2020 premium payment for office-related insurances and clinical trial coverage. Directors’ and Officers’ insurance

tail coverage, purchased in March 2013 expired in March 2020 and all prepaid amounts have been fully amortized. The amounts of

prepaid insurance amortizable in the ensuing twelve-month period are recorded as prepaid insurance in the Company’s consolidated

balance sheet at each reporting date and amortized to the Company’s consolidated statement of operations for each reporting

period.

Stock-Based

Awards

RespireRx

periodically issues its common stock, par value $0.001 (“Common

Stock”) and stock options to officers, directors, Scientific Advisory Board members, consultants and vendors for services

rendered. Such issuances vest and expire according to terms established at the issuance date of each grant.

The

Company accounts for stock-based payments to officers, directors, outside consultants and vendors by measuring the cost of services

received in exchange for equity awards based on the grant date value of the awards, with the cost recognized as compensation expense

on the straight-line basis in the Company’s consolidated financial statements over the vesting period of the awards.

Stock

grants, which are sometimes subject to time-based vesting, are measured at the grant date fair value and charged to operations

ratably over the vesting period.

Stock

options granted to members of the Company’s outside consultants and other vendors are valued on the grant date. As the stock

options vest, the Company recognizes this expense over the period in which the services are provided.

The

value of stock options granted as stock-based payments is determined utilizing the Black-Scholes option-pricing model, and is

affected by several variables, the most significant of which are the life of the equity award, the exercise price of the stock

option as compared to the fair market value of the common stock on the grant date, and the estimated volatility of the common

stock over the term of the equity award. Estimated volatility is based on the historical volatility of the Company’s common

stock. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant. The fair market value

of common stock is determined by reference to the quoted market price of the Company’s common stock.

Stock

options and warrants issued to non-employees as compensation for services to be provided to the Company or in settlement of debt

are accounted for based upon the fair value of the services provided or the estimated fair value of the stock option or warrant,

whichever can be more clearly determined. Management uses the Black-Scholes option-pricing model to determine the fair value of

the stock options and warrants issued by the Company. The Company recognizes this expense over the period in which the services

are provided.

The

Company recognizes the value of stock-based payments in general and administrative costs and in research and development costs,

as appropriate, in the Company’s condensed consolidated statements of operations. The Company issues new shares of common

stock to satisfy stock option and warrant exercises.

Income

Taxes

The

Company accounts for income taxes under an asset and liability approach for financial accounting and reporting for income taxes.

Accordingly, the Company recognizes deferred tax assets and liabilities for the expected impact of differences between the financial

statements and the tax basis of assets and liabilities.

The

Company records a valuation allowance to reduce its deferred tax assets to the amount that is more likely than not to be realized.

In the event the Company was to determine that it would be able to realize its deferred tax assets in the future in excess of

its recorded amount, an adjustment to the deferred tax assets would be credited to operations in the period such determination

was made. Likewise, should the Company determine that it would not be able to realize all or part of its deferred tax assets in

the future, an adjustment to the deferred tax assets would be charged to operations in the period such determination was made.

Pursuant

to Internal Revenue Code Sections 382 and 383, use of the Company’s net operating loss and credit carryforwards may be limited

if a cumulative change in ownership of more than 50% occurs within any three-year period since the last ownership change. The

Company may have had a change in control under these Sections. However, the Company does not anticipate performing a complete

analysis of the limitation on the annual use of the net operating loss and tax credit carryforwards until the time that it anticipates

it will be able to utilize these tax attributes.

As

of September 30, 2020, the Company did not have any unrecognized tax benefits related to various federal and state income tax

matters and does not anticipate any material amount of unrecognized tax benefits within the next 12 months.

The

Company is subject to U.S. federal income taxes and income taxes of various state tax jurisdictions. As the Company’s net

operating losses have yet to be utilized, all previous tax years remain open to examination by Federal authorities and other jurisdictions

in which the Company currently operates or has operated in the past.

The

Company accounts for uncertainties in income tax law under a comprehensive model for the financial statement recognition, measurement,

presentation and disclosure of uncertain tax positions taken or expected to be taken in income tax returns as prescribed by GAAP.

The tax effects of a position are recognized only if it is “more-likely-than-not” to be sustained by the taxing authority

as of the reporting date. If the tax position is not considered “more-likely-than-not” to be sustained, then no benefits

of the position are recognized. As of September 30, 2020, the Company had not recorded any liability for uncertain tax positions.

In subsequent periods, any interest and penalties related to uncertain tax positions will be recognized as a component of income

tax expense.

Foreign

Currency Transactions

The

note payable to SY Corporation (as defined below), which is denominated in a foreign currency (the South Korean Won), is translated

into the Company’s functional currency (the United States Dollar) at the exchange rate on the balance sheet date. The foreign

currency exchange gain or loss resulting from translation is recognized in the related condensed consolidated statements of operations.

Research

and Development

Research

and development costs include compensation paid to management directing the Company’s research and development activities,

including but not limited to compensation paid to our Chief Scientific Officer and fees paid to consultants and outside service

providers and organizations (including research institutes at universities), and other expenses relating to the acquisition, design,

development and clinical testing of the Company’s treatments and product candidates.

License

Agreements

Obligations

incurred with respect to mandatory payments provided for in license agreements are recognized ratably over the appropriate period,

as specified in the underlying license agreement, and are recorded as liabilities in the Company’s condensed consolidated

balance sheet, with a corresponding charge to research and development costs in the Company’s condensed consolidated statement

of operations. Obligations incurred with respect to milestone payments provided for in license agreements are recognized when

it is probable that such milestone will be reached and are recorded as liabilities in the Company’s condensed consolidated

balance sheet, with a corresponding charge to research and development costs in the Company’s condensed consolidated statement

of operations. Payments of such liabilities are made in the ordinary course of business.

Patent

Costs

Due

to the significant uncertainty associated with the successful development of one or more commercially viable products based on

the Company’s research efforts and any related patent applications, all patent costs, including patent-related legal and

filing fees, are expensed as incurred and recorded as general and administrative expenses.

Earnings

per Share

The

Company’s computation of earnings per share (“EPS”) includes basic and diluted EPS. Basic EPS is measured as

the income (loss) attributable to common stockholders divided by the weighted average common shares outstanding for the period.

Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (e.g., warrants

and options) as if they had been converted at the beginning of the periods presented, or issuance date, if later. Potential common

shares that have an anti-dilutive effect (i.e., those that increase income per share or decrease loss per share) are excluded

from the calculation of diluted EPS.

Net

loss attributable to common stockholders consists of net loss, as adjusted for actual and deemed preferred stock dividends declared,

amortized or accumulated.

Loss

per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during

the respective periods. Basic and diluted loss per common share is the same for all periods presented because all warrants and

stock options outstanding are anti-dilutive.

At

September 30, 2020 and 2019, the Company excluded the outstanding securities summarized below, which entitle the holders thereof

to acquire shares of common stock, from its calculation of earnings per share, as their effect would have been anti-dilutive.

|

|

|

September

30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Series B convertible preferred

stock

|

|

|

11

|

|

|

|

11

|

|

|

Convertible notes payable

|

|

|

47,239,857

|

|

|

|

867,200

|

|

|

Common stock warrants

|

|

|

288,093,579

|

|

|

|

2,016,043

|

|

|

Common stock

options

|

|

|

71,660,938

|

|

|

|

4,287,609

|

|

|

Total

|

|

|

406,994,385

|

|

|

|

7,170,863

|

|

Reclassifications

Certain

comparative figures in 2019 have been reclassified to conform to the current quarter’s presentation. These reclassifications

were immaterial, both individually and in the aggregate.

Recent

Accounting Pronouncements

In

August 2020, the FASB issued Accounting Standards Update No. 2020-06, Debt – Debt with Conversion and Other Options (Subtopic

470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40). The subtitle is Accounting

for Convertible Instruments and Contracts in an Entity’s Own Equity. This Accounting Standard Update (“ASU”)

addresses complex financial instruments that have characteristics of both debt and equity. The application of this ASU would reduce

the number of accounting models for convertible debt instruments and convertible preferred stock. Limiting the accounting models

would result in fewer embedded conversion features being separately recognized from the host contract as compared with current

GAAP. Convertible instruments that continue to be subject to separation models are (1) those with embedded conversion features

that are not clearly and closely related to the host contract, that meet the definition of a derivative, and that do not qualify

for a scope exception from derivative accounting and (2) convertible debt instruments issued with substantial premiums for which

the premiums are recorded as paid-in capital. The Company has historically issued complex financial instruments and has considered

whether embedded conversion features have existed within those contracts or whether derivatives would appropriately be bifurcated.

To date, no such bifurcation has been necessary. However, it is possible that this ASU may have a substantial impact on the Company’s

financial statements. Management is evaluating the potential impact. This ASU becomes effective for fiscal years beginning after

December 15, 2023.

In

March 2020, The FASB issued Accounting Standards Update No. 2020-03, Codification Improvements to Financial Instruments. There

are seven issues addressed in this update. Issues 1 through 5 were clarifications and codifications of previous updates. Issue

3 relates only to depository and lending institutions and therefore would not be applicable to the Company. Issue 6 was a clarification

on determining the contractual term of a net investment in a lease for purposes of measuring expected credit losses, an issue

not applicable to the Company. Issue 7 relates to the regaining control of financial assets sold and the recordation of an allowance

for credit losses. The amendment related to issues 1, 2, 4 and 5 become effective immediately upon adoption of the update. Issue

3 becomes effective for fiscal years beginning after December 15, 2019. Issues 6 and 7 become effective on varying dates that

relate to the dates of adoption other updates. Management’s initial analysis is that it does not believe the new guidance

will substantially impact the Company’s financial statements.

In

December 2019, the FASB issued an amendment to the guidance on income taxes which is intended to simplify the accounting for income

taxes. The amendment eliminates certain exceptions related to the approach for intra-period tax allocation, the methodology for

calculating income taxes in an interim period, and the recognition of the deferred tax liabilities for outside basis differences.

The amendment also clarifies existing guidance related to the recognition of franchise tax, the evaluation of a step up in the

tax basis of goodwill, and the effects of enacted changes in tax laws or rates in the effective tax rate computation, among other

clarifications. The guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December

15, 2020. Management is currently evaluating the impact the guidance will have on our consolidated financial statements.

In

June 2016, the FASB issued an amendment to the guidance on the measurement of credit losses on financial instruments. The amendment

updates the guidance for measuring and recording credit losses on financial assets measured and amortized cost by replacing the

“incurred loss” model with an “expected loss” model. Accordingly, these financial assets will be presented

at the net amount expected to be collected. The amendment also requires that credit losses related to available-for-sale debt

securities be recorded as an allowance through net income rather than reducing the carrying amount under the current, other-than-temporary-impairment

model. The guidance is effective for smaller reporting companies for fiscal years beginning after December 15, 2022 including

interim periods within those fiscal years. Early adoption is permitted for annual periods after December 15, 2018. Management

is currently evaluating the impact the guidance will have on our consolidated financial statements.

4.

Notes Payable

Convertible

Notes Payable

Q3

2020 Convertible Notes

Convertible

Note with EMA Financial, LLC

On

July 30, 2020, RespireRx and EMA Financial, LLC (“EMA”) entered into a Securities Purchase Agreement (the “EMA

SPA”) by which EMA provided a sum of $68,250 (the “EMA Consideration”) to RespireRx, in return for a fixed rate

convertible note (the “EMA Note”) with a face amount of $75,000, and a common stock purchase warrant (the “EMA

Warrant”) for 3,750,000 shares of Common Stock. The net proceeds received by RespireRx on August 4, 2020 were $63,750

after payment of $3,500 in EMA’s legal fees and the withholding by EMA of $1,000 in diligence fees.

The

EMA Note obligates RespireRx to pay by October 30, 2021 (the “EMA Maturity Date”) a principal amount of $75,000 together

with interest at a rate equal to 10% per annum, which principal exceeds the EMA Consideration by the amount of an original issue

discount of $6,750. Any amount of principal or interest that is not paid by the EMA Maturity Date would bear interest at the rate

of 24% from the EMA Maturity Date to the date such amount is paid.

EMA

has the right, in its discretion, at any time, to convert any outstanding and unpaid amount of the EMA Note into shares of Common

Stock, provided that such conversion would not result in EMA beneficially owning more than 4.99% of RespireRx’s then outstanding

Common Stock. In the absence of an event of default, EMA may convert at a per share conversion price equal to $0.02, subject to

a retroactive downward adjustment if the lowest traded price on each of the three consecutive trading days following such conversion

is lower than $0.02. Upon an event of default, the conversion price is adjusted downward based on a discount to market with respect

to subsequent financings or a percentage of the lowest traded price during the twenty one day period prior to the conversion,

if lower than $0.02. Upon such conversion, all rights with respect to the portion of the EMA Note being so converted terminate,

except for the right to receive Common Stock or other securities, cash or other assets as provided in the EMA Note due upon such

conversion.

RespireRx

may, with prior written notice to EMA, prepay the outstanding principal amount under the EMA Note during the initial 180 day period

by making a payment to EMA of an amount in cash equal to a certain percentage of the outstanding principal, interest, default

interest and other amounts owed. Such percentage varies from 110% to 115% depending on the period in which the prepayment occurs,

as set forth in the EMA Note.

If,

prior to the repayment or conversion of the EMA Note, RespireRx consummates a registered, qualified or unregistered primary offering

of its securities for capital raising purposes with aggregate net proceeds in excess of $2,500,000, EMA will have the right, in

its discretion, to demand repayment in full of any outstanding principal, interest (including default interest) under the EMA

Note as of the closing date of such offering.

The

EMA SPA includes, among other things: (1) an automatic adjustment to the terms of the EMA SPA and related documents to the terms

of a future financing if those terms are more beneficial to an investor than the terms of the EMA SPA and related documents are

to EMA, subject to limited exceptions; and (2) certain registration rights. In addition, the EMA Note prohibits RespireRx from

selling or otherwise disposing of a significant portion of its assets outside the ordinary course of business or in connection

with a merger or consolidation or sale of all or substantially all of RespireRx’s assets where the surviving or successor

entity does not assume RespireRx’s obligations under the EMA SPA. Further, any subsidiary to which RespireRx transfers a

material amount of assets must guarantee certain obligations of RespireRx under the EMA Note.

The

EMA Warrant is a common stock purchase warrant to purchase 3,750,000 shares of Common Stock, for value received in connection

with the issuance of the EMA Note, from the date of issuance of the EMA Warrant until September 30, 2023, at an exercise price

of $0.007 (subject to adjustment as provided therein) per share of Common Stock.

The

EMA Note and the shares of Common Stock issuable upon conversion thereof are offered and sold to EMA in reliance upon specific

exemptions from the registration requirements of United States federal and state securities laws, which include Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated thereunder.

Pursuant to these exemptions, EMA represented to the Company under the EMA SPA, among other representations, that it was an “accredited