Statoil Announces Series of Transactions with Repsol

December 11 2015 - 3:11AM

Dow Jones News

By Dominic Chopping

Norway's Statoil ASA (STO) Friday announced a series of

transactions with Spain's Repsol S.A. (REP.MC) in Norway, the U.K.,

U.S. and Brazil that will see the number of Statoil's operatorships

increase in priority areas, providing greater control of asset

development and costs through shared efficiencies.

Statoil will sell a 15% interest in the Gudrun field on the

Norwegian Continental Shelf to Repsol, but will remain the operator

and largest equity holder with a 36% interest.

The Norwegian oil major also plans to acquire a 31% equity share

in the U.K. licence for Alfa Sentral, a field which spans the

UK-Norway maritime border, and will acquire a 13% interest in the

U.S. Eagle Ford joint venture from Repsol, becoming sole

operator.

The final deal sees Statoil assume operatorship of the BM-C-33

licence in Brazil's Campos basin, pending approval from

authorities.

"In the current challenging market environment, these are

innovative, value-enhancing transactions which will help control

costs and strengthen Statoil's portfolio for the long term," said

John Knight, Statoil's Executive Vice-President for Global Strategy

& Business Development.

Financial details weren't disclosed.

-Write to Dominic Chopping at dominic.chopping@wsj.com; Twitter:

@domchopping @WSJNordics

(END) Dow Jones Newswires

December 11, 2015 02:56 ET (07:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

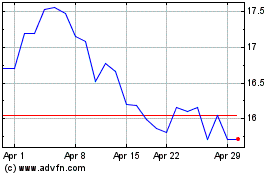

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Aug 2024 to Sep 2024

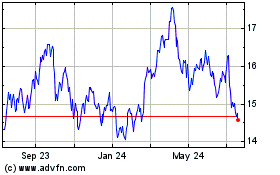

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Sep 2023 to Sep 2024