Pandemic Drives Reckitt Benckiser's Swing to 2020 Profit, Boosts Prospects for 2021 -- Second Update

February 24 2021 - 5:52AM

Dow Jones News

By Matteo Castia

--Reckitt Benckiser swung to profit in 2020 on higher revenue,

boosted by strong hygiene sales amid the coronavirus pandemic

--Together with hygiene items, a demand surge is expected for

flu-relief and sexual-wellbeing products as society reopens

--The company bought the Biofreeze pain-relief brand from

Performance Health for an undisclosed amount

Reckitt Benckiser Group PLC continues to benefit from the

coronavirus pandemic as high demand for hygiene products drove a

swing to net profit in 2020, and prospects of growth in its drugs

and sexual-wellbeing businesses increase as the reopening of

society approaches.

"Increased demand for Dettol and Lysol provided the opportunity

for expansion into a total of 41 markets during the year," the

company said, adding that sales blossomed amid a demand surge in

the hygiene division as consumers battle with the fear of

contagion.

The consumer-goods giant--which houses Dettol, Harpic and Durex

among its brands--made net profit of 1.19 billion pounds ($1.68

billion) for the year, compared with a net loss of GBP3.68 billion

in 2019. Pretax profit was GBP1.87 billion, compared with a loss of

GBP2.11 billion a year earlier, it said.

Revenue rose to GBP13.99 billion from GBP12.85 billion the prior

year. In the fourth quarter, revenue rose to GBP3.57 billion from

GBP3.32 billion in the year-earlier period, it said.

The group's hygiene division increased its revenue by 22% during

the fourth quarter to GBP1.59 billion, and by 16% to GBP5.82

billion for the full year. On a like-for-like basis, revenue from

the hygiene division jumped 26% on year during the fourth quarter

and 20% in the full year.

Reckitt Benckiser said it expects demand for Mucinex, Nurofen

and Strepsils flu-relief products to rise as schools reopen and

mobility increases. Similarly, the reopening of society is likely

to boost the already recovering group's sexual-wellbeing business,

it added.

As mobility and social interactions increase, we expect our

sexual-wellbeing business to rebound," the company said, adding

stronger demand is already being seen in countries managing

post-lockdown conditions.

Reckitt Benckiser said it expects like-for-like revenue for 2021

in a range from flat to 2% growth, including a strong first quarter

and continued underlying progress toward its mid-single-digit

sustainable-growth target, as it benefits from considerable

investments.

It said that during the year it has invested a record high

GBP745 million in building capabilities to strengthen execution and

customer service, digital and brand building and

sustainability.

The productivity program exceeded expectations and delivered

savings of over GBP400 million, driving an increase in the

company's projected productivity savings to GBP1.60 billion from

GBP1.30 billion, it added.

"We will deliver further growth for hygiene and germ protection,

as we work to hold on to the penetration gains achieved, while

growing in new places, channels and categories, strong growth in

sexual-wellbeing and start seeing the benefits of our growth

investments in other areas, including the wider hygiene, consumer

health and nutrition categories," Reckitt Benckiser said.

The company warned that pandemic-driven lower birth rates in

2020 and 2021 will contribute to a short-term slowdown for its

infant-formula business.

Already back in 2019, a lower birth rate was one of the reasons

behind Reckitt Benckiser's disappointing performance for infant

formula in China, which contributed to a GBP5.04 billion impairment

leading to a swing to net loss that year.

The board declared a final dividend of 101.6 pence, taking the

full-year payout to 174.6 pence, flat on year.

Also Wednesday, the company said in a separate release that it

has entered into a definitive agreement with Performance Health--a

company owned by Madison Dearborn Partners--to acquire the

Biofreeze pain-relief brand for an undisclosed amount.

"The brand taps into the growing global trend for wellness and

self-care and aligns with our strategy to build our U.S. health

footprint into new spaces and places," Chief Executive Laxman

Narasimhan said. Completion is expected to occur in the second

quarter of the year, Reckitt Benckiser said.

In another separate release Wednesday, the company said it is

selling the Scholl footcare brand to Boston-based private-equity

firm Yellow Wood Partners. While no financial details of the

transaction were disclosed, Reckitt Benckiser said it anticipates

the deal to complete in the third quarter of this year. Reckitt

Benckiser had acquired Scholl as part of its acquisition of SSL

International in 2010. The proposed sale also includes the Amope,

Krack and Eulactol footcare brands, the company said.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

February 24, 2021 05:37 ET (10:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

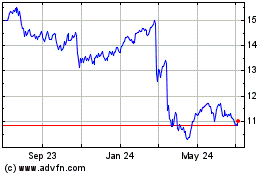

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

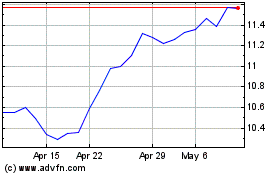

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024