Reckitt Benckiser Swings to 2020 Profit on Strong Hygiene Sales, Shuffles Brand Stable -- Update

February 24 2021 - 3:28AM

Dow Jones News

By Matteo Castia

--Reckitt Benckiser swung to profit in 2020 on higher revenue,

boosted by strong hygiene sales amid the coronavirus pandemic

--The company bought the Biofreeze pain-relief brand from

Performance Health for an undisclosed amount

--Reckitt Benckiser sold its Scholl footcare brand to Yellow

Wood Partners, also for an undisclosed amount

Reckitt Benckiser Group PLC reported Wednesday a swing to net

profit for 2020 as its hygiene division benefited from increasing

demand amid the coronavirus pandemic and boosted revenue in the

period.

The consumer-goods company--which houses Dettol, Harpic and

Durex among its brands--made net profit of 1.19 billion pounds

($1.68 billion) for the year, compared with a net loss of GBP3.68

billion in 2019.

Pretax profit was GBP1.87 billion, compared with a loss of

GBP2.11 billion a year earlier, it said.

Revenue rose to GBP13.99 billion from GBP12.85 billion.

In the fourth quarter, revenue rose to GBP3.57 billion from

GBP3.32 billion in the year-earlier period, it said. The group's

hygiene division increased its revenue by 22% during the fourth

quarter to GBP1.59 billion, and by 16% to GBP5.82 billion for the

full year.

On a like-for-like basis, revenue from the hygiene division

jumped 26% on the year during the fourth quarter and 20% in the

full year.

The board declared a final dividend of 101.6 pence, taking the

full-year payout to 174.6 pence, flat on the year.

The company said it expects like-for-like revenue for 2021 in a

range from flat to 2% growth, including a strong first quarter.

Reckitt Benckiser said that during the year it has invested a

record high GBP745 million in building capabilities to strengthen

execution and customer service, digital and brand building and

sustainability. It added that its productivity program exceeded

expectations.

The productivity program delivered savings of over GBP400

million and drove an increase in the company's projected

productivity savings to GBP1.60 billion from GBP1.30 billion, it

added.

Also on Wednesday, the company said in a separate release that

it has entered into a definitive agreement with Performance

Health--a company owned by Madison Dearborn Partners--to acquire

the Biofreeze pain-relief brand for an undisclosed amount.

"The brand taps into the growing global trend for wellness and

self-care and aligns with our strategy to build our U.S. health

footprint into new spaces and places," Chief Executive Laxman

Narasimhan said. Completion is expected to occur in the second

quarter of the year, Reckitt Benckiser said.

In another separate release Wednesday, the company said it is

selling the Scholl footcare brand to Boston-based private-equity

firm Yellow Wood Partners. While no financial details of the

transaction were disclosed, Reckitt Benckiser said it anticipates

the deal to complete in the third quarter of this year.

Reckitt Benckiser had acquired Scholl as part of its acquisition

of SSL International in 2010. The proposed sale also includes the

Amope, Krack and Eulactol footcare brands, the company said.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

February 24, 2021 03:13 ET (08:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

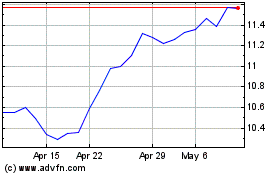

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

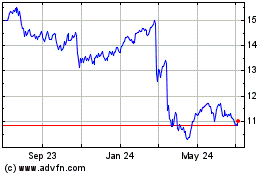

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024