Lysol Maker Bets Cleaning Boom Will Outlast Coronavirus -- Update

April 30 2020 - 1:12PM

Dow Jones News

By Saabira Chaudhuri

Consumers are cleaning their hands and homes more during the

coronavirus pandemic, a trend makers of big hygiene brands are

betting will outlast the Covid-19 crisis.

Lysol owner Reckitt Benckiser Group PLC on Thursday reported a

surge in first-quarter sales as shoppers stocked up on cleaning

products during lockdowns. While the company said it expects some

of that demand to unwind, like others in the industry, it also

thinks people will continue to clean more even when they are

spending less time at home.

"Over time we fully expect there will be more fundamental

changes happening as people will want to be in a cleaner

environment," said Reckitt Chief Executive Laxman Narasimhan. His

comments echo those of Dove soap owner Unilever PLC, which last

week said it expects the rise in interest for cleaning household

surfaces and hands to persist. Procter & Gamble Co. has also

said it expects consumers to clean more in the future.

Reckitt reported a 13.3% rise in like-for-like sales to GBP3.54

billion ($4.4 billion) for the first three months of the year,

driven by its hygiene and health divisions. Unilever and P&G

also posted gains in their corresponding operations for the

period.

Reckitt and Unilever have for years pushed behavioral marketing

campaigns trying to convince consumers to wash their hands more

often. The pandemic has offered a huge boost to those efforts, with

World Health Organization guidelines -- echoed by governments and

national health organizations -- recommending people regularly wash

their hands using soap for at least 20 seconds to protect

themselves.

A handwash challenge launched by Reckitt's Dettol brand on

TikTok, encouraging people to post videos of themselves dancing

while washing their hands, has been viewed more than 88 billion

times since mid-March, Mr. Narasimhan said.

The company's products got less-welcome publicity last week when

President Trump speculated that using disinfectants inside the body

could be an effective coronavirus treatment. The comments, later

walked back, prompted Reckitt to issue a statement warning against

ingesting its products.

To meet surging demand, Reckitt has ramped up production of hand

sanitizer and cleaning products in recent weeks. To boost

efficiency it has cut less popular variants of some brands,

allowing it to make bigger volumes of fewer products. The company

has also bought new equipment, repurposed production lines and

worked more closely with suppliers, Mr. Narasimhan said. In May

alone, Reckitt expects to make the same volume of hand sanitizer

that it made all of last year.

"We feared that Reckitt Benckiser's supply chain might not be up

to accommodating additional demand. We were very wrong," said RBC

analyst James Edwardes Jones.

However, Reckitt did caution that meeting higher demand while

practicing social distancing would result in higher costs for some

time. For instance, it has built makeshift cafes at some factories

and put in place more buses for workers traveling to its

plants.

Mr. Narasimhan also told analysts Thursday the company was

investing to capitalize on new growth opportunities as they emerge.

Lysol recently said it would work with Hilton Worldwide Holdings

Inc. to develop a more thorough cleaning regime for hotel rooms and

fitness centers that would reassure guests they are virus free.

Unilever has also adjusted its supply chain to capitalize on

greater demand for hygiene products. Last week the Anglo-Dutch

company said it had quickly rolled out soap and hand sanitizers

under its Lifebuoy antibacterial soap brand to 43 new countries. It

also sped up the launch of a new germ-killing line of products in

China called Botanical Hygiene.

P&G -- which owns Tide laundry detergent and Swiffer dusters

-- earlier this month said its five largest North American plants

produced and shipped 22% more cases in March than the average of

the prior 12 months.

In late February, the company launched Microban 24, a new brand

of cleaners it says work for 24 hours by binding bacteria-fighting

ingredients to surfaces.

On Thursday, Reckitt reported Lysol's like-for-like revenue

jumped more than 50% in the quarter in North America, helping drive

the region's hygiene unit's revenue on this basis up 20% overall.

In developing markets like-for-like hygiene revenue climbed by a

more modest 8% as rises in Latin America, the Middle East and South

East Asia offset declines in India, which has faced one of the

world's strictest lockdowns, hampering movement.

The company's over-the-counter health arm also reported higher

sales as consumers stocked up on drugstore staples, like the

Mucinex cough and cold brand in North America and Nurofen pain

relief in Europe, Australia and New Zealand.

Those gains offset a weaker performance for some of the

company's other products. Its infant formula unit reported a 2%

drop in like-for-like sales as weakness in China outweighed

stockpiling in North America. Reckitt's Durex brand, which mainly

sells condoms, also reported modest declines in sales.

Reflecting on weaker condom sales, Mr. Narasimhan said consumer

surveys show that an increase in proximity as couples stay at home

together has, in some countries, been outweighed by a rise in

anxiety about money, jobs and other issues that is dampening sexual

appetite.

In the U.K., 42% of people polled by Durex said they are having

less sex, compared with 29% saying they were having more, while in

Italy such behavior has "declined a lot," he said. The company

doesn't yet have a survey from the U.S.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 30, 2020 12:57 ET (16:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

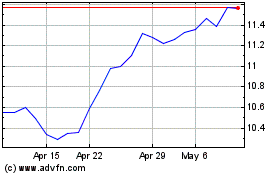

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

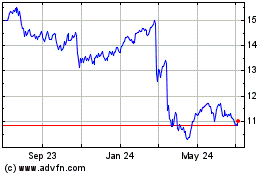

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024