Consumer stockpiling related to the Covid-19 pandemic boosted

quarterly results Thursday for food companies and makers of

cleaning products.

Church & Dwight Co.: The consumer-products company posted

first-quarter sales and earnings that topped expectations, as the

coronavirus pandemic drove a surge in demand for its cleaning and

health-care products.

Kellogg Co.: The cereal and snacks company reported

better-than-expected adjusted earnings for the first quarter as

consumer purchases during the pandemic drove organic sales

growth.

Kraft Heinz Co.: The maker of Kraft cheeses, Oscar Mayer cold

cuts, Planters nuts and other food products reported higher demand

for many of its products in the first quarter as consumers in the

U.S. snapped up food to eat at home.

Reckitt Benckiser Group PLC: The Lysol maker reported a surge in

first-quarter sales as shoppers stocked up on cleaning products

during lockdowns. While the company expects some of that demand to

unwind, it also said people are likely to continue to clean more

even when they are spending less time at home.

With many people at home due to government lockdowns, demand for

air travel evaporated, leaving airlines with lower profits.

Air China Ltd.: The airline slumped to a loss in the first

quarter as efforts to curb the coronavirus brought global and

domestic travel to a near halt.

American Airlines Group Inc.: The airline lost $2.2 billion in

the first quarter as efforts to curb the coronavirus brought global

travel to a near halt. The virus has derailed what American had

hoped would be a comeback year, after the grounding of Boeing Co.'s

737 MAX stymied growth last year and the airline's operation

stumbled amid strife with its mechanics union.

Japan Airlines Co.: JAL said full-year profit slumped after it

canceled a number of flights.

China Eastern Airlines Corp.: The airline swung to a net loss in

the first quarter as restrictions to contain the spread of Covid-19

hurt demand for business and leisure travel.

Other earnings reported Thursday, at a glance:

1-800-Flowers.com: Revenue in the florist's gourmet foods and

gift baskets segment shot up 27% in its fiscal third quarter, the

most of the company's divisions.

Altria Group Inc.: The Marlboro maker saw a 13% increase in

quarterly revenue but paused the rollout of its new heated tobacco

product because of the coronavirus pandemic. The company expects

cigarette smokers to trade down to cheaper brands as an economic

downturn takes hold.

BASF SE: The German chemicals giant said it expects sales

volumes to decline significantly in the second quarter before a

slow recovery throughout the rest of the year as the coronavirus

pandemic hits the auto industry, its largest customer segment. The

company said it won't meet its full year goals and that reliable

forecasts are impossible.

Bertelsmann SE & Co. KGaA: The German media, services and

education company said revenue for the first quarter of 2020 fell

year-over-year as the coronavirus pandemic weighed on business

since mid-March. The company said revenue fell 2.1%

organically.

Brunswick Corp.: The boat maker said it turned a profit in the

latest quarter above analysts expectations despite a lull in

manufacturing triggered by the coronavirus pandemic.

Comcast Corp. The owner of the Xfinity broadband and cable-TV

business, the NBC broadcast empire, the Universal Pictures movie

studio and Universal Studios theme parks signed up more broadband

customers last quarter than any time in 12 years, but that growth

was more than offset by the coronavirus pandemics impact on vast

portions of its business, from movie production to theme parks.

Franklin Resources Inc.: The investment manager known for its

Franklin Templeton products reported lower fiscal second-quarter

profit and revenue and a drop in assets under management of more

than $100 billion from the previous quarter, spurred by diminished

investor confidence triggered by the Covid-19 pandemic.

Denso Corp.: The Japanese auto-parts maker said its fiscal-year

net profit fell 73% as the Covid-19 pandemic weighed on its

fourth-quarter revenue.

Glencore PLC: The mining giant lowered its production guidance

across the board due to the coronavirus pandemic after experiencing

declines in copper, cobalt and coal output for the first quarter.

The Anglo-Swiss commodity trading and mining company said it

produced 293,300 metric tons of copper in the first three months of

the year compared with 320,700 tons in the year-earlier period.

Hilton Grand Vacations Inc.: The timeshare company said its

profit and revenue declined for the first quarter as its resorts

and sales centers remained closed amid the Covid-19 pandemic.

Hubbell Inc.: The manufacturer of electrical and electronic

products reported a rise in net profit for the first quarter,

although disruptions from the coronavirus pandemic reduced earnings

per share by 10 cents.

Kellogg Co.: The cereal and snack maker said consumers shopping

for packaged foods during the coronavirus pandemic helped drive a

key sales metric higher during the first quarter.

Kraft Heinz Co.: The maker of Kraft cheeses, Oscar Mayer cold

cuts, Planters nuts and other food products reported higher demand

for many of its products in the first quarter as consumers in the

U.S. snapped up food to eat at home during the coronavirus

pandemic.

LafargeHolcim Ltd.: The Swiss cement maker's first-quarter

profit and sales fell as the coronavirus pandemic hit business,

with LafargeHolcim forecasting more pain ahead in the second

quarter.

Lloyds Banking Group PLC: The U.K.'s largest retail bank

reported a significant fall in pretax profit for the first quarter

of 2020 due to higher-than-expected impairments and suspended its

previous guidance.

McDonald's Corp.: The fast-food giant said dramatic changes in

consumer behavior since the coronavirus pandemic hurt its profit

and sales.

Meritor Inc.: The U.S. auto-parts maker said second-quarter

sales dropped after it halted manufacturing because of the

coronavirus pandemic.

Molson Coors Beverage Co.: The maker of Coors and Miller beers

said it swung to a loss in the first quarter and said it expects a

significant hit to net sales and profit for the year due to the

coronavirus pandemic, particularly in the second quarter.

Murata Manufacturing Co.: The Japanese electronics parts maker's

fourth-quarter net profit fell 5.9% from a year earlier in part due

to a Covid-19 plant suspension and lower sales at its capacitors

business.

PTT Exploration & Production PCL: The Thai oil explorer and

producer's net profit fell 30% in the first quarter from a year

earlier as collapsing oil prices dragged down sales volumes and

selling prices for its products.

Royal Dutch Shell PLC: The British-Dutch oil giant cut its

quarterly dividend for the first time since World War II as

earnings for the period were dragged down by the collapse in oil

and gas demand and prices.

Société Générale SA: The French lender said it would cut costs

and rework its strategy after bad loan charges tripled in the first

quarter and stock-trading revenue was wiped out by coronavirus

disruption. Clients traded more in volatile markets, but the

transaction fees Société Générale earned on those trades were

offset by poor performance in structured products.

Swiss Re AG: The Swiss reinsurer said it swung to a loss in the

first quarter of the year due to the impact of coronavirus on the

underwriting and investment results. The company said it registered

a net loss of $225 million from a profit of $429 million a year

earlier, while net premiums earned rose to $9.59 billion from $8.93

billion.

Tempur Sealy International Inc.: The mattress company reported

higher earnings and sales in the first quarter, despite material

impacts from the coronavirus pandemic.

Tsingtao Brewery Co.: The Chinese brewer reported a 34% decline

in its first-quarter net profit, as beer sales were severely

impacted due to the Covid-19 pandemic.

Twitter Inc.: The social media company reported its strongest

user growth yet as a public company but also swung to a loss for

the first time in two years as advertisers tightened their budgets

in response to the coronavirus pandemic.

Write to Rose Manzo at rose.manzo@wsj.com

(END) Dow Jones Newswires

April 30, 2020 12:51 ET (16:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

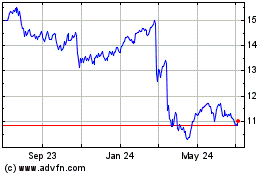

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

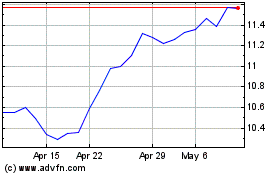

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024