Reckitt Benckiser Shares Drop After Guidance Cut

July 30 2019 - 4:07AM

Dow Jones News

By Anthony Shevlin

Shares in Reckitt Benckiser Group PLC (RB.LN) slid in early

trading after the FTSE 100 company lowered its full-year net

revenue guidance despite saying the second half of the year should

be stronger.

The consumer-goods company revised downward its 2019 net revenue

guidance growth to between 2% and 3% on a like-for-like basis. The

company previously expected growth of between 3% and 4%.

The company behind brands such as Cillit Bang cleaning products

and Nurofen painkillers said pretax profit for the six months ended

June 30 was 1.26 billion pounds ($1.55 billion), compared with

GBP1.11 billion a year prior.

At GMT 0715, shares in Reckitt Benckiser traded 5.2% lower at

6330 pence.

The company acknowledged it made a slow start to the year but

said growth levels should return to normal in the second half.

"Our like-for-like performance in 1H was [plus] 1%, somewhat

below our expectations," said Rakesh Kapoor, the company's outgoing

chief executive.

Analysts at Citi said the company's second-quarter results were

disappointing and showed the need for Reckitt to regain strategic

flexibility.

"This set of results is making a strategic rethink, and

portfolio changes in line with [the] RB 2.0 [strategy], even more

pressing," Citi said.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

July 30, 2019 03:52 ET (07:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

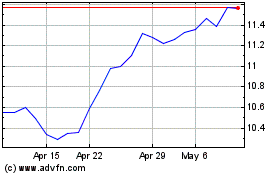

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

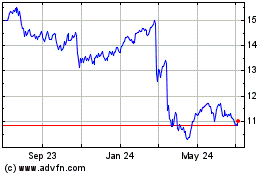

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024