| |

Filed

Pursuant to Rule 424(b)(3) |

| PROSPECTUS |

Registration

No. 333-267627 |

QHSLab,

Inc.

7,741,487

SHARES OF COMMON STOCK

This

prospectus relates to the offer and sale from time to time by the selling stockholders (the “Selling Stockholders”) identified

herein of up to 7,741,487 shares of the common stock, par value $0.001 (the “common stock”) of QHSLab, Inc. (“QHSLab,”

the “Company,” “we,” “our,” or “us”), a Nevada corporation, which includes (i) 2,310,000

shares of common stock issuable upon conversion of a 5% Original Issue Discount Convertible Note (the “2022 Note”) in the

principal amount of $440,000, plus $22,000.00 of interest to be accrued thereon through the maturity date thereof, with a conversion

price of $0.20 per share issued in a private placement that closed on July 26, 2022 (the “2022 Private Placement); (ii) 550,000

shares of common stock issuable upon exercise of warrants (the “2022 Warrants”) issued in the 2022 Private Placement having

an exercise price of $0.50 per share; (iii) 3,731,500 shares of common stock issuable upon conversion of a 5% Original Issue Discount

Convertible Note (the “2021 Note”) with a conversion price of $0.20 per share issued in a private placement that closed in

August, 2021 (the “2021 Private Placement”), together with 138,194 shares of common stock previously issued upon conversion

of the 2021 Note; (iv) 930,000 shares of common stock issuable upon exercise of warrants (the “2021 Warrants”) issued in

the 2021 Private Placement having an exercise price of $1.25 per share; (iv) 12,189 shares of common stock issuable upon the exercise

of outstanding warrants having an exercise price of $0.83 per share, 53,704 shares of common stock issuable upon the exercise of outstanding

warrants having an exercise price of $0.74 per share and (v) 15,900 shares of common stock issuable upon exercise of warrants having

an exercise price of $0.75 per share (collectively, the “Individual Warrants,” collectively with the 2022 Warrants and the

2021 Warrants, the “Warrants”). We are registering the shares which may be sold by the holder of the Notes and warrants issued

in the 2022 Private Placement and the 2021 Private Placement pursuant to the registration rights agreements (“Registration Rights

Agreements”) entered into in connection with the Private Placements. See the section of this prospectus entitled “Prospectus

Summary - Recent Developments” for a description of the 2022 Private Placement, and the section of this prospectus entitled “Selling

Stockholders” for additional information regarding the Selling Stockholders.

We

are not selling any shares in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the Selling

Stockholders.

The

registration of the shares offered under this prospectus does not mean that the Selling Stockholders will actually offer or sell any

of these shares. The prices at which the Selling Stockholders may sell the shares in this offering will be determined by the prevailing

market price for the shares of our common stock or in negotiated transactions. See “Plan of Distribution” for more information

about how the Selling Stockholders may sell the shares being registered pursuant to this prospectus.

Each

of the Selling Stockholders may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of

1933, as amended. The Selling Stockholders have informed us that they do not currently have any agreement or understanding, directly

or indirectly, with any person to distribute the shares.

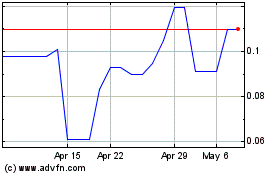

Our

Common Stock is subject to quotation on OTCQB Venture Market under the symbol USAQ. On September 26, 2022, the last reported sales

price for our Common Stock was $0.151 per share.

We

will pay the expenses of the registration of the shares of our common stock offered and sold under this registration statement. Each

of the Selling Stockholders will pay any underwriting discounts, commissions or equivalent expenses and expenses of its legal counsel

applicable to the sale of its shares.

We

are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and

are subject to reduced public company reporting requirements.

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for information

that should be considered before buying shares of our Common Stock.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

Date of This Prospectus is: October 7, 2022

TABLE

OF CONTENTS

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the common stock offered under this prospectus. The registration statement, including the exhibits, can be read on our website

and the website of the Securities and Exchange Commission. See “Where You Can Find More Information.”

Information

contained in, and that can be accessed through, our web site www.usaqcorp.com shall not be deemed to be part of this prospectus or incorporated

herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the

Shares offered hereunder.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning

of the federal securities laws. These statements relate to anticipated future events, future results of operations or future financial

performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,”

“will,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue”

or the negative of these terms or other comparable terminology.

These

forward-looking statements are only predictions, are uncertain and involve substantial known and unknown risks, uncertainties and other

factors which may cause our (or our industry’s) actual results, levels of activity or performance to be materially different from

any future results, levels of activity or performance expressed or implied by these forward-looking statements. The “Risk Factors”

section of this prospectus sets forth detailed risks, uncertainties and cautionary statements regarding our business and these forward-looking

statements. Moreover, we operate in a very competitive and rapidly changing regulatory environment. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all of the risks and uncertainties that could have an impact on the forward-looking

statements contained in this prospectus.

We

cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements,

which speak only as of the date of this prospectus. These cautionary statements should be considered with any written or oral forward-looking

statements that we may issue in the future. Except as required by applicable law, including the securities laws of the U.S., we do not

intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances

or to reflect the occurrence of unanticipated events. Our forward-looking statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or other investments or strategic transactions we may engage in.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this Prospectus. It does not contain all the information that you should

consider before investing in the Common Stock. You should carefully read the entire Prospectus, including “Risk Factors”,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements,

before making an investment decision. In this Prospectus, the terms “QHSLab” “Medical Practice Income” “MPI”

“Company,” “Registrant,” “we,” “us” and “our” refer to QHSLab, Inc. a Nevada

corporation. References to “Selling Shareholders” refer to those shareholders listed herein under “Selling Shareholders”

and their successors, assignees and permitted transferees.

Our

Business

We

are a medical device technology and software as a service (SaaS) company focused on enabling primary care physicians (PCP’s) to

increase their revenues by providing them with relevant, value-based tools to evaluate and treat chronic disease as well as provide preventive

care through reimbursable procedures. In some cases, the products we provide our physician clients will enable them to diagnose and treat

patients with chronic diseases which they historically have referred to specialists, allowing them to increase their practice revenue.

As part of our mission, we are providing PCP’s with the software, training and devices necessary to allow them to treat their patients

using value-based healthcare, informatics and algorithmic personalized medicine, including digital therapeutics. Our digital healthcare

and point of care solutions also support remote patient monitoring, to address chronic care and preventive medicine and are reimbursable

to the medical practice.

In

November 2020, we began shipping AllergiEnd® diagnostic related products and immunotherapy treatments to PCPs in response

to their requests based upon courses of treatment recommended for their patients building on the capabilities of QHSLab, our primary

SaaS tool. The Company’s revenue generated from sales of AllergiEnd® products was $124,532 in the fourth of quarter

2020 and $1,414,421 for the year ending 2021.

In

June 2021, we announced that we had acquired the method patent, trademark and website associated with AllergiEnd®’s

diagnostic and allergen immunotherapy product portfolio. The acquisition of the AllergiEnd® assets provides us the opportunity

to more fully integrate and leverage our product portfolio across our marketing platform, customer relationships and cost structure.

Based

on the success of PCPs using our Quality Health Score Lab Expert System (“QHSLab”) digital healthcare platform combined with

the acquired AllergiEnd® product line, we intend to increase our revenues by charging physicians a monthly subscription fee

for the use of QHSLab and soliciting additional PCPs to increase their revenues by using our proven revenue generating QHSLab and AllergiEnd®

line of products. We also plan to introduce additional point of care diagnostics and treatments, and digital medicine programs that PCPs

can use and prescribe in their practices. In all cases, PCPs will be paid under existing government and private insurance programs, based

upon analyses conducted utilizing QHSLab and treatments provided as a result of such analyses.

Recent

Developments

Securities

Purchase Agreement

On

July 26, 2022, we consummated a Securities Purchase Agreement with Mercer Street Global Opportunity Fund, LLC (“Mercer”),

pursuant to which we issued to Mercer our Original Issue Discount Secured Convertible Promissory Note (the “2022 Note”) in

the principal amount of $440,000 and warrants to purchase 550,000 shares of our common stock (the “2022 Warrants”) for which

we received aggregate consideration of $400,000. In addition, we entered into a Registration Rights Agreement with Mercer.

The

principal amount of the 2022 Note and all interest accrued thereon is payable on July 21, 2023, and are secured by a lien on substantially

all of our assets. The 2022 Note provides for interest at the rate of 5% per annum, payable at maturity, and is convertible into our

common stock at a price of $0.20 per share. In addition to customary anti-dilution adjustments upon the occurrence of certain corporate

events, the 2022 Note provides, subject to certain limited exceptions, that if we issue any common stock or common stock equivalents,

as defined in the 2022 Note, at a per share price lower than the conversion price then in effect, the conversion price will be reduced

to the per share price at which such stock or common stock equivalents were sold.

The

2022 Warrants are initially exercisable for a period of three years at a price of $0.50 per share, subject to customary anti-dilution

adjustments upon the occurrence of certain corporate events as set forth in the 2022 Warrant. The shares issuable upon conversion of

the 2022 Note and exercise of the 2022 Warrants are to be registered under the Securities Act of 1933, as amended, for resale by Mercer

as provided in the Registration Rights Agreement. If at any time after January 19, 2023, there is no effective registration statement

covering the resale of the shares issuable upon exercise of the 2022 Warrants at prevailing market prices, then the 2022 Warrants may

be exercised by means of a “cashless exercise” in which event the Mercer would be entitled to receive a number of shares

determined in accordance with a customary formula as set forth in the 2022 Warrant.

Registration

Rights Agreement

The

Registration Rights Agreement requires us to file with the Securities and Exchange Commission no later than September 25, 2021,

a registration statement (the “Registration Statement”) with respect to all shares which may be acquired upon conversion

of the 2022 Note and exercise of the 2022 Warrants (the “Registrable Securities”) and to cause the Registration Statement

to be declared effective no later than November 9, 2021, provided, that if we are notified by the SEC that the Registration Statement

will not be reviewed or is no longer subject to further review and comments, we shall cause the Registration Statement to be declared

effective on the fifth trading day following the date on which we are so notified. We are to cause the Registration Statement to remain

continuously effective until all Registrable Securities covered by such Registration Statement have been sold or may be sold pursuant

to Rule 144 without the volume or other limitations of such rule or are otherwise not required to be registered in reliance upon the

exemption in Section 4(a)(1) or 4(a)(7) under the Securities Act.

Placement

Agent Agreement

We

entered into a Placement Agent Agreement with Carter, Terry & Company (the “Placement Agent”) dated June 28, 2021 wherein

the Placement Agent agreed to act as our financial advisor and placement agent on a “best efforts” basis with one or more

capital raises. Pursuant to the Placement Agent Agreement we paid the Placement Agent $25,000 for services rendered in connection with

the sale of the $440,000 Note to Mercer.

Summary

of Risk Factors

Our

business and the purchase of the shares offered hereby are subject to numerous risks and uncertainties, including those described in

the section entitled “Risk Factors” and elsewhere in this prospectus. Some of the most significant challenges and risks include

the following:

●

Our Auditor has expressed substantial doubt as to our ability to continue as a going concern.

●

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

●

We have a history of losses.

●

Our revenues are dependent upon acceptance of our QHSLab Software as a Service (“SaaS”) by our health care provider clients.

●

Acceptance of our software and products is dependent upon the reimbursements available to our health care provider clients, specifically

changes in insurances reimbursement policies, will cause us to curtail or cease operations.

●

We may face new entrants and increasing competition in the Digital Medicine market.

●

We cannot be certain that we will obtain patents for our proprietary technology or that such patents will protect us.

●

The availability of a large number of authorized but unissued shares of Common Stock may, upon their issuance, lead to dilution of existing

stockholders.

●

Our stock is thinly traded, sale of your holding may take a considerable amount of time.

●

There are a substantial number of shares of our common stock available for sale by current stockholders, including those issuable upon

conversion of the Note and the sale or potential sale of such shares may adversely effect the market price of our common stock.

Before

you invest in our common stock, you should carefully consider all the information in this Prospectus, including matters set forth under

the heading “Risk Factors.”

Where

You Can Find Us

Our

principal executive office and mailing address is at 901 Northpoint Parkway, Suite 302, West Palm Beach, FL 33407, Phone: (929) 379-6503

The

Offering

| Common

Stock offered by Selling Stockholders |

|

7,741,487

shares of our common stock, including (i) 2,310,000 shares of common stock issuable upon conversion of the 2022 Note; (ii) 3,731,500

shares of common stock issuable upon conversion of the 2021 Note, together with 138,194 shares of common stock previously issued

upon conversion of the 2021 Note; (iii) 550,000 shares issuable upon exercise of the 2022 Warrants; (iv) 930,000 shares issuable

upon exercise of the 2021 Warrants; and (v) 81,793 shares of common stock issuable upon exercise of the Individual Warrants. |

| |

|

|

| Common

Stock outstanding before the Offering |

|

9,065,508

shares as of September 26, 2022 |

| |

|

|

| Common

Stock outstanding after the Offering |

|

16,806,995

shares of Common Stock assuming all of the shares offered by this prospectus are issued, including those issuable upon conversion

of the Notes and exercise of the Warrants. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of common stock by the Selling Stockholders; however, we may receive proceeds upon the

exercise of the Warrants if exercised for cash. See “Use of Proceeds.” |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire

investment. See “Risk Factors. |

RISK

FACTORS

The

shares of our common stock being offered for resale by the Selling Stockholders are highly speculative in nature, involve a high degree

of risk and should be purchased only by persons who can afford to lose their entire amount invested in the common stock. Accordingly,

prospective investors should carefully consider, along with other matters referred to herein, the following risk factors and the other

information in this Prospectus in evaluating our business before purchasing any shares of our common stock. If any of the following risks

actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may

lose all or part of your investment.

Risks

Related to our Financial Condition

We

incurred net losses in 2021 and 2020, and through the first six months of 2022 and may not be able to continue to operate as a going

concern.

We

incurred net losses of $770,176 and $327,388 for the years ended December 31, 2021 and 2020, respectively and $469,689 for the six months

ended June 30, 2022. We also had negative cash flows from operations for the years ended December 31, 2021 and 2020, respectively and

during the six months ended June 30, 2022. To support our operations we issued convertible notes and warrants in private placements concluded

in August 2021 and July 2022. The report of our independent registered public accountants on our financial statements for the year ended

December 31, 2021 states that these factors raise uncertainty about our ability to continue as a going concern.

Unless

we are able to generate positive cash flows from operations, we will continue to depend upon further issuances of debt, equity or other

financings to fund ongoing operations. We may continue to incur additional operating losses and we cannot assure you that we will continue

as a going concern.

We

may need additional financing.

We

have funded our operating losses through borrowings, including amounts borrowed from our principal shareholder and the issuance of convertible

notes. As of December 31, 2021, all related party notes due our principal shareholder, including interest accrued thereon, have been

converted into equity. As of June 30, 2022, we have notes and loans outstanding, in the aggregate amount, inclusive of accrued interest,

of $1,501,180 and an Original Discount Note in the amount of $756,000. Subsequent to June 30, 2022, we issued an additional Original

Discount Note in the amount of $440,000. If, we are not able to pay or refinance the outstanding principal and accrued interest on these

notes when due, our operations may be materially and adversely affected. We may need to offer the holders of our debt increases in the

rates of interest they receive or otherwise compensate them through payments of cash or issuances of our equity securities. Future financings

or re-financings may involve the issuance of additional debt, equity and securities convertible into or exercisable for our equity securities.

If we are unable to consummate such financings or re-financings, the trading price of our common stock could be adversely affected and

the terms of such financings may adversely affect the interests of our existing stockholders. Any failure to obtain additional working

capital when required would have a material adverse affect on our business and financial condition and may result in a decline in the

price of our common stock. If we are not able to fund ongoing losses through funds provided by third parties or our principal shareholder,

we may become insolvent

Servicing

our debt requires a significant amount of cash.

Our

ability to make payments on and to refinance our debt, to fund planned capital expenditures and to maintain sufficient working capital

depends on our ability to generate cash in the future. This is subject to numerous factors beyond our control, including our ability

to expand our physician client base. We cannot assure you that our business will generate sufficient cash flow from operations in an

amount sufficient to enable us to service our debt or to fund our other liquidity needs. If our cash flow and capital resources are insufficient

to allow us to make scheduled payments on our debt, we will need to seek additional capital or restructure or refinance all or a portion

of our debt on or before the maturity thereof, any of which could have a material adverse effect on our business, financial condition

or results of operations. We cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or

at all. If we are unable to generate sufficient cash flow to repay or refinance our debt on favorable terms, it could significantly adversely

affect our financial condition and the value of our outstanding debt and common stock. Our ability to restructure or refinance our debt

will depend on the condition of the capital markets and our financial condition. Any refinancing of our debt could be at higher interest

rates and could require us to issue to the holders additional shares of our common stock and may require us to comply with more onerous

covenants, which could further restrict our business operations. There can be no assurance that we will be able to obtain any financing

when needed.

We

are an early stage company with a short operating history and a relatively new business model in an emerging and rapidly evolving market,

which makes it difficult to evaluate our future prospects.

We

are an early stage entity subject to all of the risks inherent in a young business enterprise, such as, lack of market recognition and

limited banking and financial relationships. We have little operating history to aid in our assessing future prospects. We will encounter

risks and difficulties as an early stage company in a new and rapidly evolving market. We may not be able to successfully address these

risks and difficulties, which could materially harm our business and operating results.

We

are not generating sufficient revenues to achieve our business plan.

We

first generated revenues in the fourth quarter of 2020. There is no assurance that we will generate sufficient revenues to become cash

flow positive or ever be profitable. If planned operating levels are changed, higher operating costs encountered, more time needed to

implement our plan, or less funding is received, more funds than currently anticipated may be required. If additional capital is not

available when required, if at all, or is not available on acceptable terms we may be forced to modify or abandon our business plans.

We

have identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively

remediated or that additional material weaknesses will not occur in the future. If our internal control over financial reporting or our

disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud, or

file our periodic reports in a timely manner, which may cause investors to lose confidence in us and lead to a decline in our stock price.

We cannot remedy the deficiencies in our internal controls until we increase the number of officers in our Company.

Our

management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule

13a-15(f) under the Exchange Act. We have identified material weaknesses in our internal controls with respect to our segregation of

duties, which cannot be rectified until we have additional officers, and our limited resources and our insufficient controls over review

of accounting for certain complex transactions therefore our disclosure controls and procedures are not effective in providing material

information required to be included in our periodic SEC filings on a timely basis and to ensure that information required to be disclosed

in our periodic SEC filings is accumulated and communicated to our management to allow timely decisions regarding required disclosure

about our internal control over financial reporting. Some of the material weaknesses in our internal controls are due to our limited

management staff. Due to limited staffing, we are not always able to detect errors or omissions in financial reporting and cannot eliminate

weaknesses due to our inability to segregate duties. If we fail to comply with the rules under Sarbanes-Oxley related to disclosure controls

and procedures in the future or continue to have material weaknesses and other deficiencies in our internal control and accounting procedures

and disclosure controls and procedures, our stock price could decline significantly and raising capital could be more difficult. If additional

material weaknesses or significant deficiencies are discovered or if we otherwise fail to address the adequacy of our internal control

and disclosure controls and procedures our business may be harmed. Moreover, effective internal controls are necessary for us to produce

reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent

fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and

the trading price of our securities could drop significantly.

All

of our revenues have been generated from one product line.

To

date, all of our revenue has been derived from the sale of the “AllergiEnd®” line of products. If we fail to develop

or acquire additional products or services from which we can generate revenues, we may not achieve sustained positive cash flow or generate

profits. As a result, we will be severely constrained in our ability to fund our operations and achieve our business plan.

We

are dependent upon third parties for our products.

We

depend upon third parties to supply us with all of the products included in the “AllergiEnd®” line of products from which

we currently derive all of our revenues. If these parties were unable or unwilling to continue to supply our needs, we might not be able

to find an alternative source of supply which would materially adversely impact our business, financial condition and operating results

We

have engaged in limited product development activities and our product development efforts may not result in commercial products.

Although

our QHSLab has been provided to physicians and enabled them to generate revenues, we have only recently begun to seek to charge physicians

for this product. We intend to develop additional features to be added to QHSLab to provide PCPs with additional sources of revenue.

There is no assurance that any of the new features we develop will gain market acceptance. We cannot guarantee we will be able to produce

commercially successful products. Further, our eventual operating results could be susceptible to varying interpretations by potential

customers, or scientists, medical personnel, regulatory personnel, statisticians and others, which may delay, limit or prevent our executing

our proposed business plan.

Our

business model is unproven with no assurance of operating profits.

Our

current business model is unproven and the profit potential, if any, is unknown. We are subject to all the risks inherent in a new business

model. There can be no assurance that our business model will prove successful or that we will achieve significant revenue or profitability.

If

we fail to raise additional capital, our ability to implement our business plan and strategy could be compromised.

We

have limited capital resources and operations. To date, our operations primarily have been funded from capital contributions and loans

from our principal shareholder and more recently, third parties. We may not be able to obtain additional financing on terms acceptable

to us, or at all. Even if we obtain financing for our near-term operations and product development, we may require additional capital

beyond the near term. If we are unable to raise capital when needed, our business, financial condition and results of operations would

be materially adversely affected, and we could be forced to reduce or discontinue our operations.

If

we issue additional shares of common stock, it would reduce our stockholders’ percent of ownership and may dilute our share value.

Our

Certificate of Incorporation authorizes the issuance of 900 million shares of common stock. As

at September xx, 2022 we have outstanding 9,065,508 shares of common stock, without giving effect to shares issuable upon conversion

or exercise of convertible notes, preferred stock, options and warrants currently outstanding. The future issuance of common stock to

raise capital may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may

value any common stock issued in the future on an arbitrary basis. The issuance of common stock upon the conversion or exercise of outstanding

notes and warrants, for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares

held by our then existing stockholders and might have an adverse effect on any trading market for our common stock.

Our

cloud based software platform under development is new and unproven.

Our

QHSLab was provided to PCPs on a free test basis. We will be developing additional features to incorporate into QHSLab. The market for

our solutions is relatively new and evaluating the size and scope of the market is subject to risks and uncertainties. Our future success

will depend in large part on the growth of this market and our ability to design and incorporate features that appeal to PCPs and their

patients. Potential customers may not recognize the need for, or benefits of, our platform, which may prompt them to adopt alternative

products and services to satisfy their healthcare requirements. Assessing the market for our solutions we are competing in, or planning

to compete in, is particularly difficult due to a number of factors, including limited available information and rapid evolution of the

market. If our market does not experience significant growth, or if demand for our platform does not occur, then our business, results

of operations and financial condition will be adversely affected.

We

are Dependent on Existing Key Personnel and Need to Recruit Additional Personnel.

Our

success depends, to a large degree, upon the efforts and abilities of Troy Grogan, our sole officer and key consultants. The loss of

the services of one or more of our key providers could have a material adverse effect on our operations. In addition, as our business

model is implemented, we will need to recruit and retain additional management, financial personnel, key employees and consulting service

providers in virtually all phases of our operations. Key employees and consultants will require a strong background in our industry.

We cannot assure that we will be able to successfully attract and retain key personnel.

Our

sole officer and director is engaged in other business activities and has a conflict in determining how much time to devote to our affairs.

His failure to devote sufficient time to our business could have a negative impact on our operations.

Our

sole executive officer and director is not required to, and will not, commit his full time to our affairs, which results in a conflict

of interest in allocating his time between our operations and the other businesses in which he is engaged. Our sole executive officer

and director is engaged in several other business endeavors and is not obligated to contribute any specific number of hours to our affairs.

His failure to devote time to our business could have an adverse impact on our business, results of operations and financial condition.

We

operate in a highly competitive industry.

We

encounter competition from local, regional or national entities, some of which have superior resources or other competitive advantages.

Intense competition may adversely affect our business, financial condition or results of operations. Our competitors may be larger and

more highly capitalized, with greater name recognition. We will compete with such companies on brand name, quality of services, level

of expertise, advertising, product and service innovation and differentiation of product and services. As a result, our ability to secure

significant market share may be impeded.

We

face substantial competition, and others may discover, develop, acquire or commercialize competitive products before or more successfully

than we do.

We

operate in a highly competitive environment. Our products compete with other products or treatments for diseases for which our products

may be indicated. Other healthcare companies have greater clinical, research, regulatory and marketing resources than us. In addition,

some of our competitors may have technical or competitive advantages for the development of technologies and processes. These resources

may make it difficult for us to compete with them to successfully discover, develop and market new products.

The

growth of our business relies, in part, on the growth and success of our clients.

The

utility of our products to our clients will be determined by their ability to incorporate them into their health care regimen and the

acceptance of our products by their patients. The ability of our clients to incorporate our products into their practices is outside

of our control. In addition, if the number of patients of one or more of our clients using our products were to be reduced, such decrease

would lead to a decrease in our revenue.

We

conduct business in a heavily regulated industry. If we fail to comply with applicable laws and government regulations, we could incur

penalties or be required to make significant changes to our operations or experience adverse publicity, which could have a material adverse

effect on our business, financial condition, and results of operations.

The

healthcare industry is heavily regulated and closely scrutinized by federal, state and local governments. Comprehensive statutes and

regulations govern the products we offer and the manner in which we provide and bill for services and collect reimbursement from governmental

programs and private payors, our contractual relationships with our providers, vendors and clients, our marketing activities and other

aspects of our operations. Of particular importance are:

| |

● |

the

federal physician self-referral law, commonly referred to as the Stark Law; |

| |

● |

the

federal Anti-Kickback Act; |

| |

● |

the

criminal healthcare fraud provisions of HIPAA; |

| |

● |

the

federal False Claims Act; |

| |

● |

reassignment

of payment rules that prohibit certain types of billing and collection; |

| |

● |

similar

state law provisions pertaining to anti-kickback, self-referral and false claims issues; |

| |

● |

state

laws that prohibit general business corporations, such as us, from practicing medicine; and |

| |

● |

laws

that regulate debt collection practices as applied to our debt collection practices. |

Some

of our business activities could be subject to challenge under one or more of such laws. Achieving and sustaining compliance with these

laws may prove costly. Failure to comply with these laws and other laws can result in civil and criminal penalties such as fines, damages,

overpayment recoupment, loss of enrollment status and exclusion from the Medicare and Medicaid programs. The risk of our being found

in violation of these laws and regulations is increased by the fact that many of their provisions are open to a variety of interpretations.

Our failure to accurately anticipate the application of these laws and regulations to our business or any other failure to comply with

regulatory requirements could create liability for us and negatively affect our business. Any action against us for violation of these

laws or regulations, even if we successfully defend against it, could cause us to incur significant legal expenses, divert our management’s

attention from the operation of our business and result in adverse publicity. Dealing with investigations can be time- and resource-consuming.

Any such investigation or settlement could increase our costs or otherwise have an adverse effect on our business. In addition, because

of the potential for large monetary exposure under the federal False Claims Act, which provides for treble damages and mandatory minimum

penalties of $5,500 to $11,000 per false claim or statement, healthcare providers often resolve allegations without admissions of liability

for significant and material amounts to avoid the uncertainty of treble damages that may be awarded in litigation proceedings. Such settlements

often contain additional compliance and reporting requirements as part of a consent decree, settlement agreement or corporate integrity

agreement. It is expected that the government will continue to devote substantial resources to investigating healthcare providers’

compliance with the healthcare reimbursement rules and fraud and abuse laws. The laws, regulations and standards governing the provision

of healthcare services may change significantly in the future.

Developments

in the healthcare industry could adversely affect our business

Developments

in the healthcare industry and evolving government policy could adversely affect healthcare spending and reimbursement for healthcare

services. We are particularly dependent on primary care physicians and possibly others in the healthcare industry who are dependent upon

revenues derived from federal healthcare programs.

General

reductions in expenditures by healthcare industry participants could result from, among other things:

| |

● |

government or private initiatives that affect the manner in which healthcare providers interact with patients, payers or other healthcare

industry participants, including changes in pricing or means of delivery of healthcare products and services; |

| |

● |

consolidation of healthcare industry participants; |

| |

● |

reductions

in governmental funding for healthcare; |

| |

● |

adverse

changes in business or economic conditions affecting healthcare payers or providers, pharmaceutical, biotechnology or medical device

companies or other healthcare industry participants; and |

| |

● |

restructuring

of the healthcare industry and possible elimination of private insurers. |

Even

if general expenditures by industry participants remain the same or increase, developments in the healthcare industry may result in reduced

spending for the products or services we provide. The use of our products and services could be affected by changes in health insurance

plans resulting in a decrease in the willingness of PCPs to purchase our products.

The

timing and impact of developments in the healthcare industry are difficult to predict. We cannot assure you that the markets for any

products we may seek to distribute and services we provide will be sustained.

Our

use and disclosure of personally identifiable information, including health information, is subject to federal and state privacy and

security regulations, and our failure to comply with those regulations or to adequately secure the information we hold could result in

significant liability or reputational harm and, in turn, a material adverse effect on our client base, membership base and revenue.

Numerous

state and federal laws and regulations govern the collection, dissemination, use, privacy, confidentiality, security, availability and

integrity of personally identifiable information (PII), including protected health information (PHI). HIPAA establishes a set of basic

national privacy and security standards for the protection of PHI, by health plans, healthcare clearinghouses and certain healthcare

providers, referred to as covered entities, and the businesses with which such covered entities contract for services, which includes

us. HIPAA requires companies like us to develop and maintain policies and procedures with respect to PHI, including the adoption of administrative,

physical and technical safeguards to protect such information. HIPAA imposes mandatory penalties for certain violations which can be

significant. HIPAA mandates that the Secretary of Health and Human Services, or HHS conduct periodic compliance audits of HIPAA covered

entities or business associates. It also tasks HHS with establishing a methodology whereby individuals who were the victims of breaches

of unsecured PHI may receive a percentage of the Civil Monetary Penalty fine paid by the violator. HIPAA further requires that patients

and, in some instances, HHS be notified of any unauthorized acquisition, access, use or disclosure of their unsecured PHI that compromises

the privacy or security of such information, with certain exceptions. Numerous other federal and state laws protect the confidentiality,

privacy, availability, integrity and security of PHI. These laws in many cases are more restrictive than, and may not be preempted by,

HIPAA, creating complex compliance issues for us and our clients potentially exposing us to additional expense, adverse publicity and

liability. If we do not comply with existing or new laws and regulations related to PHI, we could be subject to criminal or civil sanctions.

Because of the extreme sensitivity of the PII we store and transmit, the security features of our technology platform are very important.

If our security measures, some of which are managed by third parties, are breached or fail, unauthorized persons may obtain access to

sensitive client and patient data, including HIPAA-regulated PHI. As a result, our reputation could be severely damaged, adversely affecting

client and patient confidence. Clients may curtail their use of or stop using our services or our client base could decrease, which would

cause our business to suffer. In addition, we could face litigation, damages for contract breach, penalties and regulatory actions for

violation of HIPAA and other applicable laws or regulations and significant costs for remediation, notification to individuals and for

measures to prevent future occurrences. Any security breach could also result in increased costs associated with liability for stolen

assets or information, repairing system damage that caused by such breaches, incentives offered to clients or other business partners

in an effort to maintain business relationships after a breach and implementing measures to prevent future occurrences, including organizational

changes, deploying additional personnel and protection technologies, training employees and engaging third-party experts and consultants.

While we maintain insurance covering certain security and privacy damages and claim expenses, we may not carry insurance or maintain

coverage sufficient to compensate for all liability and in any event, insurance coverage would not address the reputational damage that

could result from a security incident. We outsource important aspects of the storage and transmission of client and patient information,

and thus rely on third parties to manage functions that have material cyber-security risks. We attempt to address these risks by requiring

outsourcing subcontractors who handle client and patient information to sign business associate agreements contractually requiring those

subcontractors to adequately safeguard personal health data to the same extent that applies to us and in some cases by requiring such

outsourcing subcontractors to undergo third-party security examinations. However, we cannot assure you that these contractual measures

and other safeguards will adequately protect us from the risks associated with the storage and transmission of client and patient proprietary

and protected health information.

The

security of our platform, networks or computer systems may be breached, and any unauthorized access to our customer data will have an

adverse effect on our business and reputation.

The

use of our products will involve the storage, transmission and processing of our clients’ and their patients’ private data.

Individuals or entities may attempt to penetrate our network or platform security, or that of our third-party hosting and storage providers,

and could gain access to our clients’ and their patients’ private data, which could result in the destruction, disclosure

or misappropriation of proprietary or confidential information of our clients’ and their patients’ or their customers, employees

and business partners. If any of our clients’ private data is leaked, obtained by others or destroyed without authorization, it

could harm our reputation, we could be exposed to civil and criminal liability, and we may lose our ability to access private data, which

will adversely affect the quality and performance of our platform. In addition, our platform may be subject to computer malware, viruses

and computer hacking, fraudulent use attempts and phishing attacks, all of which have become more prevalent. Any failure to maintain

the performance, reliability, security and availability of our products or services and technical infrastructure to the satisfaction

of our clients may harm our reputation and our ability to retain existing customers and attract new users. While we will implement procedures

and safeguards that are designed to prevent security breaches and cyber-attacks, they may not be able to protect against all attempts

to breach our systems, and we may not become aware in a timely manner of any such security breach. Unauthorized access to or security

breaches of our platform, network or computer systems, or those of our technology service providers, could result in the loss of business,

reputational damage, regulatory investigations and orders, litigation, indemnity obligations, damages for contract breach, civil and

criminal penalties for violation of applicable laws, regulations or contractual obligations, and significant costs, fees and other monetary

payments for remediation. If customers believe that our platform does not provide adequate security for the storage of sensitive information

or its transmission over the Internet, our business will be harmed. Customers’ concerns about security or privacy may deter them

from using our platform for activities that involve personal or other sensitive information.

Because

we rely on the internet to interact with our clients, we are subject to an extensive and highly-evolving regulatory landscape and any

adverse changes to, or our failure to comply with, any laws and regulations could adversely affect our brand, reputation, business, operating

results, and financial condition.

Our

business and the businesses of our customers conducted using our platform and technology, are subject to extensive laws, rules, regulations,

policies, orders, determinations, directives, treaties, and legal and regulatory interpretations and guidance directed to those who conduct

business over the internet, including those governing privacy, data governance, data protection, cybersecurity, fraud detection, payment

services, consumer protection and tax. Many of these legal and regulatory regimes were adopted prior to the advent of the internet, mobile

technologies, digital assets, and related technologies. As a result, they are subject to significant uncertainty, and vary widely across

U.S. federal, state, and local jurisdictions. These legal and regulatory regimes, including the laws, rules, and regulations thereunder,

evolve frequently and may be modified, interpreted, and applied in an inconsistent manner from one jurisdiction to another, and may conflict

with one another. To the extent we have not complied with such laws, rules, and regulations, we could be subject to significant fines,

revocation of licenses, limitations on our products and services, reputational harm, and other regulatory consequences, each of which

may be significant and could adversely affect our business, operating results, and financial condition.

In

addition to existing laws and regulations, various governmental and regulatory bodies, including legislative and executive bodies, in

the United States may adopt new laws and regulations, or new interpretations of existing laws and regulations may be issued by such bodies

or the judiciary, which may change how we operate our business, how our products and services and those of our customers are regulated,

and what products or services we and our competitors can offer, requiring changes to our compliance and risk mitigation measures

To

the extent we use “open source” software, our use could adversely affect our ability to offer our services and subject us

to possible litigation.

We

may use open source software in connection with our products and services. Companies that incorporate open source software into their

products have, from time to time, faced claims challenging the use of open source software and/or compliance with open source license

terms. As a result, we could be subject to suits by parties claiming ownership of what we believe to be open source software or claiming

noncompliance with open source licensing terms. Some open source software licenses require users who distribute software containing open

source software to publicly disclose all or part of the source code to such software and/or make available any derivative works of the

open source code, which could include valuable proprietary code of the user, on unfavorable terms or at no cost. While we monitor the

use of open source software and try to ensure that none is used in a manner that would require us to disclose our proprietary source

code or that would otherwise breach the terms of an open source agreement, such use could inadvertently occur, in part because open source

license terms are often ambiguous. Any requirement to disclose our proprietary source code or pay damages for breach of contract could

have a material adverse effect on our business, financial condition and results of operations and could help our competitors develop

products and services that are similar to or better than ours.

Assertions

by third parties of infringement or other violations by us of their intellectual property rights could result in significant costs and

harm our business and operating results.

Our

success depends upon our ability to refrain from infringing upon the intellectual property rights of others. Some companies, including

some of our competitors, own large numbers of patents, copyrights and trademarks, which they may use to assert claims against us. As

we grow and enter new markets, we will face a growing number of competitors. As the number of competitors in our industry grows and the

functionality of products in different industry segments overlaps, we expect that software and other solutions in our industry may be

subject to such claims by third parties. Third parties may in the future assert claims of infringement, misappropriation or other violations

of intellectual property rights against us. We cannot assure you that infringement claims will not be asserted against us in the future,

or that, if asserted, any infringement claim will be successfully defended. A successful claim against us could require that we pay substantial

damages or ongoing royalty payments, prevent us from offering our services, or require that we comply with other unfavorable terms. We

may also be obligated to indemnify our customers or business partners or pay substantial settlement costs, including royalty payments,

in connection with any such claim or litigation and to obtain licenses, modify applications or refund fees, which could be costly. Even

if we were to prevail in such a dispute, any litigation regarding our intellectual property could be costly and time-consuming and divert

the attention of our management and key personnel from our business operations.

The

continuation of the COVID-19 pandemic could adversely affect our business, operating results, cash flow and financial condition.

The

COVID-19 pandemic could adversely affect our business, operating results, cash flow and financial condition. In March 2020, the World

Health Organization characterized COVID-19 as a pandemic and the President of the United States declared the COVID-19 outbreak a national

emergency. Since then, the COVID-19 pandemic has resulted in significant volatility, uncertainty and economic disruption. The future

impacts of the pandemic and any resulting economic impact are largely unknown. It is possible that the COVID-19 pandemic, the measures

taken by local, state and national governments and the resulting economic impact may materially and adversely affect our business, results

of operations, cash flow and financial condition. The extent to which COVID-19 ultimately impacts our business, results of operations,

cash flow and financial condition will depend on future developments, which are uncertain and cannot be predicted, including, but not

limited to, the duration and spread of the outbreak, its severity, the actions taken by governments and authorities to contain the virus

or treat its impact, and when and to what extent normal economic and operating conditions can resume. These uncertainties have resulted

in volatility in securities and financial markets, which may prevent us from accessing the equity or debt capital markets on attractive

terms or at all for a period of time, which could have an adverse effect on our liquidity position. The current level of uncertainty

over the economic and operational impacts of COVID-19 means the impact on our business, results of operations, cash flows and financial

position cannot be reasonably estimated at this time.

Risks

Related to Regulation

Our

products may be subject to product liability claims, which could have an adverse effect on our business, results of operations and financial

condition.

Certain

of our products provide applications that relate to patient clinical information. Any failure by our products to provide accurate and

timely information concerning patients, their medication, treatment and health status, generally, could result in claims against us which

could materially and adversely impact our financial performance, industry reputation and ability to market new system sales. In addition,

a court or government agency may take the position that our delivery of health information directly, including through licensed practitioners,

or delivery of information by a third party site that a consumer accesses through our websites, exposes us to assertions of malpractice,

other personal injury liability, or other liability for wrongful delivery/handling of healthcare services or erroneous health information.

We anticipate that in the future we will maintain insurance to protect against claims associated with the use of our products as well

as liability limitation language in our end-user license agreements, but there can be no assurance that our insurance coverage or contractual

language would adequately cover any claim asserted against us. A successful claim brought against us in excess of or outside of our insurance

coverage could have an adverse effect on our business, results of operations and financial condition. Even unsuccessful claims could

result in our expenditure of funds for litigation and management time and resources.

There

is significant uncertainty in the healthcare industry in which we operate, and we are subject to the possibility of changing government

regulation, which may adversely impact our business, financial condition and results of operations.

The

healthcare industry is subject to changing political, economic and regulatory influences that may affect the procurement processes and

operation of healthcare facilities. During the past several years, the healthcare industry has been subject to an increase in governmental

regulation of, among other things, reimbursement rates and certain capital expenditures.

Recently

enacted public laws reforming the U.S. healthcare system may have an impact on our business. The Patient Protection and Affordable Care

Act (H.R. 3590; Public Law 111-148) (“PPACA”) and The Health Care and Education Reconciliation Act of 2010 (H.R. 4872) (the

“Reconciliation Act”), which amends the PPACA (collectively the “Health Reform Laws”), were signed into law in

March 2010. The Health Reform Laws contain various provisions which may impact us and our patients. Some of these provisions may have

a positive impact, while others, such as reductions in reimbursement for certain types of providers, may have a negative impact due to

fewer available resources. Increases in fraud and abuse penalties may also adversely affect participants in the health care sector, including

us.

Various

legislators have announced that they intend to examine further proposals to reform certain aspects of the U.S. healthcare system. Healthcare

providers may react to these proposals, and the uncertainty surrounding such proposals, by curtailing or deferring investments, including

those for our systems and related services. Cost-containment measures instituted by healthcare providers as a result of regulatory reform

or otherwise could result in a reduction of the allocation of capital funds. Such a reduction could have an adverse effect on our ability

to sell our systems and related services. On the other hand, changes in the regulatory environment have increased and may continue to

increase the needs of healthcare organizations for cost-effective data management and thereby enhance the overall market for healthcare

management information systems. We cannot predict what effect, if any, such proposals or healthcare reforms might have on our business,

financial condition and results of operations.

We

have taken steps to modify our products, services and internal practices as necessary to facilitate our compliance with applicable regulations,

but there can be no assurance that we will be able to do so in a timely or complete manner. Achieving compliance with these regulations

could be costly and distract management’s attention and divert other company resources, and any noncompliance by us could result

in civil and criminal penalties.

Developments

of additional federal and state regulations and policies have the potential to negatively affect our business.

Our

software is anticipated to be considered a medical device by the U.S. Food and Drug Administration (“FDA”) and therefore

subject to regulation by the FDA as a medical device. Such regulation requires the registration of the applicable manufacturing facility

and software and hardware products, application of detailed record-keeping and manufacturing standards, and FDA approval or clearance

prior to marketing. An approval or clearance requirement could create delays in marketing, and the FDA could require supplemental filings

or object to certain of these applications, the result of which could adversely affect our business, financial condition and results

of operations.

Compliance

with changing regulation of corporate governance and public disclosure will result in significant additional expenses.

Changing

laws, regulations, and standards relating to corporate governance and public disclosure for public companies, including the Sarbanes-Oxley

Act of 2002 and various rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), are creating

uncertainty for public companies. Our Company’s management will need to invest significant time and financial resources to comply

with both existing and evolving requirements for public companies, which will lead, among other things, to significantly increased general

and administrative expenses and a certain diversion of management time and attention from revenue generating activities to compliance

activities.

We

may be subject to false or fraudulent claim laws.

There

are numerous federal and state laws that forbid submission of false information or the failure to disclose information in connection

with submission and payment of physician claims for reimbursement. Any failure of our services to comply with these laws and regulations

could result in substantial liability including, but not limited to, criminal liability, could adversely affect demand for our services

and could force us to expend significant capital, research and development and other resources to address the failure. Errors by us or

our systems with respect to entry, formatting, preparation or transmission of claim information may be determined or alleged to be in

violation of these laws and regulations. Determination by a court or regulatory agency that our services violate these laws could subject

us to civil or criminal penalties, invalidate all or portions of some of our client contracts, require us to change or terminate some

portions of our business, require us to refund portions of our services fees, cause us to be disqualified from serving clients doing

business with government payers and have an adverse effect on our business.

We

are subject to the Stark Law, which may result in significant penalties.

Provisions

of the Omnibus Budget Reconciliation Act of 1993 (42 U.S.C. § 1395nn) (the “Stark Law”) prohibit referrals by a physician

of “designated health services” which are payable, in whole or in part, by Medicare or Medicaid, to an entity in which the

physician or the physician’s immediate family member has an investment interest or other financial relationship, subject to several

exceptions. Unlike the Fraud and Abuse Law, the Stark Law is a strict liability statute. Proof of intent to violate the Stark Law is

not required. The Stark Law also prohibits billing for services rendered pursuant to a prohibited referral. Several states have enacted

laws similar to the Stark Law. These state laws may cover all (not just Medicare and Medicaid) patients. Many federal healthcare reform

proposals in the past few years have attempted to expand the Stark Law to cover all patients as well. As with the Fraud and Abuse Law,

we consider the Stark Law in planning our products, marketing and other activities, and believe that our operations are in compliance

with the Stark Law. If we violate the Stark Law, our financial results and operations could be adversely affected. Penalties for violations

include denial of payment for the services, significant civil monetary penalties, and exclusion from the Medicare and Medicaid programs.

We

are Required to Comply with Medical Device Reporting (MDR) and We Must Report Certain Malfunctions, Deaths and Serious Injuries Associated

with Our Medical Device Which Can Result In Voluntary Corrective Actions, Mandatory Recall or FDA Enforcement Actions.

Under

applicable FDA MDR regulations, medical device manufacturers are required to submit information to the FDA when they receive a report

or become aware that a device has or may have caused or contributed to a death or serious injury or has or may have a malfunction that

would likely cause or contribute to death or serious injury if the malfunction were to recur.

All

manufacturers placing medical devices on the market in the European Economic Area and the United States are legally bound to report any

serious or potentially serious incidents involving devices they produce or sell to the regulatory agency, or Competent Authority, in

whose jurisdiction the incident occurred.

If

our products fail to comply with evolving government and industry standards and regulations, we may have difficulty selling our products.

We

may be subject to additional federal and state statutes and regulations in connection with offering services and products via the Internet.

On an increasingly frequent basis, federal and state legislators are proposing laws and regulations that apply to Internet commerce and

communications. Areas being affected by these regulations include user privacy, pricing, content, taxation, copyright protection, distribution,

and quality of products and services. To the extent that our products and services are subject to these laws and regulations, the sale

of our products and services could be harmed.

Risks

related to our Common Stock

There

is not now, and there may never be, an active market for our common stock.

Our

common stock is listed on the OTCQB level of the OTC Market under the symbol “USAQ,” but there is no active trading market

for our common stock. There can be no assurance that an active trading market for our securities will develop, or that if one develops,

that it will be sustained. The trading market for securities of companies listed on the OTC Market is substantially less liquid than

the average trading market for companies listed on a national securities exchange. In addition, our ability to raise capital will be

adversely affected by a listing on the OTC Market, as compared to a listing on a national securities exchange.

Our

stock price is likely to be highly volatile because of several factors, including a limited public float.

The

market price of our common stock has been volatile and is likely to be highly volatile in the future. You may not be able to resell shares

of our common stock following periods of volatility because of the market’s adverse reaction to volatility.

Factors

that could cause such volatility include, among other things:

| |

● |

actual

or anticipated fluctuations in our operating results; |

| |

● |

the

limited number of securities analysts covering us and distributing research and recommendations about us; |

| |

● |

the

low public float for our common stock; |

| |

● |

the

low trading volume of our common stock; |

| |

● |

announcements

concerning our business or those of our competitors; |

| |

● |

actual

or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; |

| |

● |

conditions

or trends in our industry; |

| |

● |

litigation; |

| |

● |

changes

in market valuations of similar companies; |

| |

●

● |

future

sales of common stock;

the

perception that a significant number of shares of our common stock may be sold upon conversion of outstanding notes or the exercise

of outstanding warrants if the price of our common stock increases; |

| |

● |

departure

of key personnel or failure to hire key personnel; and |

| |

● |

general

market conditions. |

Any

of these factors could have a significant and adverse impact on the market price of our common stock. In addition, the stock market in

general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock and/or

warrants, regardless of our actual operating performance.

Our

common stock is subject to the “Penny Stock” Rules of the SEC, which makes transactions in our stock cumbersome and may reduce

the value of an investment in our stock.

The

SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity

security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain

exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (a) that a broker or dealer approve a person’s

account for transactions in penny stocks; and (b) the broker or dealer receive from the investor a written agreement to the transaction,

setting forth the identity and quantity of the penny stock to be purchased.

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must: (a) obtain financial information

and investment experience and objectives of the person; and (b) make a reasonable determination that the transactions in penny stocks

are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating

the risks of transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating

to the penny stock market, which, in highlight form: (a) sets forth the basis on which the broker or dealer made the suitability determination;

and (b) that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Generally, brokers

may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult

for investors to dispose of our common shares and cause a decline in the market value of our stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

Shares

eligible for future sale may adversely affect the market.

The

Shares of common stock being offered by this Prospectus, other than any of such shares which are acquired by our “affiliates,”

as defined in Rule 144, will be freely tradable without restriction or registration under the Securities Act. In addition, from time

to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage

transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general,

pursuant to Rule 144, non-affiliate stockholders may sell freely after six months, subject only to the current public information requirement.

Affiliates may sell after six months, subject to the Rule 144 volume, manner of sale (for equity securities), current public information,

and notice requirements. Given the limited trading of our common stock, resale of even a small number of shares of our common stock pursuant

to Rule 144 or an effective registration statement, including the shares offered by this Prospectus, may adversely affect the market

price of our common stock.

Our

sole director and officer controls a majority of the votes which may be cast at a meeting of our stockholders.

In

addition to the common stock owned by our sole director and officer, he owns shares of our Series A Preferred Stock which have the right

to vote on all issues presented to our common stockholders. Taking into account the votes he is eligible to cast by virtue of the number

of shares of our common stock and Series A Preferred Stock held by our sole officer and director, he controls a majority of the votes

which may be cast at a meeting of our stockholders, and therefore controls our operations and will have the ability to control all matters

submitted to stockholders for approval. This stockholder thus has complete control over our management and affairs. Accordingly, his

ownership may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential

acquirer from making a tender offer for our common stock, which may further affect its liquidity.

Under

our Certificate of Incorporation, our director has the authority, without stockholder approval, to issue preferred stock with terms that

may not be beneficial to common stockholders and with the ability to adversely affect stockholder voting power and perpetuate the board’s

control over our company.

Our

director may authorize the issuance of preferred stock in one or more series with such limitations and restrictions as it may determine,

in its sole discretion, with no further authorization by security holders required for the issuance of such shares. The Board may determine

the specific terms of the preferred stock, including: designations; preferences; conversions rights; cumulative, relative; participating;