UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Filed

by the Registrant ☑

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

|

☑

|

Preliminary

Information Statement

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

☐

|

Definitive

Information Statement

|

PCT LTD

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

☑

|

No

fee required.

|

|

|

☐

|

Fee computed

on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

3)

|

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of securities::

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

4)

|

Date Filed:

|

PCT LTD

4235 COMMERCE STREET

LITTLE RIVER, SOUTH CAROLINA 29566

INFORMATION STATEMENT

IN LIEU OF SPECIAL OR ANNUAL MEETING OF STOCKHOLDERS

Dear PCT LTD Stockholder:

The purpose of this letter and the enclosed

Information Statement is to inform you that stockholders holding shares of Series B – Super Voting Convertible Preferred

Stock (the “Series B Preferred”), representing in excess of a majority of the outstanding shares of common stock of

PCT LTD have executed a written consent (the “Written Consent”) in lieu of a special or annual meeting to effectuate

the following (the “Actions”):

-

Amend PCT’s articles of incorporation to increase its authorized shares of common stock from 300,000,000

shares to 1,000,000,000 shares,

-

Elect four members to the Board (two Class II and two Class III) to serve additional terms, and

-

Ratify the appointment of Sadler, Gibb & Associates, LLC as PCT’s independent public accountant

for the year ended December 31, 2019.

A copy of the amendment

to the Articles of Incorporation is attached hereto as Exhibit A (the “Amended Articles”).

Pursuant to Rule 14c-2

of the Exchange Act, the Actions will become effective on or after _______ __, 2019, which is 20 calendar days following the date

we first mail the Information Statement to our stockholders. As soon as practicable after such date, we intend to file

the Amended Articles with the Nevada Secretary of State.

The accompanying Information

Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Exchange Act

and the rules and regulations prescribed thereunder. As described in this Information Statement, the Actions have been

approved by stockholders representing more than a majority of the voting power of our outstanding Common Stock. We are not soliciting

your proxy or consent in connection with the matters discussed above. You are urged to read the Information Statement

in its entirety for a description of the Actions approved by certain stockholders holding more than a majority of the voting power

of our outstanding Common Stock.

The Information Statement

is being mailed on or about ______ __. 2019 to stockholders of record as of October 4, 2019.

THIS IS FOR YOUR INFORMATION ONLY. YOU

DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

Yours truly,

________________________

Gary J. Grieco

Chairman

Little River, South Carolina

_______ __, 2019

PCT LTD

4235 COMMERCE STREET

LITTLE RIVER, SOUTH CAROLINA 29566

INFORMATION STATEMENT

(Dated _____ __, 2019)

NO VOTE OR OTHER ACTION OF PCT’S

STOCKHOLDERS IS REQUIRED IN

CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

PCT LTD is furnishing this information

statement (the “Information Statement”) to its stockholders in full satisfaction of any notice requirements

PCT may have under the Securities and Exchange Act of 1934, as amended, and applicable Nevada law (the “NRS”).

No additional action will be undertaken by PCT with respect to the receipt of written consents, and no dissenters’ rights

with respect to the receipt of the written consents, and no dissenters’ rights under the NRS, are afforded to PCT’s

stockholders as a result of the adoption of the resolutions contemplated herein.

The Information Statement is being mailed on

or about ______ __, 2019 to the holders of record at the close of business on October 4, 2019 (the “Record Date”),

of the common stock of PCT LTD, a Nevada corporation (“PCT”), in connection with actions approved by written

consent (the “Written Consent”) in lieu of an annual or special meeting to effectuate the following (the “Actions”):

|

|

•

|

Amend

PCT’s articles of incorporation to increase its authorized shares of common stock

from 300,000,000 shares to 1,000,000,000 shares,

|

|

|

•

|

Elect

four members to the Board (two Class II and two Class III) to serve additional terms,

and

|

|

|

•

|

Ratify

the appointment of Sadler, Gibb & Associates, LLC as PCT’s independent public

accountant for the year ending December 31, 2019.

|

This Information Statement is being mailed on

or about ______ __, 2019 to PCT’s stockholders of record as of the Record Date.

The entire cost of furnishing this Information

Statement will be borne by PCT. PCT will request brokerage houses, nominees, custodians, fiduciaries and other like parties to

forward this Information Statement to the beneficial owners of its common stock held of record by them and will reimburse such

persons for their reasonable charges and expenses in connection therewith.

The corporate offices of PCT are located at

4235 Commerce Street, Little River, South Carolina 29566 and PCT’s telephone number is (843) 390-7900.

Except as otherwise described herein, no director,

executive officer, associate of any director or executive officer, or any other person has any substantial interest, other than

election of office, direct or indirect, by security holdings or otherwise, in the Actions, which is not shared by all other holders

of PCT’s common stock.

The Amendments to the

Articles of Incorporation will be effective when the Amended Articles are filed with the Nevada Secretary of State. PCT

will not make such filing until on or after ______ __, 2019, a date that is 20 calendar days after this Information Statement is

first sent to its stockholders.

Under

the NRS, PCT stockholders are not entitled to dissenters’ rights with respect to the Actions.

No security holders have transmitted

any proposals to be acted upon by PCT.

VOTE REQUIRED AND

INFORMATION ON VOTING STOCKHOLDERS

We are not seeking

consents, authorizations or proxies from you.

As of the date of the Written Consent, PCT had

240,774,150 shares of Common Stock issued and outstanding and entitled to vote, which for voting purposes are entitled to one vote

per share. On September 18, 2019, the following consenting Voting Stockholders owning a total of 1,000,000 shares of our Series

B Preferred stock, whereby each share is entitled to cast five hundred (500) votes for each share held of the Series B Preferred

stock on all matters presented to the stockholders of the Corporation for stockholder vote, thereby allowing such Series B Preferred

stock to cast votes totaling 500,000,000 million shares of common stock (which exceeds the number of shares of common stock outstanding

by approximately 208%), delivered the executed Written Consent authorizing the Actions described herein. The consenting Voting

Stockholders’ names, affiliation with the Company and holdings are as follows:

|

Name

|

|

Affiliation with the Company

|

|

Number of Voting Shares

|

|

% of Total

Voting Shares

|

|

Gary J. Grieco

|

|

Chairman of the Board, President

|

|

|

250,000,000

|

|

|

|

104

|

%

|

|

Francis J. Read

|

|

Director, CEO

|

|

|

250,000,000

|

|

|

|

104

|

%

|

|

Total

|

|

|

|

|

500,000,000

|

|

|

|

208

|

%

|

Pursuant to the Company’s

existing Bylaws and the NRS, the holders of the issued and outstanding shares of our Common Stock representing a majority of our

voting power may approve and authorize the Actions by written consent as if such Actions were undertaken at a duly called and held

meeting of stockholders. In order to significantly reduce the costs and management time involved in soliciting and obtaining

proxies to approve the Actions, and in order to effectuate the Actions as early as possible, the Board elected to utilize, and

did in fact obtain, the Written Consent of the Voting Stockholders. The Written Consent satisfies the stockholder approval

requirement for the Actions. Accordingly, under the NRS and the Bylaws, no other approval by the Board or stockholders

of the Company is required in order to effect the Actions.

ACTION 1. AMEND ARTICLES OF INCORPORATION

Increase in Authorized Shares of Common Stock

Existing Articles

The total number of shares of Common Stock authorized

under the existing Articles of Incorporation of the Company, as in effect prior to the completion of the Actions, is 300,000,000

shares.

Amended Articles

The total number of shares of Common Stock authorized

under the Amended Articles will be 1,000,000,000 shares.

Reasons for and Principal Effects of Amendment

The Board believes that the increase in the

number of shares of authorized capital stock is necessary in order to support the continued growth of the Company. To

date, the Company has supported its operations primarily through sales of shares of its common stock, including sales of derivative

securities that give the holder rights to acquire shares of the Company’s common stock. Such derivative securities

include warrants to purchase shares of common stock and convertible debt instruments that are convertible into shares of common

stock.

The Board anticipates that the Company will

continue to sell shares of its common stock, common stock-based derivative securities and shares of newly authorized Series C Convertible

Preferred Stock in order to support its operations. As a result, the Board has determined that it is necessary to increase

the number of authorized shares of capital stock that the Company is authorized to issue in order to accommodate the Company’s

continued financing activity and existing obligations under its outstanding derivative securities. Accordingly, the Voting Stockholders

approved the increase in number of authorized shares of Common Stock in order to accommodate for any such share issuances.

Furthermore, the Voting Stockholders voted in

favor of the amendment to increase the authorized shares of Common Stock to 1,000,000,000, in order to improve the Company’s

financial flexibility with respect to the Company’s capital structure by having additional shares for future equity financings

and acquisitions. The additional shares of authorized Common Stock would be available for issuance from time to time as determined

by the Board for any proper corporate purpose. Such purposes might include, without limitation, issuance in public or private sales

for cash as a means of obtaining additional capital for use in the Company’s business and operations, and issuance as part

or all of the consideration required to be paid by the Company for acquisitions of other businesses or assets. Notwithstanding

the foregoing, the Company has no obligation to issue such additional shares and there are no plans, proposals or arrangements

currently contemplated by the Company that would involve the issuance of the additional shares to acquire another company or its

assets, or for any other corporate purpose stated.

The Company’s stockholders will not realize

any dilution in their ownership or voting rights as a result of the increase in authorized shares of Common Stock, but will experience

dilution to the extent additional shares are issued in the future.

Having an increased number of authorized but

unissued shares of Common Stock would allow the Company to take prompt action with respect to corporate opportunities that develop,

without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in the Company’s

capitalization. The issuance of additional shares of Common Stock may, if such shares are issued at prices below what current stockholders’

paid for their shares, reduce stockholders’ equity per share and dilute the value of current stockholders’ shares.

It is not the present intention of the Board to seek stockholder approval prior to any issuance of shares of Common Stock that

would become authorized by the amendment unless otherwise required by law or regulation. Frequently, opportunities arise that require

prompt action, and it is the belief of the Voting Stockholders that the delay necessitated for stockholder approval of a specific

issuance could be to the detriment of the Company and its stockholders.

When issued, the additional shares of Common

Stock authorized by the amendment will have the same rights and privileges as the shares of Common Stock currently authorized and

outstanding. Holders of Common Stock have no preemptive rights and, accordingly, stockholders would not have any preferential rights

to purchase any of the additional shares of Common Stock when such shares are issued.

Shares of authorized and unissued Common Stock

could be issued in one or more transactions that could make it more difficult, and therefore less likely, that any takeover of

the Company could occur. Issuance of additional Common Stock could have a deterrent effect on persons seeking to acquire control.

The Board also could, although it has no present intention of so doing, authorize the issuance of shares of Common Stock to a holder

who might thereby obtain sufficient voting power to assure that any proposal to effect certain business combinations or amendment

to the Company’s Articles of Incorporation or Bylaws would not receive the required stockholder approval. Accordingly, the

power to issue additional shares of Common Stock could enable the Board to make it more difficult to replace incumbent directors

and to accomplish business combinations opposed by the incumbent Board.

ACTION 2. ELECTION

OF DIRECTORS

PCT stockholders generally

elect the members of the board of directors annually. PCT’s board of directors at the time of the Written Consent consisted

of five members; Gary J. Grieco, Gregory W. Albers, Paul Branagan, Francis J. Read, and William E. Prince. The election of PCT

directors required a plurality of the votes cast in person or by proxy at an annual meeting or by a majority consent of PCT’s

stockholders in accordance with the NRS and Bylaws. In accordance with the Written Consent, stockholders holding the Series B Preferred

stock, representing more than a majority of PCT’s outstanding shares of common stock, voted to elect Gregory W. Albers (Class

II), Paul Branagan (Class II), Francis J. Read (Class III), and William E. Prince (Class III) as board members.

|

Name

|

|

Age

|

|

Position(s) Held

|

|

Class of Director

|

|

Director Term

|

|

Gregory W. Albers

|

|

|

70

|

|

|

Current Class II Director and Secretary/Treasurer

|

|

Class II

|

|

Two Years

|

|

Paul Branagan

|

|

|

76

|

|

|

Current Class II Director

|

|

Class II

|

|

Two Years

|

|

Francis J. Read

|

|

|

54

|

|

|

Current Class III Director, CEO

|

|

Class III

|

|

One Year

|

|

William E. Prince

|

|

|

68

|

|

|

Current Class III Director

|

|

Class III

|

|

One Year

|

CLASS II DIRECTORS (serving two year terms expiring at the

2021 annual meeting):

Gregory W. Albers

-- Mr. Albers was appointed to fill a vacancy on our Board and to serve as Secretary/Treasurer on April 1, 2016. He is the President

and Chief Executive Officer of Life Insurance Buyers, Inc., a life insurance brokerage. Since 1995 to the present, Mr. Albers has

worked in the viatical and life settlement industry and, based on his experience, he has testified as an expert regarding that

industry’s issues in Kansas legislative committees. Prior to 1995 he worked as an independent life broker and a New England

Life Insurance Company insurance agent. He earned a Bachelor’s degree in Business from Kansas State University.

Mr. Albers experience owning

and operating his insurance business may prove helpful in management of our subsidiary’s operations. Prior to his appointment,

Mr. Albers has not had any related party transactions with the Company or its affiliates and he has no family relationship with

any current executive officer or director of the Company.

Paul Branagan

– was appointed as a director of the Company on March 23, 2018. From 1993 to the present Mr. Branagan has been the President

and Senior Scientist of Branagan & Associates, Inc. Mr. Branagan is a physicist with over 40 years of experience in a variety

of technical ventures ranging from nuclear weapons development, improving and monitoring civil structural and construction activities

to enhanced energy development for the oil and gas industry. Most of his efforts involved large scale commercialization and Research

& Development (R&D) in advanced technical projects. Mr. Branagan has authored and co-authored numerous papers, articles

and presentations covering a broad range of technical accomplishments. Many involved topical oil and gas R&D activities and

their ultimate commercialization. In addition to being a Distinguished Lecturer he has also served on a numerous symposium committees

charged with reviewing, editing and selecting the most advanced and topical technical articles for presentation. Mr. Branagan graduated

from the University of Las Vegas Nevada with a B.S. in physics.

CLASS III DIRECTORS (serving one year terms expiring at the

2020 annual meeting):

Francis J. Read

– was appointed as a director of the Company on March 23, 2018. On November 8, 2018, Mr. Read became the Chief Executive

Officer of PCT LTD. In 2017, Mr. Read became the Chief Operations Officer for Paradigm Convergence Technologies Corp., the Company’s

wholly-owned operating subsidiary. In 1998, Mr. Read founded and since 2016 has served as the CEO of CSA Service Solutions, a $44

million field support company specializing in providing support solutions for large equipment manufacturers. CSA has over 350 employees

nationwide with over 270 engineers operating in the Healthcare, Clinical Education, Life Sciences, Security, and Power Industries.

Mr. Read holds a MBA from Tulane University and a BS, electronic Engineering from DeVry Institute of Technology.

William E. Prince

– was appointed as a director of the Company on March 23, 2018. Since 2014, Mr. Prince has served as Sr. Vice President Sales

& Marketing for Paradigm Convergence Technologies Corp., the Company’s wholly-owned operating subsidiary. For two years

prior to joining Paradigm, Mr. Prince was an independent consultant in the electro-chemically activated solution industry. From

2003 through 2011, Mr. Prince was the President, CEO and Chairman of Integrated Environmental Technologies, Ltd, a publicly traded

company with its common stock registered under the 34 Act.

The Corporation’s Bylaws allow for the

appointment of up to seven directors. The Board may appoint up to two additional Class III directors to fill such vacancies at

any time prior to the next annual meeting or at any time there is a vacancy on the Board.

Compliance with Section 16(a) of the Exchange

Act

Section 16(a) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially

own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in ownership with the

SEC. Executive officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish us

with copies of all Section 16(a) forms they file. Based upon a review of the copies of such forms furnished to us and written representations

from our executive officers and directors, we believe that as of the date of this information statement they were not current in

their filings.

Code of Ethics

We have not adopted a code of ethics for our

principal executive and financial officers. Our board of directors intends to address this issue in the future and adopt a code

of ethics as appropriate. In the meantime, our management intends to promote honest and ethical conduct, full and fair disclosure

in our reports to the SEC and comply with applicable governmental laws and regulations.

Corporate Governance

We are a smaller reporting company and, as a

result, we did not have a standing nominating committee for directors, nor did we have an audit committee with an audit committee

financial expert serving on that committee, nor did we have a compensation committee. Our entire board of directors acted as our

nominating, audit and compensation committees. Our board of directors intends to address these issues in the future and enact committees

as appropriate.

Stockholder Communications with the Board

of Directors

Stockholders who wish to communicate with the

Board or a particular director may send a letter to the Secretary of the Company at 4235 Commerce Street, Little River, South Carolina

29566. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication”

or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder and clearly state

whether the intended recipients are all members of the Board or just certain specified individual Directors. The Secretary will

make copies of all such letters and circulate them to the appropriate director or Directors.

Current Officers and Directors

The following table sets forth the names and

positions of PCT’s executive officers and directors as of the date of the Written Consent.

|

Name

|

|

Age

|

|

Position(s) Held

|

|

Class of Director

|

|

Director Term

|

|

Gary J. Grieco

|

|

|

77

|

|

|

Existing Director and President

|

|

Class I

|

|

Since August 10, 2016

|

|

Gregory W. Albers

|

|

|

69

|

|

|

Existing Director and Secretary/Treasurer

|

|

Class II

|

|

Since April 1, 2016

|

|

Paul Branagan

|

|

|

75

|

|

|

Newly Appointed Director

|

|

Class II

|

|

Since March 23, 2018

|

|

Francis J. Read

|

|

|

53

|

|

|

Newly Appointed Director

|

|

Class III

|

|

Since March 23, 2018

|

|

William E. Prince

|

|

|

67

|

|

|

Newly Appointed Director

|

|

Class III

|

|

Since March 23, 2018

|

CLASS I DIRECTOR (serving three year

term expiring at the 2020 annual meeting):

Gary J. Grieco

-- Mr. Grieco was appointed to serve as a Director and as President of Bingham on August 10, 2016. He currently serves as a Director

for Paradigm and from June 2014 to the present he has served as the President of Paradigm and has served as Secretary of that company

since June 2012. He also served as Paradigm’s Chief Financial Officer from June 2012 to June 2014. His responsibilities have

included sales, marketing and testing of the Paradigm technologies and seeking additional technology for the company to license.

He supervises four employees and two outside consultants. In addition, for the past 25 years he has served as President of 3GC,

Ltd. He attended the University of Buffalo and studied securities analysis at the New York Institute of Finance and New York University.

Mr. Grieco’s experience

as a director and officer of Paradigm and his knowledge and experience with the products and operations of Paradigm should assist

our Board with future decisions regarding the development of the Paradigm subsidiary.

CLASS II DIRECTORS (serving two year

terms expiring at the 2021 annual meeting):

Gregory W. Albers

– see resume above.

Paul Branagan

– see resume above.

CLASS III DIRECTORS (serving one year

terms expiring at the 2020 annual meeting):

Francis J. Read

– see resume above.

William E. Prince

– see resume above.

Limitation of Liability of Directors

Pursuant to the NRS, the Company’s articles

of incorporation exclude personal liability for its directors for monetary damages based upon any violation of their fiduciary

duties as directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faith or which

involve intentional misconduct or a knowing violation of law, or any transaction from which a director receives an improper personal

benefit. This exclusion of liability does not limit any right which a director may have to be indemnified and does not affect any

director’s liability under federal or applicable state securities laws. The Company has agreed to indemnify its directors

against expenses, judgments, and amounts paid in settlement in connection with any claim against a director if he acted in good

faith and in a manner he believed to be in the Company’s best interests.

Election of Officers

Officers are appointed to serve until the meeting

of the board of directors following the next annual meeting of stockholders and until their successors have been elected and qualified.

Involvement in Certain Legal Proceedings

During the past ten years none of our executive

officers have been involved in any legal proceedings that are material to an evaluation of their ability or integrity; namely:

(1) filed a petition under federal bankruptcy laws or any state insolvency laws, nor had a receiver, fiscal agent or similar officer

appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within

two years before the time of such filing, or any corporation or business association of which he was an executive officer at or

within two years before the time of such filing; (2) been convicted in a criminal proceeding or named subject to a pending criminal

proceeding (excluding traffic violations and other minor offenses); (3) been the subject of any order, judgment or decree, not

subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him or

her from or otherwise limiting his/her involvement in any type of business, securities or banking activities; or (4) been found

by a court of competent jurisdiction in a civil action, by the SEC or the Commodity Futures Trading Commission to have violated

any federal or state securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed,

suspended, or vacated.

Executive Compensation

Executive Officer Compensation

PCT LTD did not pay any

compensation to its officers for the last two fiscal years; however, Paradigm paid Mr. Grieco for services. In 2019, PCT LTD entered

into employment agreements with Gary Grieco and Jody Read.

Summary Compensation Table

|

Name and Principal Position

|

|

Fiscal Year

|

|

Salary ($)

|

|

Bonus ($)

|

|

Option Awards ($)

|

|

Restricted Stock Awards ($)

|

|

All Other

Compensation ($)

|

|

Total ($)

|

|

Gary J. Grieco (1)

|

|

|

2018

|

|

|

$

|

24,000

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

24,000

|

|

|

President, Principal Financial Officer

|

|

|

2017

|

|

|

$

|

24,000

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

24,000

|

|

|

Principal Financial Officer

CEO of Paradigm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gregory Albers

|

|

|

2018

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Secretary/Treasurer

|

|

|

2017

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

(1)

Represents compensation paid by Paradigm for Mr. Grieco’s services.

Grieco Employment Agreement

On August 12, 2019, the Company executed a new

Employment Contract with Gary J. Grieco, President. Mr. Grieco earns a base salary of $2,000 per month to serve as president. His

employment agreement provides for one week’s vacation and indemnification rights. He is subject to a non-compete provision

during the term of his employment, plus one year after termination. Per the terms of the employment agreement he is obligated to

protect the Company’s information and any work product he creates shall belong to the Company. His employment may be terminated

by him or the Company with or without cause. In addition, Mr. Grieco was issued 500,000 Preferred Series B shares of PCT LTD.

Read Employment Agreement

The Board duly appointed Mr. Read to the CEO

role on November 8, 2018 and on January 2, 2019, the Company entered into a four-year employment agreement with F. Jody Read in

his role as Chief Executive Officer. The terms of the contract call for an annual salary of $90,000 for the first year, effective

March 1, 2019 and increasing to $120,000 once company’s revenue exceeds expenses monthly, then incrementally over the four

years and upon reaching certain operational results, up to $200,000/year. The salary may be paid, at Mr. Read’s discretion,

either in cash or in common stock. A $1,000/month allowance will be granted to the executive for housing near the Company’s

South Carolina facility. The employment agreement awards the CEO 1,500,000 restricted shares of the Company’s restricted

stock, which shall vest in the following manner: 375,000 shares on March 1, 2019, 375,000 shares on March 1, 2020; 375,000 shares

on March 1, 2021 and the final 375,000 shares on March 1, 2022. On August 12, 2019 the Company entered into an addendum to its

Employment Contract with Mr. Read Read, CEO, whereby 500,000 Preferred Series B shares were issued to Read.

Securities under Equity Compensation Plans

PCT LTD does not have securities authorized

for issuance under any equity compensation plans approved by its stockholders as of December 31, 2018.

Compensation of Directors

PCT LTD does not have any standard arrangement

for compensation of our directors for any services provided as director, including services for committee participation or for

special assignments.

Certain Relationships and Related Transactions

The following information summarizes transactions we have either

engaged in for the past two fiscal years or propose to engage in, involving our executive officers, directors, more than 5% stockholders,

or immediate family members of these persons. These transactions were negotiated between related parties without “arm’s

length” bargaining and, as a result, the terms of these transactions may be different than transactions negotiated between

unrelated persons.

Other than as set forth below, we were not a

party to any transactions or series of similar transactions that have occurred during fiscal 2018 in which:

|

|

•

|

The amounts involved exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years ($26,136); and

|

|

|

|

|

|

|

•

|

A director, executive officer, holder of more than 5% of our common stock or any member of their immediate family had or will have a direct or indirect material interest.

|

Transactions with Related Parties

On April 10, 2018 the Company entered

into a promissory note with a related party, a company owned by the Chairman and then CEO of the Company, for $30,000. The note

is due January 15, 2019, is unsecured and bears an interest rate of 3.0% per annum.

On April 10, 2018 the Company issued 120,000

shares of common stock at $0.50 per share to a related party for cash proceeds of $60,000.

On May 31, 2018 the Company entered into a promissory

note with the Chairman and then CEO of the Company for $24,000. The note is due June 30, 2019, is unsecured and bears an interest

rate of 3.0% per annum.

On June 20, 2018, the Company had the following

notes to an employee and Director of the Company outstanding:

|

|

•

|

$275,000 issued October 4, 2017

|

|

|

•

|

$100,000 issued November 15, 2017

|

On June 20, 2018, the Company issued a new note

that consolidated into one note the notes above as well as any outstanding interest owed. The new note has a principal of $380,000,

bears interest at 8% per annum and is due on January 2, 2020.

On June 20, 2018, the Company had the following

notes to the Chairman and then CEO of the Company outstanding:

|

|

•

|

$17,500 issued April 27, 2017

|

|

|

•

|

$10,000 issued June 12, 2017

|

|

|

•

|

$5,500 Issued July 3, 2017

|

|

|

•

|

$25,000 issued July 13, 2017

|

|

|

•

|

$5,000 issued August 14, 2017

|

|

|

•

|

$250,000 issued November 15, 2017

|

|

|

•

|

$24,000 issued May 31, 2018

|

On June 20, 2018, the Company issued a new note

that consolidated into one note the notes above as well as any outstanding interest owed. The new note has a principal of $350,000,

bears interest at 5% per annum and is due on January 2, 2020.

On June 20, 2018, the Company had a $15,000

note to the spouse of the then CEO of the Company outstanding. On June 20, 2018, the Company issued a new note that consolidated

the note above as well as any outstanding interest owed. The new note has a principal of $17,000, bears interest at 5% per annum

and is due on January 2, 2020.

On July 13, 2018 the Company entered into a

promissory note with the Chairman and then CEO of the Company for $5,000. The note is due June 30, 2019, is unsecured and bears

an interest rate of 3.0% per annum. This note was repaid during the period ended December 31, 2018.

On July 27, 2018, the Company entered into a

short-term promissory note with an employee and Director of the Company, for $50,000 to be used in operations. The note is unsecured,

incorporates the purchase of a piece of SurvivaLyte® equipment at cost and grants a three-year (from installation of equipment),

non-exclusive US EPA sub-registration for markets (with specific exceptions) in a specific geographical location with a per gallon

royalty feature as added benefits, is due on November 15, 2018, and bears an interest rate of 8% per annum. The Note Payable agreement

was extended through November 30, 2018 on November 19, 2018, the additional benefit section of the note was removed, the equipment

was never transferred to the Officer and Director, the equipment was never installed, and no related sales occurred nor related

royalties were earned by the Company, through December 31, 2018 and through the date of this filing.

On October 9, 2018 the Company entered into

a promissory note with a Director and employee of the Company for $5,000. The note is due on demand, is unsecured and non-interest

bearing.

On October 19, 2018 the Company entered into

a promissory note with a Director and employee of the Company for $5,000. The note is due on demand, is unsecured and non-interest

bearing.

On October 19, 2018 the Company entered into

a promissory note with a Director and employee of the Company for $2,000. The note is due on demand, is unsecured and non-interest

bearing. This note was repaid during the year ended December 31, 2018.

On October 24, 2018 the Company entered into

a promissory note with a Director of the Company for $3,000. The note is due on demand, is unsecured and non-interest bearing.

The Company has agreements with related parties

for consulting services, notes payable and stock options. See Notes to Financial Statements numbers 6, 7, 8 and 10 for more details.

Director Independence

Two of the Company’s directors are independent

directors as defined by NASDAQ Stock Market Rule 5605(a)(2). This rule defines persons as “independent” who are neither

officers nor employees of the company and have no relationships that, in the opinion of the board, would interfere with the exercise

of independent judgment in carrying out their responsibilities as directors.

Beneficial Ownership

The following table sets forth certain information

concerning the number of shares of our Common Stock owned beneficially as of the Record Date or exercisable within the next 60

days thereafter, by: (i) our directors; (ii) our named executive officers; and (iii) each person or group known by us to beneficially

own more than 5% of our outstanding shares of common stock. Beneficial ownership is determined in accordance with the rules of

the SEC and generally includes voting or investment power with respect to securities. Except as indicated by footnote, the persons

named in the table below have sole voting power and investment power with respect to all shares of common stock shown as beneficially

owned by them.

|

Name and Address of Beneficial Owner(1)

|

|

Amount and

Nature of

Beneficial

Ownership

|

|

Percentage

of

Common Stock

Outstanding(2)

|

|

Gary J. Grieco, Chairman and President (3)

|

|

254,018,514

|

|

|

105.5%

|

|

Francis J. Read, CEO and Director (3)

|

|

251,666,666

|

|

|

104.5%

|

|

Gregory Albers, Secretary/Treasurer and Director

|

|

50,167

|

|

|

0%

|

|

Paul Branagan, Director

|

|

1,500,000

|

|

|

0.6%

|

|

William E. Prince, Director

|

|

-0-

|

|

|

0%

|

|

|

|

|

|

|

|

|

Directors and executive officers as a group (5 People)

|

|

507,222,680

|

|

|

210.6%

|

|

|

(1)

|

Unless otherwise noted above, the address of the persons and entities listed in the table is c/o

PCT LTD, 4235 Commerce Street, Little River, SC 29566.

|

|

|

(2)

|

Percentage is based upon 240,774,150 shares of common stock issued and outstanding and figures

are rounded to the nearest tenth of a percent.

|

|

|

(3)

|

Includes 500,000 shares of Series B Preferred stock, whereby each share is entitled to cast five

hundred (500) votes for each share held of the Series B Preferred stock on all matters presented to the stockholders of the Corporation

for stockholder vote.

|

ACTION

3. RATIFY

the appointment of Sadler, Gibb & Associates, LLC as auditors for the next year

PCT’s board of directors selected Sadler,

Gibb & Associates, LLC as its independent auditor for the current fiscal year ended December 31, 2019, and the Written Consent

ratified that selection.

INDEPENDENT PUBLIC ACCOUNTANTS

Sadler, Gibb & Associates, LLC served as

our principal independent public accountants for fiscal 2018 and 2017 years. Aggregate fees billed to us for the fiscal years ended

December 31, 2018 and 2017 by Sadler, Gibb & Associates, LLC were as follows:

|

|

|

For the Fiscal Years Ended

December 31,

|

|

|

|

2018

|

|

2017

|

|

(1) Audit Fees(1)

|

|

$

|

63,693

|

|

|

$

|

31,035

|

|

|

(2) Audit-Related Fees(2)

|

|

|

-0-

|

|

|

|

-0-

|

|

|

(3) Tax Fees(3)

|

|

|

-0-

|

|

|

|

-0-

|

|

|

(4) All Other Fees

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Total fees paid or accrued to our principal accountant

|

|

$

|

63,693

|

|

|

$

|

31,035

|

|

Audit fees represent fees for professional services

rendered by our principal accountants for the audit of our annual financial statements and review of the financial statements included

in our Forms 10-Q or services that are normally provided by our principal accountants in connection with statutory and regulatory

filings or engagements.

Audit-related fees represent professional services

rendered for assurance and related services by the accounting firm that are reasonably related to the performance of the audit

or review of our financial statements that are not reported under audit fees.

Tax fees represent professional services rendered

by the accounting firm for tax compliance, tax advice, and tax planning.

All other fees represent fees billed for products

and services provided by the accounting firm, other than the services reported for the other three categories.

Pre-approval Policies

PCT does not have an audit committee currently

serving and as a result our board of directors performs the duties of an audit committee. Our board of directors will evaluate

and approve in advance the scope and cost of the engagement of an auditor. All services rendered by our principal accountant are

performed pursuant to a written engagement letter between us and the principal accountant. We do not rely on pre-approval policies

and procedures.

OTHER MATTERS

Annual Report

A copy of the 2018 Form 10-K report as required

to be filed with the Securities and Exchange Commission, excluding exhibits, will be mailed to stockholders without charge upon

written request to Gary Grieco, President, 4235 Commerce Street, Little River, South Carolina 29566. Such request must set forth

a good-faith representation that the requesting party was either a holder of record or a beneficial owner of Common Stock of PCT

on October 4, 2019. Exhibits to the Form 10-K will be mailed upon similar request and payment of specified fees. The 2018 Form

10-K is also available through the Securities and Exchange Commission’s website free of charge (www.sec.gov).

Proposals of Stockholders

Any stockholder proposal intended to be considered

for inclusion in the proxy statement for presentation at the 2020 Annual Meeting must be received by PCT by January 31, 2020. The

proposal must be in accordance with the provisions of Rule 14a-8 promulgated by the Securities and Exchange Commission under the

Exchange Act. It is suggested the proposal be submitted by certified mail -- return receipt requested. Stockholders who intend

to present a proposal at the 2020 Annual Meeting without including such proposal in PCT’s proxy statement must provide PCT

notice of such proposal no later than March 1, 2020. PCT reserves the right to reject, rule out of order, or take other appropriate

action with respect to any proposal that does not comply with these and other applicable requirements.

Where You Can Find More Information

PCT files annual, quarterly and special reports

and other information with the SEC that can be inspected and copied at the public reference facility maintained by the SEC at 100

F Street, N.E., Room 1580, Washington, D.C. 20549-0405. Information regarding the public reference facilities may be obtained from

the SEC by telephoning 1-800-SEC-0330. PCT’s filings are also available through the SEC’s Electronic Data Gathering

Analysis and Retrieval System which is publicly available through the SEC’s website (www.sec.gov). Copies of such materials

may also be obtained by mail from the public reference section of the SEC at 100 F Street, N.E., Room 1850, Washington, D.C. 20549-0405

at prescribed rates.

Stockholders may obtain documents by requesting

them in writing or by telephone (843) 390-7900 from the Company at the following address: 4235 Commerce Street, Little River,

South Carolina 29566.

This information statement is dated __________

__, 2019. You should not assume that the information contained in this information statement is accurate as of any date other than

that date.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE NOT

REQUESTED TO SEND US A PROXY

Yours truly,

________________________

Gary Grieco, Chairman

Little River, South Carolina

_______ __, 2019

EXHIBIT A –AMENDED ARTICLES OF INCORPORATION

ARTICLE V

SHARES OF CAPITAL STOCK

Section 1. Authorized

Shares. The total number of shares which this corporation is authorized to issue is: (i) 1,000,000,000 shares of Common Stock

of $0.001 par value and (ii) 10,000,000 shares of Preferred Stock of $0.001 par value, of which; 1,000,000 are designated as Series

A Convertible Preferred Stock, 1,000,000 are designated as Series B – Super Voting Convertible Preferred Stock, and 5,500,000

are designated as Series C Convertible Preferred Stock. The authority of the Corporation to issue non-voting convertible and/or

non-voting non-convertible preferred shares together with additional classes of shares may be limited by resolution of the Board

of Directors of the Corporation. Preferred shares and additional classes of shares may be issued from time to time as the Board

of Directors may determine in their sole judgment and without the necessity of action by the holders of Shares.

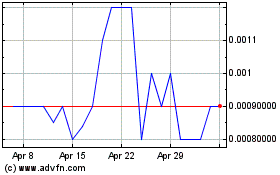

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Apr 2023 to Apr 2024