Biotechs to Watch at the 2012 San Francisco Healthcare Confrences - Analyst Blog

January 09 2012 - 1:14AM

Zacks

Several biotech companies we cover at Zacks Investment Research

are attending the series of healthcare conferences this week in San

Francisco. These conferences include the JP Morgan Healthcare

Conference, OneMed Forum, and Biotech Showcase.

Companies are attending include Advaxis (ADXS),

Bio-Path Holdings Inc. (BPTH), CytRx Corp (CYTR), EpiCept Corp

(EPCT), Galena Biopharma (GALE), ImmunoCellular Biotherapeutics

(IMUC), NeoGenomics (NGNM), Northwest Biotherapeutics (NWBO),

andPressure BioSciences (PBIO).

These biotech companies are covered by Zacks Small Cap Research

team. Following are the investment highlights for each company.

Full research reports can be obtained from our sales team.

Advaxis Inc. (ADXS)

Advaxis is a Listeria based immunotherapy company focused on the

development of immunotherapeutics for cancer treatment. We are

optimistic about the Company’s unique Listeria platform technology

which holds advantages over its peers. The Company’s lead drug

candidate ADXS11-001 is in Phase II clinical trials for the

treatment of cervical cancer and cervical dysplasia. Another Phase

II trial will be initiated for the treatment of head and neck

cancer soon. Other pipeline candidates target breast, brain and

prostate cancer. We believe Advaxis is heading in the right

direction.

Bio-Path Holdings Inc. (BPTH)

Bio-Path is a development stage drug delivery biotech

company. We are optimistic about the great potential of the

Company’s neutral lipid drug delivery technology and

ligand-enhanced lipid tumor targeting technology, which enable

systemic delivery of antisense, RNAi and siRNA drug candidates.

Bio-Path’s pipeline targets the multi-billion dollar cancer market

and the Company has moved its lead drug candidate liposomal-Grb-2

into a Phase I trial. The Company’s good working relationship with

the MD Anderson Cancer Center and its out-license oriented strategy

should build shareholder value in a rapid and cost-effective

way.

CytRx Corp (CYTR)

CytRx is a biopharmaceutical company with a focus on oncology. The

Company has three candidates in middle to late stage development

targeting various cancer indications. The most advanced candidate

is tamibarotene which is in a pivotal clinical trial for acute

promyelocytic leukemia (APL). The combined market opportunity for

CytRx’s pipeline is huge. The Company’s strategy is to develop

drugs with known mechanisms of action which will minimize

operational risks. CytRx is well capitalized with a strong balance

sheet which sets it apart from its peers. Current valuation is low

based on the Company’s fundamentals. Therefore, we assign a market

Outperform rating on CytRx.

EpiCept Corp (EPCT)

EpiCept is a commercial stage specialty pharmaceutical company

targeting large cancer and pain markets. The Company’s lead cancer

candidate Ceplene has been already approved in EU and Israel for

the remission maintenance of AML and a pivotal trial for Ceplene is

planned in the US. The Company’s other candidates include AmiKet

for peripheral neuropathy, Azixa and Crolibulin for cancers which

are all in Phase II trials. We are optimistic about EpiCept’s

prospect. Current valuation is low and we see a great potential for

appreciation in share price as the Company continues to advance its

pipeline and boosts its balance sheet.

Galena Biopharma (GALE)

Galena has been transformed into a late stage development biotech

company through its acquisition of Apthera. The Company is focused

on cancer vaccines. Lead drug candidate NeuVaxTM has demonstrated

excellent efficacy data and safety profile for breast cancer

patients in Phase II trials and will enter into a Phase III trial

in the first half of 2012. Newly acquired cancer vaccine FBP

targets gynecological cancers and is going to enter into the clinic

in 1H2012. Galena has a relatively strong balance sheet. Current

valuation is low based on the Company’s strong fundamentals. We

have an Outperform rating on Galena.

ImmunoCellular Biotherapeutics

(IMUC)

IMUC is a clinical stage biotech company focused on the research

and development of innovative cancer therapeutics. The Company’s

lead drug candidate ICT-107 is next generation cancer vaccine

targeting cancer stem cells to prevent recurrence. ICT-107 has

demonstrated best clinical data for glioblastoma so far and is

under a Phase II trial. ICT-107 holds a high promise for

glioblastoma and has potential for other cancers. IMUC also has a

pipeline based on its off-the-shelf peptide vaccine technology and

monoclonal antibody technology which ensures sustainable growth of

the Company. IMUC is heading in the right direction and poised to

deliver shareholder value.

NeoGenomics (NGNM)

NeoGenomics is a pure play cancer genetics testing lab with

competitive advantages. The Company’s industry leading turn-around

times, unique tech-only business model, state of the art lab

information system, and extensive client education programs are key

factors to attract clients.

Total revenue will grow at 25.6% CAGR from 2010 to 2015. Meanwhile,

increased operating leverage will ultimately contribute to the

bottom line. The Company will turn profitable in 4Q2011 and EPS

will grow to $0.17 per share in 2015.

We rate NGNM shares Outperform based on the Company’s strong

fundamentals.

Northwest Biotherapeutics (NWBO)

Northwest Biotherapeutics is a late clinical stage biotech company

engaged in the development of cell based cancer

immunotherapeutics. We are optimistic with the Company’s

dendritic cell-based platform technology and its lead program

DCVax-L for glioblastoma multiform, which is in a Phase II clinical

trial designed and powered as a pivotal trial. Another late stage

program is DCVax-Prostate. The Company is looking for a partner to

initiate Phase III trials of this program due to scale of resources

required for the Phase III trials.

Both DCVax-L and DCVax-Prostate have the potential to become

blockbusters if approved in our view. NWBO has established an

unusually deep pipeline. Its DCVax-Direct technology can target

almost every solid tumor. Current targets include liver, head &

neck, ovarian and pancreatic cancers.

Progress has been made in the past few months in terms of clinical

trials, business development and balance sheet strengthening.

Current valuation is attractive and upside potential is high at

current price level.

Pressure BioSciences (PBIO)

Pressure BioSciences (PBIO) is a research products and services

provider for the life science industry. We are impressed and

optimistic about the Company’s novel, enabling platform technology:

pressure cycling technology (PCT), which has competitive advantages

over existing technologies in the sample preparation market.

PBIO operates in the multi-billion dollar but underserved research

products and services market with a current focus on sample

preparation for life science research. The research products and

services market is a rapidly growing market with a large and

immediate need for better technology, which we expect will create a

huge opportunity for PBI to grow its business in the coming

years.

Based upon the PCT platform, PBIO has established a broad product

portfolio for the sample preparation market. The instruments and

consumables, a “razor and blade” model, that form its PCT Sample

Preparation System (PCT SPS) are now increasingly being recognized

by many research labs as a novel and paradigm shifting sample

preparation method due to PBI’s focused marketing efforts. We

believe uptake of the PCT SPS will accelerate in the coming

years.

PCT is increasingly gaining recognition by research labs and user

adoption will accelerate in the coming years due to the focused

marketing efforts by the Company.

Current price is undervalued compared to its peers in our view. We

encourage investors to accumulate PBI’s shares at the current

level.

Please email scr@zacks.com with the ticker as the subject

to request a free copy of the full research report

on any company mentioned above.

ADVAXIS INC (ADXS): Free Stock Analysis Report

BIO-PATH HLDGS (BPTH): Free Stock Analysis Report

CYTRX CORP (CYTR): Free Stock Analysis Report

EPICEPT CORP (EPCT): Free Stock Analysis Report

GALENA BIOPHARM (GALE): Free Stock Analysis Report

IMMUNOCELLULAR (IMUC): Free Stock Analysis Report

NEOGENOMICS INC (NGNM): Free Stock Analysis Report

NORTHWEST BIOTH (NWBO): Free Stock Analysis Report

PRESSURE BIOSCI (PBIO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

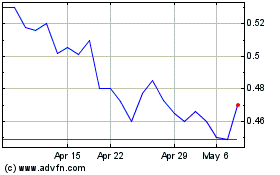

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Sep 2023 to Sep 2024